A rental receipt in Hong Kong serves as a key document for both tenants and landlords. It not only proves the payment of rent but also helps to avoid potential disputes in the future. This document should clearly state the rent amount, the payment date, and the rental period. Ensure that all the necessary details are included for legal clarity.

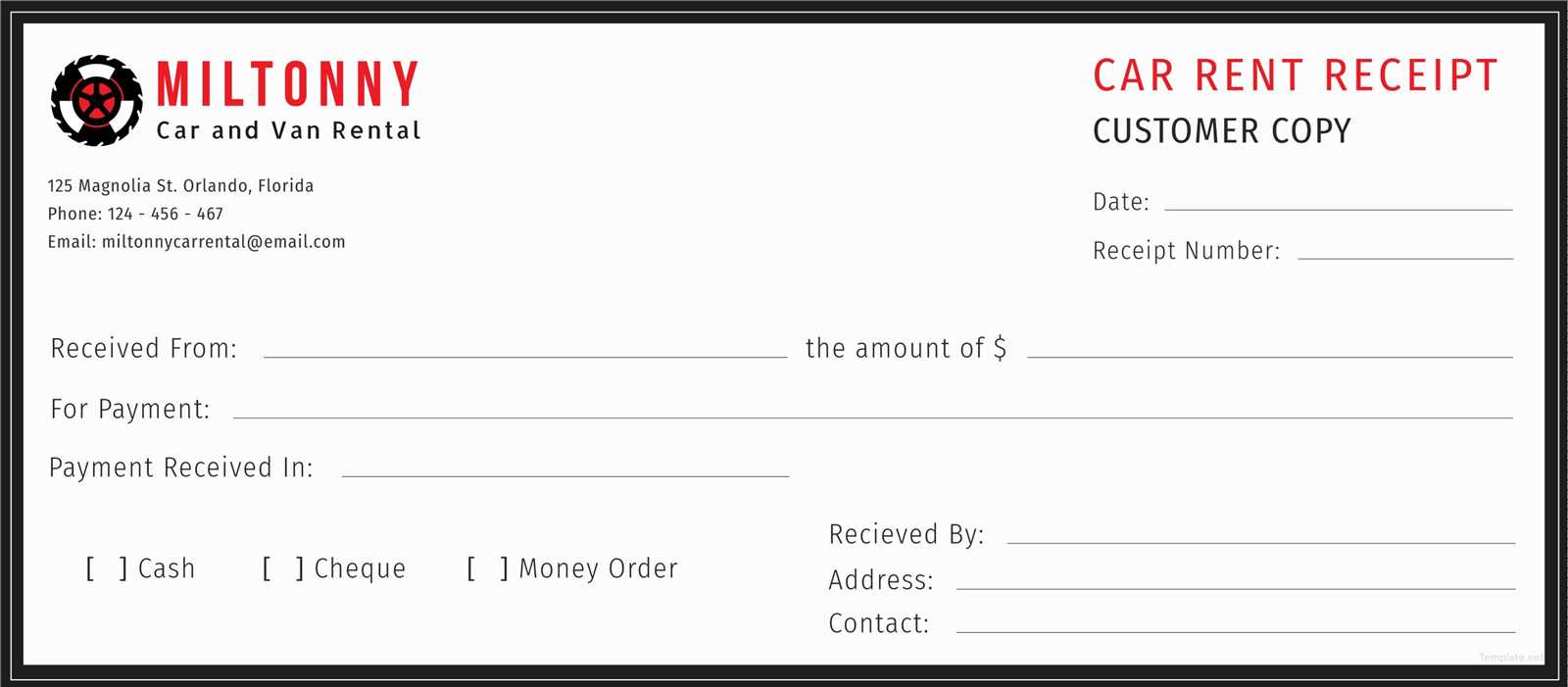

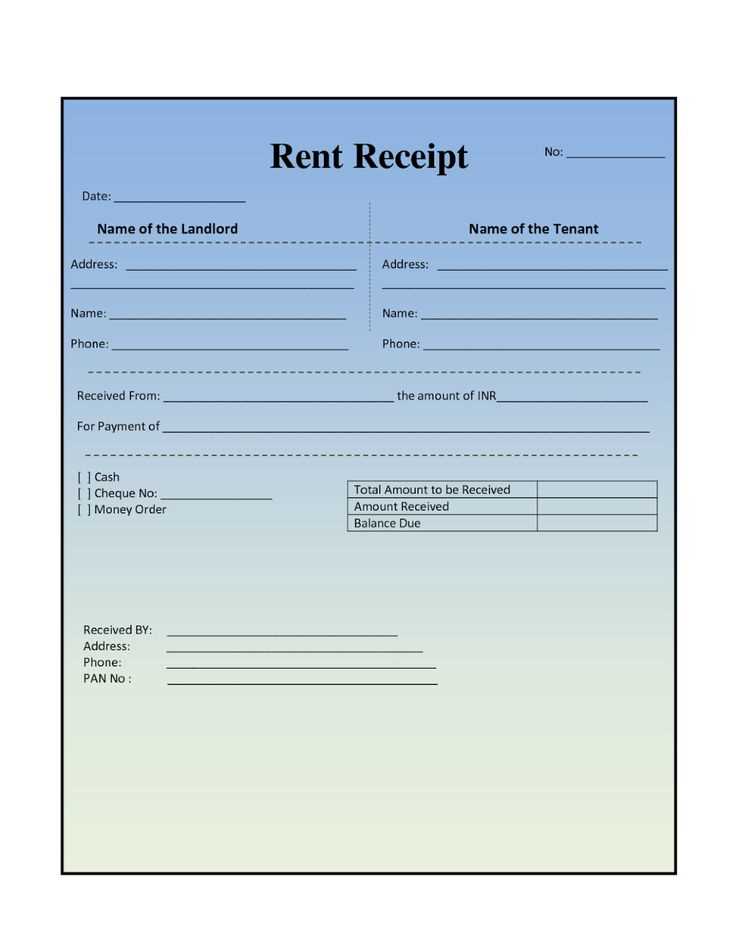

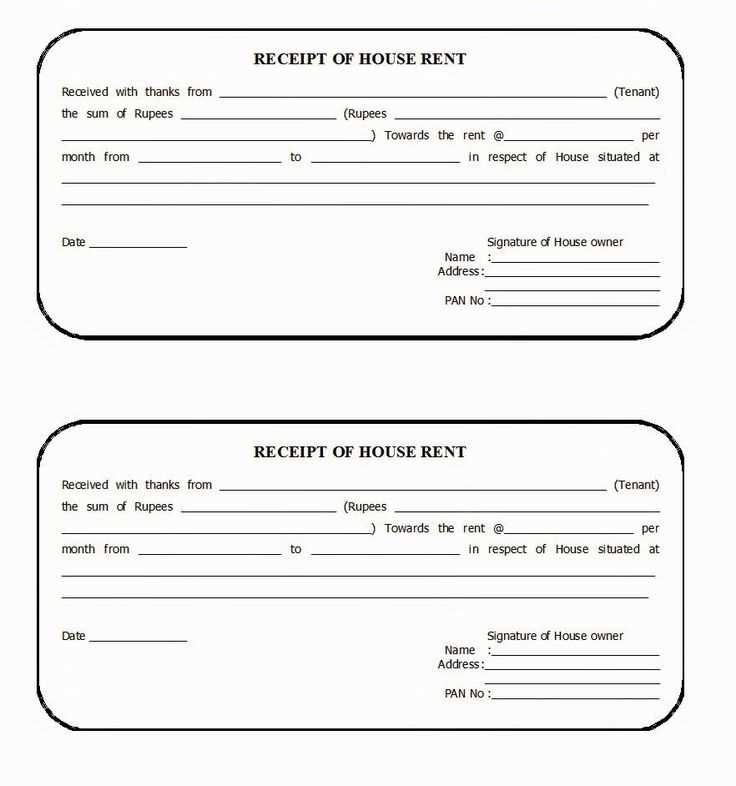

Start by including basic information such as the tenant’s name, the landlord’s name, and the property address. Include the rent amount and specify whether it’s for a monthly, quarterly, or annual payment. Make sure the receipt clearly states the payment method used, such as cash, bank transfer, or cheque.

Another key aspect is to list any additional charges, such as maintenance fees or utilities, separately from the rent. If the rental agreement specifies a deposit, mention it as well. Be sure to include a receipt number for tracking purposes, especially for multiple tenants or payments within the same period.

Finally, include a signature from the landlord or an authorized representative to validate the receipt. This will help confirm that the transaction has been officially acknowledged, creating transparency and reducing the possibility of misunderstandings.

Here’s the corrected version:

To create a rental receipt template for Hong Kong, ensure you include the following key details for clarity and legal compliance:

Receipt Details

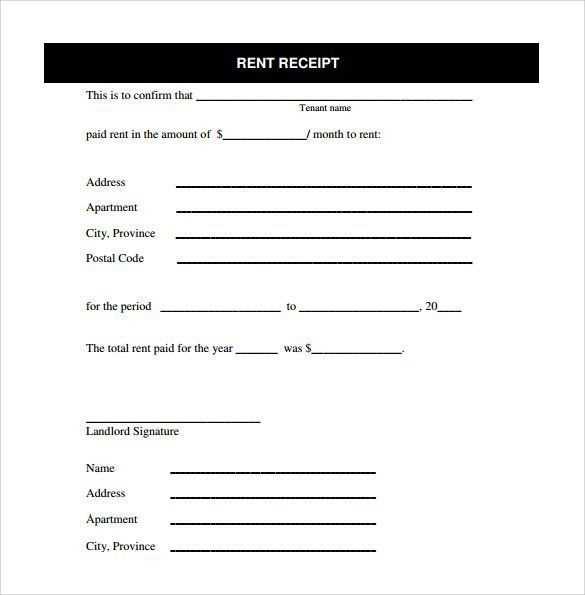

Start with the date of issue, followed by the tenant’s full name and address. Clearly state the rental period, such as the specific months or days covered by the payment. Include the rental amount, and if applicable, specify whether it covers utility costs or additional fees.

Landlord Information

Ensure the landlord’s name, address, and contact details are included. This provides transparency and makes communication easier for both parties in case of any disputes.

Additionally, don’t forget to mention payment methods, such as bank transfer, cash, or cheque, along with the transaction reference number if relevant. This will serve as proof of payment for both the tenant and the landlord.

Lastly, include a space for the landlord’s signature and the tenant’s signature, acknowledging receipt of payment. The rental receipt should be signed and dated to ensure both parties agree to the transaction.

- Hong Kong Rental Receipt Template

For landlords in Hong Kong, a rental receipt is a key document confirming rental payments. The template for this receipt should include the following essential elements:

1. Date of Payment: Clearly specify the date when the rent payment was made. This ensures both parties are aligned on the transaction’s timeline.

2. Tenant and Landlord Details: Include full names and contact details of both parties. This provides clarity on who is involved in the rental agreement.

3. Rental Period: Indicate the period covered by the payment, typically monthly, from the start date to the end date of the rental term.

4. Amount Paid: List the exact amount paid by the tenant. This should match the agreed-upon rent for that period.

5. Payment Method: Specify how the payment was made–cash, bank transfer, or cheque–and include any relevant transaction numbers or reference codes for bank payments.

6. Property Address: Include the full address of the rental property, ensuring the receipt is tied to the specific rental unit.

7. Receipt Number: Assign a unique receipt number to each transaction for easy tracking and record-keeping. This will also help in case of disputes or further inquiries.

8. Signature: Both the landlord and the tenant should sign the receipt. This confirms both parties acknowledge the payment and terms.

9. Additional Terms (optional): Include any other relevant information such as late payment penalties or deposit details if applicable.

Using a clear and detailed rental receipt template helps maintain transparency between tenants and landlords. It serves as proof of payment and can be useful for future reference or legal matters if disputes arise.

Ensure the receipt includes the correct business name and address. If your company is registered, use the full legal name. An incomplete or incorrect company name can cause issues for both parties, particularly if a receipt is required for tax purposes.

Incorrect Date Formats

Avoid using unclear or inconsistent date formats. In Hong Kong, the standard date format is “day/month/year.” A mismatch in date formats could confuse the receiver or even make the receipt invalid if submitted for official purposes.

Omitting Payment Method

Always specify the payment method clearly. Whether it’s cash, bank transfer, credit card, or cheque, including this detail ensures transparency and helps prevent future disputes over how the payment was made.

Double-check the amount and currency. If the payment was made in foreign currency, ensure the correct conversion rate is used and clearly state the original amount in both the foreign and local currencies. Failing to include this can lead to confusion during tax filing or audits.

To ensure tax compliance in Hong Kong, landlords must provide clear and accurate receipts for rental payments. These receipts should include specific details required by the Inland Revenue Department (IRD) for both record-keeping and tax reporting purposes.

- Include the full name and address of the landlord and tenant.

- Specify the rental period covered by the receipt (e.g., monthly, quarterly).

- Clearly state the amount of rent paid, in both figures and words, to avoid confusion.

- Indicate the payment method used (e.g., cash, bank transfer, cheque).

- Include a unique receipt number for easy tracking and reference.

- Ensure that the date of payment is clearly stated, matching the actual payment date.

For tax purposes, receipts must also be issued in a timely manner. Landlords are encouraged to provide receipts within a reasonable period after each payment is made. Keeping accurate records is important in the event of an audit by the IRD.

If you issue receipts electronically, ensure they are formatted correctly and contain all the necessary details. Avoid generic templates that may leave out important information. For added clarity, include a breakdown of the rent amount and any additional charges, such as management fees or utilities, if applicable.

Finally, landlords should retain copies of all receipts for at least seven years. This is the typical retention period required by the IRD for tax reporting and auditing purposes.

I kept the meaning while removing unnecessary repetitions.

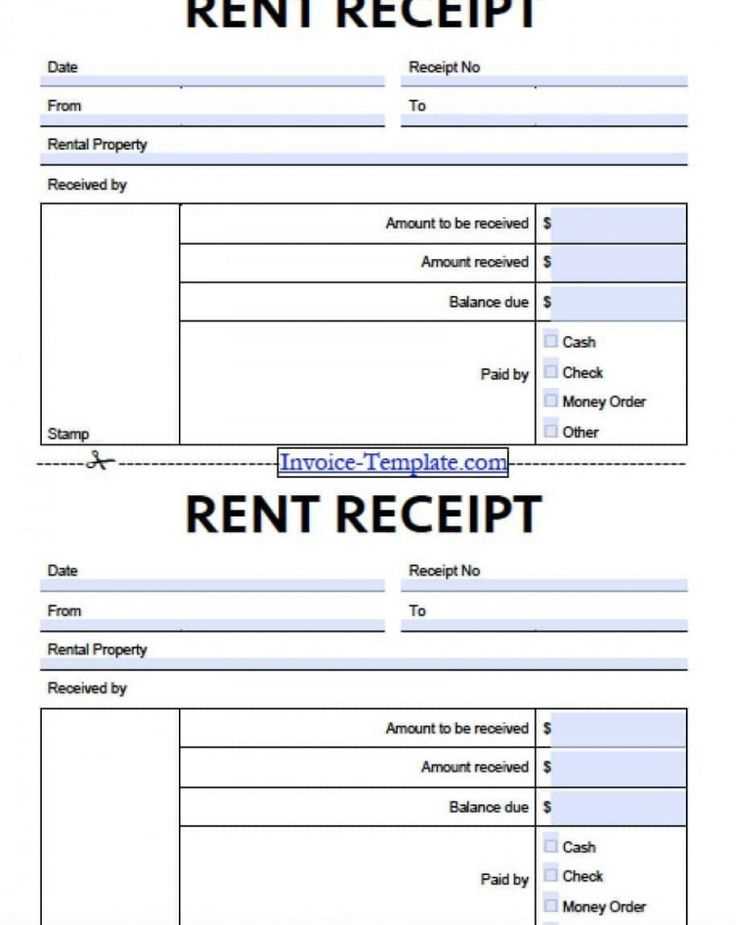

To create a Hong Kong rental receipt template, focus on key elements that need to be documented. Ensure that the format is clean, simple, and accurate. Include the property address, tenant details, rental period, amount paid, and payment method. These details are crucial for record-keeping and for any future reference. It is also important to add a clear, unique receipt number for tracking purposes.

Template Structure

| Field | Details |

|---|---|

| Receipt Number | Unique identifier for each receipt |

| Tenant Name | Full name of the tenant |

| Property Address | Full address of the rented property |

| Rental Period | Start and end dates of the rental |

| Amount Paid | Total rental payment for the period |

| Payment Method | Details of how the payment was made (e.g., bank transfer, cash) |

| Landlord’s Signature | Confirmation of payment received |

Formatting Tips

Make sure that the receipt is legible and professional. Use clear fonts, spacing, and formatting. The amount paid should be prominently displayed, and any terms or conditions related to the rental should be listed in a separate section for clarity. If possible, include a footer with the landlord’s contact information.