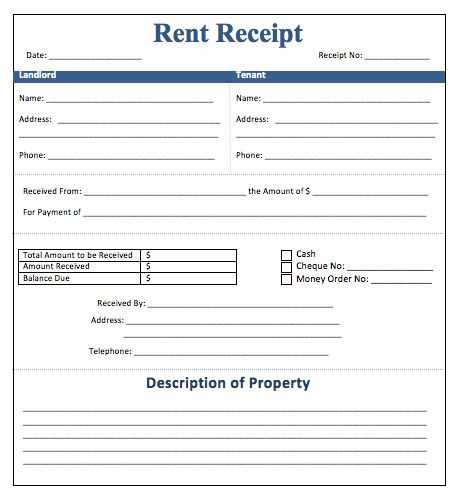

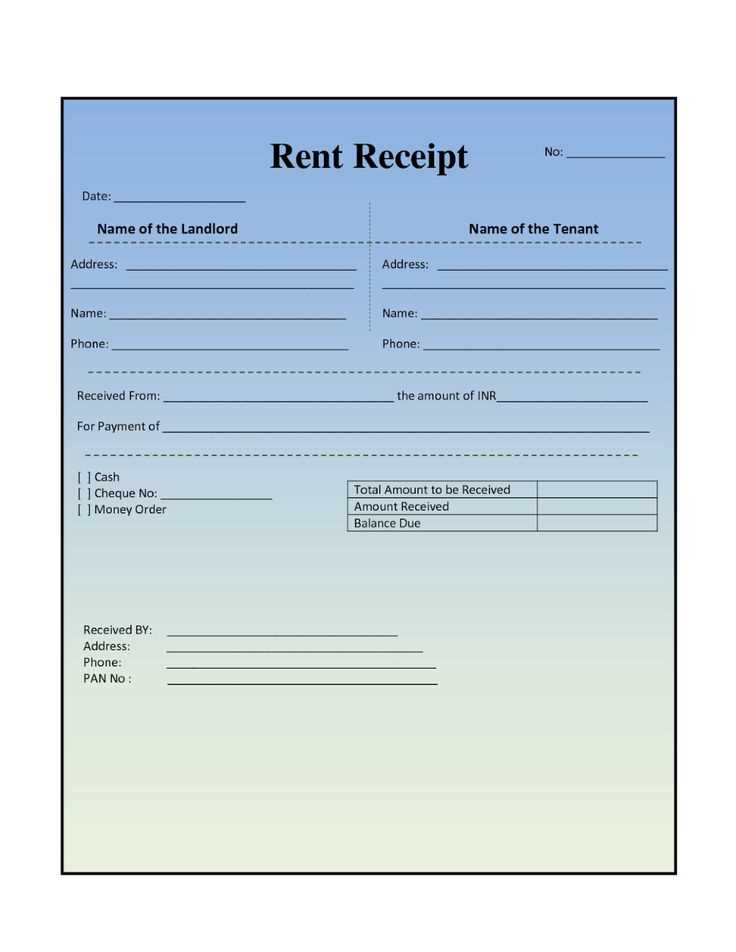

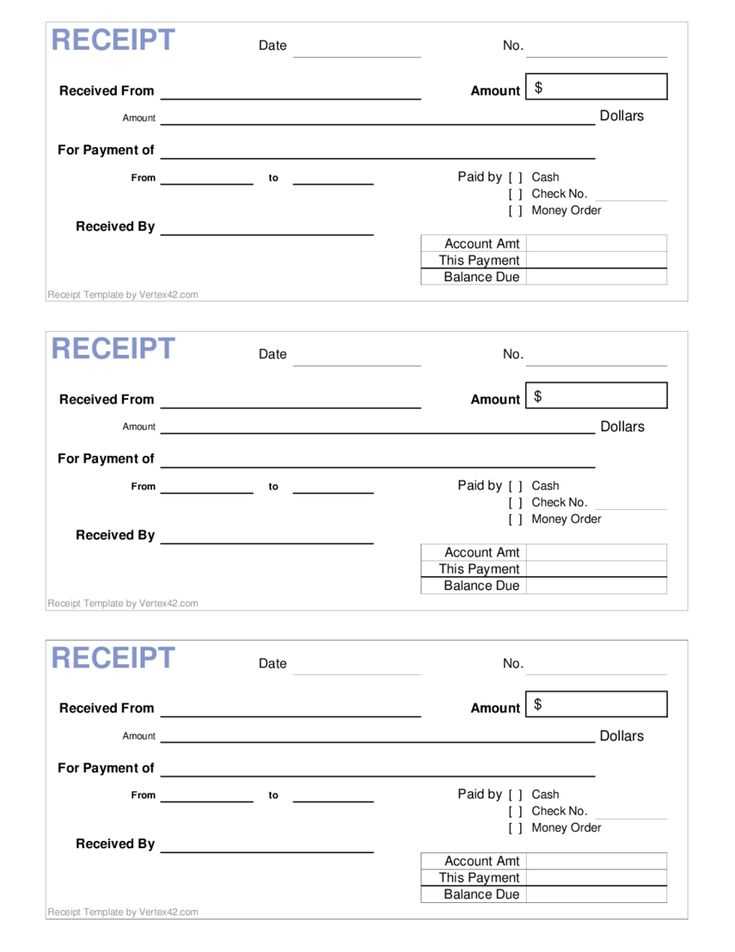

A clear cash receipt template for rent is a practical tool for landlords and tenants. It helps to confirm the payment of rent, ensuring both parties have a record of the transaction. This template should include the tenant’s name, property address, date of payment, amount paid, and the payment method. By using a structured format, it minimizes confusion and provides legal protection for both the landlord and tenant.

Make sure to include the following details: a unique receipt number, the payment period, and any additional fees that may apply. If the payment covers multiple months or includes utilities, specify those details clearly. Keep a copy for your records and provide a copy to the tenant. This process ensures transparency and prevents disputes in case of payment issues.

Customize your template to fit your specific needs, such as adding any terms specific to your rental agreement or creating a space for both parties to sign. This will add an extra layer of formality and security to the transaction. By following these guidelines, you can create a reliable system for rent payments that benefits everyone involved.

Here are the corrected lines:

For better clarity and precision in your rent cash receipt template, ensure each of the following sections is correctly filled out.

| Field | Corrected Example |

|---|---|

| Tenant Name | John Doe |

| Property Address | 123 Elm Street, Apt 4B |

| Rent Amount | $1,200.00 |

| Payment Method | Bank Transfer |

| Receipt Date | February 14, 2025 |

| Landlord Name | Jane Smith |

Make sure that all the necessary details are included, such as the exact payment amount and the method used. Clear formatting will help avoid misunderstandings.

Cash Receipt Template for Rent

Ensure clarity and accuracy by using a cash receipt template for rent payments. A well-structured receipt helps both landlords and tenants keep track of transactions and avoid disputes. The template should include essential details such as the tenant’s name, rental property address, payment amount, and payment date. This provides transparency for both parties and serves as a reliable record for accounting purposes.

Key Elements of the Template

Include the following fields in your receipt template:

- Tenant Name: Ensure the tenant’s full name is clearly stated.

- Property Address: Mention the address of the rental property to avoid confusion.

- Payment Amount: Indicate the exact amount received, including any applicable late fees if necessary.

- Payment Date: Include the specific date the payment was made to ensure proper record-keeping.

- Payment Method: Specify how the payment was made (cash, check, bank transfer, etc.).

- Receipt Number: Assign a unique number to each receipt for easy reference and organization.

Why Use a Template?

A template streamlines the process of recording rental payments and ensures consistency across all transactions. It helps avoid errors and eliminates the need for manual tracking, which can lead to mistakes. By using a pre-designed format, landlords can save time while providing tenants with a professional and transparent transaction record.

To customize a cash receipt for rent payments, start with a clear header that includes the title “Cash Receipt” and the name of your rental business or landlord. Add the date the payment is received and a unique receipt number for reference.

- Tenant Information: Include the tenant’s full name and address. This helps ensure the payment is attributed correctly.

- Payment Details: Clearly list the amount received and specify whether it’s for the current month’s rent or another charge. If applicable, break down partial payments or additional fees.

- Payment Method: Specify the method of payment (e.g., cash, check, bank transfer). This provides transparency and record-keeping accuracy.

- Landlord’s Signature: Include a section for the landlord’s signature or a digital equivalent, acknowledging the receipt of payment.

- Terms and Conditions: If necessary, include a note about late fees, payment deadlines, or other relevant rental terms. Keep this section brief but clear.

Once these elements are in place, consider adding a footer with your contact information or additional instructions for tenants. Customize the design and layout to match your branding or personal preferences while keeping the receipt easy to read and professional.

Clearly specify the tenant’s full name and address. This ensures both parties can identify who made the payment and where it applies.

Include the landlord’s details–name and contact information–so the tenant knows who they paid and can reach out if needed.

State the date the payment was received. This helps both parties track when rent was paid and confirm the exact timing.

Specify the rental period covered by the payment. For example, whether it’s for one month or a specific range of dates, this clarifies the scope of the payment.

List the amount received in both numerical and written form. This eliminates any confusion about the payment amount.

Clarify the method of payment, whether it was by cash, check, bank transfer, or another method. This adds transparency to the transaction.

If applicable, note any late fees or adjustments applied to the payment. This ensures that any changes in the agreed rent amount are documented.

Include the payment reference number or check number, if any, for easy tracking. This makes it easier to trace the payment in case of issues.

Finally, add a receipt number for internal record-keeping. This helps in organizing payments and ensures easy retrieval in the future.

Ensure that your rent receipt template includes all the necessary details to comply with local laws and accounting standards. Include the landlord’s full name or business name, the tenant’s name, the rental property’s address, the payment date, the amount paid, and the payment method. Double-check that your template complies with any state or municipal requirements for rental transactions.

For accounting purposes, make sure the receipt is numbered or has a unique identifier to help track payments efficiently. This also supports tax preparation by maintaining a clear record of income. Landlords should retain copies of receipts for several years in case of audits or disputes with tenants.

From a legal standpoint, rent receipts can serve as proof of payment in case of disputes. Ensure your template clearly states whether the payment is for rent only or includes any additional fees, such as late fees or utilities. This prevents confusion and potential legal issues in the future.

Keep in mind that if you are renting out multiple properties or using property management services, you may need to adjust your receipt template accordingly. A professional accountant can help tailor the template to meet your specific needs while ensuring compliance with tax laws.

Ensure the cash receipt template for rent is clear and concise. Begin by including the landlord’s full name or business name at the top. Follow this with the tenant’s details and the rental property address. Specify the amount paid in both numeric and written formats to avoid confusion. Include the payment method used, such as cash, cheque, or bank transfer.

Details of the payment should be listed, including the date the payment was made and the rental period it covers. It’s also helpful to include a reference number or transaction ID for future tracking. Be sure to add a signature line for both the landlord and the tenant to confirm the transaction. This provides transparency for both parties.

Maintain consistency across all receipts. Use the same format each time to prevent misunderstandings and ensure all necessary information is captured in an organized way.