To claim deductions on house rent paid under Section 80GG of the Income Tax Act, it’s important to keep a proper record of rent payments. A house rent receipt serves as the primary document to verify rental payments made during the financial year. Using a clear and accurate template for these receipts simplifies this process and helps ensure compliance with tax regulations.

The receipt should include key details such as the tenant’s and landlord’s names, the address of the rented property, the rent amount, payment date, and the period for which the rent has been paid. These details are critical for both tenants claiming deductions and landlords reporting rental income.

It’s recommended to maintain a systematic record of rent receipts for each month to avoid confusion during tax filing. A standardized template reduces the chances of missing any important data and ensures that you can easily present proof of rent payments if required by tax authorities.

Ensure that the template is signed by the landlord and includes all necessary details to avoid any issues during the tax assessment process. A well-organized rent receipt template not only supports your tax claims but also acts as a safeguard in case of any discrepancies or audits.

Here’s the corrected version:

If you’re renting out property, make sure your rent receipt includes the following details to meet tax requirements:

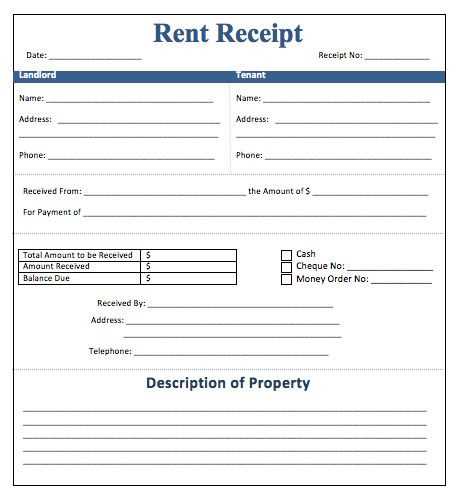

- Landlord and Tenant Information: Include full names, addresses, and contact details of both parties involved in the rental agreement.

- Receipt Date: Clearly mention the date the payment was made to ensure it aligns with your financial records for tax reporting.

- Amount Received: State the exact amount paid by the tenant and specify the currency.

- Payment Period: Specify the rental period the payment covers, such as “for the month of January 2025.”

- Rental Property Address: Always mention the complete address of the rented property to avoid confusion.

- Signature: The landlord’s signature, or a digital equivalent, to confirm the transaction has taken place.

- Receipt Number: Include a unique receipt number for record-keeping purposes, making it easier to track payments.

Ensure the rent receipt is clear, accurate, and easy to reference for both parties. This will help you with any future income tax filings and disputes, should they arise.

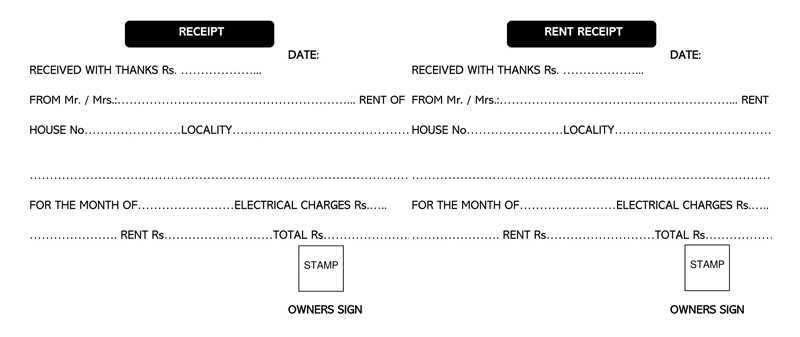

House Rent Receipt Template for Tax Purposes

To claim tax benefits related to house rent, landlords must issue a proper house rent receipt. The receipt must include key details to meet the requirements set by tax authorities. A good house rent receipt template ensures clarity and accuracy in record-keeping for both tenants and landlords.

What to Include in a House Rent Receipt

A valid house rent receipt should contain the following elements:

- Date: The exact date when the rent was paid.

- Tenant’s Name: Full name of the person paying rent.

- Landlord’s Name: Full name of the person receiving the rent.

- Property Address: Complete address of the rented property.

- Amount Paid: The rent amount paid by the tenant.

- Payment Method: Cash, cheque, online transfer, or other methods of payment.

- Rent Period: Specify the month or duration for which the rent is being paid.

- Signature: A signature from the landlord (or their representative) confirming receipt of payment.

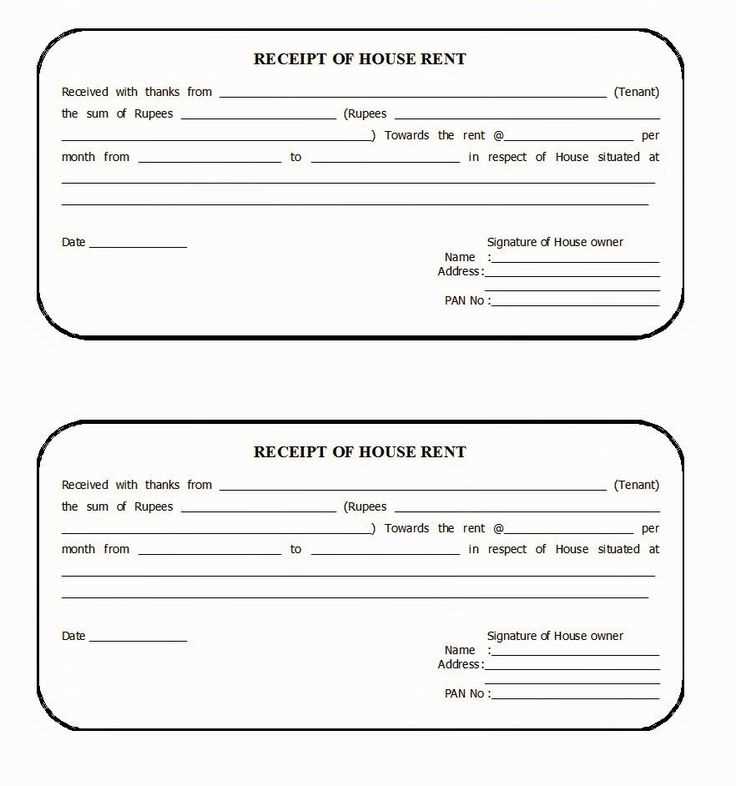

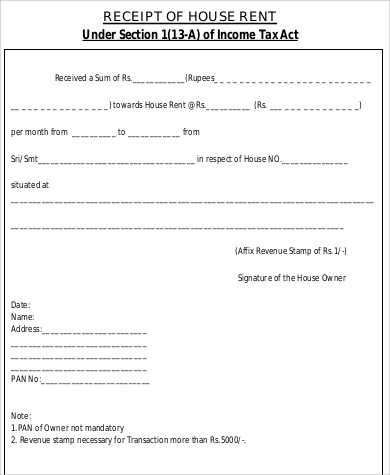

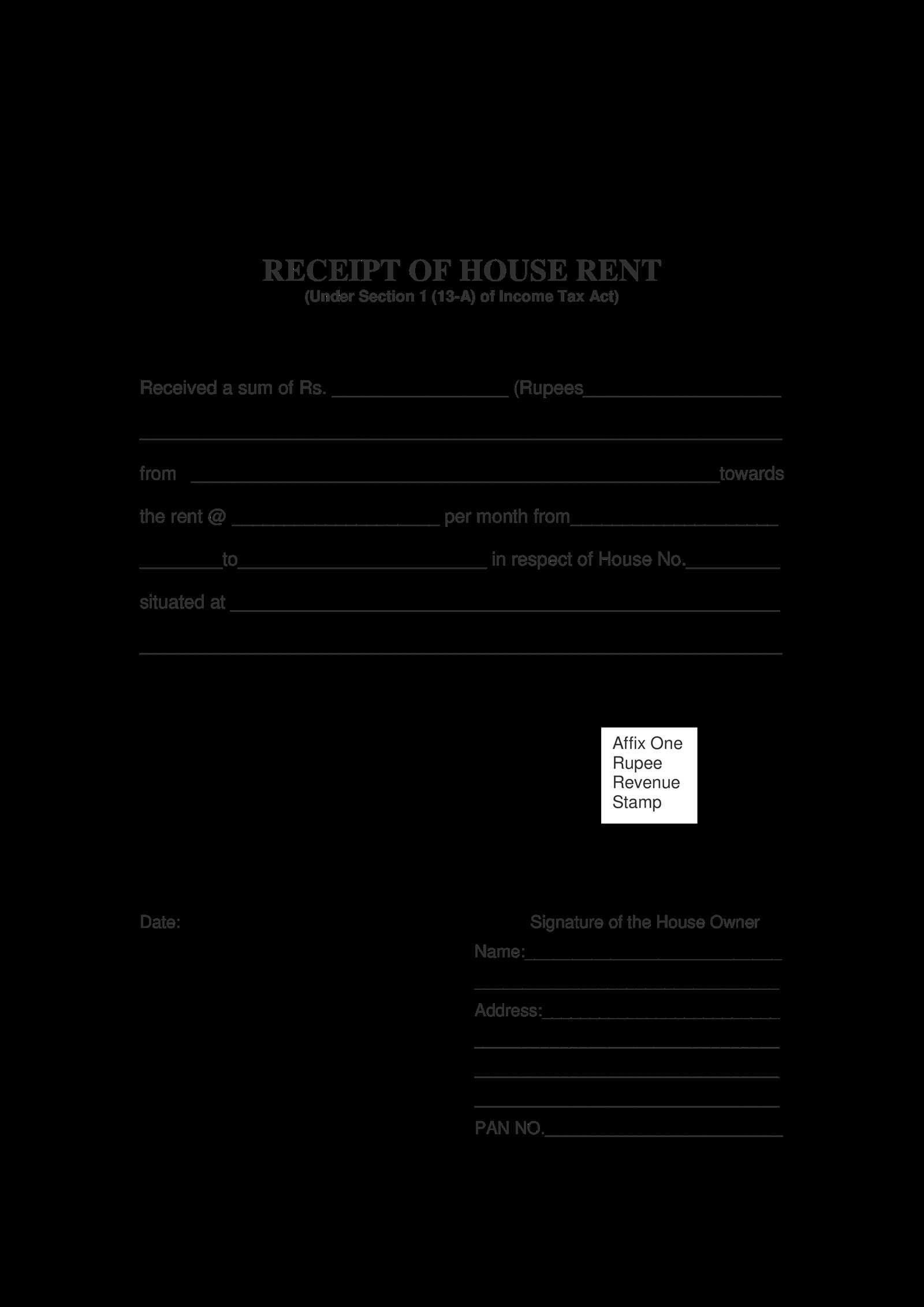

Example of a Simple House Rent Receipt Template

This is a sample format for creating a house rent receipt:

Date: [DD/MM/YYYY]Received from [Tenant's Full Name], the sum of [Amount in Words] ([Amount in Numbers]) as rent for the property at [Property Address].Rent Period: [Start Date] to [End Date] Payment Method: [Cash/Cheque/Bank Transfer/Other]Landlord's Name: [Landlord's Full Name] Landlord's Signature: ______________________

Ensure all fields are filled correctly to maintain accurate records. This template will make it easier to claim House Rent Allowance (HRA) and avoid complications during tax filing.

To create a rent receipt that aligns with tax requirements, include specific details in a clear format. The IRS expects precise information, so ensure the receipt contains the following:

| Required Element | Description |

|---|---|

| Tenant’s Name | Include the full name of the tenant who made the payment. |

| Landlord’s Name | Provide the full name of the landlord or property owner. |

| Property Address | List the exact address of the rental property for which the payment was made. |

| Amount Paid | Clearly mention the exact amount of rent paid, including any additional charges or fees. |

| Payment Date | State the date when the payment was received. |

| Payment Method | Specify whether the rent was paid via check, cash, online transfer, or other methods. |

| Period Covered | Indicate the rental period the payment covers (e.g., January 2025). |

| Signature | If possible, have the landlord’s signature to authenticate the receipt. |

For tax purposes, make sure the rent receipt includes these elements to avoid complications during an audit or tax filing. Use clear, professional language and avoid ambiguity to ensure the document is acceptable for tax reporting.

Include the full name of the landlord and tenant. This ensures clarity regarding the parties involved in the rental agreement.

State the rental property address, making sure it matches the one used in tax filings. This helps confirm the exact location of the rented property.

List the rent payment amount clearly, as well as the period for which it is being paid. Include the start and end date of the rental period to avoid any confusion about the specific time frame.

Specify the payment method, such as cash, cheque, or bank transfer. This adds transparency and can help in verifying the payment record.

Ensure to mention any additional fees or charges included in the payment, such as maintenance costs or utilities. This will help accurately reflect total payments made for tax purposes.

Sign the receipt and add the date of issuance. This authenticates the document and confirms the transaction took place on a specific date.

Include any other relevant information, such as the receipt number, to keep track of records in case of future inquiries or audits.

Ensure your receipt template includes all the key details needed for tax filing. Start with your name, address, and contact information clearly visible at the top. Below this, list the tenant’s information, including their full name and address, to confirm who the payment is from.

- Receipt Number: Add a unique number to each receipt for tracking purposes.

- Date of Payment: Include the exact date the rent was received.

- Payment Amount: State the exact amount paid, including currency. If the tenant made partial payments, break down the amounts.

- Payment Method: Specify how the payment was made (cash, bank transfer, cheque, etc.).

- Rental Period: Mention the specific period covered by the rent payment, such as “February 1, 2025 – February 28, 2025.”

- Landlord Signature: Include a space for the landlord’s signature to authenticate the receipt.

Customize the layout to keep it simple and easy to read. Use clear fonts and a clean design. Ensure that the important sections are organized logically for quick reference. Finally, make sure you have a backup copy of each receipt, either digitally or in print, for your records.

To ensure a valid house rent receipt for income tax purposes, structure it clearly. Include the landlord’s name, tenant’s name, property address, rental period, rent amount, and payment date. Always mention whether the payment is made monthly, quarterly, or annually. The document should also contain the signature of the landlord and a stamp, if required in your jurisdiction.

Key Elements of the Receipt

Make sure to include the following details:

- Landlord’s full name and contact information

- Tenant’s name and address

- Address of the rented property

- Rent amount and payment frequency

- Date of rent payment

- Signature of the landlord

- Receipt number for future reference

Legal Considerations

For tax purposes, the receipt must accurately reflect the rental transaction. If the payment method is by cheque or bank transfer, include transaction details for proof of payment. Make sure both parties retain copies for record-keeping and potential audits. Check if your country requires a specific format or additional details on the receipt.