Key Elements of a Rent Receipt

A rent receipt should include several critical details to ensure accuracy and transparency. First, specify the full name of the tenant and the landlord. Clearly list the rental property’s address and the payment period, whether monthly, quarterly, or annually. Include the exact date of payment and the amount received. Mention the payment method–whether it’s cash, check, or online transaction–and the check number if applicable.

Detailed Breakdown

- Tenant Name: Ensure the tenant’s name is accurately written.

- Landlord Name: Include the landlord’s full name or company name if applicable.

- Property Address: Provide the exact address of the rental property.

- Payment Amount: Include the exact dollar amount received.

- Payment Date: Record the date the payment was received.

- Payment Method: Specify if the payment was made by cash, check, or online transfer.

- Receipt Number: Include a unique receipt number for better record-keeping.

Why Rent Receipts Matter

Issuing a rent receipt is essential for both landlords and tenants. For tenants, it serves as proof of payment in case any disputes arise. For landlords, it helps keep organized financial records. It’s a tool to track transactions and provide legal documentation should any issues occur with the rental agreement.

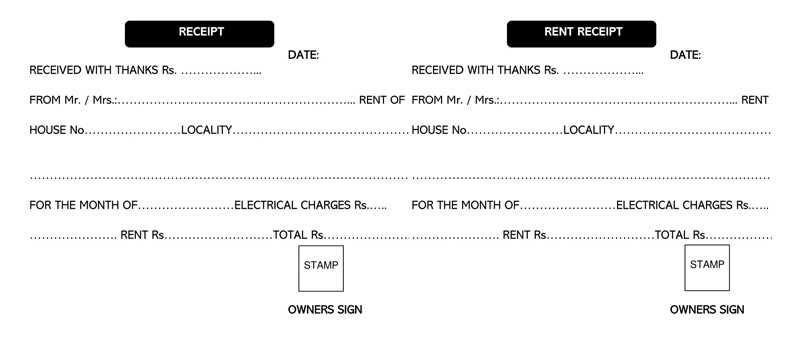

Template Example

Below is a simple rent receipt template that can be easily customized for each transaction:

RENT RECEIPT Tenant Name: ___________________________ Landlord Name: _________________________ Property Address: _______________________ Payment Date: __________________________ Payment Amount: ________________________ Payment Method: ________________________ Check Number (if applicable): ____________ Receipt Number: ________________________ Thank you for your payment!

Best Practices for Rent Receipts

- Always issue a receipt immediately after receiving payment.

- Keep a copy of the receipt for your own records and provide a copy to the tenant.

- Ensure the receipt is clear and contains all relevant details to avoid future confusion.

- Use a consistent format for all receipts to maintain organization.

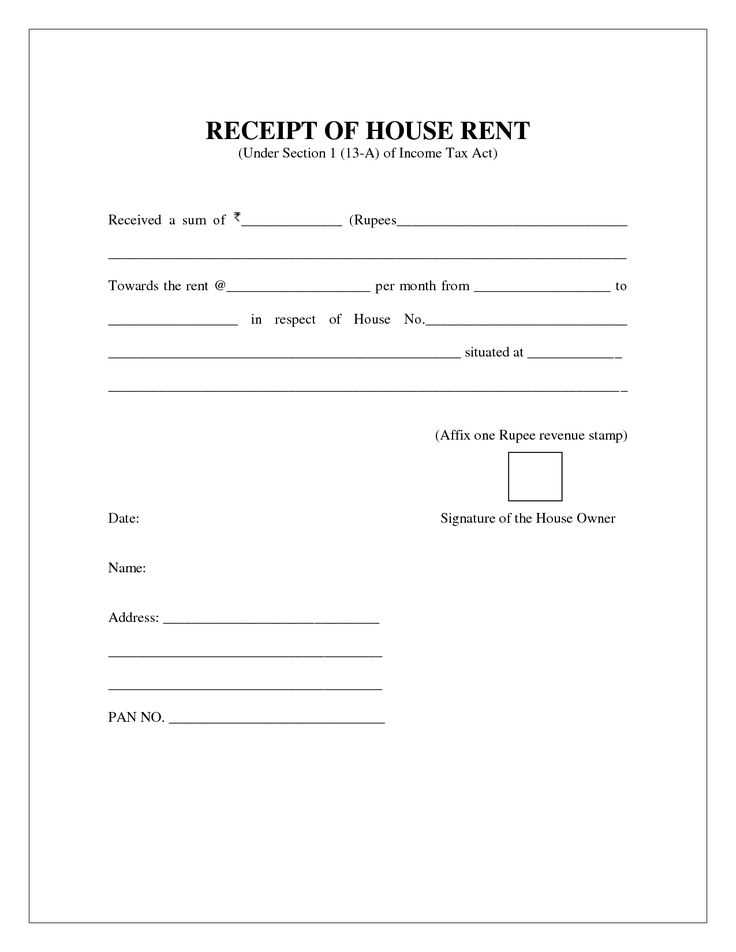

Commercial Rent Receipt Template Guide

Creating a rent receipt that is clear and accurate is key to keeping financial records in order. Start with the basic elements: the date of payment, tenant’s name, rental period, the amount paid, and payment method. These details will make your receipt both functional and professional.

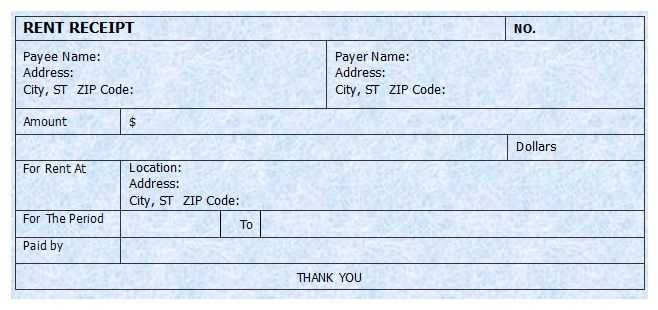

How to Create a Simple Rent Receipt

To build a simple receipt, follow a straightforward layout. First, include your business name and contact information at the top. Then, state the payment date and period covered by the rent. Specify the tenant’s name and address, as well as the total rent amount and payment method (cash, check, etc.). Conclude with a thank-you message and your signature for authenticity.

Key Components to Include in a Rent Receipt

Ensure your rent receipt contains these key components: the rental property’s address, the payment date, rental period, tenant’s name, amount paid, and payment method. It’s also helpful to have a space for additional notes, like late fees or discounts, to provide transparency. Make sure the receipt is easy to read, and use clear sections to organize the information.

Customizing a rent receipt for your business needs can add a level of professionalism. You may want to include a receipt number for tracking purposes or include tax details if applicable. Keeping a consistent format will help both you and your tenants stay organized and maintain clear financial records.