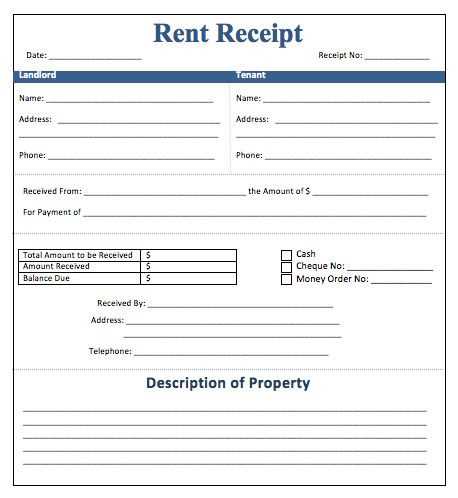

A clear and accurate deposit receipt is a key part of any rental agreement. It serves as proof that the tenant has paid the required deposit, which can help avoid disputes later on. Make sure to include specific details like the tenant’s name, the landlord’s name, the property address, the amount paid, and the date of payment. This provides transparency for both parties.

Keep it simple and specific. You don’t need to overcomplicate the document. List the payment amount and clarify if it’s refundable or non-refundable. If the deposit is meant to cover damages or unpaid rent, mention that explicitly. Be sure to include any conditions under which the deposit may be retained or returned.

Double-check the format. Ensure that the receipt is easy to read. A clean, structured format with well-organized sections will help both parties understand the details at a glance. The landlord and tenant should each keep a signed copy for their records to ensure clarity if questions arise about the deposit in the future.

Here’s the corrected version:

Ensure that the rent deposit receipt clearly lists the amount received, the date of payment, and the names of both the landlord and tenant. It should also mention the rental property address and specify whether the deposit is refundable under certain conditions. Avoid ambiguous wording–clarity will prevent misunderstandings later on.

Include a section noting the payment method used (e.g., cash, bank transfer) and any specific terms or conditions tied to the deposit. If applicable, state the date by which the deposit will be refunded, and the process for returning it once the lease ends. For transparency, both parties should sign and keep copies of the receipt for reference.

By keeping the document simple but detailed, both parties will have a clear record of the transaction, preventing disputes down the line.

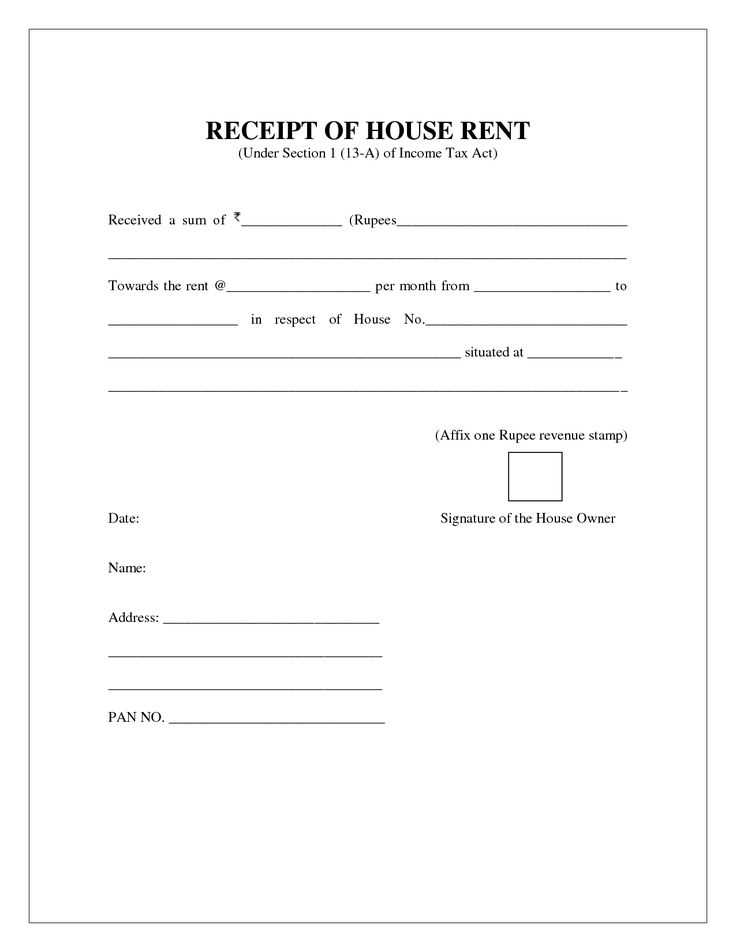

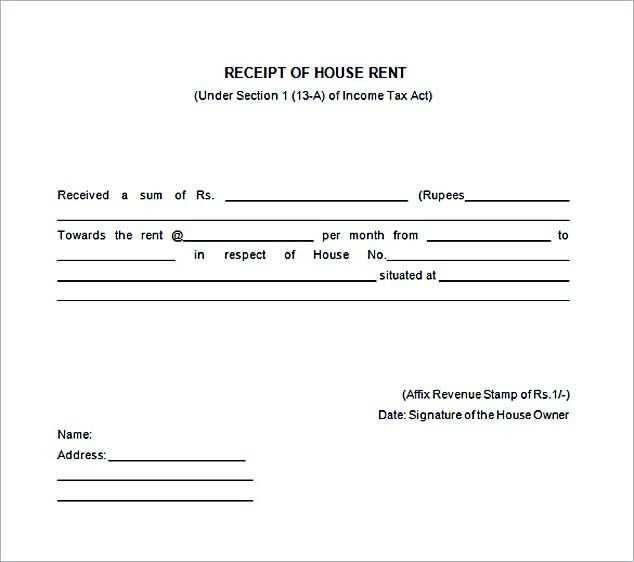

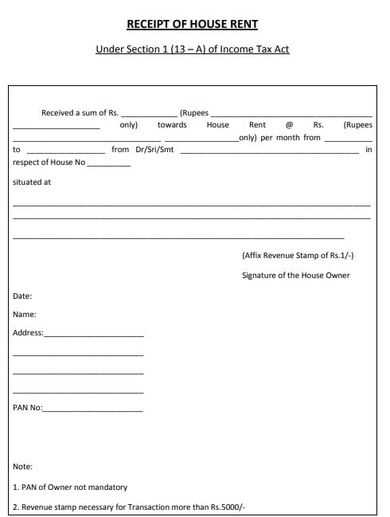

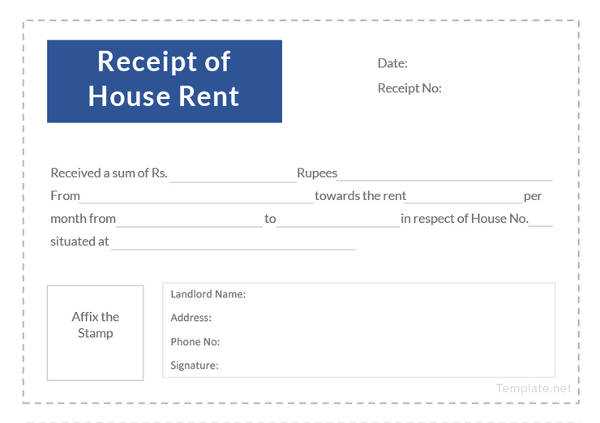

- House Rent Deposit Receipt Template

To create a house rent deposit receipt template, include the following key details: the tenant’s name, address of the rented property, the landlord’s name, the date the deposit was paid, and the exact amount received. It’s crucial to provide a clear breakdown of the deposit amount, noting whether it covers damages, last month’s rent, or any other agreed-upon purpose. Ensure the receipt includes a statement confirming that the deposit is refundable based on the terms of the rental agreement.

Details to Include

Start by listing the tenant’s full name and property address. This information ties the receipt to the specific rental agreement. Then, mention the landlord’s name or the authorized agent who received the payment.

Payment Information

Specify the deposit amount, followed by the payment method used (e.g., cash, cheque, bank transfer). A reference number, if available, should be included for easy tracking. Additionally, include a clear statement confirming the deposit is held as security for the duration of the rental agreement, refundable subject to the agreed conditions at the lease’s conclusion.

Clearly outline the key components to ensure the form is legally sound and easy to understand. Start by including the date of the agreement at the top. This provides clarity on when the deposit was received.

Key Information to Include

- Tenant’s Details: Full name, address, and contact information.

- Landlord’s Details: Full name, address, and contact information.

- Rental Property Address: The exact address of the property being rented.

- Deposit Amount: Clearly state the amount of the deposit paid.

- Payment Method: Specify whether the deposit was paid in cash, cheque, or bank transfer.

- Reason for Deposit: Mention that it is for securing the rental agreement or covering potential damages.

- Return of Deposit: Clearly state the conditions under which the deposit will be returned and the timeframe for its return after the end of the lease.

Additional Notes

- Signatures: Both tenant and landlord should sign the form to confirm agreement.

- Witness: Optionally, a witness can be included to validate the agreement.

Ensure the document includes the following details:

| Information | Description |

|---|---|

| Tenant and Landlord Details | Full names, contact information, and addresses of both parties. |

| Property Address | The complete address of the rental property. |

| Deposit Amount | The exact amount of the deposit paid by the tenant. |

| Payment Date | The date when the deposit was received. |

| Purpose of Deposit | A clear statement on the purpose (e.g., security, damage coverage). |

| Return Conditions | Specify when and under what conditions the deposit will be returned to the tenant. |

| Signatures | Both parties should sign to confirm the terms and agreement. |

These elements confirm the rental transaction and help protect both parties’ interests.

To issue a deposit confirmation, follow these steps:

1. Record the Deposit Amount

Ensure the exact amount of the deposit is clearly documented. This should match the agreed amount from the rental agreement. Double-check both the payment details and the transaction records for accuracy.

2. Include Property Details

Provide a brief description of the rental property. Include the address, the tenant’s name, and the rental period. This ensures clarity regarding the property involved in the deposit.

3. State the Payment Method

Specify how the deposit was made–whether through cash, bank transfer, or other methods. Include the transaction reference number for bank payments for further verification.

4. Clarify Deposit Terms

Outline the conditions under which the deposit may be refunded, including any deductions for damages or unpaid rent. Be transparent with the terms agreed upon during the lease signing.

5. Provide Landlord’s Contact Information

Include the landlord or property management’s name and contact details. This allows the tenant to reach out for further questions or clarifications.

6. Sign the Confirmation

Both parties should sign the deposit confirmation. The tenant should receive a copy for their records. This confirms mutual agreement on the deposit details.

By following these steps, you ensure clear and professional handling of the deposit confirmation process.

Rental receipts must contain specific details to be legally valid. Always include the full name of both the landlord and tenant, the rental property’s address, the amount paid, and the payment date. These details ensure both parties have a clear record of the transaction.

Additionally, make sure the receipt specifies the purpose of the payment, such as the rent deposit or security deposit, to avoid confusion later. It’s also a good practice to note the payment method, whether it’s cash, check, or electronic transfer, as this can be used to verify the transaction in case of disputes.

Ensure that the receipt is signed by the landlord or their authorized representative. A signature adds an extra layer of authenticity to the document, making it more reliable in legal situations.

Finally, know that some jurisdictions may require landlords to provide a written agreement alongside the receipt. Always check local laws to ensure compliance with specific legal obligations regarding rental transactions.

One of the most frequent errors is neglecting to include the exact deposit amount. Always specify the full deposit amount paid by the tenant. Failing to do this can lead to confusion or disputes down the line.

Missing Important Tenant and Landlord Details

Ensure that both the tenant’s and landlord’s full names, addresses, and contact information are listed correctly. Omitting or misspelling these details can make it difficult to resolve any future issues regarding the deposit.

Unclear Payment Method

Document the payment method clearly. Whether the deposit was made via bank transfer, cheque, or cash, specifying the method adds clarity. Missing this information can cause problems if questions arise about how the payment was made.

Failing to Specify Deposit Conditions is another common mistake. Make sure the receipt includes any conditions related to the deposit, such as the purpose of the deposit and any circumstances under which it may be withheld. This protects both parties.

Not Providing a Signature can be an overlooked detail, but a signature from both the tenant and landlord is key to confirming that the deposit agreement is acknowledged. Without signatures, the validity of the deposit record might be questioned.

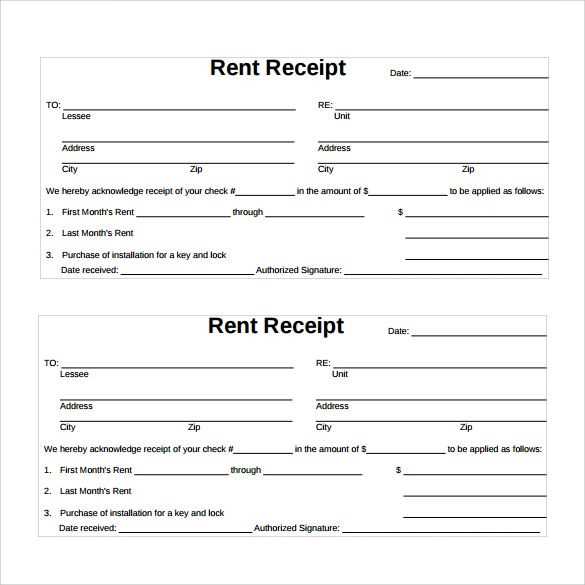

Adjust the header to include relevant rental property details like the address and landlord’s contact information. This ensures clarity for both parties. Update the recipient’s name and the rental period to reflect the current transaction. Be specific about the payment amount, including any separate fees for maintenance or utilities. Make sure to include a space for the payment method used, such as cash, cheque, or bank transfer. You can add a line for any balance due or additional notes if necessary.

Next, ensure that the date is accurate. Include both the date of receipt and the date the payment was made. If applicable, use a unique receipt number to help track the transaction in case of any future disputes. Customize the footer with any legal disclaimers, or include a thank-you note for clarity and professionalism. Keep the formatting clear, with sufficient spacing between each section to avoid confusion.

For creating a house rent deposit receipt, ensure that the document is clear and straightforward. Include all the necessary details to avoid future disputes. The following items should be present:

- Tenant’s Name – Clearly state the name of the person renting the property.

- Landlord’s Name – Include the full name of the property owner or representative.

- Amount Paid – Specify the exact amount of the deposit received.

- Date of Payment – Record the date the deposit was paid by the tenant.

- Property Address – Mention the complete address of the rented property.

- Deposit Terms – Outline any conditions or terms related to the deposit return.

- Signature – Both the landlord and tenant should sign the receipt to confirm the transaction.

Using this format ensures transparency and helps protect both parties. Always keep a copy of the receipt for your records.