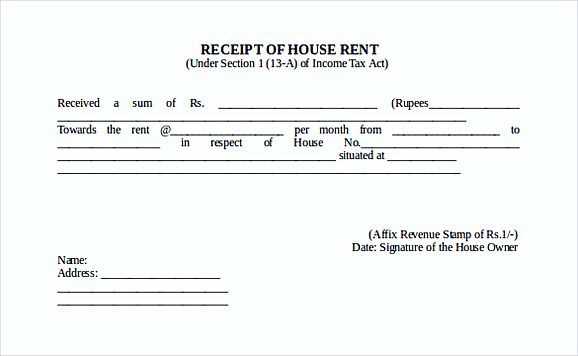

Creating a house rent receipt can simplify the process of documenting rental transactions for both tenants and landlords. This template allows you to quickly generate a receipt with all the necessary details, ensuring that all parties involved have a clear and accurate record of payment.

Include key elements like the date of payment, tenant and landlord names, address of the rented property, the amount paid, and the payment method. These details make it easy to track payments and can serve as proof in case of disputes or future reference. Always ensure that both tenant and landlord sign the receipt to validate the transaction.

For added clarity, you can also specify the rental period covered by the payment and include any extra charges such as maintenance or late fees. Having a detailed, well-organized rent receipt makes it easier to manage rental agreements and avoid misunderstandings down the line.

Here is the revised version of the text:

To create a reliable house rent receipt, ensure that the document includes key details. The receipt should clearly list the tenant’s name, rental property address, the rental period, and the total amount paid. Always mention the payment method and the date it was made. This helps both the tenant and landlord maintain accurate records.

Here’s what to include in your house rent receipt template:

- Tenant’s Full Name: Clearly state the name of the tenant.

- Property Address: Include the full address of the rented property.

- Rental Period: Specify the dates the payment covers (e.g., “January 1st, 2025 – January 31st, 2025”).

- Amount Paid: State the exact payment made, specifying the currency.

- Payment Method: Note whether the payment was made via cash, cheque, bank transfer, or another method.

- Payment Date: Mention the exact date when the payment was received.

- Landlord’s Information: Include the landlord’s name and contact details.

When drafting the receipt, ensure that it’s clear, concise, and free from ambiguities. This prevents potential disputes over payments or lease terms. Make sure both parties keep a copy of the receipt for their records.

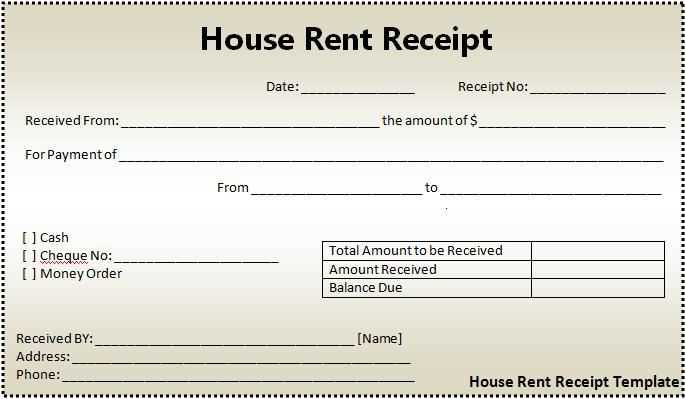

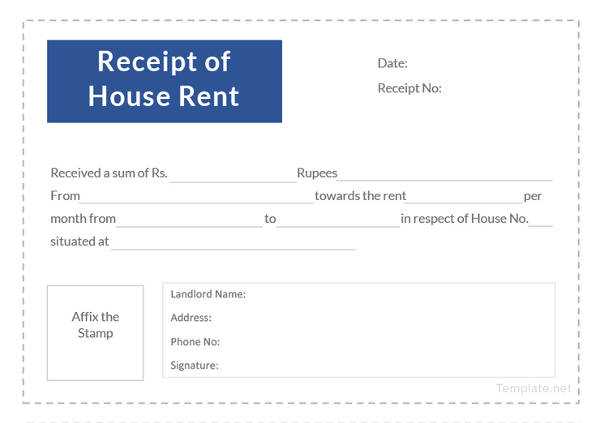

- House Rent Receipt Template

For landlords and tenants, creating a house rent receipt is a simple yet necessary task to document rental payments. A house rent receipt template should include specific details to ensure clarity and transparency for both parties.

- Landlord and Tenant Information: Always include the full names and contact details of both the landlord and the tenant. This ensures both parties can be easily identified.

- Property Address: Clearly state the address of the rented property to avoid any confusion.

- Payment Details: Specify the amount paid, the payment method (cash, bank transfer, etc.), and the rental period for which the payment was made.

- Date of Payment: Include the exact date on which the rent payment was received.

- Receipt Number: Assign a unique receipt number for easy reference, especially in case of disputes or queries.

- Signature: Have the landlord or authorized person sign the receipt to verify its authenticity.

Providing a well-structured rent receipt builds trust and avoids potential misunderstandings. Templates make this process efficient by ensuring all necessary details are consistently included.

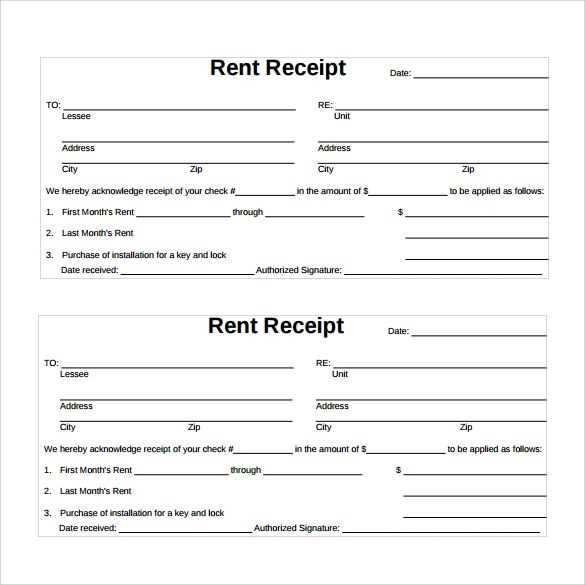

To create a simple rent receipt template, include the following key elements: landlord’s name, tenant’s name, rental property address, payment amount, date of payment, payment method, and a receipt number for record-keeping.

Set up a table format to organize these details clearly. Here’s an example layout:

| Field | Description |

|---|---|

| Receipt Number | Unique number assigned to the receipt for reference. |

| Landlord’s Name | Full name of the landlord or property manager. |

| Tenant’s Name | Full name of the tenant who made the payment. |

| Rental Property Address | The full address of the rental property. |

| Amount Paid | The exact amount the tenant paid for the rental period. |

| Payment Date | The date the rent was paid. |

| Payment Method | The method used for the payment (e.g., check, cash, bank transfer). |

This structure helps ensure all necessary details are captured for both the tenant and landlord to have a clear record of the transaction.

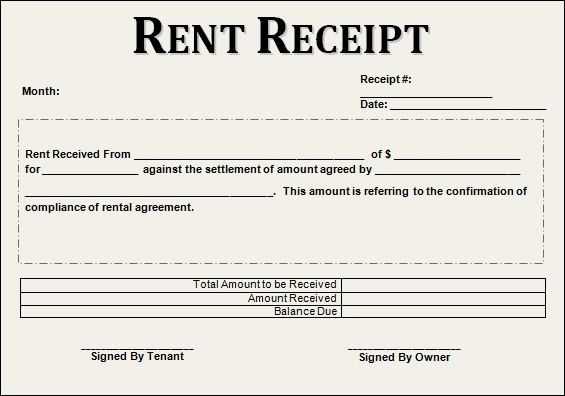

A rent receipt must contain specific details to serve its purpose effectively. Include the following key elements for clarity and completeness:

- Landlord and Tenant Information: Clearly list the names of both the landlord and tenant. This helps identify both parties involved in the transaction.

- Property Address: Include the full address of the rental property. This ensures the receipt is linked to the correct property.

- Amount Paid: Specify the exact rent amount paid by the tenant for the period. Include the currency and any applicable taxes or fees, if necessary.

- Payment Date: State the date on which the rent payment was made. This confirms the timeline of the transaction.

- Payment Method: Indicate how the payment was made, whether by cash, check, or online transfer. This provides transparency regarding the payment method.

- Rental Period: Mention the start and end dates of the rental period for which the payment applies. This helps track the timing of payments and leases.

- Receipt Number: Assign a unique receipt number for record-keeping purposes. This number can be useful for both the landlord and tenant for future reference.

- Signature: Both the landlord and tenant should sign the receipt, confirming that the transaction is complete and agreed upon.

Including these details ensures that the rent receipt serves as a proper record and minimizes potential disputes.

When dealing with multiple payment methods, adjust your receipt template to reflect each transaction’s details clearly. Start by including payment-specific fields that can vary, such as credit card numbers, transaction IDs, or bank account details. These ensure the receipt accurately represents the method used.

Credit Card Payments

For credit card payments, include the last four digits of the card number for reference. If applicable, provide the type of card (Visa, MasterCard, etc.) and the authorization code or transaction ID. This helps both the landlord and tenant keep track of their records for any future inquiries.

Bank Transfers

For bank transfers, add the sender’s account number, bank name, and the transaction reference number. These details confirm that the payment was processed and traceable through the bank’s records. If the transfer was done via an online banking service, also include the date and time of the transaction.

Lastly, adjust the formatting based on the payment method used. For example, highlight electronic payments with additional transaction tracking details or add a specific note for cash payments. This customization improves clarity and ensures your receipt works for every type of transaction.

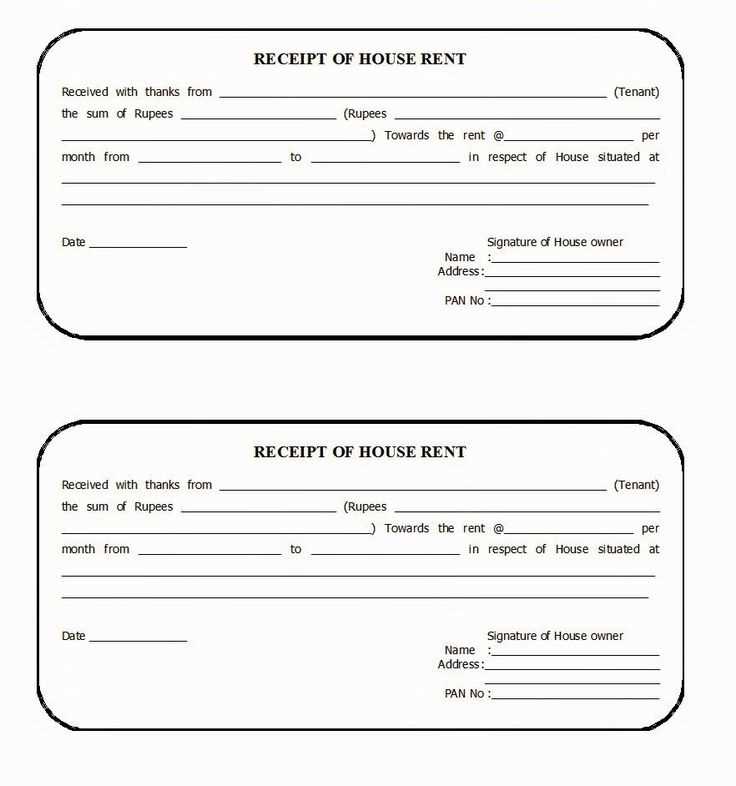

Clearly outline the details of the transaction. Include the full names and addresses of both the landlord and tenant, as well as the date of the payment. This ensures both parties can easily verify their involvement. Specify the rental period covered by the payment, such as the month or quarter.

Payment Breakdown

Include a breakdown of the payment amount. Specify the rent amount, any additional charges, and the total paid. If the payment covers multiple months, list them separately with the corresponding amounts.

Legal Identifiers

For tax purposes, it’s important to include tax identification numbers if applicable. This is particularly relevant if the landlord is a business entity or if the payment involves taxable services. Ensure the receipt includes the correct classification of the property for tax reporting.

To make rent receipts digital, use a reliable PDF editor or template generator. There are plenty of free online tools that allow you to input rental details and create a clean, professional-looking receipt in seconds. This is an easy way to convert paper receipts into a digital format, reducing clutter and ensuring receipts are always legible.

1. Use Receipt Templates

Utilize ready-made templates in PDF or Word format. Platforms like Google Docs and Microsoft Word offer free templates you can fill in with rental details. Templates automatically ensure consistency in style and format, saving time and effort in creating receipts from scratch.

2. Convert Documents to PDF

Once you’ve generated a receipt, convert it into a PDF. PDF files are universally accessible and maintain their format across devices. Many online tools allow you to convert Word or image files into PDFs in just a few clicks. This ensures the recipient receives the file exactly as intended, with no formatting issues.

Sharing Made Easy: Once your receipt is ready, sharing is straightforward. Upload it to cloud storage platforms like Google Drive or Dropbox, or attach it directly to an email. Make sure the file name is clear and descriptive for easy identification. Sending receipts through messaging apps such as WhatsApp or Slack is also a quick and secure option for instant delivery.

Keep copies organized by storing them in folders based on the tenant’s name or the year of the transaction. This allows for easy retrieval when needed, ensuring smooth record-keeping for both you and the tenant.

One of the most common mistakes is failing to include all necessary details. Always ensure that the receipt contains the full name of both the landlord and the tenant, the address of the rented property, the rental amount, and the payment date. Omitting any of these can lead to confusion and disputes later.

Incomplete or Incorrect Information

Double-check all figures, including the rental amount, and ensure the payment is correctly recorded. It’s easy to miss a digit or make a typo. This can create issues if the receipt is ever questioned. Never round amounts or skip over critical fields. Being precise saves both parties from unnecessary issues.

Not Providing a Unique Receipt Number

A unique receipt number helps track payments, especially for long-term leases. Without one, it becomes difficult to identify specific payments, which can be problematic for both the landlord and tenant. Assign a new number to each receipt and keep a log of all issued receipts.

Another issue is not using a clear, readable format. Ensure the receipt is easy to read, with a clear layout and organized sections. Unclear handwriting or cluttered receipts can cause misunderstandings. Consider using a template or software to maintain consistency in format.

Incorrect Payment Methods – Make sure to note the payment method used, whether it’s cash, bank transfer, or another form. Not specifying this can create issues if a tenant disputes the method of payment at a later date.

Lastly, don’t forget to include the signature of the landlord or the person authorized to issue the receipt. The absence of a signature can make the receipt look unofficial and less reliable in case of a dispute.

I kept the meaning intact and avoided repeating the word “House” or “Rent” excessively.

Design your receipt with clear sections to enhance clarity. Begin by listing the date of payment and the full name of the tenant, followed by the landlord’s details. These details set the stage for the document’s authenticity.

In the next section, indicate the amount received. Specify the payment method (e.g., cash, bank transfer), and if applicable, mention the period for which the payment is made. This step provides transparency and ensures both parties are aligned.

Include a brief note or reference number for further identification. This can be especially useful for tracking purposes or in case of any disputes. It’s a simple way to keep records organized.

End the document with a statement confirming the payment has been received in full. This will assure both parties that the transaction is complete and no further balance is owed for the specified period.

| Section | Details |

|---|---|

| Date | [Enter Date] |

| Tenant Name | [Enter Tenant Name] |

| Landlord Name | [Enter Landlord Name] |

| Amount Paid | [Enter Amount] |

| Payment Method | [Enter Method] |

| Period Covered | [Enter Period] |

| Reference Number | [Enter Reference] |

| Confirmation Statement | Payment received in full. |

Ensure this template reflects all relevant details to maintain professionalism and keep your records in order. A concise, well-organized receipt helps avoid misunderstandings and provides a clear, traceable record of the transaction.