Creating a POS receipt template in PDF format allows for streamlined transaction records and easy customization for your business. With just a few steps, you can design a clean, professional receipt layout that suits your needs. Whether you’re using it for small-scale retail or more advanced transactions, a PDF template offers flexibility in both design and distribution.

First, focus on simplicity. A clean layout ensures that customers easily understand the details of their purchase. Include essential fields such as the date, transaction number, items purchased, and total amount. The use of clear, readable fonts will enhance the user experience for both the business owner and the customer.

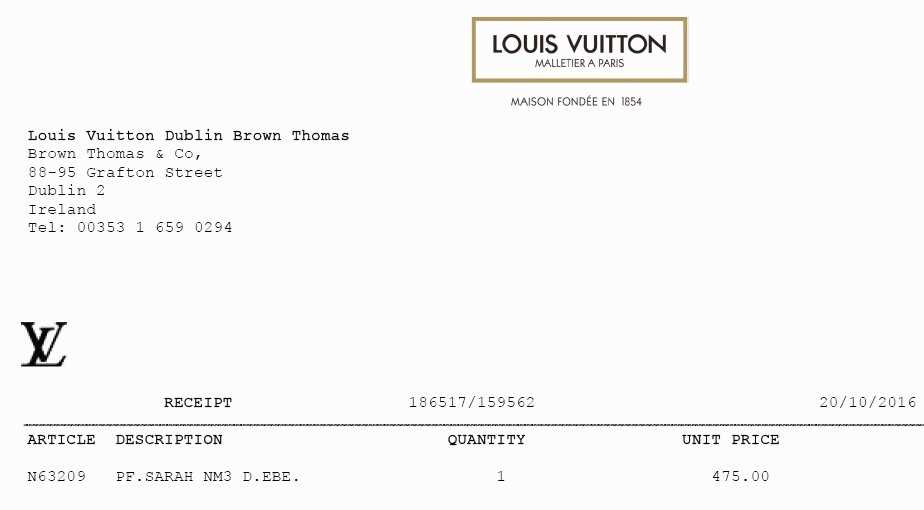

Secondly, include your business branding. Adding your company logo, address, and contact information to the template helps with professional consistency. This simple step increases your brand visibility every time a receipt is issued, especially when shared electronically. Ensure that all information is placed in a manner that doesn’t overwhelm the recipient.

Once the template is designed, you can save it as a PDF for easy sharing and printing. This format ensures that the layout remains consistent across different devices, making it reliable for both in-store and remote transactions. The ability to modify the template as needed gives you full control over your receipt design.

Here is the revised version:

To create a precise POS receipt template in PDF format, ensure all critical details are included. Start with the store name, address, and contact information. Clearly display the transaction date and time. Include the itemized list of purchases with unit prices and quantities. Subtotal the items, followed by any taxes or discounts. Clearly separate the total amount due from the other figures.

When designing, prioritize readability. Use a simple, easy-to-read font and avoid excessive spacing between sections. Make sure there is enough space for the receipt number and payment method at the bottom. Include a thank-you note or customer support contact for a personal touch.

To generate this template as a PDF, you can use popular tools like Adobe Acrobat, Google Docs, or a dedicated POS software solution. Ensure the template is compatible with your POS system’s print function to avoid issues during receipt generation.

Guide to POS Receipt Template PDF

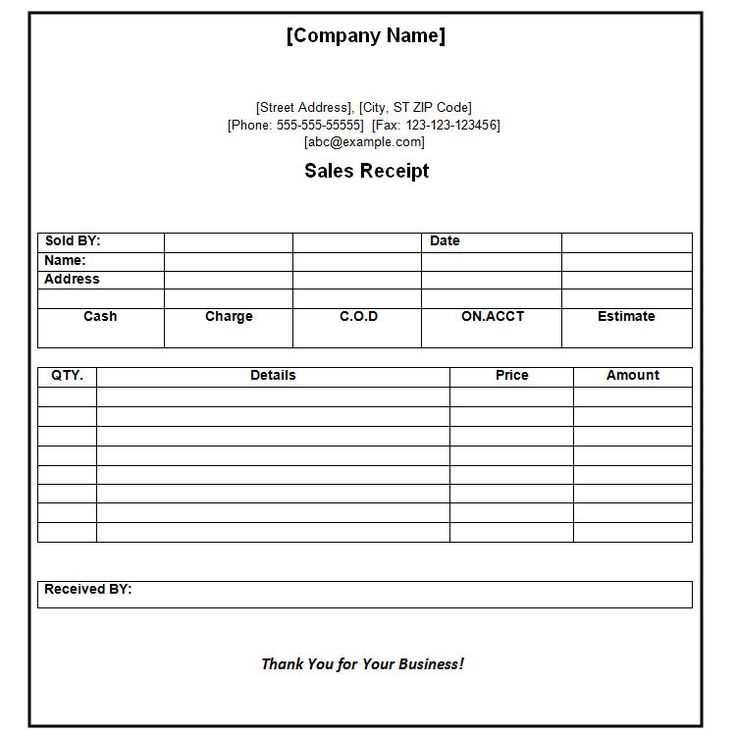

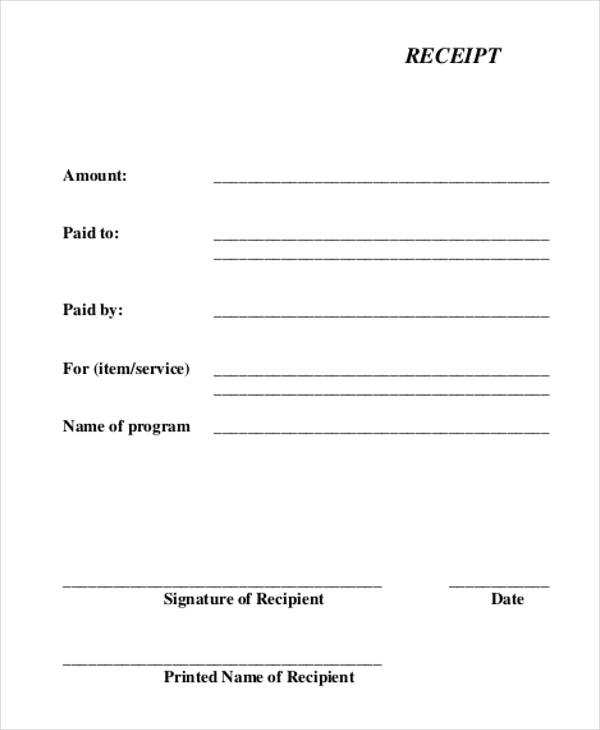

Creating a Simple Sales Receipt Template

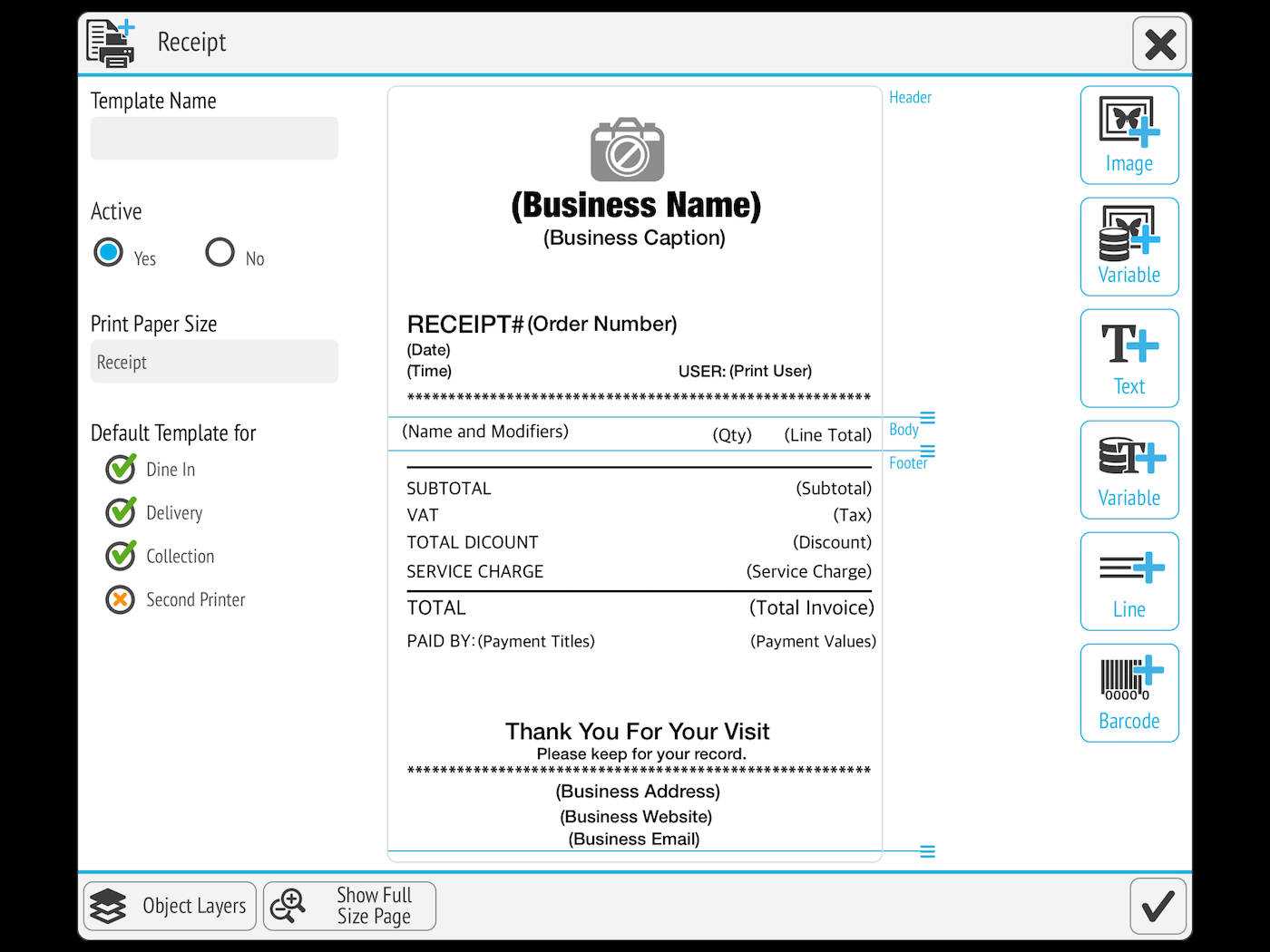

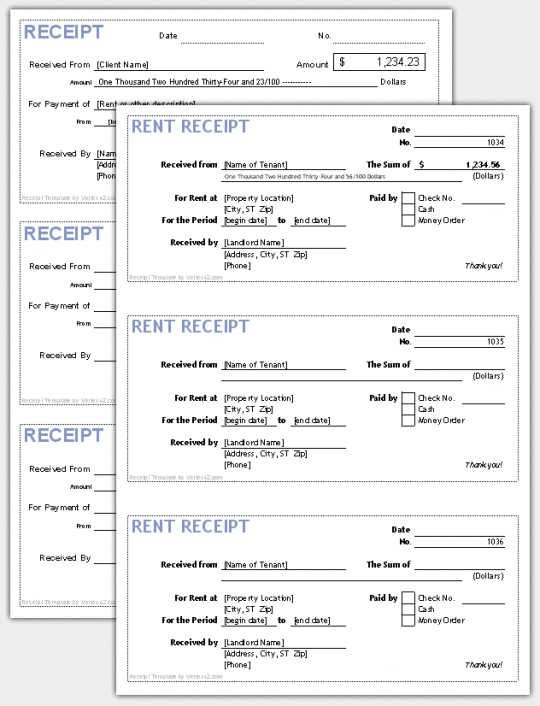

Customizing Layout for Specific Needs

Incorporating Item Breakdown on Receipts

Adding Branding to Your Sales Receipt

Configuring Automated Receipt Generation

Ensuring Compliance with Tax Regulations

Start by selecting a clean and minimal design for the receipt template. Choose simple fonts and easy-to-read layouts to make the receipt user-friendly. The main sections should include the store name, transaction details, and itemized products or services. Use gridlines or tables to organize the data clearly.

For a customized layout, adjust the placement of the store logo, customer information, and payment details to align with your brand’s style. This can include changing the font size, color scheme, and logo position to match the business’s identity.

Including a breakdown of each item on the receipt helps customers understand what they’ve purchased and how much they’ve paid. List each product or service with its price, any discounts applied, and the total cost. This level of transparency builds trust and reduces customer confusion.

Add your branding by incorporating your logo, business colors, and contact information. Placing these elements consistently on each receipt reinforces your brand identity and makes your receipts stand out. Don’t forget to include your business’s social media handles or website for future customer engagement.

Automating the generation of receipts can streamline the process. Use software or point-of-sale systems that allow automatic receipt creation once the payment is processed. This ensures quick and accurate receipts every time, reducing the chance of errors.

Stay compliant with tax regulations by including necessary tax details on the receipt. This includes the applicable tax rate, total tax amount, and tax ID number if required. Be sure to follow local laws to avoid potential penalties and ensure all tax information is correct on every receipt.