Download a ready-to-use trust receipt template PDF to simplify the process of documenting transactions involving goods or assets held in trust. This form is crucial for maintaining transparency and ensuring all parties involved have a clear understanding of the terms and obligations.

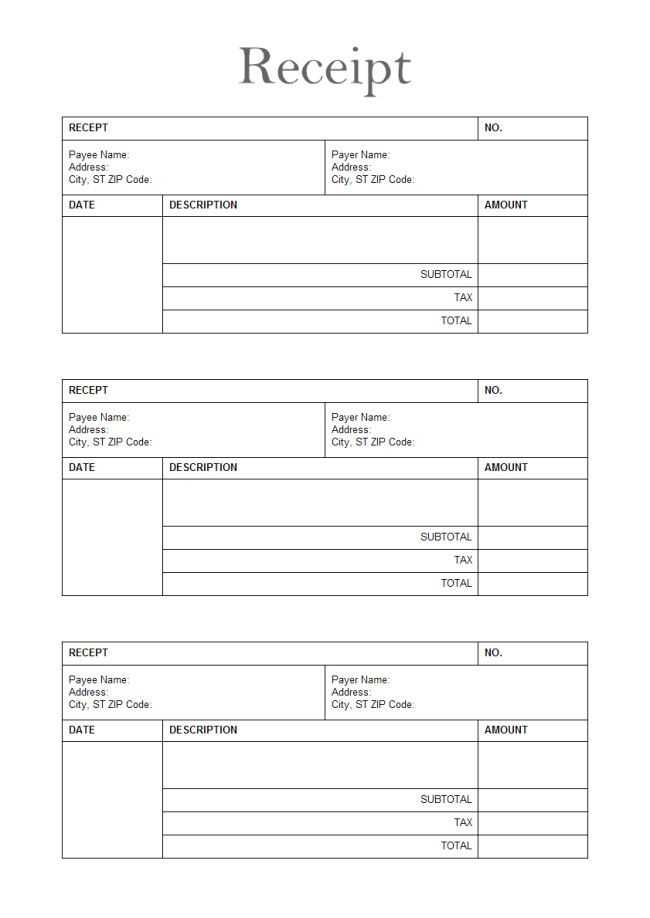

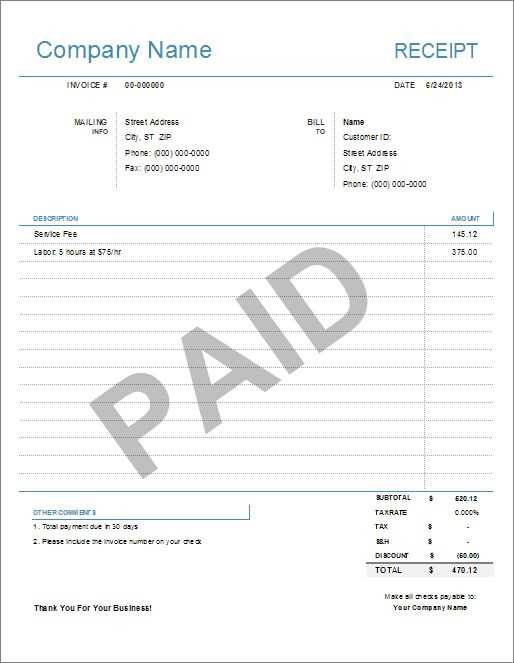

The template includes all necessary sections such as the identification of the involved parties, description of the items held in trust, and the terms for release. Customize it according to your needs to ensure all relevant information is captured and legally binding.

For better results, ensure the template is signed by both the trustee and the beneficiary. Keep a copy for your records and share with the involved parties to avoid future disputes. Using this standardized document reduces ambiguity and fosters trust in the transaction process.

Here are the corrected lines:

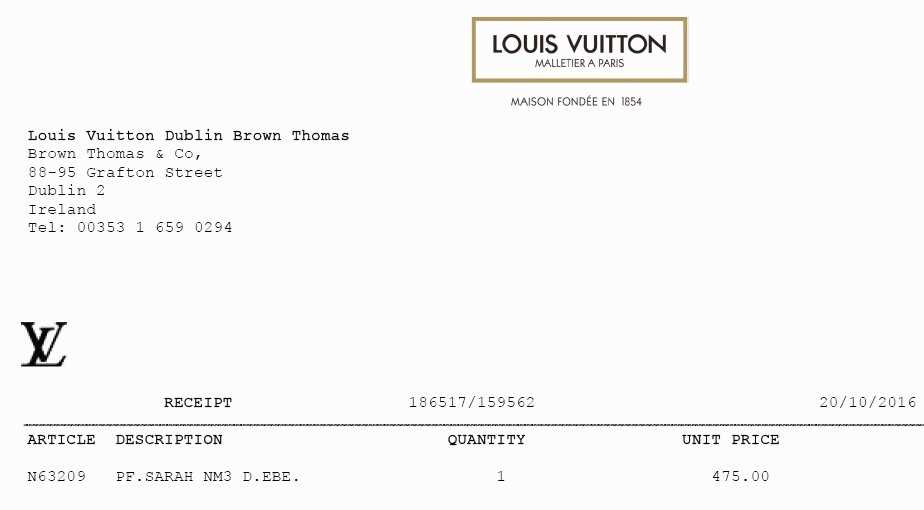

Ensure you have the correct information in the header section of your template. Use specific details such as the date, parties involved, and unique document identifiers. This provides clarity and avoids confusion.

Correct the payment terms section to include clear payment deadlines, the amount due, and the currency. Avoid vague terms that could cause disputes later.

Ensure proper formatting in the signature area. Each party should have space to sign and date, making it clear who is responsible for which part of the agreement.

Double-check the item description for accuracy. Include a precise list of items or services being financed, with specific quantities and values. This prevents misunderstandings down the line.

Make sure the footer contains a clear statement about the terms of the agreement, including any penalties for non-compliance or late payments.

- Understanding the Trust Receipt Concept

A trust receipt is a financial arrangement used in trade finance, primarily in situations where a borrower acquires goods but does not yet own them outright. This agreement allows the borrower to hold and use the goods while making payments. Here’s a clear breakdown:

- Role of the Lender: The lender provides funding for the goods, which the borrower must repay. Until the payment is made, the lender retains legal ownership, but the borrower has possession and use of the items.

- Goods in Trust: The goods, though physically with the borrower, remain the property of the lender until the loan is fully repaid.

- Repayment Terms: The borrower typically agrees to repay the loan within a specific timeframe, often tied to the sale or use of the goods.

- Risk and Control: The borrower assumes responsibility for the goods and their condition, even though they don’t own them. If the borrower fails to repay, the lender can reclaim the goods.

Practical Applications

Trust receipts are commonly used in international trade, especially for importers and exporters dealing with large inventories. It ensures that the importer can access goods and sell them while managing payment schedules.

Advantages

- Enables liquidity by allowing goods to be sold or used before full payment.

- Provides flexible terms based on sales cycles or product turnover rates.

- Helps businesses bridge the gap between receiving goods and finalizing payments.

The trust receipt template should clearly identify the parties involved, including the lender and borrower. It must specify the exact terms and conditions governing the use of goods under the agreement. This includes the detailed description of the collateral, including its quantity, type, and value.

It is important to outline the conditions for the possession and sale of the goods, as well as the borrower’s obligation to return or repay the loan. A payment schedule, including due dates and amounts, must be present. This ensures both parties are aware of the financial commitment.

The template should also include a section for the signatures of both parties, confirming the terms and their acceptance. In some cases, a witness or notary section may be required to validate the document legally.

Lastly, the template must specify the consequences of non-compliance, such as penalties or legal action. This ensures clarity on what happens if the borrower fails to meet their obligations.

Tailor your trust receipt template by adjusting key fields to reflect your specific needs. Focus on the information that matters to your transactions, ensuring clarity and accuracy.

1. Modify the Title and Header

Start by changing the title to suit the nature of your agreement. If your receipt is part of a commercial transaction, include terms like “Loan Agreement” or “Collateral Receipt” for clarity. Customize the header with your company name, logo, and contact details to make it easily recognizable and professional.

2. Adjust the Payment Terms and Conditions

Specify payment terms according to your agreement. Include details such as the due date, interest rates, and any penalties for delayed payments. Clearly state the consequences of non-payment to avoid confusion and ensure all parties are aligned.

By customizing these sections, you’ll create a trust receipt that serves both your legal needs and operational requirements. Focus on accuracy, and make sure all relevant details are clearly outlined.

One of the most common mistakes is leaving out crucial details such as the date of transaction or full descriptions of the goods involved. Without this information, there can be confusion about the terms and nature of the transaction, leading to misunderstandings later. Always double-check that every necessary field is filled in completely and accurately.

Another error is failing to ensure the correct legal terms are used in the trust receipt template. The language should be clear and unambiguous to avoid any potential legal disputes. Using overly complicated or vague wording can lead to issues when the terms are enforced. Stick to standard language that aligns with the agreement’s intent.

Not specifying the repayment terms in detail is also a frequent problem. Some templates overlook crucial information about repayment schedules, interest rates, or penalties for delayed payments. This omission can create confusion or even open up the possibility of disputes between parties involved. Always outline the exact terms of repayment to avoid future complications.

Another mistake is not adjusting the template to suit specific transactions. Many templates are generic, and a failure to modify them for particular cases can lead to gaps or ambiguities in the contract. Customize your trust receipt template to match the specifics of each deal, including the goods, parties involved, and payment arrangements.

Lastly, neglecting to have the document signed and witnessed properly is a common error. Even if the template is filled out correctly, it holds no value unless it is signed by the appropriate parties. Ensure that signatures are obtained and verified as per legal requirements to make the document enforceable.

Ensure that the trust receipt agreement explicitly outlines the rights and responsibilities of all parties involved. This ensures clarity and helps to avoid misunderstandings during the term of the agreement. One key point to address is the legal ownership of goods, which remains with the lender until the borrower fully satisfies the terms of the agreement.

Key Legal Elements

- Transfer of Title: The lender retains ownership of the goods until payment is made. Make sure this transfer is clearly stated to prevent future disputes.

- Obligations of the Borrower: The borrower must keep the goods in good condition and insure them appropriately during the term of the trust receipt. These duties should be detailed in the agreement.

- Default Clauses: Clearly define the consequences of non-payment or failure to return the goods. Specify the legal steps the lender may take to reclaim the goods or any payments due.

Enforcement of Trust Receipt Agreements

When a borrower defaults, the lender can seek legal recourse through the courts. It is important to know the jurisdiction where the agreement will be enforced, as different laws may apply. Ensure the agreement complies with local legal frameworks and includes an arbitration clause to settle disputes without going to court.

Consulting legal professionals familiar with trust receipt agreements is advised to tailor the document to specific business needs and legal requirements.

Visit trusted legal document platforms, such as LawDepot or Rocket Lawyer, which offer high-quality templates with customizable options. These websites frequently update their documents to match the latest legal standards, ensuring compliance.

Professional Associations and Websites

Explore sites run by financial institutions, such as banks and credit unions, which often provide templates for trust receipts tailored to industry requirements. These sources are highly reliable as they follow strict regulations and standards.

Document Software Providers

Document management software platforms like Microsoft Word and Google Docs also offer various templates, including trust receipts. These templates are often user-friendly and can be edited easily to suit specific needs.

To create an accurate trust receipt, ensure that the document includes all required details. Start with the names of the parties involved: the buyer, seller, and the financial institution. Clearly state the terms, such as the amount borrowed, the repayment schedule, and any collateral. Specify the goods or items involved, providing serial numbers or descriptions if necessary. Include any conditions regarding insurance, taxes, and shipping if applicable. Finally, make sure both parties sign the document, and have a witness if required by local laws.

When filling out a template, double-check all fields for accuracy, especially the dates and payment terms. A well-structured trust receipt minimizes the chance of misunderstandings and ensures smooth processing of the transaction.

Be cautious about the type of document you use. Make sure the template aligns with the legal requirements in your jurisdiction. Using a template designed for another type of agreement could lead to complications. Always customize the content based on your specific deal to avoid generic or incomplete information.