Creating a cash deposit receipt for rental security return is a straightforward process that helps both tenants and landlords document the transaction clearly. This receipt serves as proof that the tenant’s security deposit has been returned, either fully or partially, and it outlines any deductions made from the original deposit. It ensures transparency and protects both parties in case of future disputes.

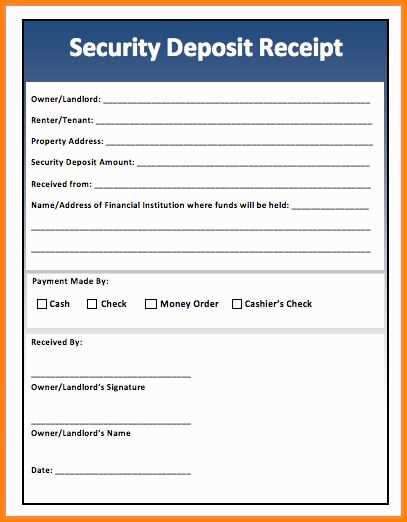

Include key details in the receipt such as the tenant’s name, rental property address, deposit amount, return date, and a breakdown of any deductions. It’s also useful to note the method of return–whether in cash, check, or bank transfer–so the transaction is fully documented. This prevents misunderstandings and provides clarity for both the tenant and landlord.

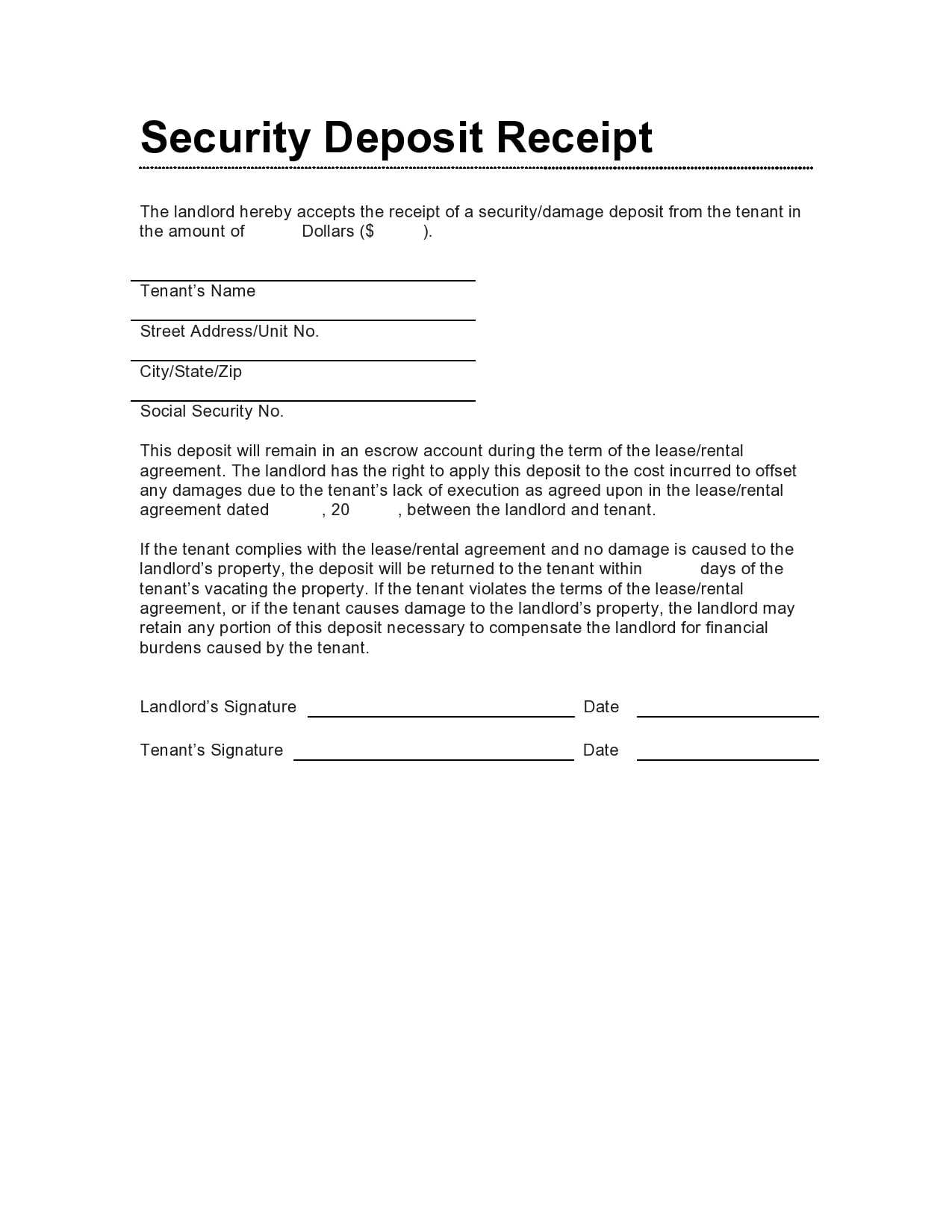

A well-structured receipt acts as an official record, minimizing risks and offering peace of mind to everyone involved. Always ensure the receipt is signed by both parties to acknowledge the completion of the return process.

Here is the revised version of the text, with reduced repetitions but keeping the meaning intact:

To return the rental security deposit smoothly, provide a clear cash deposit receipt template. The document should include essential information such as the tenant’s name, rental property address, deposit amount, and the date of the transaction. Ensure that it outlines the condition of the property upon move-out and specifies any deductions made from the deposit.

Key Elements to Include:

1. Tenant details: Full name, contact information, and lease dates.

2. Property address: Full address of the rented premises.

3. Deposit details: The amount received, including payment method and transaction date.

4. Condition report: Document the condition of the property and list any damages or issues leading to deposit deductions.

Formatting Tips:

Keep the language simple and to the point. Use bullet points for clarity, especially when listing damages or deductions. Ensure both parties sign the document to confirm agreement on the conditions of the return.

By following this structure, you make the process transparent and ensure both the landlord and tenant are on the same page.

- Cash Deposit Receipt Template for Rental Security Return

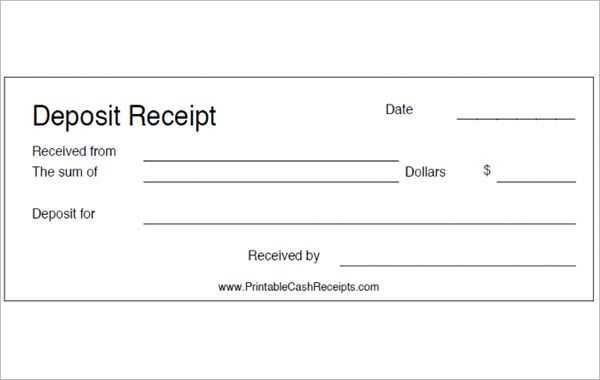

A cash deposit receipt serves as proof that the rental security deposit has been returned to the tenant. It includes critical details to ensure transparency and avoid disputes. Below is a template for such a receipt, which you can customize according to your needs:

Key Elements of the Receipt

- Tenant’s Name: Full legal name of the tenant receiving the refund.

- Property Address: The address of the rental property where the tenant stayed.

- Deposit Amount: The total amount returned from the security deposit.

- Date of Return: The exact date when the security deposit was returned.

- Payment Method: How the deposit was returned (cash, check, or bank transfer).

- Deduction (if any): If applicable, list any deductions made from the deposit, such as for damages or unpaid rent.

- Landlord’s Name and Signature: The name and signature of the landlord or authorized agent who processed the refund.

Sample Template

Here’s a simple example of what a cash deposit receipt might look like:

Date: [Insert Date] Tenant's Name: [Tenant's Full Name] Property Address: [Insert Address] Total Deposit Returned: $[Amount] Payment Method: [Cash/Check/Bank Transfer] Deductions (if any): $[Amount] for [Describe Reason] Amount Returned: $[Amount] Landlord's Name: [Landlord’s Full Name] Landlord’s Signature: ___________________________

Make sure to keep a copy of this receipt for your records, and provide the tenant with one as well. This ensures both parties have documentation of the transaction for future reference.

A cash deposit in a rental agreement serves as a safeguard for both tenants and landlords. It ensures the property is returned in good condition and provides financial protection in case of damages or unpaid rent. The deposit is typically refundable, given that the property is maintained properly throughout the lease term.

What Does the Deposit Cover?

The cash deposit primarily covers any repairs needed to fix damage caused by the tenant during the lease period. This could include broken appliances, stained carpets, or damage to walls. If the property is returned without damage, the tenant is usually refunded the full deposit at the end of the lease.

How is the Deposit Handled?

The landlord must keep the deposit in a separate account, and it is often subject to certain legal guidelines. Some regions require landlords to return the deposit within a set number of days after the lease ends, while others may allow deductions for specific reasons such as cleaning or repairs. The tenant should receive an itemized list explaining any deductions taken from the deposit.

| Reason for Deduction | Possible Deduction Amount |

|---|---|

| Property Damage | Cost of repairs or replacement |

| Unpaid Rent | Amount due |

| Excessive Cleaning | Cost of cleaning services |

Ensure the rental agreement clearly outlines the deposit terms and conditions, including how much is required and when it will be returned. This helps avoid confusion or disputes at the end of the lease.

Clearly outline the total deposit amount. Specify the exact monetary figure to avoid any ambiguity. It’s crucial to state whether the amount includes tax or other fees. This ensures transparency between landlord and tenant.

Include the date the deposit is made. This helps to track when the deposit was received and may be useful for both parties when addressing future concerns.

Tenant and Landlord Details

Provide the names and contact information of both parties involved. This ensures that the receipt is valid and that any future communication can be easily directed to the right individuals.

Property Details

Specify the address of the rented property. This ensures there’s no confusion regarding which property the deposit applies to, especially when managing multiple rental units.

Note the purpose of the deposit. Clearly state that it is for the security of the rental property. If it covers any specific damages or maintenance, make this clear as well.

Lastly, indicate the terms for refunding the deposit. Mention the conditions under which the deposit may be withheld or returned, including any deductions for repairs or unpaid rent. This protects both parties by setting clear expectations from the start.

Start with a clear heading at the top of the document, such as “Security Deposit Return Receipt.” This should be centered and bolded for easy identification. Right below it, include the rental property address and the tenant’s name. It’s helpful to include the rental period, starting from the move-in date to the move-out date.

Details of the Return

Next, clearly state the amount of the security deposit being returned. If any deductions were made (e.g., for repairs or unpaid bills), itemize these charges in a separate section. Use a simple table format with columns for description, amount deducted, and the reason for the deduction. This helps avoid confusion later on.

Additional Information

Include the date the deposit was returned, along with the method of payment (cash, check, or bank transfer). Add a final statement acknowledging that the tenant has received the return in full, or mention any pending amounts if applicable. End with a space for both parties to sign, confirming that the details are accurate and accepted.

Ensure the deposit receipt clearly outlines the amount, date of payment, and purpose of the deposit. Specify that the funds are held as a security deposit for potential damages or unpaid rent. This clarity helps avoid disputes and confusion later on.

Itemize Conditions for Refund

State the conditions under which the deposit will be returned. This should include any possible deductions for damages, unpaid rent, or cleaning costs. Make sure both parties agree to these terms and have them documented in the receipt. This provides legal protection for both the landlord and the tenant.

Include Clear Identification

Clearly identify both the landlord and the tenant in the receipt. Include full names, addresses, and contact details for all parties involved. This is vital in case any legal action is necessary regarding the deposit.

Finally, retain a copy of the receipt for both the landlord and the tenant. This ensures accountability and is useful if any disputes arise about the deposit return. Keep a record of all transactions related to the deposit for future reference.

Clarity and precision are key. Ensure the receipt includes specific details about the amount deposited, the purpose of the deposit, and the date it was made. Leaving out any of these crucial details can create confusion or disputes later on.

1. Failing to Include Exact Deposit Amount

Always list the exact amount deposited, including any relevant taxes or fees. This prevents misunderstandings regarding the agreed-upon amount and avoids potential legal issues if the deposit amount is questioned.

2. Not Specifying the Purpose of the Deposit

Indicate the reason for the deposit clearly, such as “security deposit for rental property.” This ensures both parties understand the intent behind the deposit and prevents the funds from being misused or misinterpreted.

3. Leaving Out the Date

Never omit the date when the deposit was made. Without a clear timestamp, there is no way to confirm whether the terms of the agreement have been met, potentially complicating future returns or disputes.

4. Neglecting to Include Party Information

Both the tenant’s and landlord’s names should be clearly listed in the receipt. Without this, it may become unclear who the transaction is between, leading to confusion in case of disputes or legal proceedings.

5. Using Vague Language

Avoid general terms like “deposit” or “amount” without further clarification. Instead, use detailed descriptions that specify what the funds are for, ensuring transparency and mutual understanding.

6. Failing to Outline Refund Conditions

Clearly outline the conditions under which the deposit will be refunded, such as the return of the property in good condition. This helps set expectations and prevents misunderstandings regarding the deposit’s return.

7. Not Making Copies of the Receipt

Both parties should retain a copy of the receipt for their records. If there is no copy, it can be difficult to prove the terms agreed upon in case of a dispute.

For tenants, reviewing the itemized list of deductions, if provided, ensures transparency and clarity regarding the security deposit return. If the tenant disagrees with any deductions, they should raise the issue with the landlord, referencing the lease agreement and any photographs or documentation of the property’s condition upon move-in and move-out. If an agreement cannot be reached, tenants may seek mediation or legal advice depending on local laws.

Landlords should ensure all necessary repairs or cleaning costs are clearly documented and backed by receipts. It’s recommended to provide the tenant with an itemized list of any deductions and a timeline for the deposit return to avoid misunderstandings. If no deductions are necessary, return the full deposit within the stipulated time frame as outlined in the lease agreement. Both parties should keep a record of the transaction for future reference.

Handling Disagreements

If disagreements arise, both tenants and landlords should first attempt to resolve the issue through direct communication. If this doesn’t work, tenants can contact local tenant advocacy organizations or seek legal support to understand their rights. Landlords should be prepared to explain their deductions clearly and provide evidence if necessary.

Final Steps

Once any disputes are resolved, tenants should ensure they receive a final statement regarding the return of their security deposit. Landlords should also retain records of the transaction and any related correspondence in case of future claims. Keeping a clear paper trail will protect both parties in the event of further disputes or legal inquiries.

To ensure smooth return of a rental security deposit, create a detailed cash deposit receipt. This document should specify the amount received, the rental property’s address, and the date of the transaction. A clear description of the condition of the rental property should be included, noting any damages or issues. Both the landlord and tenant should sign the receipt, confirming the agreement. Keep a copy for future reference to prevent any disputes.

Include in the receipt the payment method (cash, check, bank transfer) and provide a breakdown of any deductions from the deposit, if applicable. If the tenant has already paid a portion of the security deposit, make sure to outline the remaining balance and confirm receipt of that amount. Accuracy is key, as it ensures both parties have a clear understanding of the transaction.

If any deductions are made, list them with the corresponding costs, and explain why they are necessary. It’s important to be transparent, so the tenant understands where their money went. Once both parties agree on the terms, the receipt serves as a legal acknowledgment that both the deposit and its return have been handled properly.