Creating a vehicle purchase receipt template is simple but important for documenting the transaction details. It serves as proof of purchase and includes key information such as buyer and seller names, the vehicle’s VIN, sale price, and date of sale. A well-structured receipt eliminates confusion and provides clarity for both parties involved.

Ensure you include the full name and contact details of both the buyer and seller. Clearly list the vehicle make, model, year, VIN, and odometer reading at the time of sale. A brief description of the vehicle’s condition at the time of purchase should also be included to avoid any misunderstandings later on.

The total price paid for the vehicle, including any taxes or additional fees, should be itemized. If any warranties or guarantees are offered, make sure these are outlined in the receipt, along with the terms. Lastly, both parties should sign and date the receipt, confirming agreement to the terms and details of the transaction.

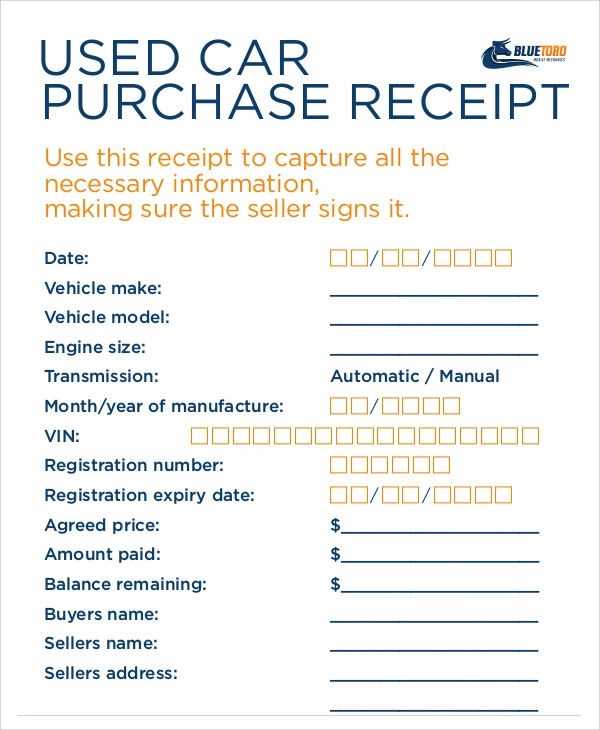

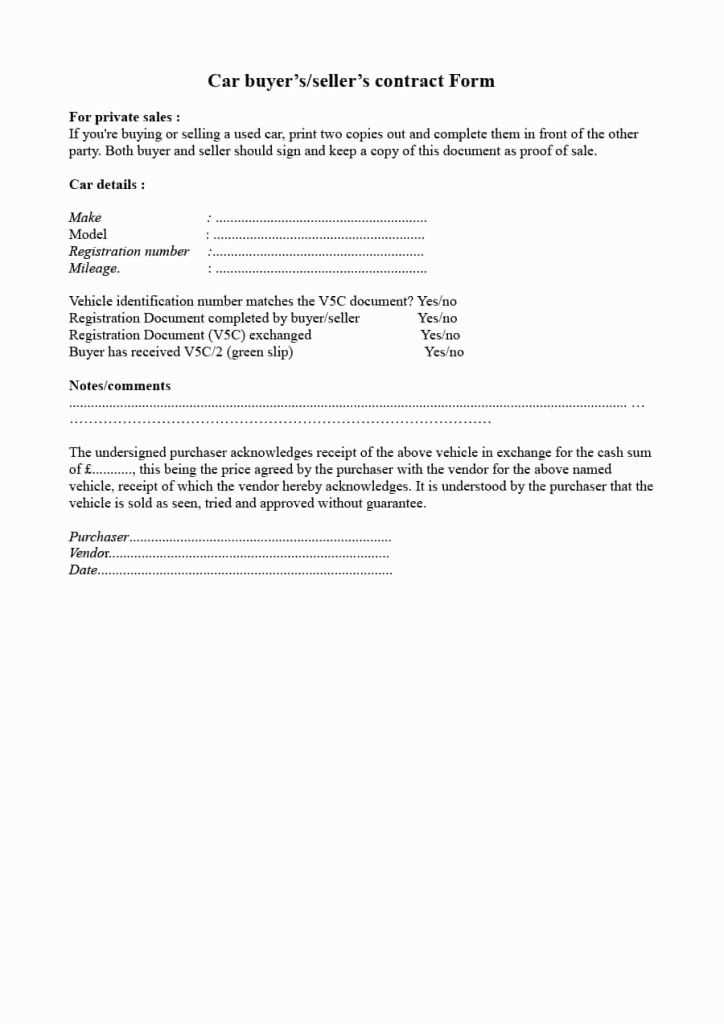

Vehicle Purchase Receipt Template

For a clear and professional vehicle purchase receipt, include specific details that confirm the transaction. List the vehicle’s make, model, year, and VIN (Vehicle Identification Number) for precise identification. Ensure both buyer and seller’s full names, addresses, and contact details are noted. Mention the total purchase amount, including tax, and the method of payment, such as cash, check, or financing. Add the date of purchase and any warranties or terms agreed upon. A signature section for both parties at the bottom ensures that the transaction is finalized properly.

Below is a suggested template layout for simplicity:

Receipt No: [Unique ID]

Seller’s Name: [Full Name]

Seller’s Address: [Street, City, State, Zip Code]

Buyer’s Name: [Full Name]

Buyer’s Address: [Street, City, State, Zip Code]

Vehicle Make: [Make]

Vehicle Model: [Model]

Year: [Year]

VIN: [Vehicle Identification Number]

Purchase Amount: $[Amount]

Payment Method: [Cash/Check/Credit/Other]

Payment Terms: [Any details about payment plans or financing]

Warranty (if applicable): [Warranty details, if any]

Transaction Date: [Date of Purchase]

Seller’s Signature: _______________________

Buyer’s Signature: _______________________

Adjust the format to fit the details of your specific transaction, ensuring all parties are clear about the terms and agreement. This document serves as proof of the sale and can be used for registration or other legal purposes.

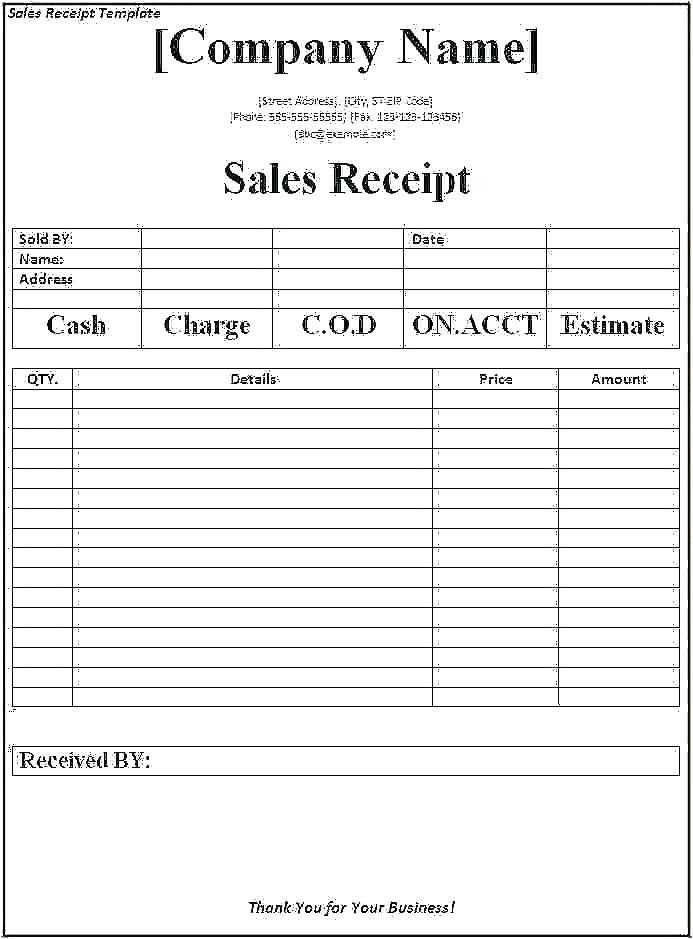

How to Structure Vehicle Purchase Information

Begin by organizing the key details about the vehicle in a clear, straightforward manner. Focus on the vehicle’s make, model, year, and VIN. These are the core identifiers that will distinguish the car from others. Ensure this information is easy to spot and accurately recorded. Include the vehicle’s mileage at the time of sale and confirm if it has undergone any repairs or modifications.

Vehicle Details

List the vehicle’s make, model, and year in separate lines or columns. The Vehicle Identification Number (VIN) should follow immediately for clarity. Next, specify the mileage, including whether the vehicle has been involved in any accidents or whether any major components have been replaced. Include details about its warranty status, if applicable. Be clear about whether the vehicle is new or used, and if used, include the history report if available.

Pricing Information

Clearly state the purchase price and break down any additional costs, such as taxes, registration fees, and dealer charges. If financing was involved, mention the loan amount, interest rate, and payment terms. This ensures transparency for both parties and minimizes any confusion over the total cost.

Make sure that each section is presented in a logical sequence. Align details like vehicle information, pricing, and payment terms to reflect their relationship with one another. This method will keep the document organized, clear, and easy to reference.

Key Data to Include in the Receipt

Ensure the receipt includes the vehicle identification number (VIN) for accurate tracking. The VIN is unique to each vehicle and is critical for any future ownership transfer, registration, or insurance claim.

Include the vehicle’s make, model, year, and color. These details identify the specific vehicle purchased and should match the information on the registration documents.

Transaction Information

Clearly list the total purchase price, including any taxes, fees, or additional charges. Be specific about the breakdown of these amounts to avoid confusion. Also, include the payment method used, such as credit card, loan, or cash.

Seller and Buyer Information

Document the full names and addresses of both the buyer and seller. This establishes the parties involved and helps avoid any disputes in the future.

Legal Considerations When Drafting a Receipt

Make sure the receipt clearly identifies both parties: the buyer and the seller. Include full names, addresses, and contact details to avoid confusion or disputes. If possible, use official names and legal titles to ensure accuracy.

State the transaction amount explicitly. Break down any taxes, fees, or additional charges separately to ensure transparency. This prevents misunderstandings if the buyer questions the total cost later.

Specify the Payment Method

- Detail the payment method used–whether cash, check, credit card, or bank transfer. This helps track the transaction’s legitimacy and clarifies whether any payment was pending.

- Include transaction references or confirmation numbers, especially for electronic payments.

Include Terms and Conditions of Sale

- Note if the item is sold “as is” or if any warranties or guarantees are provided. This protects the seller from potential claims of faulty goods.

- Define any return or refund policies in the receipt to set expectations for both parties.

Ensure the receipt includes the date and location of the transaction. These details confirm the timeframe and jurisdiction should a dispute arise.

Finally, both parties should sign the document, providing additional verification of the transaction’s authenticity.

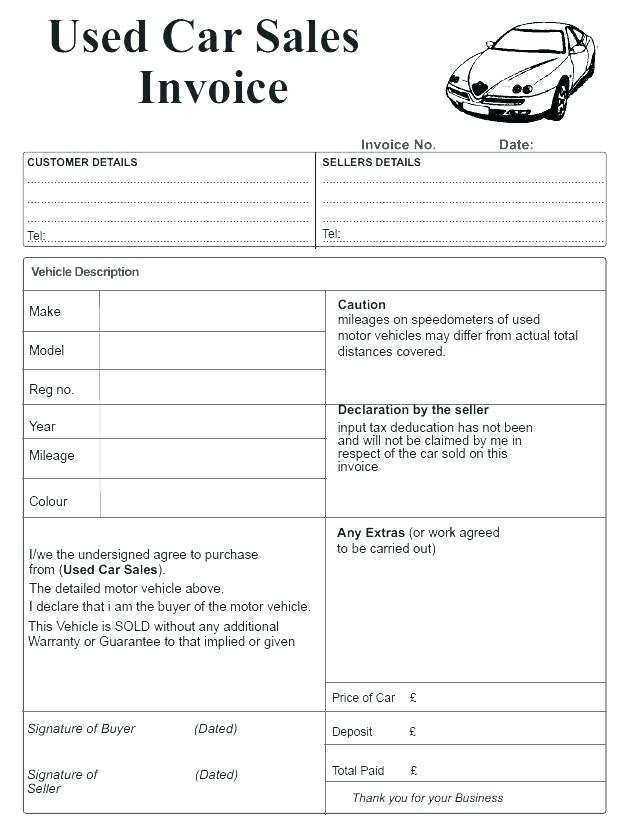

Customizing the Template for Different Vehicle Types

Adjust the vehicle purchase receipt template based on the specific vehicle type to ensure all relevant details are captured. For each vehicle category, there are unique features that need to be included.

- For Cars: Include details like engine type, model year, fuel efficiency, and transmission. Ensure the vehicle identification number (VIN) is clearly specified.

- For Motorcycles: Add specifics such as engine capacity, bike type (e.g., cruiser, sport), and whether it is a custom or stock model. The VIN and any special license information should also be included.

- For Trucks: Specify load capacity, axle configuration, and any unique features like towing capacity or modifications for commercial use. The vehicle’s gross weight and VIN are also critical for trucks.

- For Electric Vehicles: Note battery capacity, range, and charging specifications. Additionally, include details on any warranty coverage specific to the battery and electric systems.

- For Recreational Vehicles (RVs): Mention the RV’s model, type (motorhome, camper trailer), capacity, and any installed amenities (e.g., kitchen, bathroom, sleeping areas). A separate section for exterior and interior condition can also be useful.

These adjustments ensure the receipt provides a complete and tailored record that reflects the unique characteristics of each vehicle type. This makes it easier for both buyer and seller to track the specifics for future reference or resale.

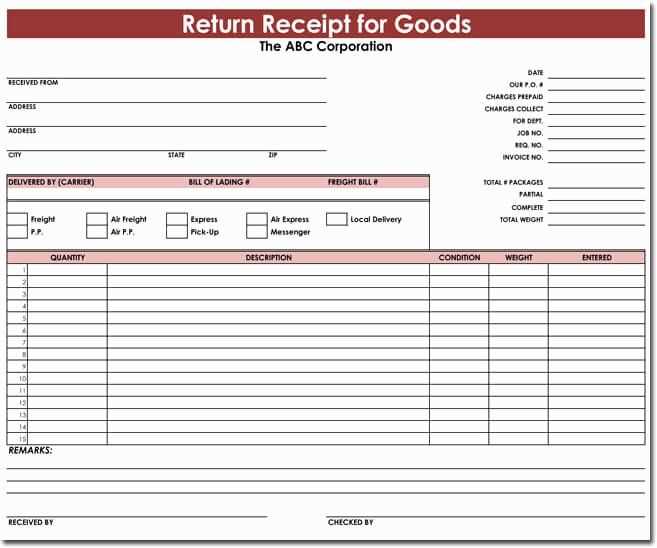

Steps for Adding Payment Details and Terms

Include the payment method first, specifying whether the buyer paid in full, via installment, or other methods like bank transfer, credit card, or cash. If applicable, mention the payment plan, including dates and amounts due.

Outline any taxes or additional fees that are part of the total cost. Clarify if any discounts were applied and how they impact the final price.

Clearly define the payment due date or dates. If the payment is split into installments, list the amounts and due dates for each installment.

If any special conditions apply to the payment, such as a deposit or specific terms for late payments, include them here. Make sure to mention any penalties for missed or delayed payments, if relevant.

| Payment Method | Amount Paid | Due Dates | Fees/Discounts |

|---|---|---|---|

| Credit Card | $25,000 | Due by 15th February | 10% Discount Applied |

| Bank Transfer | $5,000 | Due by 30th March | No Additional Fees |

End by specifying any warranties or guarantees tied to payment terms. This helps ensure both parties are clear about the terms of the transaction.

Ensuring Accuracy and Compliance with Local Regulations

Check your local regulations for specific requirements when drafting a vehicle purchase receipt. Verify that the document includes all necessary information, such as vehicle identification number (VIN), make, model, year, sale price, and buyer/seller details. Some regions may require additional clauses or terms, like emissions certifications or warranty information. Always use the correct format for dates, prices, and other key details as specified by local laws.

Double-Check Taxation Requirements

Local taxation rules must be reflected accurately. Include the appropriate sales tax rate, which may vary depending on the jurisdiction. Ensure that the receipt shows a breakdown of the tax amount and the total sale price separately. Failing to correctly calculate and report taxes can lead to legal complications for both parties.

Stay Up to Date with Consumer Protection Laws

Ensure that your receipt complies with consumer protection laws. In some areas, the buyer may be entitled to specific rights regarding vehicle return or refund policies. If applicable, state the buyer’s rights clearly on the receipt. Verify that your document provides all necessary disclosures to protect both the buyer and seller.