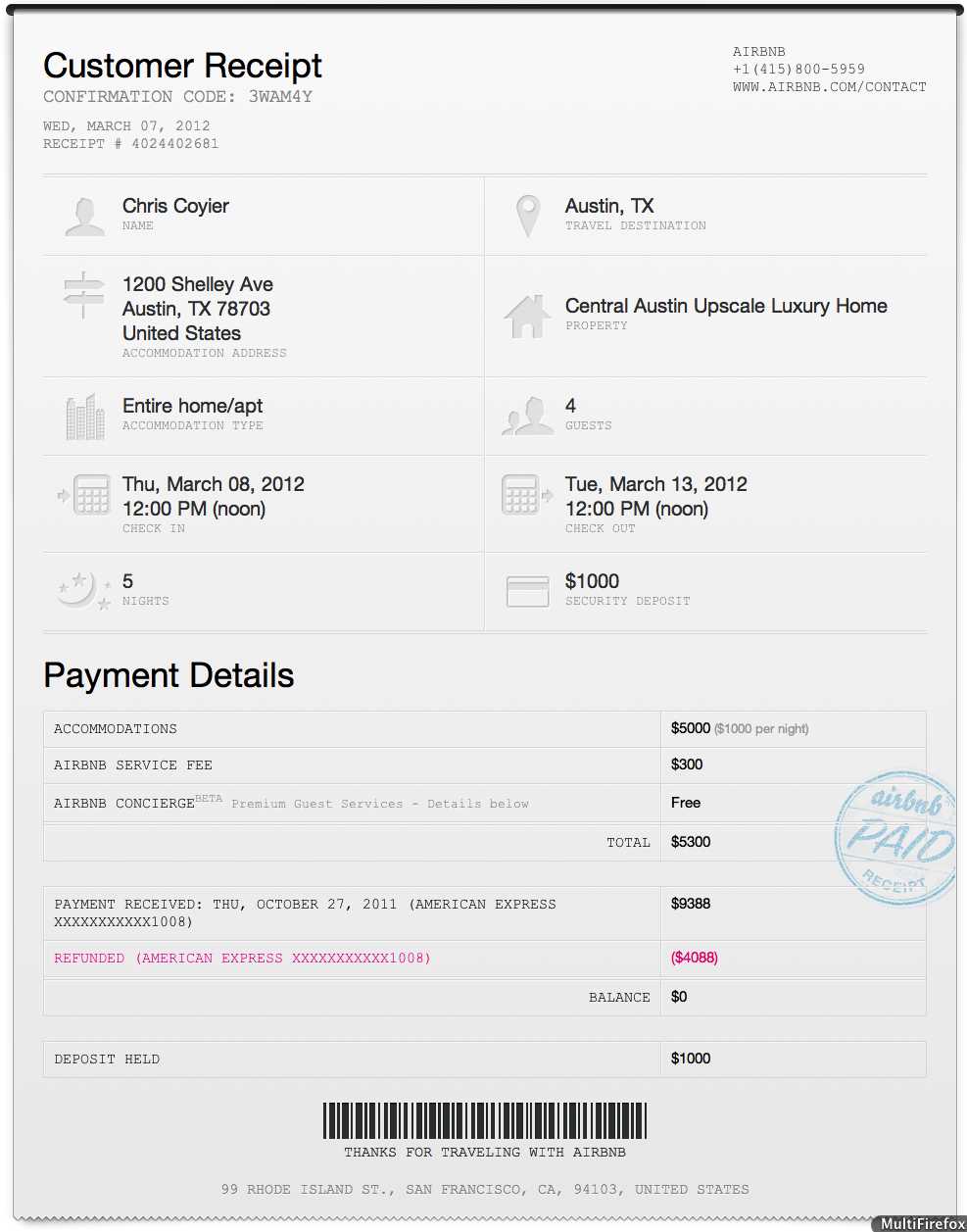

Download and Customize an Airbnb Receipt

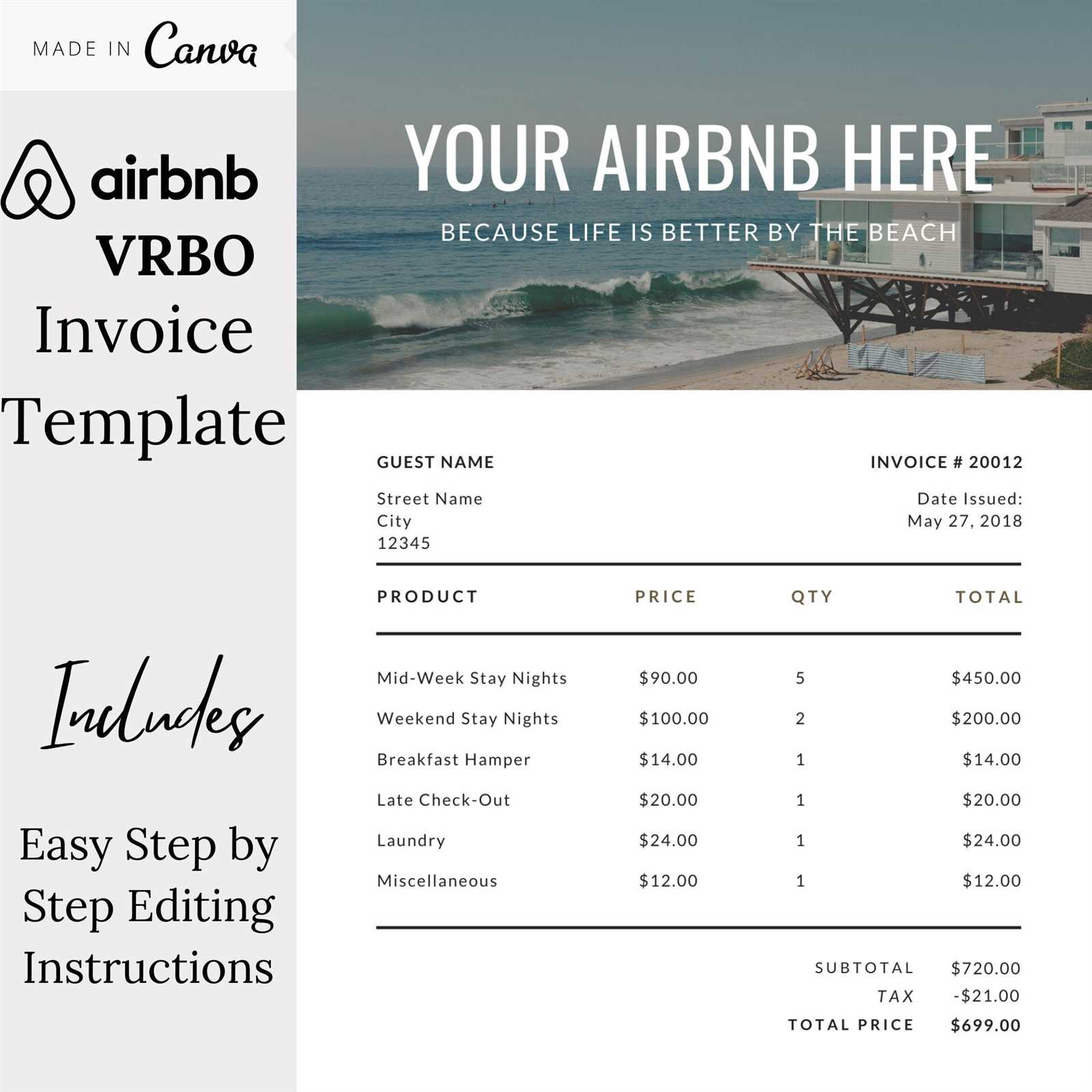

Need a detailed Airbnb receipt for business or personal records? Use a pre-formatted template that includes all essential details such as guest name, stay dates, total amount, and payment method. This ensures accurate documentation for reimbursements or tax purposes.

- Guest Information: Name, contact details, and booking reference.

- Stay Details: Check-in and check-out dates, property address.

- Cost Breakdown: Nightly rate, service fees, taxes, and total amount paid.

- Payment Method: Credit card, PayPal, or other payment sources.

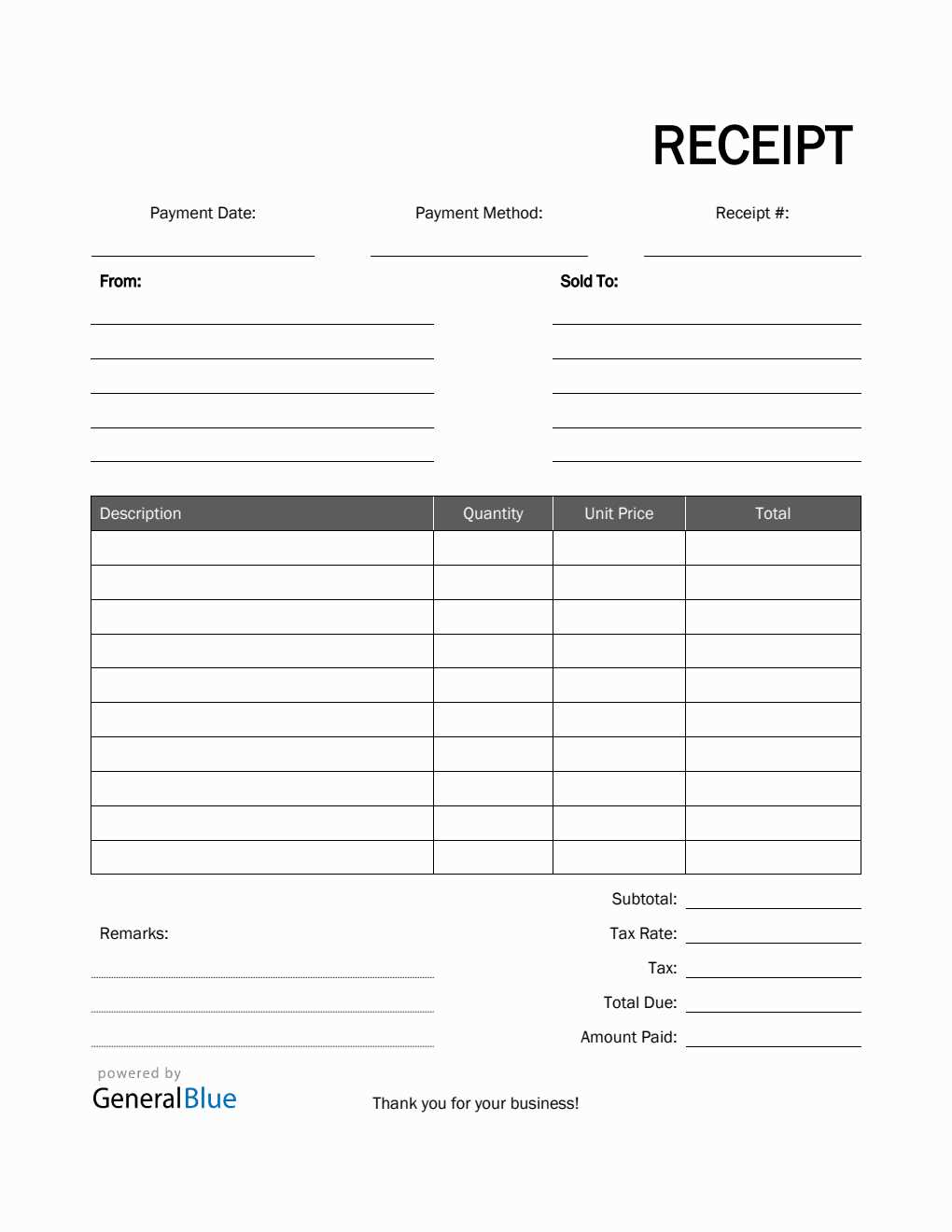

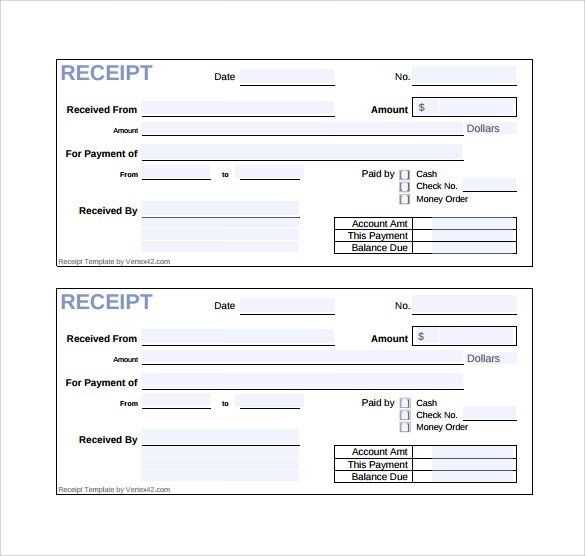

How to Use the Template

- Download: Choose a template in PDF or Word format.

- Fill in Details: Enter guest and booking information.

- Customize: Add a logo, company name, or additional notes.

- Print or Save: Generate a hard copy or store it digitally.

Why Use a Printable Receipt?

Not all hosts provide official receipts, making it necessary to create one manually. A well-structured template simplifies the process, ensuring accuracy and professionalism.

Where to Get a Free Template?

Several platforms offer Airbnb receipt templates at no cost. Look for options that allow easy customization and support multiple formats for convenience.

Printable Airbnb Receipt Template

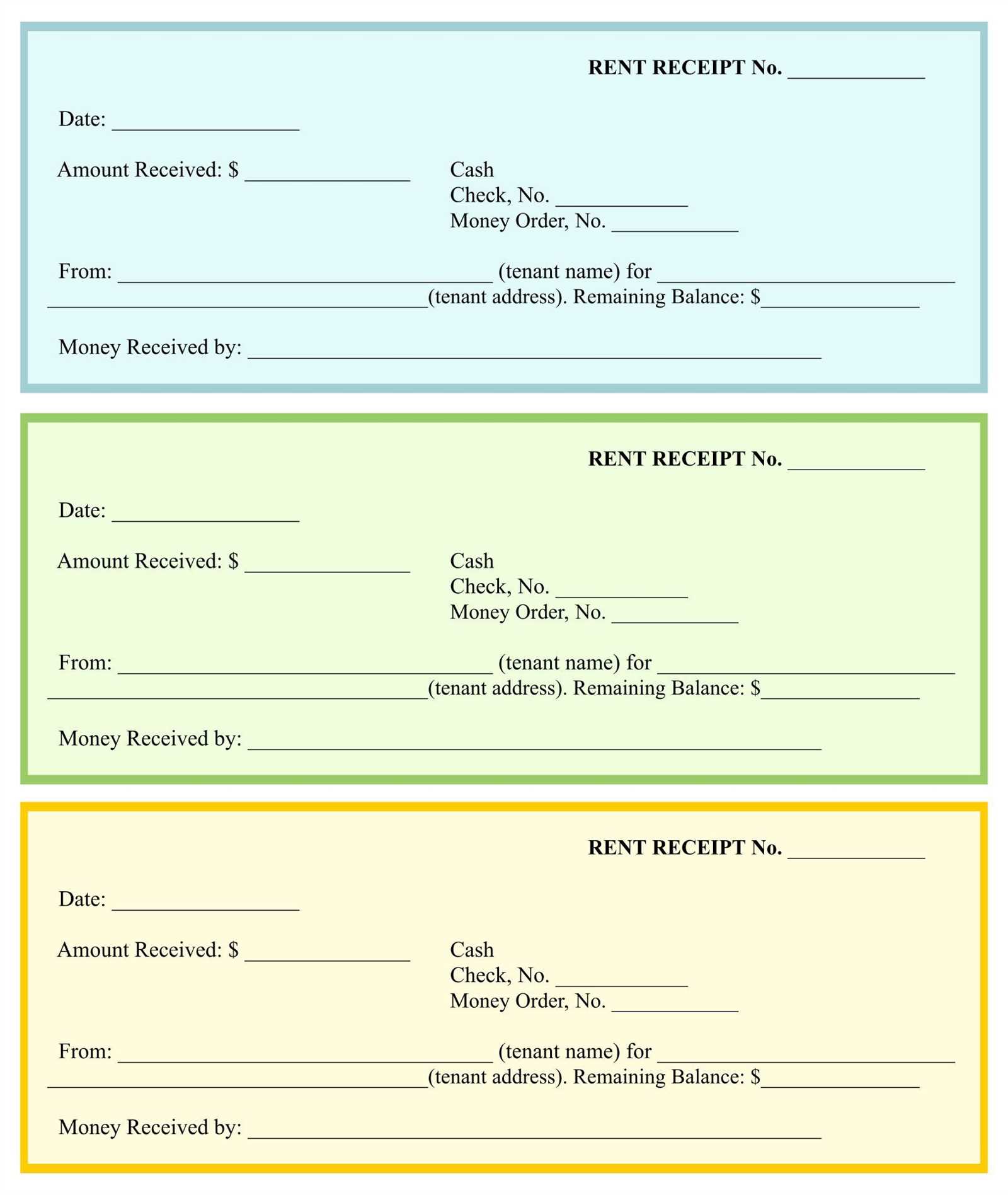

Key Elements to Include in a Rental Receipt

How to Customize a Printable Lodging Receipt

Legal and Tax Considerations for Rental Receipts

Best File Formats for Printable Receipts

Where to Find Free and Paid Receipt Templates

Common Mistakes to Avoid When Creating a Rental Receipt

Include essential details such as guest name, check-in and check-out dates, total amount paid, payment method, and property address. Specify the tax amount separately if applicable. A unique receipt number helps with record-keeping.

Customize templates by adding a logo, adjusting fonts, and modifying layout elements. Ensure all information is clearly structured for easy reading. PDF and Word formats provide flexibility, while Excel is ideal for automated calculations.

Ensure compliance with local tax laws by including necessary information such as VAT or occupancy tax details. Digital and printed copies should be stored securely for audit purposes. Consult a tax professional for specific regional requirements.

PDF is the preferred format for fixed layouts, while Word allows edits before printing. Excel is useful for dynamic calculations, and Google Docs provides easy online sharing. Choose the format based on your needs.

Free templates are available on Microsoft Office, Canva, and template marketplaces. Paid versions offer advanced customization and branding options. Verify that the chosen template meets legal and professional standards.

Avoid missing key details such as payment confirmation, guest information, and applicable taxes. Do not use overly complex layouts that hinder readability. Proofread before finalizing to prevent errors.