If you need a receipt template for transactions in the UK, using a PDF format is one of the easiest and most reliable methods. PDF files ensure that the format remains intact regardless of the device or software used to open them. This can be especially useful for both personal and business needs, where having a professional-looking, accessible receipt is essential.

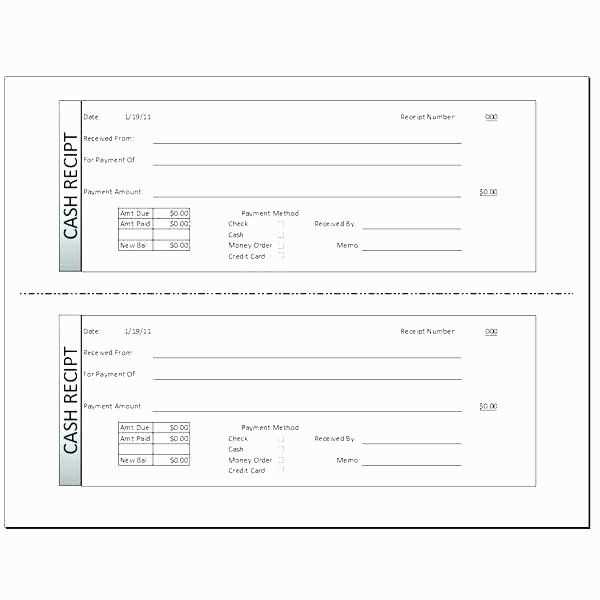

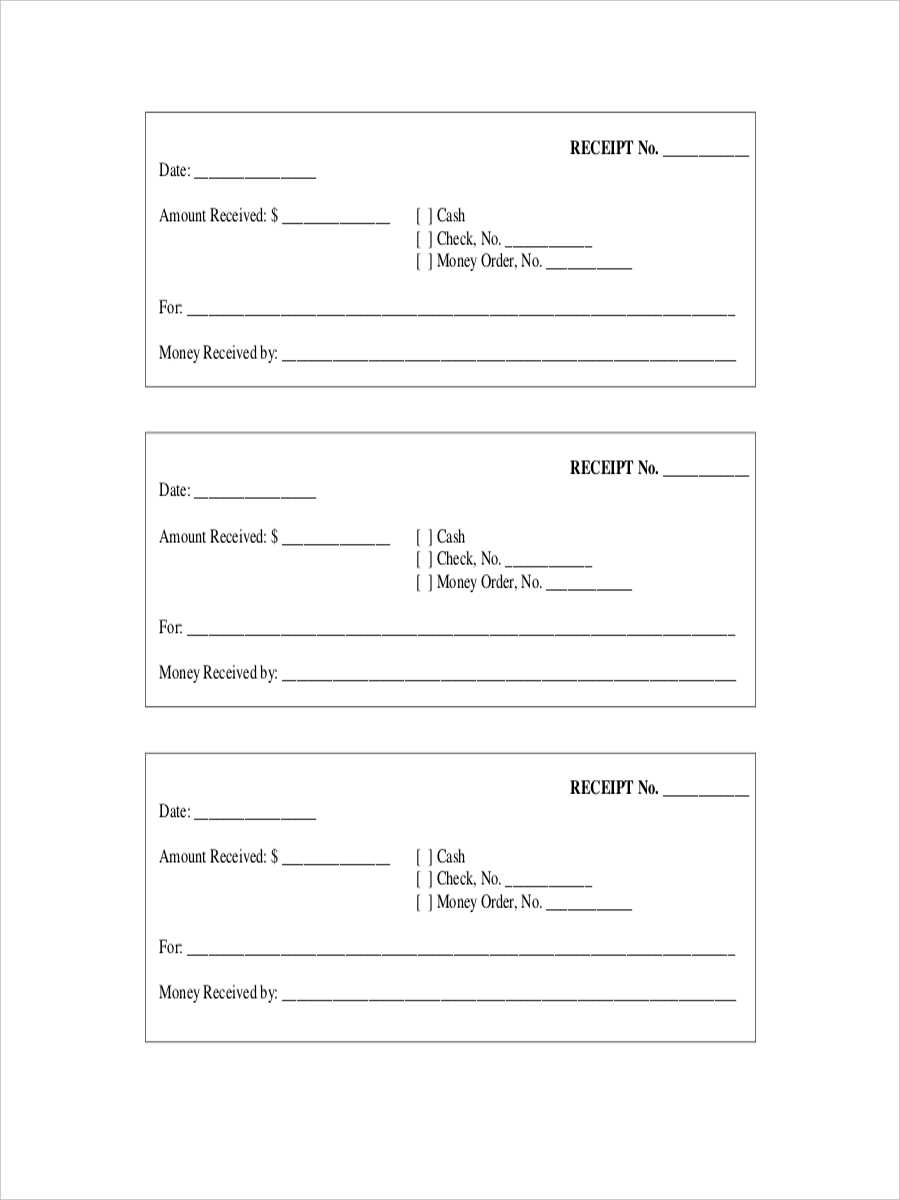

When selecting a receipt template, make sure it includes key details like the date, transaction amount, goods or services provided, and the payment method. A clear breakdown of these elements will provide transparency and help prevent disputes later on. Additionally, ensure that the template reflects the legal requirements for receipts in the UK, which may include specific information for VAT-registered businesses.

PDF templates also allow for easy customization. You can personalize the design to match your business branding, adding logos or changing fonts to align with your style. Templates designed for UK receipts typically follow common conventions, but always double-check that the document complies with UK tax regulations to avoid any future issues.

Here’s the revised version without excessive repetition:

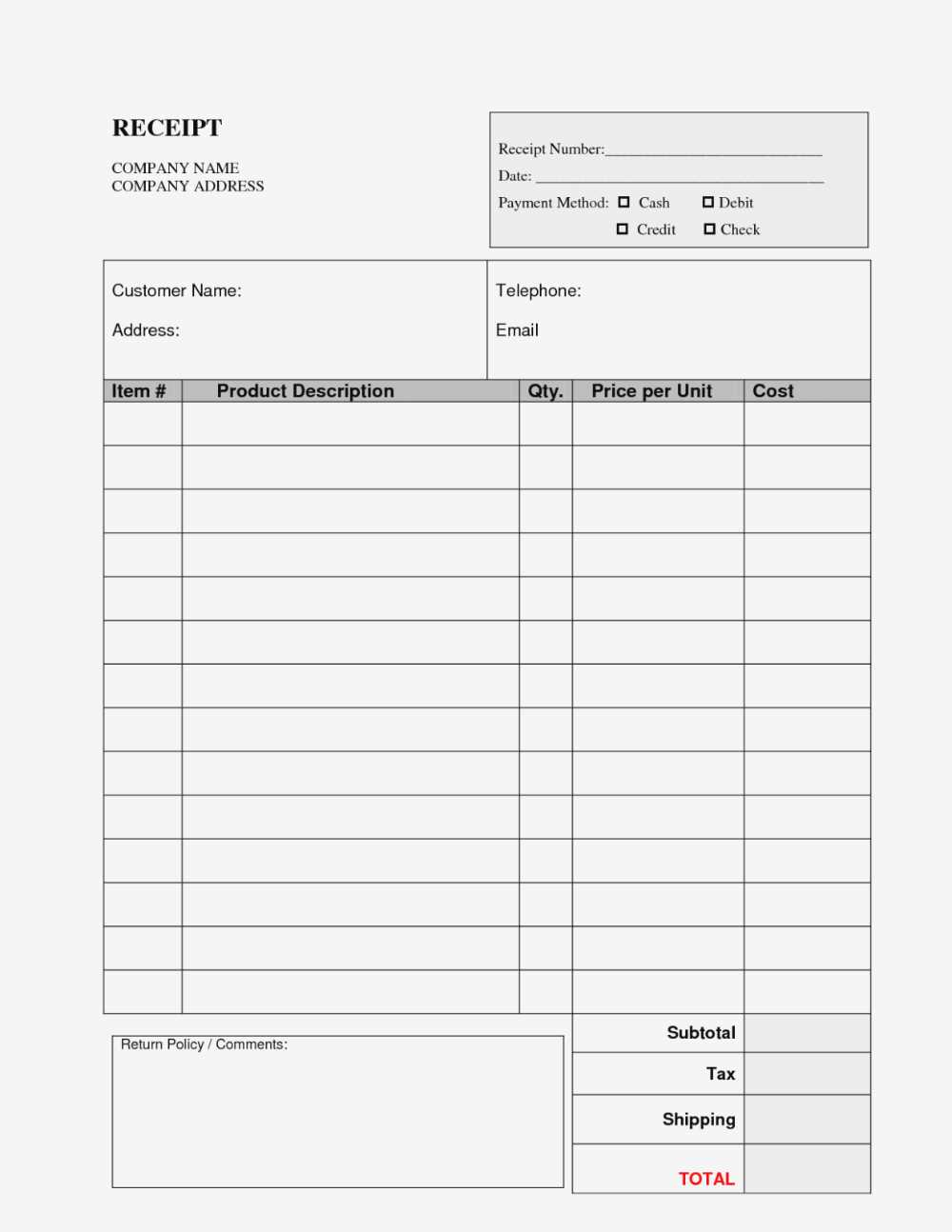

To streamline your receipt templates, focus on key sections that customers need: transaction details, company information, and payment confirmation. Keep the format simple and easy to follow. Below is a recommended breakdown of essential components:

Receipt Template Structure

| Section | Description |

|---|---|

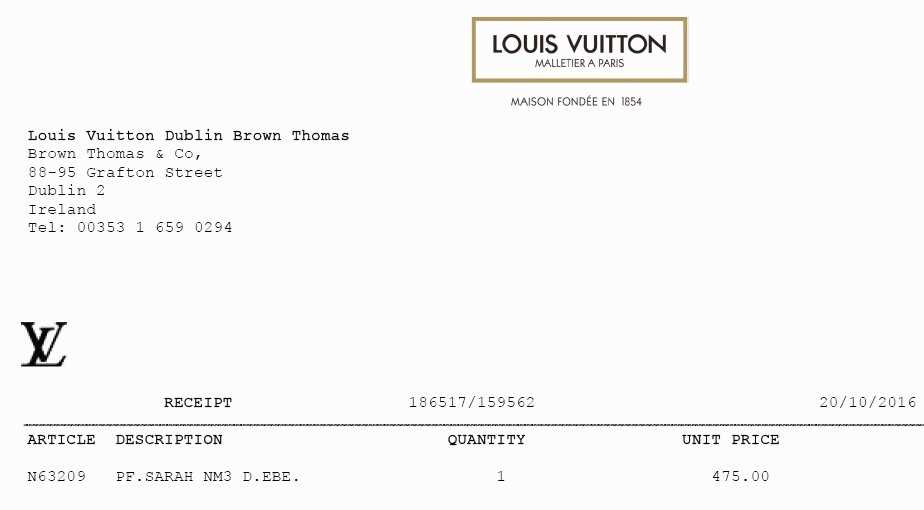

| Company Information | Include your company name, address, contact details, and logo (if applicable). Ensure this section is clear and easy to locate. |

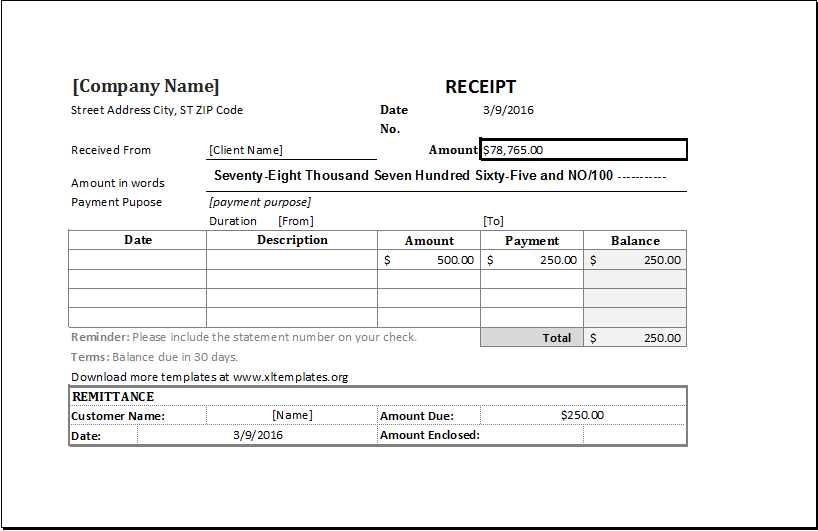

| Transaction Details | List item names, quantities, prices, and any applicable taxes. Use a simple table format to keep it readable. |

| Payment Confirmation | Include the payment method used, amount paid, and any discounts or special offers applied. Ensure the total is easy to spot. |

| Thank You Message | A brief thank-you note can make your receipt more personable without adding unnecessary text. |

By adhering to this format, you will create professional receipts that deliver key information quickly, without clutter. Stick to clear headings and avoid redundant text to ensure a smooth, streamlined experience for both your business and customers.

- Receipt Template PDF UK

Creating a receipt template in PDF format for use in the UK involves ensuring that it adheres to local legal requirements while remaining clear and simple for both the issuer and the recipient. Start by including all necessary details: business name, address, and contact information. The receipt should also feature the transaction date, a unique receipt number, and a breakdown of the goods or services purchased, including quantities, descriptions, and prices.

Key Components of a Receipt Template

Include a section for the total amount paid, as well as any taxes applied. Ensure that there is space for payment methods, such as cash, card, or bank transfer. If applicable, add a field for VAT number for VAT-registered businesses. It’s also advisable to leave room for any discounts or refunds, as these are common in many transactions.

Creating a Functional Template

Choose a simple layout that allows for easy filling in of details. Many online tools offer free PDF receipt templates that can be customised to suit your business needs. After designing the template, save it as a fillable PDF so customers can receive their receipts digitally, which streamlines the process for both parties.

To create a custom receipt template in PDF format, begin by choosing the right software. Tools like Adobe Acrobat, Google Docs, or Microsoft Word can help you design the layout. Start with a simple design that includes key details such as business name, address, contact info, date, itemized list of purchases, total amount, and payment method.

Step 1: Layout Design

Use clear sections to separate each part of the receipt. Make sure to include fields for the business information at the top, followed by a list for purchased items. Below, add a summary section for the total amount and payment method.

Step 2: Customize Your Template

Personalize your template with your business logo and colors. Choose legible fonts for easy reading and maintain a professional look. Keep the design simple yet functional, ensuring it can be filled out quickly for each transaction.

After finalizing your design, save it as a PDF to preserve the format. Most software allows you to export or print documents directly as PDF files. If you use a template, make sure to adjust it to fit your specific needs before saving it.

Once your custom template is saved, you can easily fill it out and share it with customers for a seamless transaction experience.

Receipt templates in the UK must meet specific legal criteria to ensure they are valid for both the business and consumer. These include key information such as the business name, address, and VAT number (if applicable). It’s important that the receipt clearly shows the transaction date, the items or services purchased, and the total amount paid, including VAT where relevant.

Required Information on a Receipt

- Business name and address: This should include the full address of the business issuing the receipt.

- VAT details: If the business is VAT-registered, the VAT number should be included. This is mandatory for VAT-related transactions.

- Transaction date: The date when the transaction took place should be clearly visible on the receipt.

- Itemized list: A detailed list of the goods or services purchased, with the corresponding price for each item.

- Total amount paid: The total cost of the transaction, including VAT, should be clearly displayed.

Retention Period

Receipts must be kept for at least six years for tax purposes. This period is required for businesses to comply with HM Revenue & Customs (HMRC) regulations. Keeping records for this duration ensures businesses are prepared for audits or any disputes over transactions.

Canva is an intuitive and accessible design tool that allows you to create PDF receipt templates effortlessly. It offers pre-made receipt templates and customization options for fonts, colors, and logos, all without needing advanced design skills. You can download your design as a high-quality PDF once you’re done.

Invoice Generator provides a simple and direct solution to create professional PDF receipts quickly. It includes pre-built templates where you can easily input payment details, dates, and business information. You can download the receipts instantly in PDF format without creating an account.

Google Docs, though often overlooked for design purposes, can also be used to create basic PDF receipts. With its customizable tables and easy export options, you can format your receipt and download it as a PDF directly from the platform.

Adobe Express offers a free version of its design software, which includes templates and customization tools. It is great for creating tailored receipts and exporting them as PDFs. You can upload your own logos, adjust layouts, and add unique text elements.

Zoho Invoice is a free online tool primarily used for invoicing but also allows you to create and save receipt templates. It provides a range of customization features, including currency options, branding, and automatic calculations, making it easy to generate professional PDF receipts.

Include the VAT registration number at the top or bottom of the receipt if your business is VAT registered. This is a requirement for VAT-registered businesses in the UK. The format should look like “VAT Registration Number: GB123456789”.

Clearly separate the VAT amount for each item listed. For instance, next to each product or service, include both the price before VAT and the VAT amount. For example: “Product A: £50.00 + VAT £10.00”.

Add a summary section at the bottom to show the total amount of VAT charged. Label it clearly, such as “Total VAT: £20.00”, so the customer understands the full tax amount for the purchase.

If your business applies different VAT rates for different items, show this clearly on the receipt. Break down each item by its applicable VAT rate, such as “Item 1: £10.00 (20% VAT)” and “Item 2: £15.00 (5% VAT)”.

For non-VATable items, ensure they are listed without any VAT charge. This transparency helps avoid confusion.

Common Mistakes to Avoid When Creating Receipts

Double-check the accuracy of the transaction amount. A small typo or error in totals can lead to disputes and misunderstandings. Always ensure that the sum of the individual items matches the total cost displayed.

Omitting crucial transaction details is a common issue. Every receipt should clearly list the date, time, and location of the purchase. This information helps both you and your customer track the transaction in case of returns or inquiries.

Do not forget to include a unique receipt number for easy reference. This is especially useful for keeping your records organized and helps in identifying a particular transaction quickly if needed in the future.

Ensure tax information is properly shown. Failing to display the correct tax amount, or any tax exemptions, can create confusion and may even lead to legal issues. Always verify the tax rate before finalizing the receipt.

Using unclear or incorrect item descriptions is another frequent mistake. Be specific with product or service names to avoid confusion. A vague description can lead to misunderstandings, especially in cases of returns or refunds.

It’s easy to overlook the importance of formatting. Keep the receipt clear, legible, and structured. Use well-spaced lines, consistent font sizes, and proper alignment. A messy receipt could create an impression of disorganization and lead to customer frustration.

To download and print your PDF receipt template, follow these simple steps:

- Locate the Download Link: Find the PDF download link on the website or page that offers the template. It’s usually labeled as “Download” or “Get PDF”.

- Click the Link: Clicking the download link will prompt your browser to start the download process. Make sure you are using a compatible browser that can open PDFs.

- Open the File: After the file has downloaded, open it by double-clicking on the file or using a PDF reader like Adobe Acrobat Reader.

- Check the Template: Review the template to ensure it’s formatted correctly and ready for printing. Make any necessary adjustments or fill in any placeholders before proceeding.

- Print the Template: To print, click the print icon or press “Ctrl + P” (Windows) or “Cmd + P” (Mac). In the print settings, make sure to select your printer and adjust the print scale if needed.

- Finalize and Save: If you need a physical copy, click “Print”. Otherwise, save the PDF for future use by clicking “Save as PDF” in the print settings.

That’s it! You now have your PDF receipt template ready to use or print as needed.

Receipt Template PDF UK

Use a clear, concise format when designing a receipt template for the UK. Include essential details such as the business name, address, contact details, VAT number, and date of the transaction. Ensure that all items purchased, including their quantity and price, are clearly listed with a subtotal and total amount due. For tax-compliant receipts, display the VAT rate applied to each item and the overall tax amount.

For a professional appearance, consider aligning your text properly and using legible fonts. Ensure the layout is easy to follow with distinct sections for the buyer and seller information. A simple header with a logo adds a personalized touch, while clear item descriptions minimize confusion. Keep the design simple, avoiding excessive information or unnecessary graphics that might distract from the key details.

Save your template in PDF format to ensure it is easy to print and share electronically. Use a template that supports fillable fields, allowing users to easily input transaction-specific data such as product names, quantities, and prices. This can streamline the process for both the business and the customer.

When preparing receipts for online transactions, include the method of payment, whether it be through card, bank transfer, or other means. This adds clarity and accountability, especially for digital transactions. Additionally, ensure the receipt is numbered for easy reference, especially when dealing with returns or exchanges.