Landlords in California must provide a rent receipt upon request, even if payments are made electronically. A well-structured receipt serves as proof of payment and helps both landlords and tenants maintain clear financial records.

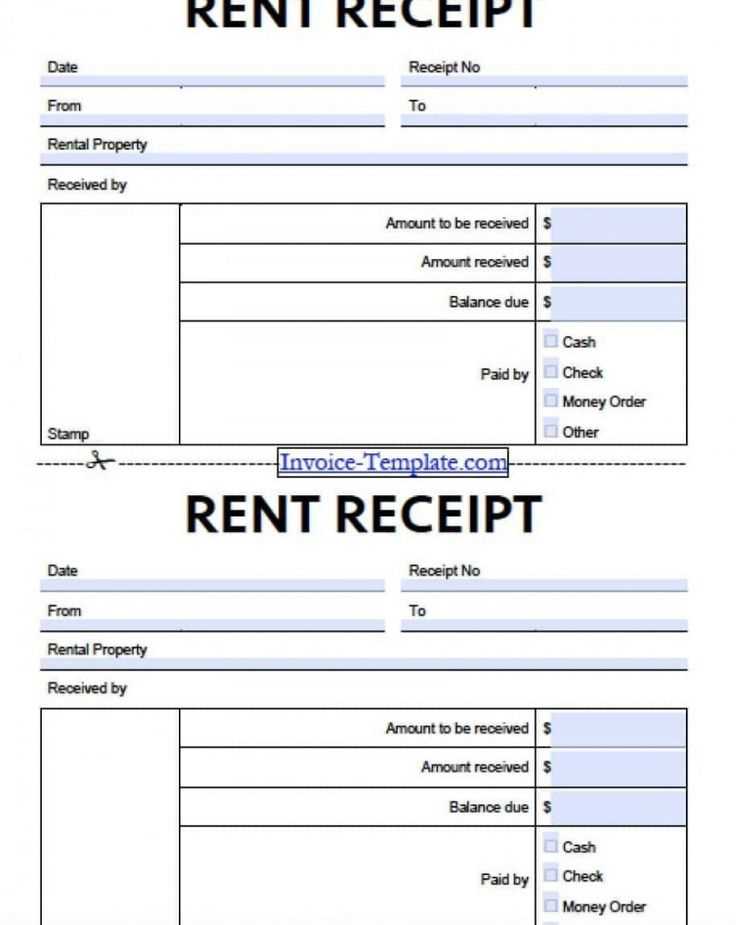

A proper rent receipt includes the tenant’s name, payment date, amount paid, rental period covered, payment method, and the landlord’s signature. If the payment includes multiple charges, such as late fees or utilities, each amount should be itemized.

Using a standardized template ensures accuracy and compliance with state regulations. Whether you manage multiple properties or rent out a single unit, a structured receipt reduces disputes and keeps financial documentation organized.

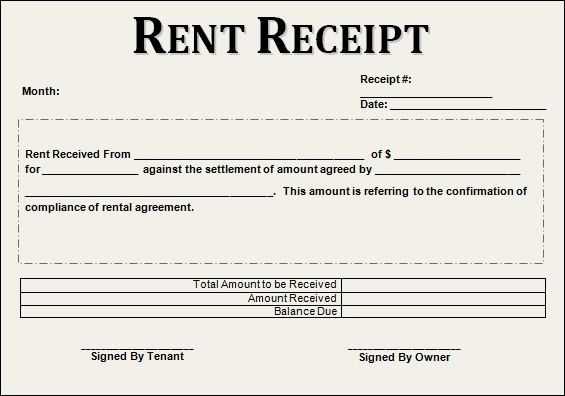

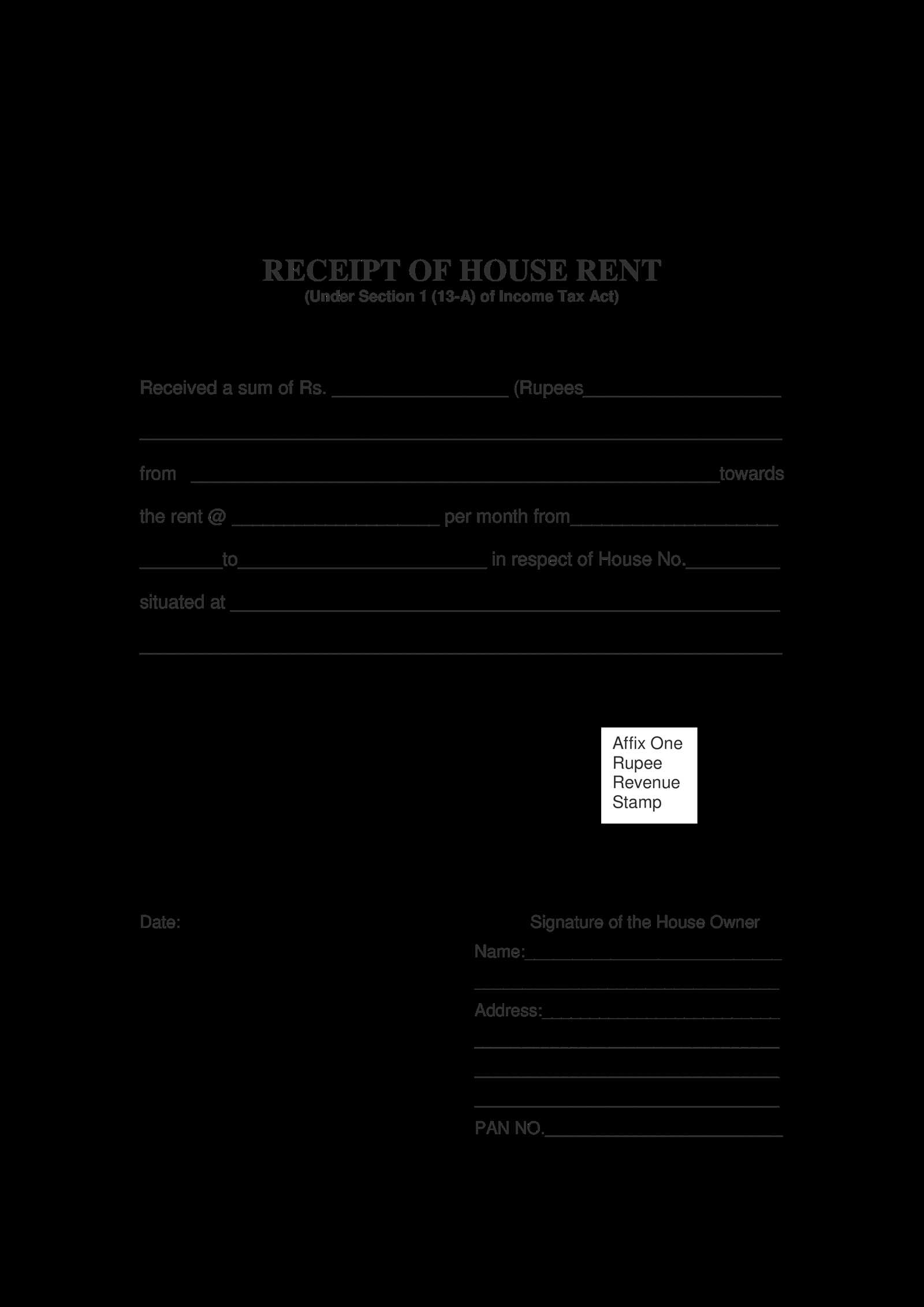

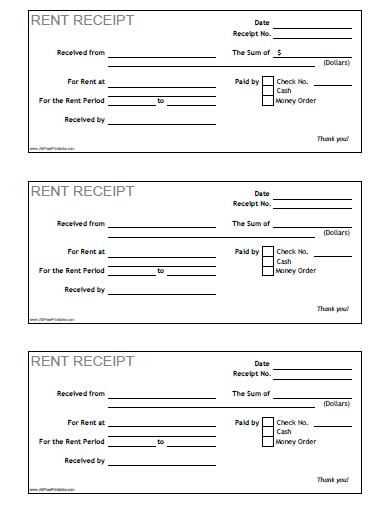

Below, you’ll find a ready-to-use rent receipt template tailored to California’s rental laws. Fill in the necessary details, print or save a digital copy, and provide it to tenants upon receiving rent payments.

Here is the corrected version with repetitions removed:

Ensure your rent receipt template includes all necessary details for clarity and compliance with California laws. The following sections are required:

| Field | Details |

|---|---|

| Tenant Name | Include the full name of the tenant who made the payment. |

| Landlord Name | Include the full name of the landlord or property management company. |

| Address of Rental Property | Specify the rental property’s address for verification purposes. |

| Payment Amount | Clearly list the amount paid, indicating rent and any additional charges. |

| Payment Date | Specify the exact date the payment was made. |

| Payment Method | Note how the payment was made (e.g., check, cash, bank transfer). |

| Receipt Number | Assign a unique receipt number for tracking and reference. |

This structure ensures all critical information is recorded, protecting both parties in case of disputes.

- California Rent Receipt Template

To create a California rent receipt template, include the following key details: the landlord’s name, tenant’s name, rental property address, the amount of rent paid, and the payment date. Specify the rental period that the payment covers. If any additional fees are included, list them clearly. Make sure the receipt is signed by the landlord or property manager. A simple example would look like this:

- Landlord’s Name: John Doe

- Tenant’s Name: Jane Smith

- Rental Property Address: 123 Main St, Apartment 4B, Los Angeles, CA

- Amount Paid: $1,200

- Payment Date: February 8, 2025

- Rental Period: February 1, 2025 – February 28, 2025

- Signature: John Doe

Having a clear and straightforward rent receipt helps avoid misunderstandings and provides proof of payment for both tenants and landlords. Always keep a copy for your records.

A California rental proof must contain specific information to be legally recognized. Include these key details to ensure clarity and validity:

- Tenant’s Name: Clearly state the full name of the tenant renting the property.

- Landlord’s Name and Contact Information: Provide the landlord’s full name, address, and phone number or email for communication.

- Property Address: List the exact address of the rental property, including unit number if applicable.

- Rental Payment Amount: Specify the amount of rent paid, including whether it covers utilities or other fees.

- Payment Date: Include the exact date the payment was made to confirm timeliness.

- Payment Method: Indicate the method of payment (check, wire transfer, cash, etc.) to verify how the transaction was completed.

- Receipt Number: Provide a unique identifier for the transaction, such as a receipt number, for tracking purposes.

- Signature: Ensure both the tenant and landlord (or agent) sign the receipt for authenticity.

- Lease Terms: If applicable, mention any specific terms from the lease that are reflected in the payment (e.g., late fees, rent adjustments).

Including these elements makes the rental proof document reliable and legally sound for both tenant and landlord records.

In California, landlords must provide a receipt for any rent payment made in cash. This is required by law to ensure proper documentation and to prevent disputes about whether a payment was made. If the tenant pays by other methods, such as check or bank transfer, a receipt is not mandatory, but providing one can help clarify any future questions about payment history.

The receipt should include specific details: the amount of rent paid, the date of payment, the property address, and the name of the tenant. If the payment is made in cash, the landlord must also note the cash method of payment. The landlord is required to provide a receipt at the time the payment is made, and it must be signed by the landlord or their representative.

Tenants can request a receipt for any payment method, and landlords should honor that request. While it’s not a legal requirement to issue a receipt for check or electronic payments, doing so provides transparency and can help avoid misunderstandings later.

Begin by clearly identifying the landlord and tenant’s names at the top of the receipt. Include the address of the rental property to avoid confusion. Next, list the amount of rent paid and the date it was received. If there were any additional fees, such as for late payments or maintenance, include those separately with their respective amounts.

Include the rental period, specifying the start and end dates for which the payment applies. If the payment was made in part or full, note the payment method (e.g., cash, check, or bank transfer) for further clarity. Always sign and date the receipt to confirm the transaction.

Double-check all details for accuracy. Providing a detailed, professional rental receipt protects both parties in case of future disputes.

For keeping track of rent payments, both printable and digital formats serve their purpose. Printable receipts offer a tangible option for renters who prefer physical records. A simple template that includes the date, amount, and rental property details can be printed directly from your computer or local printing service. This method works best for tenants who want to file paper copies or hand them to landlords in person.

Printable Receipts

Printable receipts allow you to create a customized document with all necessary details. Many online platforms offer free templates specifically designed for rent payments, allowing you to add property information, payment dates, and amounts paid. Once completed, you can print these templates for your personal record-keeping.

Digital Receipts

Digital receipts provide an easily accessible, eco-friendly alternative. You can generate and store payment records as PDFs or save them directly into cloud storage. Digital receipts offer convenience, as they can be emailed to landlords or accessed anytime from your phone or computer. They are also beneficial for organizing and searching through records when needed.

Both options ensure clear documentation and can be used according to your preferred storage method, whether physical or digital.

One major mistake is failing to include all required details in the rental receipt. Always ensure that the tenant’s full name, address of the rental property, payment amount, and the payment date are clearly stated. Missing any of these elements could lead to confusion or disputes later.

- Not Including a Signature: Both the landlord and the tenant should sign the rental receipt. Without signatures, the proof may not hold up in a legal setting.

- Leaving Out Payment Method: It’s important to specify the method of payment–whether it’s cash, check, or bank transfer. This can avoid misunderstandings about how the rent was paid.

- Failing to Update Receipts: When rent changes, ensure that new receipts reflect the updated amount. Using old receipts with outdated payment amounts can cause confusion.

- Not Providing Copies: Both parties should receive a copy of the receipt. Always ensure that you provide a copy to the tenant for their records.

- Incorrect Date: Double-check the date to ensure accuracy. A wrong date could create doubts about the timing of payments.

Avoiding these mistakes helps maintain clear, accurate, and legally sound rental records.

Start by visiting websites like Template.net and Vertex42, which offer a wide selection of free and customizable rent receipt templates specifically for California. You can download templates in various formats such as Word and PDF, allowing you to edit and personalize them as needed. If you need more design flexibility, Canva provides an intuitive platform where you can create a rent receipt from scratch or modify existing templates according to your preferences.

Another great option is Microsoft Office’s template gallery, where you can find downloadable templates for Word or Excel. These templates are simple to use and can be easily customized to fit your needs. You can also check out Google Docs, which has free templates available for use directly in your browser. With Google Docs, you can quickly adjust the format, add necessary fields, and share the receipt with tenants instantly.

If you’re looking for something more specific, consider browsing rental-specific forums or online communities, where individuals often share their templates for free. These resources can provide you with templates that are tailored to California’s rental laws and regulations.

Rent Receipt Template Recommendations

For a California rent receipt, it is crucial to provide clear and concise information. Keep the details organized by including the tenant’s name, the rental property address, the amount paid, and the payment date. A good structure will allow both parties to quickly identify the payment details. Try to minimize repetitive phrasing like “Rent Receipt” while maintaining clarity and meaning.

How to Adjust for Clarity

When you are preparing the receipt, avoid overuse of terms such as “Rent Receipt.” Instead, refer to it simply as “Receipt” after its first mention. For example, after stating “Rent Receipt for [date]”, you can just use “Receipt” for the subsequent references. This will ensure the document remains readable and less redundant.

Additional Tips for Formatting

Ensure that the format is straightforward: Include all necessary fields such as the landlord’s name, the rent amount, and the payment method. Using bullet points or clear sections can help break the information down. A concise layout improves readability, making it easier to reference if needed in the future.