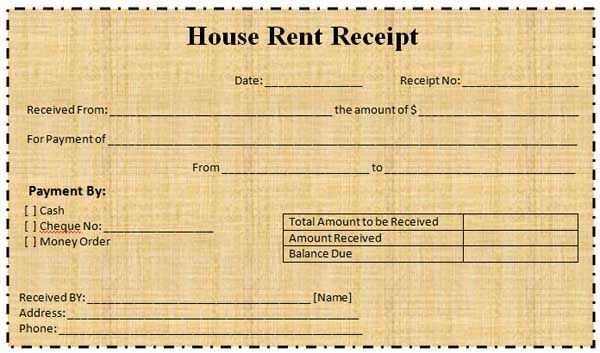

To create a reliable and clear house rent receipt, use a simple template that includes key details such as tenant’s name, address of the rental property, rent amount, and the date of payment. Ensure the format is easy to read, with clear sections for each detail.

Start with the header, which should include the title “House Rent Receipt” in bold letters. Directly below, list the tenant’s full name and the address where rent is being paid. This helps both the landlord and tenant stay organized and ensures the document is easily traceable for any future reference.

Payment details must be listed next, including the exact rent amount, the period covered by the payment (for example, the start and end date of the rental month), and the date the payment was made. It’s important to note the payment method, whether it’s cash, bank transfer, or check, to maintain transparency.

Finish with a signature section at the bottom. Both the landlord and the tenant should sign and date the receipt to confirm that both parties agree to the transaction. This provides legal protection and verification in case of disputes.

Here is the corrected version with repetition removal:

To avoid repetition in the cash receipt template for house rent, ensure the text is clear and concise. A good template should include the essential elements like tenant name, address, rent amount, payment date, and payment method without redundant phrases.

Key Elements to Include

- Tenant’s name and contact information

- Property address

- Amount of rent paid

- Date of payment

- Payment method (cash, bank transfer, etc.)

- Signature of the landlord or authorized agent

Tips for Clarity

- Use clear, simple language to describe each section.

- Avoid repeating information in multiple places, such as listing payment methods several times.

- Ensure each section has only one piece of relevant information.

By streamlining the content, you create a more professional and easy-to-understand document. Repeating words or phrases unnecessarily can lead to confusion and should be eliminated for clarity.

Here’s a detailed HTML article plan for the topic “House Rent Cash Receipt Template,” with 6 specific and practical headings:

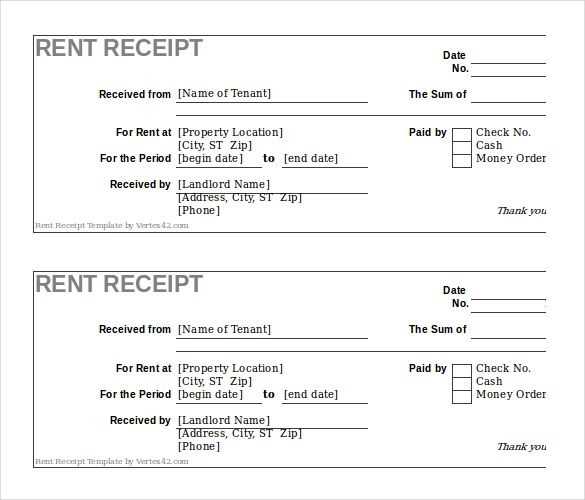

To create a clear and functional house rent cash receipt template, follow these key sections:

1. Header Information

Start by including the landlord’s and tenant’s names, address of the rental property, and the rental period. This basic info ensures both parties can easily identify the receipt. It’s also helpful to include the property manager’s contact details if applicable.

2. Date of Payment

Clearly state the date the payment was made. This helps establish a timeline and acts as proof of payment. It’s best to format the date consistently (e.g., MM/DD/YYYY) to avoid any confusion.

3. Amount Paid

Specify the exact amount of money paid. If the payment covers more than one month or includes additional charges (e.g., maintenance), break it down into categories for clarity. Use currency symbols to avoid ambiguity.

4. Payment Method

Indicate the payment method used, such as cash, check, or bank transfer. This provides clear documentation for both parties and can help resolve any disputes in the future. If payment was made by check, include the check number.

5. Signature Line

Provide space for the signatures of both the landlord and the tenant. This serves as an acknowledgment of the transaction. The signatures confirm that both parties agree to the terms and amounts stated on the receipt.

6. Additional Notes

Include a section for any extra information, such as late fees, repair costs, or future rent agreements. This allows for transparency and helps avoid confusion about additional charges not covered by the rent.

- How to Create a Simple Rent Receipt

Begin by clearly stating the amount paid. Specify the exact rental amount, including the currency. For instance, “Paid $1200 for the month of February.” This ensures both parties are clear on the transaction.

Include the date of payment. The receipt should reflect the date the payment was made, such as “Payment received on 1st February 2025.” This helps keep a precise record of the rental payment history.

Identify the tenant and the landlord. Use full names, e.g., “Received from John Doe” and “Paid to Jane Smith.” This avoids any confusion about the parties involved.

Note the rental period. Mention the specific period being paid for, like “For the rental period from February 1st to February 28th, 2025.” This keeps the transaction transparent and precise.

Write the receipt in a simple and readable format. Avoid clutter by keeping the receipt to the point. Use bullet points if necessary to highlight key information.

Finally, sign the receipt to confirm its authenticity. The landlord’s signature can serve as proof that the receipt is legitimate. If necessary, include contact information for future references.

The receipt should clearly display the tenant’s name and address. This ensures both parties have a reference to the individual responsible for the payment. Next, include the rental property address to specify the location tied to the payment.

Make sure to state the payment amount clearly, along with the payment method (e.g., cash, bank transfer). If applicable, list the date of payment and any late fees or adjustments, ensuring all charges are transparent.

Provide a receipt number or unique identifier for easy tracking. Include the rental period being covered, whether it’s for a month, a week, or another time frame. This helps avoid confusion regarding which rent cycle the payment applies to.

Lastly, include a landlord’s or property manager’s signature or a space for confirmation of receipt. This validates the transaction and confirms both parties acknowledge the agreement.

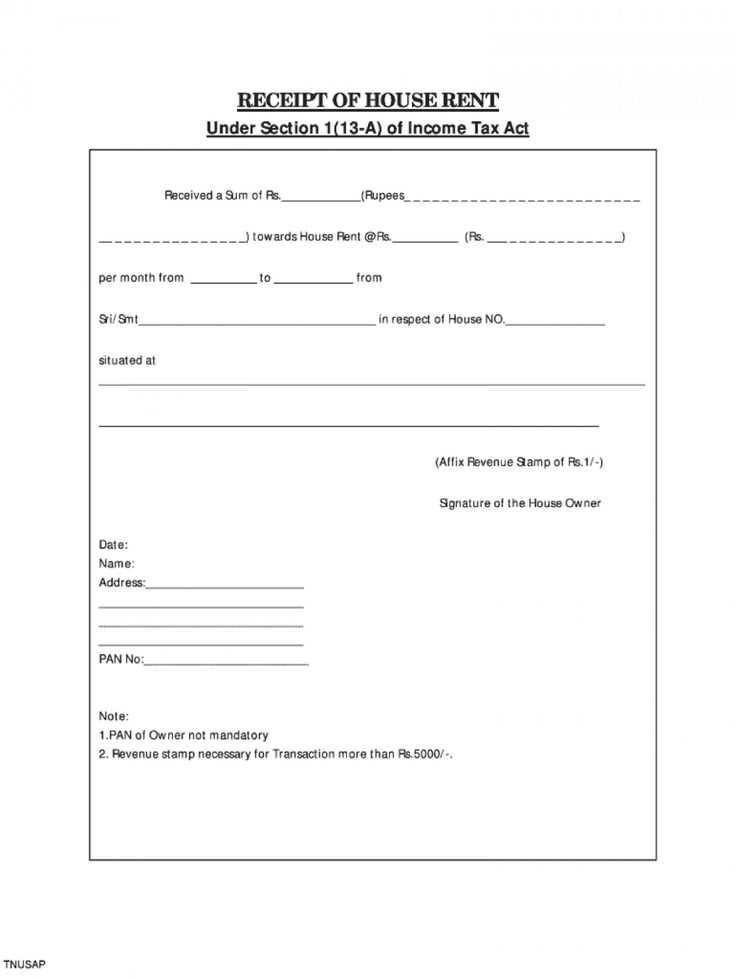

Adjust your template based on the type of lease agreement you are working with. For residential leases, include details like the duration of the lease, security deposit requirements, and rent due dates. Make sure to specify if the rent amount includes utilities or if tenants are responsible for additional costs. For commercial leases, be more detailed about property use, maintenance responsibilities, and any clauses related to improvements or modifications to the property.

In case of short-term leases or vacation rentals, highlight flexible payment options, check-in/check-out procedures, and any cleaning fees. You can also add specific conditions for early termination, which are often part of these agreements. For rent-to-own arrangements, incorporate terms about purchase options, down payments, and timelines for ownership transfer.

Another adjustment could be the inclusion of late payment penalties or grace periods for late rent, depending on the lease type. For corporate leases, clarify additional stipulations related to subletting, insurance requirements, and property alterations that could affect the lease.

Remember to tailor each template to meet the legal requirements in your region. Lease agreements may vary significantly depending on local laws and the property’s nature. Ensuring your template reflects the right terms will help avoid disputes and streamline the leasing process.

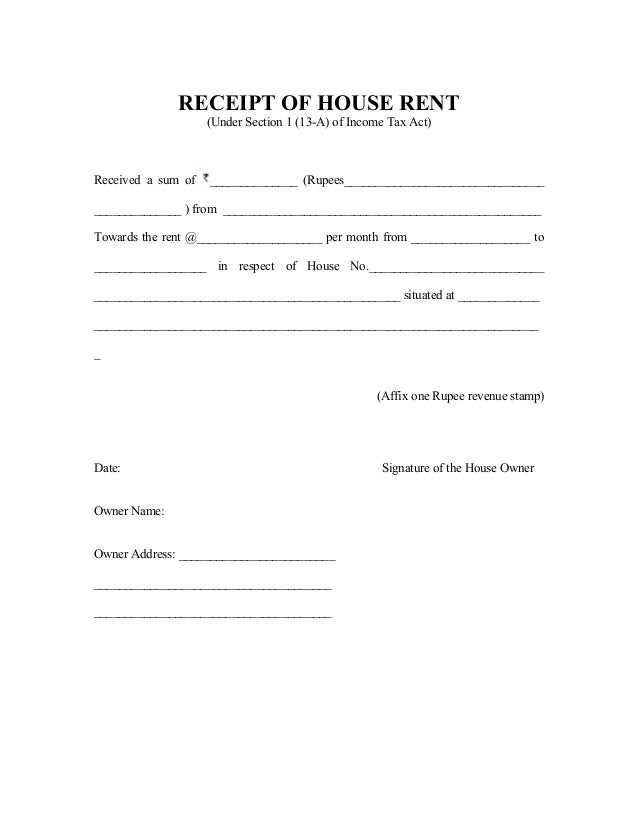

Make sure a rent receipt includes both the landlord’s and tenant’s names, address of the property, and rental period. Specify the payment amount, payment method, and the date of receipt. Clearly indicate whether it covers a partial or full payment for the rental period. This helps avoid any confusion or disputes in the future.

In some jurisdictions, keeping a record of rent payments is legally required, especially for tax purposes. Rent receipts act as proof of transaction for both parties, serving as evidence in case of any legal disputes. If a dispute arises over payment amounts or lease terms, these receipts can be used to verify the rent payment history.

It’s also important that the receipt is signed or includes a clear acknowledgment from the landlord, confirming receipt of the payment. This provides an additional layer of security for both parties and ensures that the payment is formally recognized.

Digital receipts offer convenience and easy storage, while paper receipts are traditional and can be physically stored. Choosing between them depends on your needs and preferences.

Advantages of Digital Receipts

Digital receipts are ideal for quick access and organization. They can be stored on your phone, cloud, or email, eliminating the clutter of physical papers. Searching for a past transaction is as easy as typing a keyword in your inbox or app. Digital receipts are also environmentally friendly, reducing paper waste.

Benefits of Paper Receipts

Paper receipts are tangible and useful for those who prefer having physical documentation. Some people find it easier to track spending with paper, especially when they need to keep receipts for returns or warranty claims. Paper also avoids potential digital security risks associated with storing personal data online.

| Factor | Digital Receipts | Paper Receipts |

|---|---|---|

| Storage | Cloud, Email, Mobile | Physical Storage |

| Organization | Easy Search | Requires Physical Organization |

| Environment | Eco-friendly | Paper Waste |

| Security | Risk of Online Breaches | Less Likely to Be Hacked |

Choose digital receipts if you prefer a streamlined, paperless system. Opt for paper if you prioritize physical documentation or need reliable records without relying on devices.

Keep a separate record for each tenant’s rent payment. Create individual folders or files for each tenant, whether digital or physical. This helps you track payments easily and avoid mixing up information.

- For each tenant, use a unique identifier, such as a tenant name or unit number, to avoid confusion.

- Maintain a consistent format for each receipt, including the date, amount paid, and the payment method. This ensures all records are uniform and easy to follow.

- Regularly update your records to reflect late fees, partial payments, or adjustments. This helps in managing any discrepancies.

For tenants who pay by check or bank transfer, record the payment reference number. This provides a clear trail if you need to verify or follow up on a payment.

- Consider using rental management software to streamline the process and automate receipt generation for each tenant. This reduces the risk of errors and makes it easier to retrieve information.

- Periodically review your records for completeness and accuracy. A periodic audit can help identify issues before they become larger problems.

By keeping organized and clear records for each tenant, you ensure smooth management of multiple receipts and avoid potential disputes.

How to Create a Simple House Rent Cash Receipt

For an efficient cash receipt, include the payer’s name, amount received, date, and the purpose of the payment. Specify the address of the rented property and ensure the format is clear, with easy-to-read fonts. Include both the landlord’s and tenant’s signatures to make the receipt valid and legally binding. If needed, add payment method details (e.g., cash, bank transfer). Keep the receipt short and to the point, focusing on the key details to avoid unnecessary information.