Use a home rental receipt template to keep accurate records of payments made by tenants. This template simplifies the process for both landlords and renters, ensuring clarity and transparency. It should include key details such as the tenant’s name, rental property address, payment amount, payment date, and the period covered by the payment.

A well-structured receipt can serve as proof of payment and reduce disputes. Customize your template by adding your business name, contact information, and any additional payment terms specific to your rental agreement. Always ensure the receipt is issued immediately after payment to maintain trust and professionalism in your rental transactions.

The template can be easily updated to reflect changes in rent or lease terms. For repeat tenants, this small step enhances organization and allows both parties to quickly reference past transactions. Keeping these records helps avoid misunderstandings and provides legal protection if needed.

Here are the corrected lines based on your request:

For a clear and accurate home rental receipt, include the tenant’s name, the property address, and the rental period. Specify the amount paid along with the payment method used. If applicable, note any late fees or security deposits. Ensure that the landlord’s name and contact information are visible. The date of payment should also be clearly marked. Always use clear language and avoid any unnecessary jargon.

Ensure to include a receipt number for easy tracking and reference. If the rental payment is split into multiple installments, each payment should be clearly outlined with amounts, dates, and payment methods. Including the purpose of the payment (such as rent or deposit) can help prevent misunderstandings. Double-check that all figures are accurate to avoid discrepancies.

By following these guidelines, you’ll create a receipt that’s both legally valid and simple to understand for both parties involved.

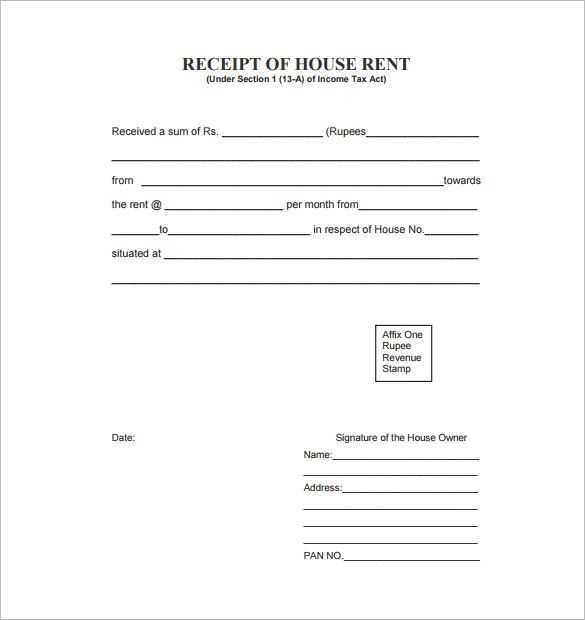

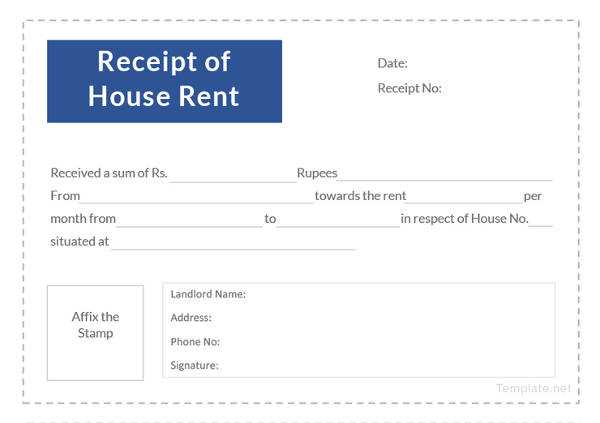

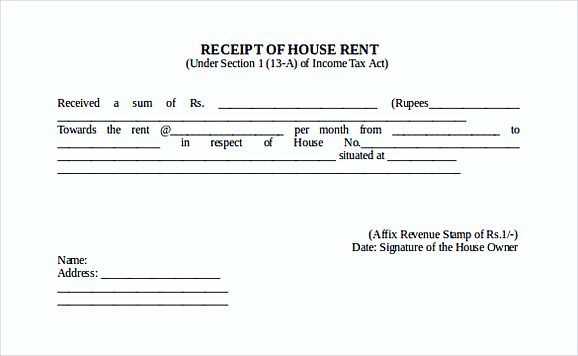

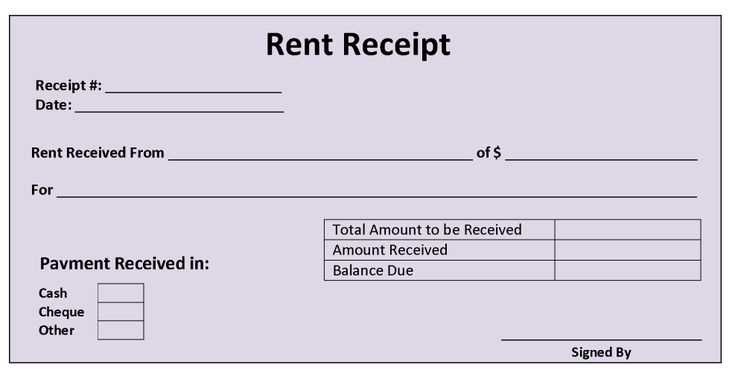

- Home Rental Receipt Template

A home rental receipt should include key details to provide a clear and verifiable record of payment. Ensure all necessary information is present for both the landlord and tenant to track payments efficiently.

Important Information to Include

| Field | Description |

|---|---|

| Tenant Name | The full name of the person who made the payment. |

| Landlord Name | The full name of the person receiving the payment. |

| Property Address | The address of the rental property associated with the payment. |

| Amount Paid | The total amount paid by the tenant for the rental period. |

| Payment Date | The exact date the payment was made. |

| Payment Method | The method used for payment (e.g., cash, check, bank transfer). |

| Rental Period | The specific time frame that the payment covers (e.g., January 2025). |

| Receipt Number | A unique number for tracking the receipt. |

Additional Considerations

Include any special agreements or discounts if applicable. Both the tenant and landlord should retain a copy of the receipt for future reference. If the payment was made electronically, an email confirmation can also be used as a receipt. Organizing rental receipts helps in maintaining clear financial records and preventing disputes.

Include key details like the tenant’s name, property address, and the payment period (e.g., “January 2025”). This identifies the transaction and avoids confusion about the rental period covered by the payment.

Clearly state the rental amount paid and any additional fees (e.g., maintenance or utilities). Break down the charges for transparency, listing each one separately so both parties understand what was paid.

Specify the payment method, such as cash, check, or bank transfer. If applicable, include a transaction reference number or check number to track the payment easily.

Leave space for both the landlord’s and tenant’s signatures. This validates the payment and ensures both parties acknowledge the transaction.

Keep the receipt neat and organized, using headings and bullet points. This ensures clarity and makes the document easy to understand at a glance.

A rental receipt must contain specific details to comply with local laws and regulations. These key components help ensure that both parties have a clear understanding of the transaction and prevent future disputes. Here are the most important elements to include:

1. Rent Amount

The exact rent amount paid should be clearly stated. This includes the base rent and any additional charges, such as for utilities or maintenance. This helps verify the total payment made by the tenant.

2. Payment Date

Include the date when the payment was received. This acts as a proof of transaction and can help resolve any timing disputes later on.

3. Tenant and Landlord Information

Ensure that both the tenant’s and landlord’s names and contact details are included. This identifies the parties involved and can be referenced if any issues arise in the future.

4. Property Details

Specify the address of the rental property to avoid confusion with other properties. Including the unit number, street name, and city is critical.

5. Payment Method

Clearly indicate how the payment was made (e.g., cash, cheque, or bank transfer). This helps maintain a record of the transaction method and can be useful for tax purposes.

6. Rental Period

Document the period for which the payment covers, whether it’s for a month, a week, or another duration. This ensures transparency about what the payment is intended for.

7. Receipt Number

A unique receipt number helps track payments and provides an easy way to reference past transactions. This is useful in case of disputes or audits.

8. Signature of the Landlord

Having the landlord’s signature adds authenticity to the receipt and confirms their acknowledgment of the payment.

9. Additional Notes or Terms

If there are any special agreements, such as late fees or discounts, include them in the receipt. This ensures both parties are aware of any additional clauses associated with the rental payment.

By including these components in the rental receipt, both tenant and landlord will have a clear, documented record of the payment, minimizing the chance of legal issues later on.

When adapting your rental receipt template, tailor it to accommodate the specifics of each payment method. Each method has unique details that should be reflected for clarity and record-keeping purposes.

Credit and Debit Card Payments

For payments made via credit or debit cards, include the transaction number, card type (e.g., Visa, MasterCard), and the last four digits of the card number. This helps the payer verify the transaction and ensures transparency for both parties.

Bank Transfers

If payment is made through a bank transfer, specify the bank name, transfer reference number, and date of payment. These details will help verify the transaction and act as a proof of payment in case of disputes.

By including this specific information, you create a clear and tailored receipt that aligns with the chosen payment method, making the process straightforward for both you and the renter.

Receipt Template Details

To create a home rental receipt, include the following details: the tenant’s name, rental period, and the amount paid. Specify the rental address clearly. Mention any deposit, if applicable, and provide a breakdown of charges (e.g., rent, utilities). Include the payment method and the date of payment. Use a unique receipt number for each transaction to ensure easy tracking.

Make sure the landlord’s contact details are on the receipt for future reference. Always provide a signature or a space for one, especially for transactions involving cash payments. This adds an extra layer of authenticity.

Optional details can include the reason for any partial payments or late fees. If applicable, note any special agreements such as repairs or maintenance included in the rent. This helps avoid confusion later on.

Once the template is ready, save it in a digital format for easy access and record-keeping. Having a structured template will streamline the rental process and maintain clarity in future transactions.