When managing short-term rentals, a daily rental receipt is crucial for documenting each transaction. It’s a straightforward yet highly effective tool for keeping track of payments and providing a professional service to your clients. A well-organized receipt ensures both parties have a clear record of the rental terms and payment details.

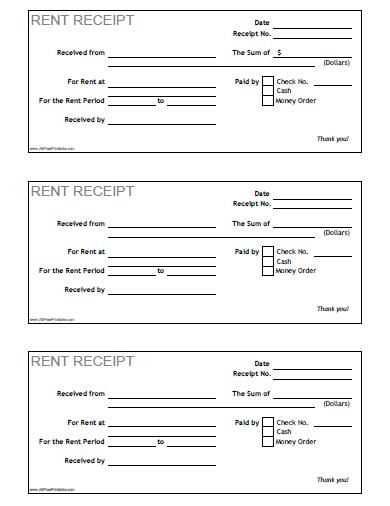

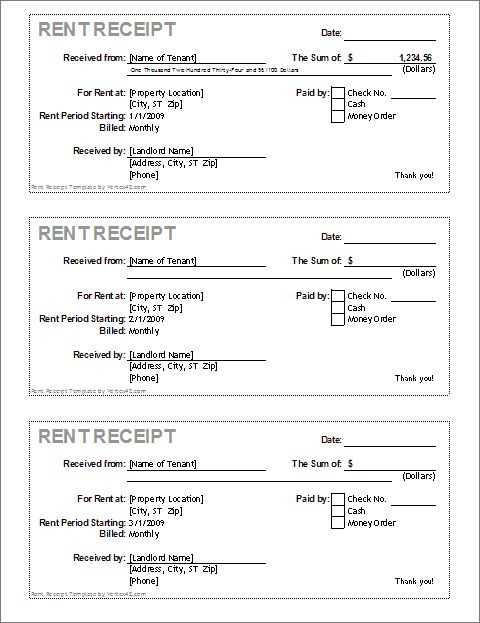

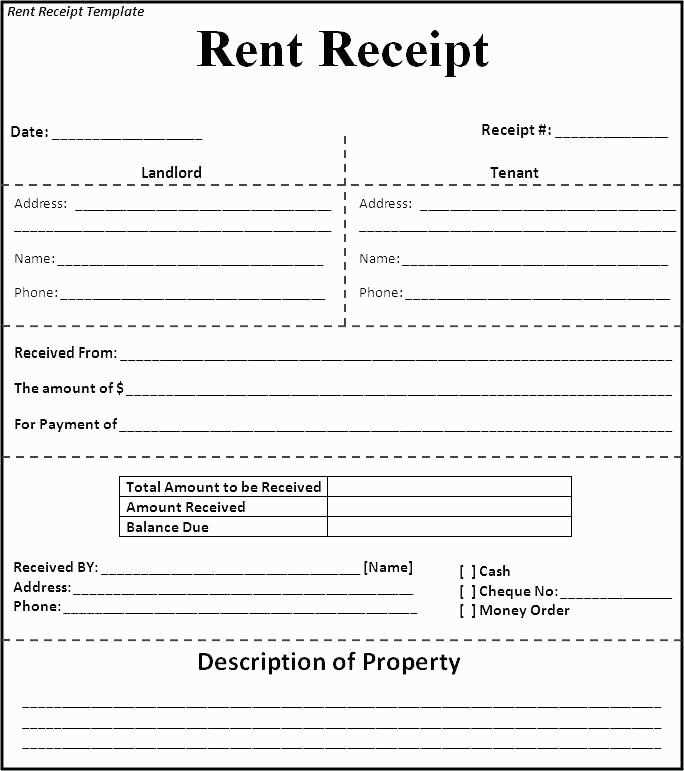

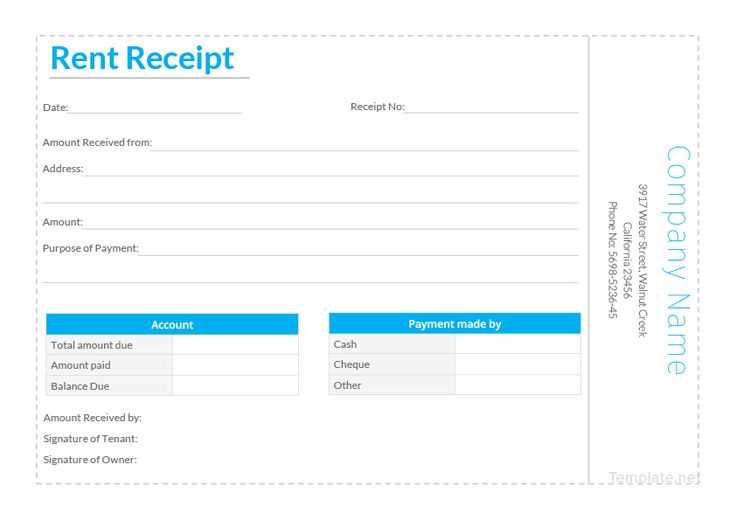

To create a daily rental receipt template, include fields for the rental date, property details, total rental amount, payment method, and any additional charges. Customize it to suit your specific needs, whether you’re renting out a car, equipment, or accommodation. A clean, easy-to-read format ensures that the information is accessible and transparent for both you and your client.

Make sure to include your business name, contact information, and any legal disclaimers or terms that may apply. This not only strengthens your professionalism but also helps avoid any potential disputes. Keep your template simple, with a clear structure, so clients can easily verify the details of the transaction.

Got it! How can I help today?

- Template for Daily Rental Receipt

A daily rental receipt should clearly indicate all necessary details of the transaction. Start with the rental company’s name and address at the top. This helps customers easily identify the source of the receipt. Include the date of the transaction, the rental period, and the amount paid for clarity.

Use a simple structure to break down the costs. This can include:

- Rental fee per day

- Additional fees (e.g., cleaning, security deposit)

- Total amount paid

Don’t forget to list any payment method (e.g., credit card, cash) and the receipt number for easy reference. If there are any terms and conditions related to the rental, mention them briefly at the bottom.

Here’s an example template structure:

- Rental Company Name: XYZ Rentals

- Rental Period: February 5, 2025 – February 6, 2025

- Rental Fee per Day: $50

- Additional Fees: Cleaning Fee – $10, Security Deposit – $20

- Total Amount Paid: $80

- Payment Method: Credit Card

- Receipt Number: 00123

- Terms and Conditions: Rental must be returned by 10:00 AM for full deposit refund.

Keep the receipt simple and readable to avoid confusion. Ensure it is easy to understand and contains all relevant financial information.

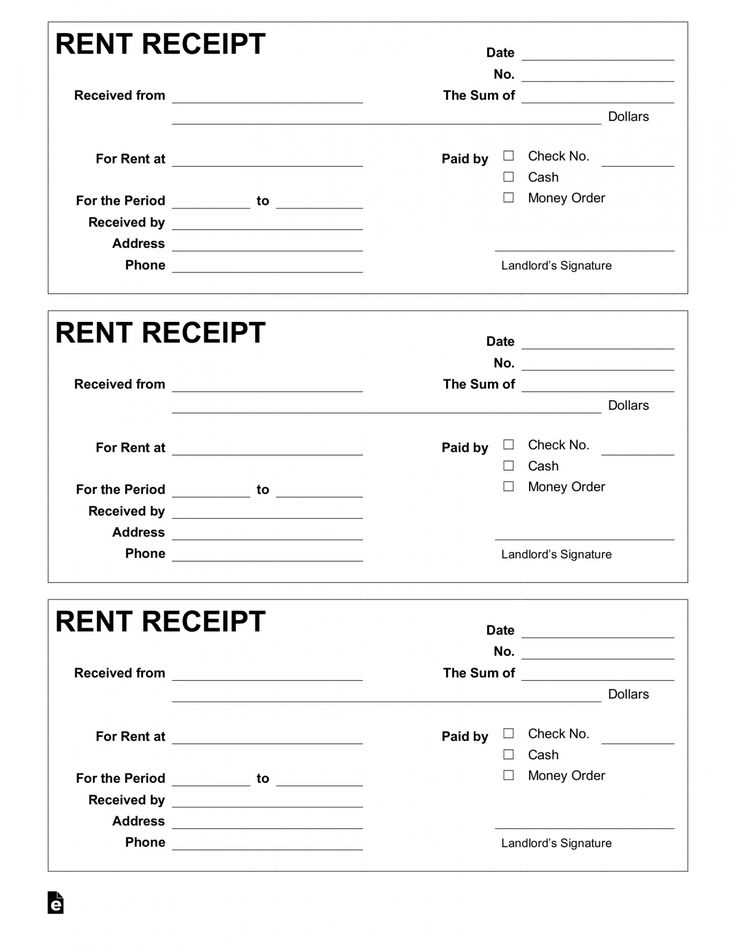

Begin by including all necessary details that define the rental agreement. Clearly state the rental item, rental rate, rental duration, and total amount due. Ensure these elements are easy to find by organizing them in a logical order. This way, both parties can quickly refer to any part of the receipt when needed.

Include Accurate Date and Time Information

Provide the exact start and end dates for the rental period. If relevant, include the time of rental as well, especially for hourly-based rentals. This helps clarify the scope of the rental agreement and avoids confusion about the billing period.

Specify Payment Methods

State the payment method used, such as cash, credit card, or bank transfer. This avoids ambiguity about how the transaction was completed. If any deposit or prepayment is involved, note that as well to give a complete overview of the financial exchange.

Finally, add a unique receipt number or identifier to track each rental transaction. This makes future reference easier and keeps records organized.

Make sure your daily rental receipt contains all relevant details for both you and the renter. Start with the renter’s full name and contact information at the top of the receipt. This ensures that both parties can reach each other easily if needed.

Rental Information

Clearly list the item or property being rented. Include specifics such as the make, model, or description, along with any unique identifiers like serial numbers or vehicle registration numbers. This helps avoid confusion and confirms what exactly is being rented.

Dates and Times

Include the rental start and end date, as well as the time. This helps establish the exact duration of the rental period and supports any future reference or dispute resolution. Make sure the times are specified in a standard format (e.g., 9:00 AM to 5:00 PM).

Cost Breakdown

Include a detailed cost breakdown. List the daily rental fee along with any additional charges, such as deposits, cleaning fees, or taxes. Show both the subtotal and the total amount due. This ensures transparency and clarity about the payment structure.

Payment Information

Record the payment method used–whether by cash, credit card, or other means. If the renter made a deposit, include that amount as well. Document any balance due or refunds processed, if applicable.

Terms and Conditions

Clearly state any terms and conditions relevant to the rental. This could include late return policies, damage fees, or insurance coverage. Include any required signatures for both parties to acknowledge the terms.

By including these details, you ensure that the rental transaction is documented clearly, reducing potential misunderstandings or disputes later on.

Choose software that integrates seamlessly with your current rental management system. Look for tools that allow easy customization, so you can adjust receipt templates to meet your needs. Prioritize programs with built-in invoicing features to save time and reduce errors. Ensure the software supports all necessary payment methods, including credit cards, bank transfers, and cash, for accurate receipt generation.

Check for cloud-based options to access and manage receipts from anywhere, especially if you run a mobile rental business. Additionally, review security features such as encryption to protect sensitive customer information. Look for tools with automatic tax calculations and updates, as this can reduce manual input and minimize mistakes during transactions.

Opt for a user-friendly interface to streamline receipt creation, even for those without advanced technical skills. Lastly, assess the customer support options available. A responsive support team can be crucial when resolving any software-related issues that may arise during busy rental periods.

Each region has its own specific legal requirements for daily rental receipts. Understanding these rules helps both renters and property owners stay compliant with local regulations.

- United States: In many states, a rental receipt must include the rental amount, payment date, and the full name of the landlord or property manager. Some states, like California, require additional information, such as rental period and property address.

- European Union: Most EU countries have similar regulations, requiring receipts to list the rental fee, rental duration, and the identity of both parties involved. However, certain countries like Germany may ask for a tax identification number on the receipt if VAT is applied.

- Canada: Provinces such as Ontario and British Columbia mandate receipts that include details like rental amount, the date of the transaction, and tenant information. A unique feature here is that receipts in some regions need to mention whether a deposit is included.

- Australia: In most states, the rental receipt must clearly indicate the rent amount and payment date. Queensland, for example, requires receipts for bond payments, and these receipts must also include a unique reference number.

- United Kingdom: Legal receipts are required for all rent payments under the Housing Act. The receipt must show the amount paid, date, property address, and landlord details. In some cases, landlords must issue receipts for both rent and deposits separately.

- Asia: In countries like Japan and China, rental receipts are similarly required for rent payments. Japan’s receipt format is very structured, requiring the date, tenant name, amount paid, and landlord contact details. In China, receipts are often digitally processed and must include the landlord’s registration number.

Familiarizing yourself with the specific legal requirements in your region ensures proper documentation of rental transactions and protects both renters and landlords.

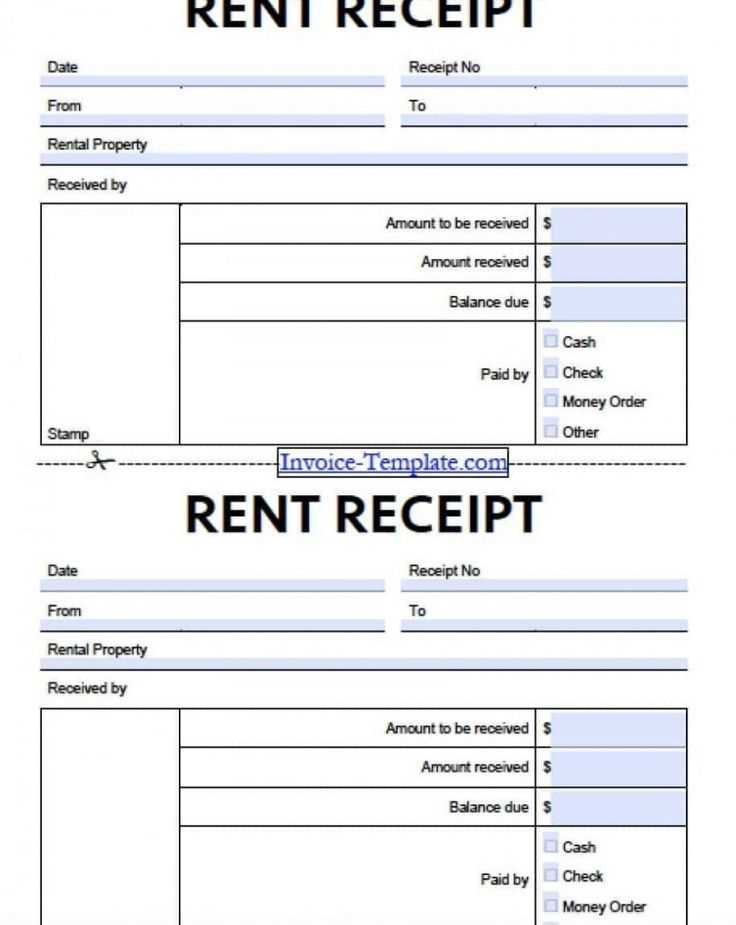

To make a daily rental receipt more relevant for particular services, consider adding fields that align with the type of rental and the services offered. This approach ensures clarity for both parties involved in the transaction. Below are key adjustments you can make for specific services:

| Service Type | Custom Fields |

|---|---|

| Vehicle Rentals | Vehicle make, model, year, license plate number, mileage at pick-up and drop-off, fuel level at return |

| Equipment Rentals | Serial number, condition at pickup, accessories included, maintenance details |

| Property Rentals | Address, property description, inventory of items provided, security deposit amount, cleaning fees |

For each service, ensure you track specific details that may affect the price or condition of the rented item. This helps both the renter and the owner avoid disputes and clarifies expectations. Customizing fields based on the rental type allows for a more professional and transparent transaction process.

In addition, for more personalized receipts, you may want to include payment terms such as deposit requirements, late fees, or damage charges. Tailoring these elements based on your services will provide a comprehensive and accurate record of the rental agreement.

Double-check all details on the rental receipt before finalizing it. A simple typo can cause confusion and lead to disputes. Begin with verifying the rental dates–ensure the start and end times reflect the exact duration of the rental period. Any discrepancy could result in an incorrect charge.

Verify Payment Details

Always match the total amount charged with the payment method provided. If the customer paid by credit card or cash, confirm the correct amount appears on the receipt. Incorrect charges can undermine trust and lead to payment issues.

Include Accurate Contact Information

Make sure both the renter’s and the rental company’s contact details are accurate and up-to-date. This ensures that any follow-up communication, such as late fee notices or inquiries, is delivered without problems.

Consistency in your rental receipt template is key. Reuse the same format each time to minimize the chances of making errors. Keep a checklist for each piece of information required: renter’s name, item description, rental period, payment method, and any additional terms or conditions that may apply.

Avoid vague or unclear terms. Specify the rental items or services, listing quantities and prices in detail to eliminate misunderstandings. This transparency builds trust and reduces the risk of confusion. By following these steps, you’ll ensure the receipt accurately reflects the transaction, protecting both parties involved.

Hey! How’s your day going so far?