A security deposit receipt is a formal acknowledgment that a deposit has been paid for a rental or lease agreement. It is crucial for both landlords and tenants to have a written record to avoid misunderstandings and ensure transparency. A well-organized template can simplify the process and save time.

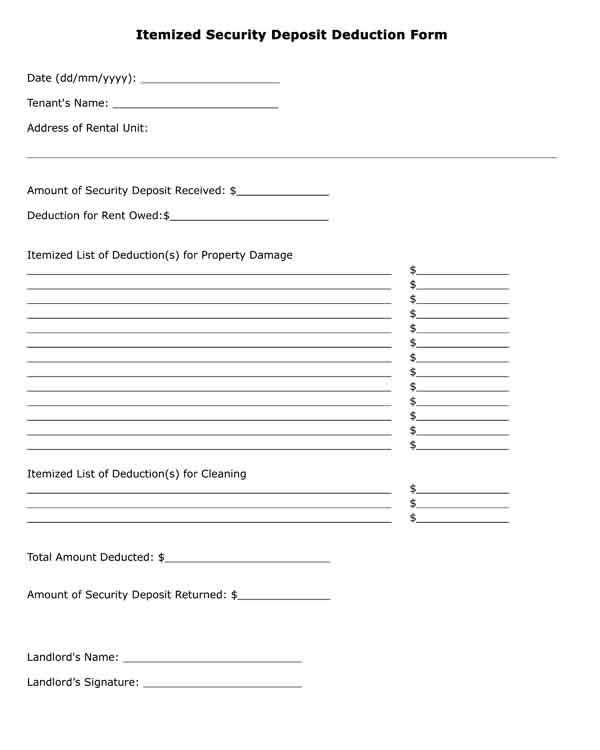

Ensure the template includes specific details, such as the tenant’s name, address, the amount deposited, and the date of payment. It should also outline any conditions related to the return of the deposit, such as deductions for damages or unpaid rent. Clear, concise language will help both parties understand their obligations.

Using a printable template streamlines the process, allowing you to create a receipt quickly and consistently. Look for one that allows space for additional comments or notes, making it customizable for different situations. Whether you’re a tenant or landlord, having this document on hand helps maintain an organized record of all rental transactions.

Got it! How can I assist with your writing today? Are you working on a new article or project?

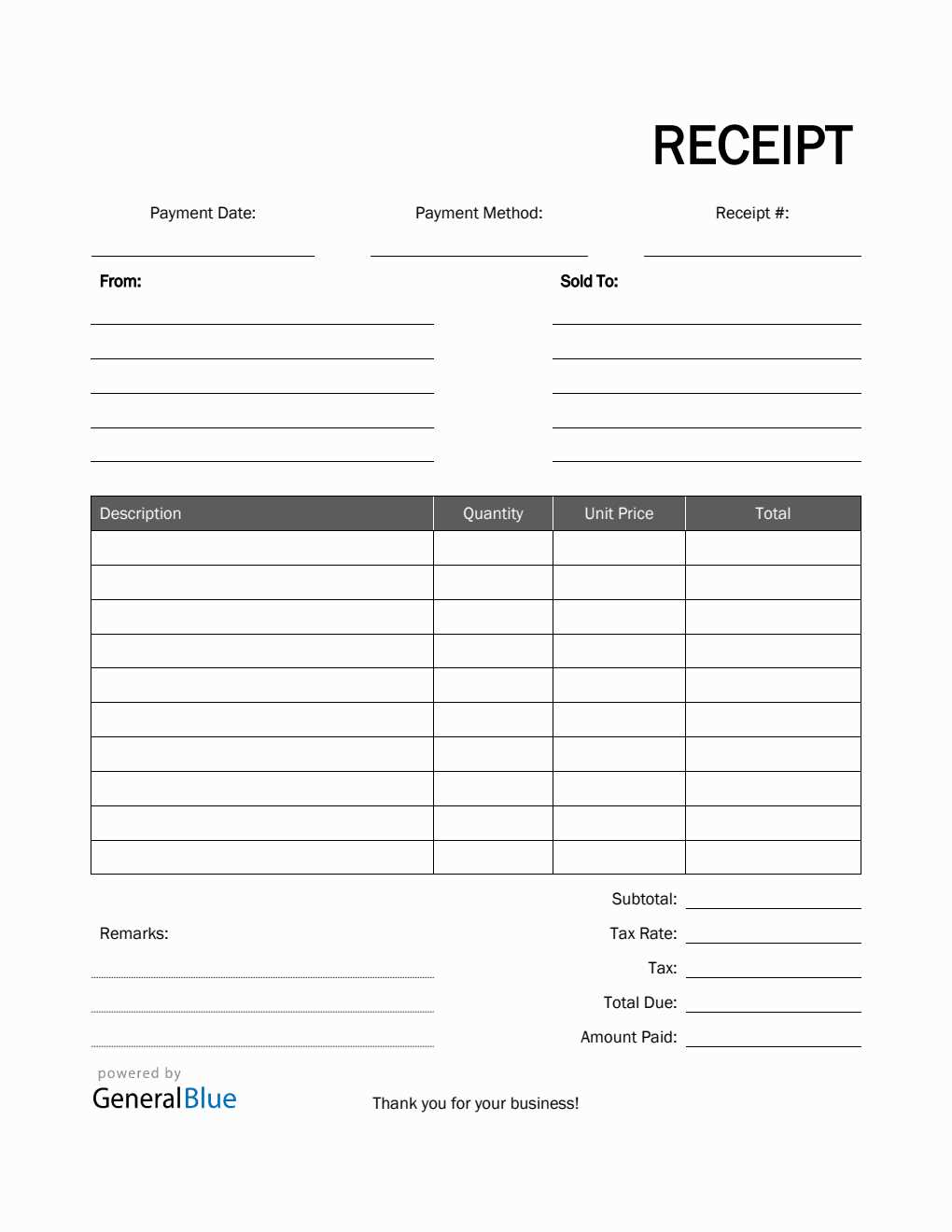

- Printable Security Deposit Receipt Template

Use a clear, straightforward template to issue security deposit receipts. The template should include the following details:

- Tenant’s Name – Full name of the tenant who provided the deposit.

- Landlord’s Name – The name of the property owner or landlord receiving the deposit.

- Property Address – Exact location of the rental property.

- Amount of Deposit – Total sum of the security deposit paid.

- Date Received – Date on which the security deposit was paid by the tenant.

- Payment Method – Indicate whether it was paid by cash, check, or another method.

- Condition of Property – A brief note about the state of the property at the time of payment, if relevant.

- Signatures – Both tenant and landlord should sign and date the receipt for validity.

This template ensures that all critical details are recorded clearly, preventing misunderstandings. Having a receipt format in place helps both parties track the deposit and serves as documentation in case of future disputes.

Ensure the template is simple to fill out, with space for all required details, and easy to print. A clean design can also make the receipt more professional and easier to store for future reference.

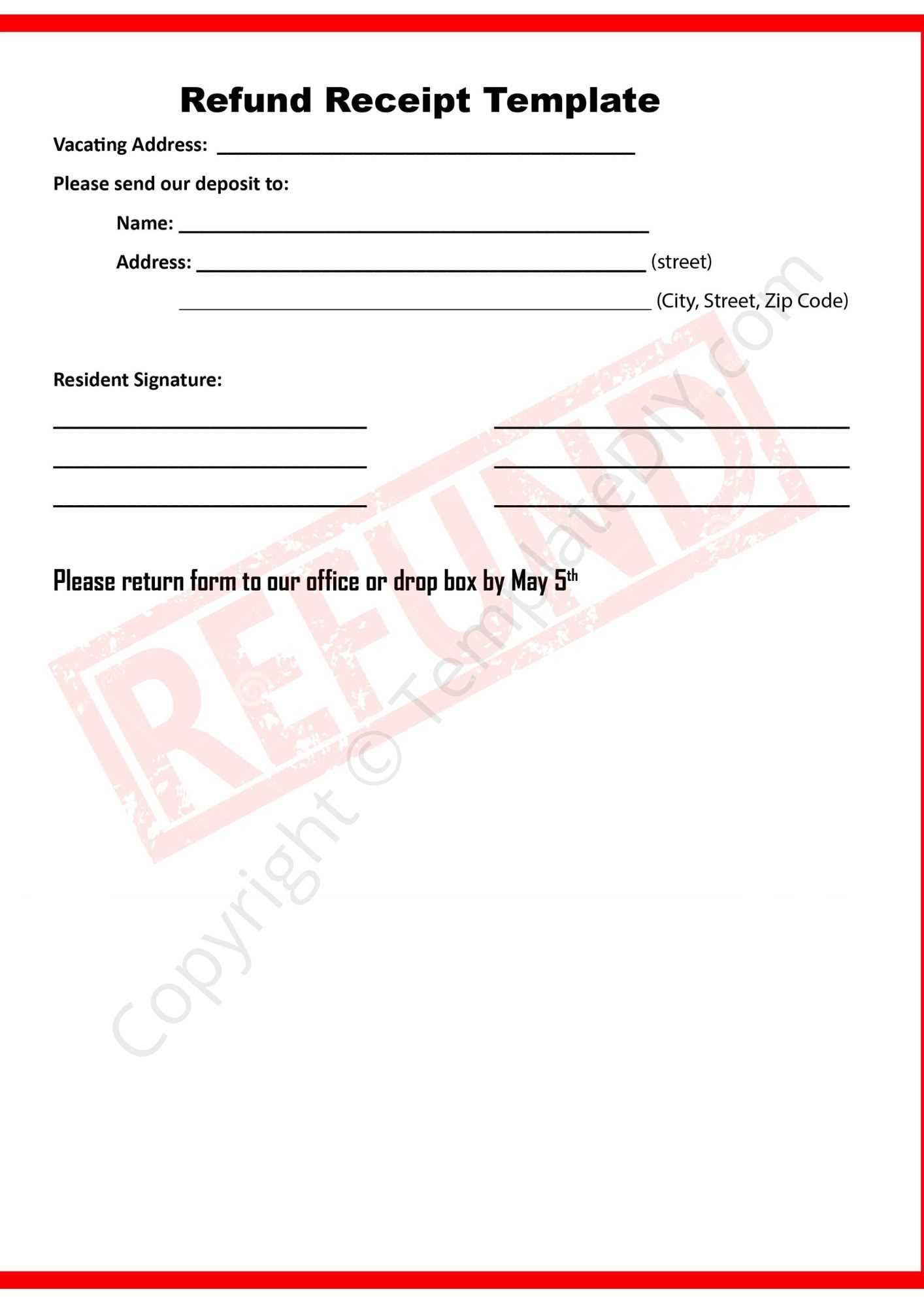

To create a personalized security deposit receipt, begin by ensuring it reflects the key details of your rental agreement. Tailor the receipt to the specific terms of your lease to avoid ambiguity and ensure both parties are clear on the deposit’s purpose and conditions.

1. Include Tenant and Landlord Information

- Full name of the tenant and landlord.

- Rental property address.

- Tenant’s contact information for follow-up.

2. Specify the Deposit Amount and Payment Date

- List the exact amount of the security deposit received.

- Indicate the payment method (e.g., cash, check, bank transfer).

- Record the date of receipt to track the transaction timeline.

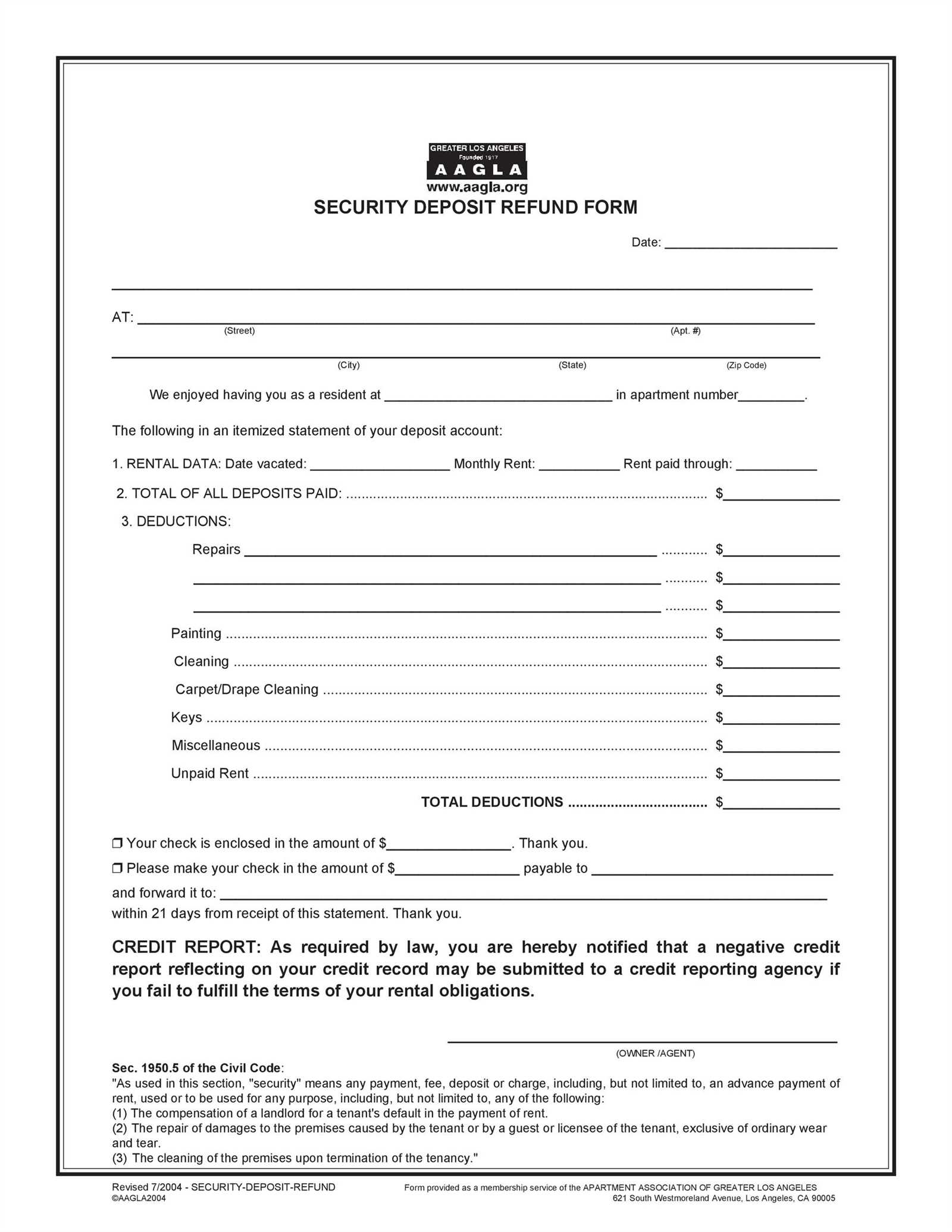

3. Outline Terms and Conditions

- Clarify the deposit’s purpose (e.g., damage, cleaning, unpaid rent).

- Explain conditions under which the deposit may be withheld or refunded.

- Include any deductions that may apply at the end of the lease.

4. Add a Signature Section

- Provide spaces for both the tenant’s and landlord’s signatures.

- Include the date when both parties sign to confirm agreement.

Adjust the wording to match the style of your rental agreement while keeping the format clear and straightforward. By personalizing this receipt, you protect both parties and ensure transparency in the deposit handling process.

Clearly state the date the deposit was made. This helps both parties reference the transaction and avoid confusion over the timeline.

Include the full names of both the payer and the recipient. This ensures that the deposit can be traced to the correct individuals in the future.

Specify the amount of the deposit in both numbers and words. This eliminates ambiguity and provides a clear record of the transaction.

Note the purpose of the deposit. Whether it’s for rent, a security deposit, or another reason, this detail clarifies the intent behind the payment.

Provide a unique receipt number for reference. This can assist in tracking the transaction and help with future inquiries or disputes.

List any payment methods used, such as cash, check, or bank transfer. This adds transparency and helps verify how the payment was made.

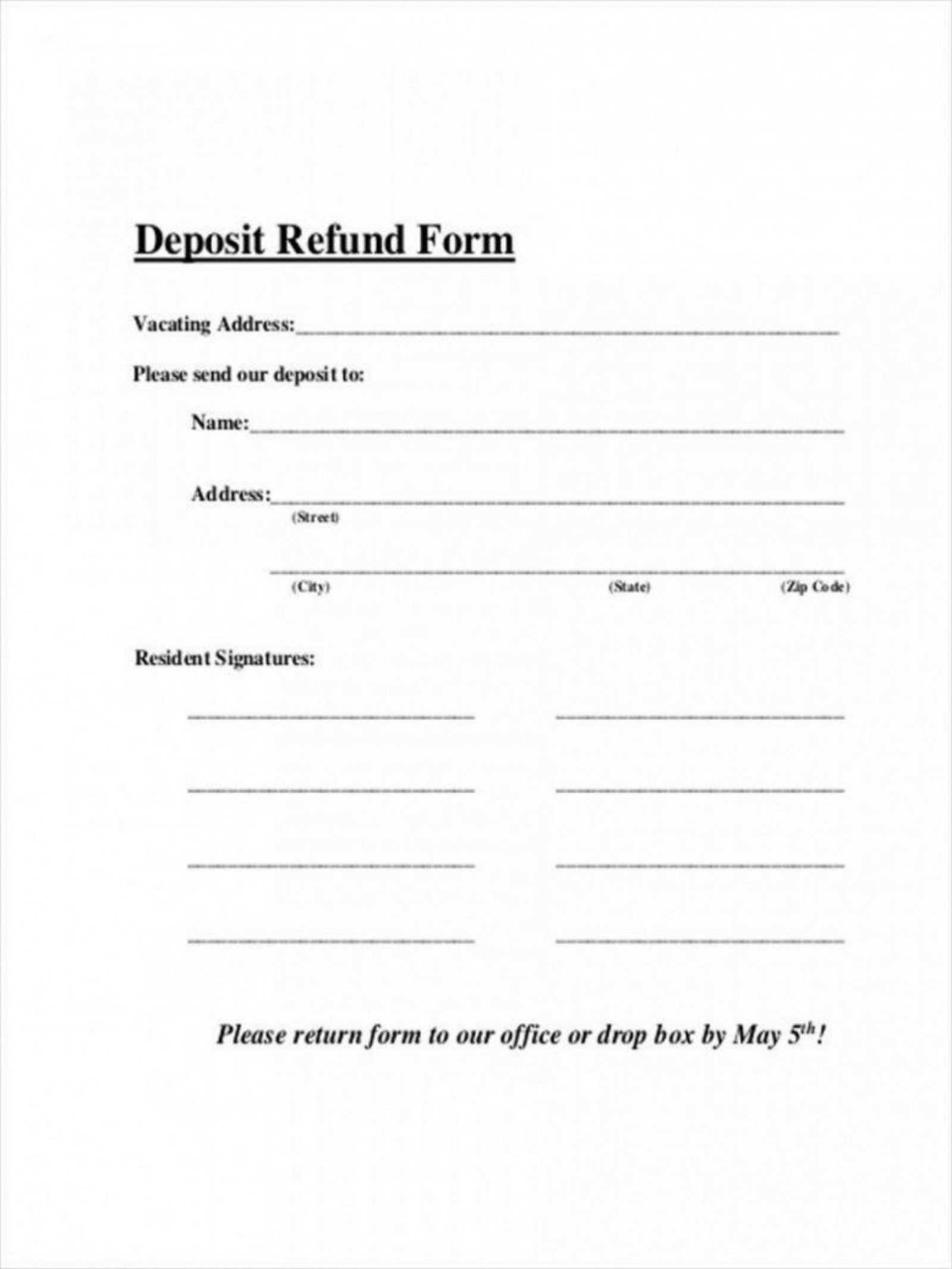

If applicable, include a return date or conditions under which the deposit may be refunded. This is especially important for security deposits to avoid confusion regarding the terms.

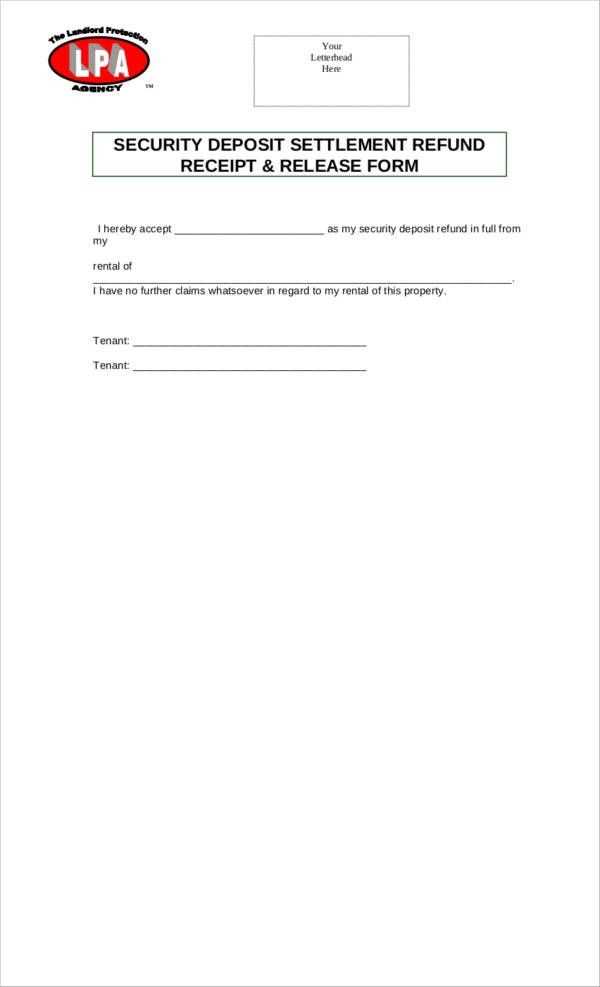

Finally, both parties should sign the receipt. This confirms that the transaction has been acknowledged and agreed upon by both individuals involved.

Distribute receipts immediately after transactions. Whether digitally or physically, send them as soon as possible to avoid confusion. For digital receipts, ensure email delivery with clear subject lines for easy retrieval. For paper receipts, hand them directly to tenants or customers to prevent delays.

Store receipts securely. For physical receipts, organize them in labeled folders or filing cabinets to maintain easy access and prevent loss. Use fireproof or lockable storage if possible. For digital receipts, back them up regularly in secure cloud storage or encrypted drives to avoid data loss.

Ensure proper organization. Categorize receipts by type (e.g., rent payments, maintenance fees) and date for simple reference. Digital systems can automate this with folder structures or tagging. Paper receipts can benefit from monthly or quarterly sorting to maintain a clear record.

Protect personal data. Whether storing receipts digitally or physically, avoid sharing sensitive information without proper authorization. For digital records, implement encryption and password protection. For paper receipts, ensure that they are kept out of sight and in a secure location.

Periodically review stored receipts. Set up a schedule for reviewing stored receipts to confirm their relevance. This can help identify outdated records that no longer need to be kept. Dispose of any unnecessary receipts securely, using shredding for paper copies and deleting files for digital records.

Security Deposit Receipt: Key Information to Include

Include the rental property address at the top of the receipt. This ensures both parties know which property the security deposit applies to. Clearly list the amount paid by the tenant and the date the deposit was received. This provides an official record for future reference.

Breakdown of Receipt Details

State the purpose of the deposit, such as “security deposit for damages” or “security deposit for utilities.” This clarifies the deposit’s role and helps prevent misunderstandings. If applicable, note the conditions for its return, such as the inspection of the property at move-out or any deductions for damages.

Include both the landlord’s and tenant’s full names and contact details. This is important for identification and communication, especially if disputes arise. Ensure that the receipt is signed by the landlord or the authorized agent, confirming the deposit was received in full.

Final Notes on the Template

Make sure the template is clear and easy to understand. Using simple language can prevent confusion, helping both the landlord and tenant stay on the same page. Providing a printed version of this receipt will also make the transaction more official and legally binding.