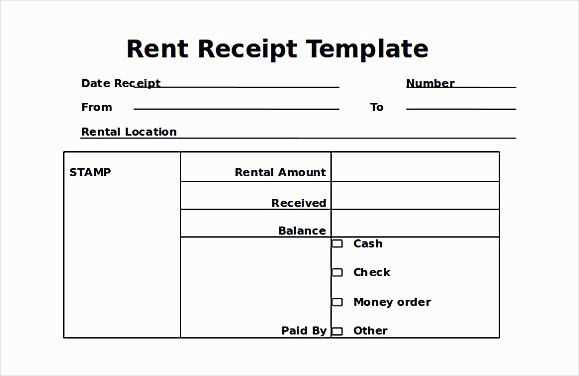

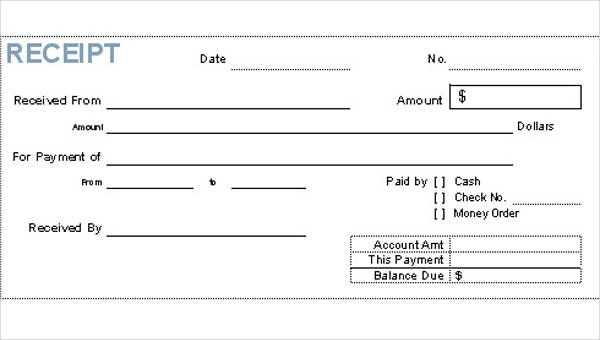

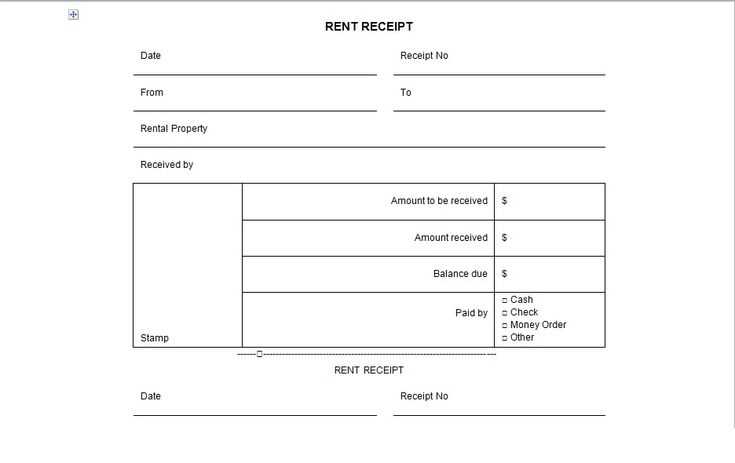

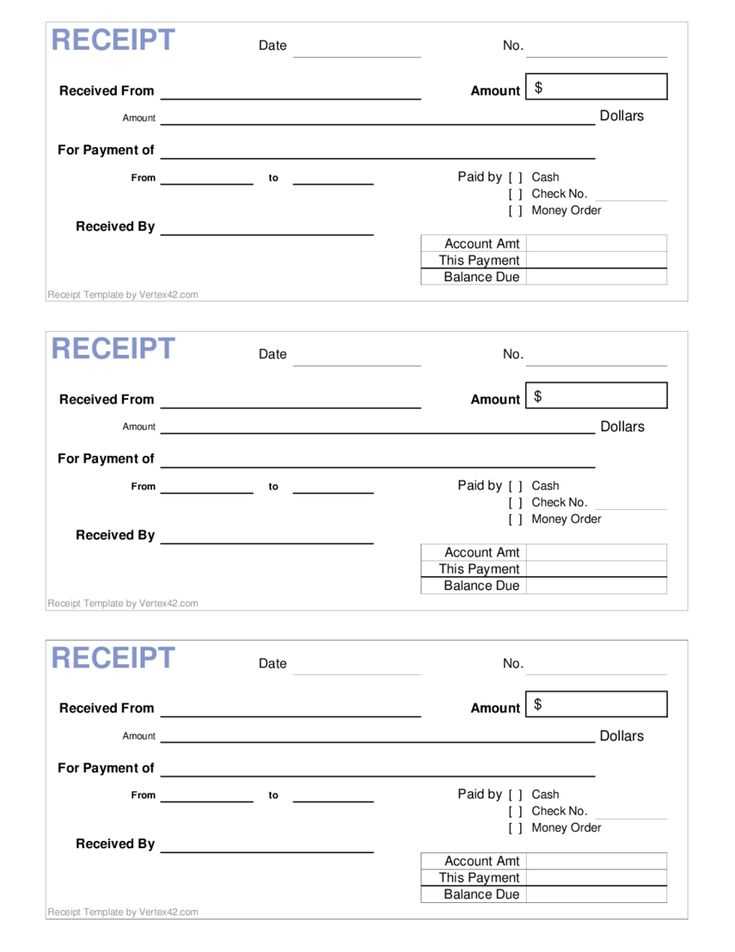

Use this cash rent receipt template to streamline your rental transactions. It’s straightforward and includes all necessary fields to ensure clarity for both the landlord and tenant.

Fill in the tenant’s name, rental amount, and payment date in the corresponding sections. This ensures both parties are on the same page regarding the terms and the amount paid. Add a payment method, such as check or bank transfer, to avoid any confusion.

For added accuracy, include a payment reference number or any specific details related to the payment. It helps track the transaction and avoid discrepancies later on. Don’t forget to sign the receipt to confirm its validity.

This template can be customized further depending on the agreement, but it covers the basics required for a legal cash rent receipt.

Here are the revised lines with minimized repetition:

Focus on providing clear information and maintaining consistency across all entries. Start by including the payment amount and due date. Ensure to mention the rental period clearly, specifying the start and end dates for transparency.

Key Adjustments

- Remove unnecessary phrases that repeat the same idea.

- Use specific terms like “monthly payment” instead of general references like “payment details.”

- Ensure the tenant’s name is clearly stated in the first line, avoiding repetition later.

To enhance readability, consider simplifying the language and eliminating redundant terms. This approach helps keep the template professional while avoiding clutter.

It’s important to maintain a clear structure, ensuring that all key elements like contact information, rental terms, and payment history are easy to locate.

- Cash Rent Receipt Template Guide

For a clear and concise record, always include the following details in a cash rent receipt:

- Tenant Name: Clearly mention the full name of the tenant who paid the rent.

- Landlord Name: Include your name or the entity receiving the payment.

- Payment Date: Specify the exact date when the payment was made.

- Amount Paid: List the full amount of the cash rent paid, clearly indicating the currency.

- Property Description: Provide a brief description of the rental property (address, type, etc.).

- Payment Method: State that the payment was made in cash and any additional specifics (e.g., exact denomination if relevant).

- Receipt Number: Assign a unique number to each receipt for tracking purposes.

- Signature: Have both the tenant and landlord sign the receipt to confirm the transaction.

Organizing the Receipt

To make the receipt easy to read, use a simple format. List the details in bullet points or short paragraphs. This ensures no vital information is overlooked. Make sure that all sections are clear and legible.

Template Example

Tenant Name: John Doe

Landlord Name: Jane Smith

Payment Date: 02/04/2025

Amount Paid: $1,000

Property Description: 1234 Oak Street, 2-bedroom apartment

Payment Method: Cash

Receipt Number: 001234

Signature of Tenant: ____________

Signature of Landlord: ____________

Rent receipts provide clear proof of payment. Landlords should always issue receipts to tenants for each rent payment made. This simple step prevents disputes by establishing a reliable record. It also protects both parties if any issues arise regarding payment dates or amounts. A rent receipt can be used by tenants to confirm their payment history, which is helpful for tax purposes and when moving to a new rental property.

Building Trust with Tenants

Providing a receipt builds a sense of trust between landlords and tenants. It shows a professional approach to managing rental agreements. Tenants feel more secure when they know their payments are documented, and landlords benefit by having a transparent record for financial tracking and future references.

Legal Protection for Both Parties

In case of legal disputes, a rent receipt serves as a key piece of evidence. It offers protection in situations where a tenant may falsely claim they have not paid rent. Additionally, landlords can use receipts to demonstrate their compliance with rental agreements and legal requirements.

Ensure the receipt clearly states the date of payment. This prevents confusion and provides a reference point for both parties.

Include the tenant’s name and property address to specify who made the payment and for which rental property.

Specify the amount paid and the payment method (e.g., cash, check, bank transfer). This adds clarity and helps in tracking financial transactions.

Indicate the rental period the payment covers. Whether it’s for a specific month or a longer duration, this keeps the terms clear.

If applicable, note any late fees or security deposit payments. This helps to distinguish between regular rent payments and additional charges.

Always include the landlord’s signature or a statement confirming receipt of payment. This adds authenticity to the document.

Optionally, add a receipt number for easy tracking. This is particularly helpful for both the landlord and tenant in case of disputes or record keeping.

Modify the basic structure of the template by adding your personal or company details such as name, address, and contact information at the top. This ensures that the recipient knows exactly who issued the receipt.

Include payment information, such as the amount paid, payment method (e.g., cash, check, credit card), and the date of payment. Be specific about the rental period covered to avoid confusion.

| Payment Details | Description |

|---|---|

| Amount Paid | List the exact payment amount received for rent. |

| Payment Method | Specify whether payment was made in cash, via check, or through another method. |

| Rental Period | Define the exact time period the payment covers (e.g., from January 1st to January 31st). |

Include additional details like the property address or unit number if necessary, especially when managing multiple properties. This avoids any confusion about which rental property the receipt refers to.

Finally, add a unique receipt number for record-keeping purposes. This helps both the landlord and tenant track transactions more easily in the future.

Begin by clearly identifying the tenant’s name and property address on the receipt. This information ensures that the payment is associated with the correct rental agreement.

Include the payment date to confirm the exact day the rent was received. This prevents confusion and serves as a record for both parties.

Clearly state the amount paid along with the payment method, whether it’s cash, check, or digital payment. This provides transparency and helps track the payment history.

If the rent covers a specific time period, specify the rental period (e.g., “for the month of January”). This clarifies what the payment is for and helps avoid disputes over timing.

Include the landlord’s signature and the tenant’s signature to acknowledge that both parties have agreed to the payment details. These signatures confirm that the transaction was completed.

Finally, provide a receipt number or transaction ID for future reference. This allows both parties to easily find the record if they need to verify details at a later date.

Ensure the correct date is included. Missing or incorrect dates can lead to confusion about the rent period, especially in case of disputes. Always specify the exact month or period for which the payment is made.

Clearly state the amount received. It’s important to specify the exact rent amount and any additional fees. Ambiguous language could cause issues if there is a question regarding payment.

Avoid omitting payment method details. Always record whether the rent was paid by cash, check, or another method. This transparency helps avoid confusion about how the payment was made.

Include both landlord and tenant information. Ensure that both parties’ names, addresses, and contact details are clearly listed. This helps to prevent any misunderstandings in case the receipt is needed for future reference.

Don’t forget to include the property address. The receipt should specify the address of the rental property to clearly link the payment to the correct location.

Be careful with receipts for partial payments. If the tenant makes a partial payment, make sure it’s indicated clearly. A simple “remaining balance” note can prevent disputes about outstanding amounts.

Store receipts in a secure, organized system to avoid losing them. Digital storage is a reliable option for easy access and backup.

- Use digital tools: Apps like Google Drive or Dropbox offer secure cloud storage where receipts can be categorized and accessed from anywhere.

- Keep a backup: Regularly back up digital receipts to a secondary cloud service or external hard drive.

- Label and categorize: Clearly label each receipt with dates and payment details for easy retrieval. Create folders or tags for each property or tenant.

- Regular updates: Update your storage system regularly, ensuring that all new receipts are added in a timely manner.

- Physical copies: If keeping physical receipts, store them in a safe, organized filing system. Consider using labeled folders or binders for quick access.

Track payment status by noting whether receipts are for fully paid rents or partial payments, and update your records consistently.

- Record payment details: Include information such as payment method, amount, and due date on each receipt entry.

- Use spreadsheets: For those who prefer a manual tracking method, a well-maintained spreadsheet can be an excellent way to monitor payments and track any outstanding balances.

Adhering to these practices will streamline the process of managing receipts and ensure that records remain accurate and accessible when needed.

To create a clear cash rent receipt template, follow these guidelines:

- Ensure the template includes basic details like tenant and landlord names, address, and the property description.

- Include the rental amount and payment due date. Specify if the rent is paid weekly, monthly, or annually.

- Clearly state the payment method (e.g., cash, check, bank transfer) and any reference numbers for the transaction.

- Provide space for both parties to sign and date the receipt. This will confirm both the payment and the receipt.

- Incorporate a section for late fees if applicable, along with the terms and conditions for late payments.

Make sure the receipt is concise but detailed enough to serve as a legal document, avoiding any ambiguity in the terms.