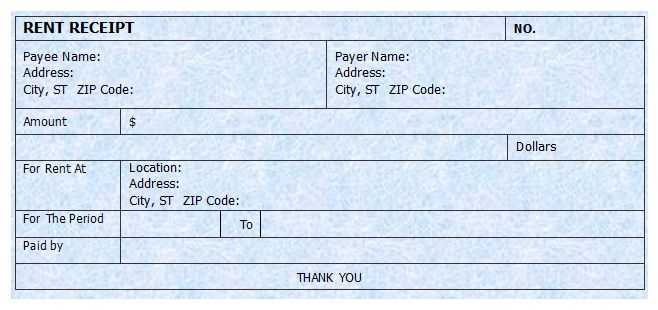

To create a valid house rent receipt in India, you should ensure that it includes specific details that protect both the tenant and the landlord. A basic template should contain the tenant’s name, the landlord’s name, the rent amount paid, and the period for which the payment is made.

Start with the date of payment and specify the rental period clearly. This is crucial for accurate record-keeping. Include the address of the property, along with the name and contact information of both the tenant and landlord. Mention if the payment was made in cash, cheque, or bank transfer.

For example, the receipt could start with a statement like: “Received from [tenant name] a sum of [amount] for the rent of the property located at [address] for the period of [start date] to [end date].” It’s a simple but effective format that avoids any confusion later.

Finally, make sure the receipt is signed by both parties, with the landlord’s signature serving as confirmation of the payment received. This small step ensures a clear and reliable record, which can be useful in case of future disputes or verification needs.

Here are the corrected lines where the same word is repeated no more than 2-3 times:

When creating a rent receipt, it is crucial to ensure clarity and accuracy. Avoid redundant repetition of terms in the document, as this could lead to confusion or ambiguity. For example, instead of writing “The rent amount for the rent is $500,” use “The rent for the property is $500.” This reduces redundancy while keeping the sentence clear.

Best practices for rent receipt wording:

To make the rent receipt clear and concise, avoid overusing terms like “amount,” “rent,” or “payment.” Use synonyms or rephrase sentences to maintain readability and flow. For instance, instead of saying “The rent for the property is $500 per month as rent payment,” try “The monthly rent is $500.” This minor adjustment ensures the wording remains efficient without unnecessary repetition.

- House Rent Receipt Template in India

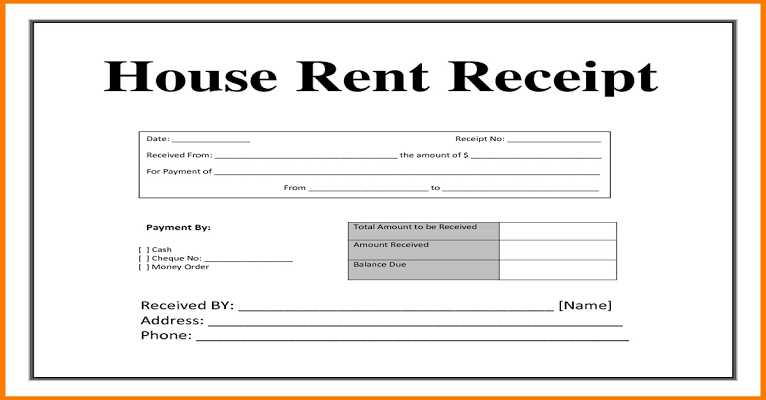

A house rent receipt in India should include the landlord’s and tenant’s details, rental amount, payment date, and the rental period covered. Specify the payment mode, whether cash, cheque, or bank transfer. Provide a receipt number for tracking purposes. The landlord’s signature at the end confirms receipt of payment.

Use this format for clarity and accuracy:

Receipt No: [Unique Number] Date: [Date of Payment] Received from: [Tenant's Name] Amount: Rs. [Amount Paid] For rental period: [Start Date] to [End Date] Mode of Payment: [Cash/Cheque/Bank Transfer] Landlord's Name: [Landlord's Full Name] Signature: [Landlord's Signature]

This simple structure ensures that both parties have a clear record of the transaction. Keep copies for future reference or tax purposes.

A rent receipt serves as a formal document that records the payment of rent from a tenant to a landlord. It is a crucial piece of evidence in rental agreements, ensuring clarity in financial transactions. Whether you’re a tenant or a landlord, keeping a rent receipt helps avoid any disputes or misunderstandings in the future.

Benefits for Tenants

- Proof of Payment: A rent receipt acts as proof of rent paid, which can be useful for tax deductions under Section 80GG of the Income Tax Act.

- Rental Dispute Resolution: It protects tenants by documenting timely payments and confirming that rent has been settled for the agreed-upon period.

- Record Keeping: Rent receipts provide a detailed record of payments made, which can be helpful when reviewing financial matters, such as applying for loans or mortgages.

Benefits for Landlords

- Tax Purposes: Landlords use rent receipts to maintain accurate records of rental income, ensuring compliance with tax laws.

- Clear Communication: Issuing rent receipts ensures transparency between the landlord and tenant, reducing the risk of confusion regarding rent payments.

- Legal Protection: In case of any disputes, rent receipts serve as legally binding documents that can be presented in court or before authorities.

Each rent receipt template must contain specific details for clarity and legal protection. Start with the tenant’s name, ensuring their full name appears accurately. The property address should be listed, including the building number, street name, city, and zip code.

The payment amount is non-negotiable. It’s crucial to state the exact rent paid and the corresponding payment method, such as cash, cheque, or bank transfer. Specify the date the payment was made for proper record-keeping. If there’s a late fee involved, mention it clearly alongside the rent amount.

Don’t forget to include the receipt number for tracking purposes. This helps organize receipts in case of future disputes. The landlord’s name and signature should also be included to validate the receipt. Some receipts may require a tenant’s signature for acknowledgment.

Lastly, mention the rental period the payment covers, like the start and end dates of the rental month or the specific period being paid for.

Start with the correct title at the top of the document, such as “Rent Receipt” or “Rental Payment Receipt.” This will ensure that both parties know the document’s purpose immediately.

Include the landlord’s name, address, and contact information at the top, followed by the tenant’s name and address. Clearly state the rental property’s address. This creates transparency and ensures both parties are identified correctly.

Next, mention the rental period clearly, such as “for the month of January 2025,” and specify the due date. Also, include the payment date to avoid any confusion about whether the payment was timely.

Provide an exact breakdown of the rent paid. Mention the total amount, payment method (such as cheque, cash, or bank transfer), and any additional charges (like maintenance fees). If there was any discount or adjustment, include it for transparency.

For a better understanding, use a table format to present the details of the rent paid:

| Detail | Amount |

|---|---|

| Rent for the Month | ₹15,000 |

| Maintenance Fee | ₹1,000 |

| Discount | ₹500 |

| Total Amount Paid | ₹15,500 |

Finally, include a section for the landlord’s signature and date. This confirms the authenticity of the receipt and that both parties agree to the transaction. Be clear about the receipt’s purpose by including the words “Received with thanks.”

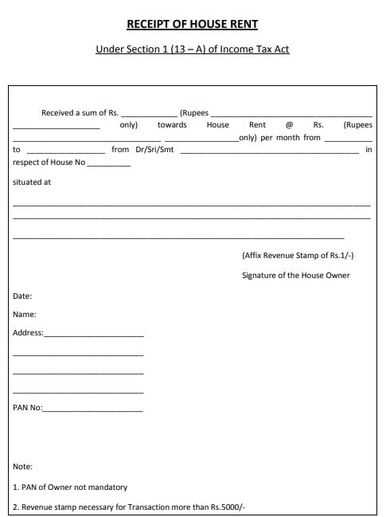

In India, landlords must issue a rent receipt to tenants for each payment made. This is crucial for both parties to maintain a clear record of transactions. Rent receipts are legally recognized proof of rent payments, ensuring that tenants can claim deductions under Section 80GG of the Income Tax Act, which allows them to claim tax benefits for rent paid.

According to the Income Tax Act, rent receipts must include specific details like the name of the landlord, tenant, the address of the property, the amount paid, and the period for which rent is being paid. Both the landlord and tenant should keep these receipts for future reference, particularly if tax deductions or legal disputes arise.

Additionally, under the Rent Control Act in various states, landlords must provide rent receipts in specific formats to ensure compliance with local laws. The receipt should not only serve as proof of payment but also protect both parties in case of a legal dispute regarding payment arrears.

Rent receipts can play a pivotal role in reducing your tax liability. Claiming a deduction on house rent under Section 10(13A) of the Income Tax Act requires a rent receipt. This deduction is available for salaried individuals who live in rented accommodation. To benefit from this, ensure that your rent receipts include key details such as the landlord’s name, address, the rent paid, the period of rent, and the signatures of both parties.

If you are paying rent to a relative or family member, it’s essential to have a formal agreement in place, as this will support your tax claim. The rent receipt can also assist in claiming HRA (House Rent Allowance) for the self-employed if they provide clear documentation of their rent payments along with a properly formatted receipt.

In addition to HRA claims, rent receipts can be used to claim deductions for rent paid on other properties as well. Ensure that you store these receipts properly as they are necessary to verify the rent payments during the tax filing process. Keeping a record of your rent payments along with these receipts can also protect you in case of any audits or discrepancies.

Digital rent receipts offer clear advantages over paper receipts. They are easily stored, accessible anytime, and reduce the risk of loss. Paper receipts can be damaged, misplaced, or destroyed over time, while digital copies are safe and searchable. If you want to save space and have quick access to your rental history, digital receipts are the way to go.

On the other hand, paper receipts still hold value for certain situations. They can be more reliable in areas with limited internet access. For tenants who prefer physical proof, paper receipts may be more reassuring. However, in most cases, digital receipts are more convenient and practical.

- Storage: Digital receipts are stored electronically, taking up no physical space. Paper receipts require physical storage, which can become cluttered over time.

- Access: You can access digital receipts anytime from any device, whereas paper receipts can only be accessed in person.

- Environment: Going digital helps reduce paper waste, making it an eco-friendly choice.

- Security: Digital receipts can be backed up and encrypted, ensuring better protection against loss or theft compared to paper copies.

In conclusion, for most tenants and landlords, digital rent receipts are a practical and reliable option. They offer convenience, security, and environmental benefits, making them the more effective choice overall.

When creating a house rent receipt in India, make sure to include the tenant’s details, the landlord’s details, rental amount, and duration of the lease. A clear breakdown of the payment for the specific month is key. You should also mention the mode of payment (cash, cheque, or online transfer), along with the receipt date. Including both parties’ signatures will ensure that the document is legally valid. Lastly, it is advisable to keep a copy for future reference, especially in case of disputes.