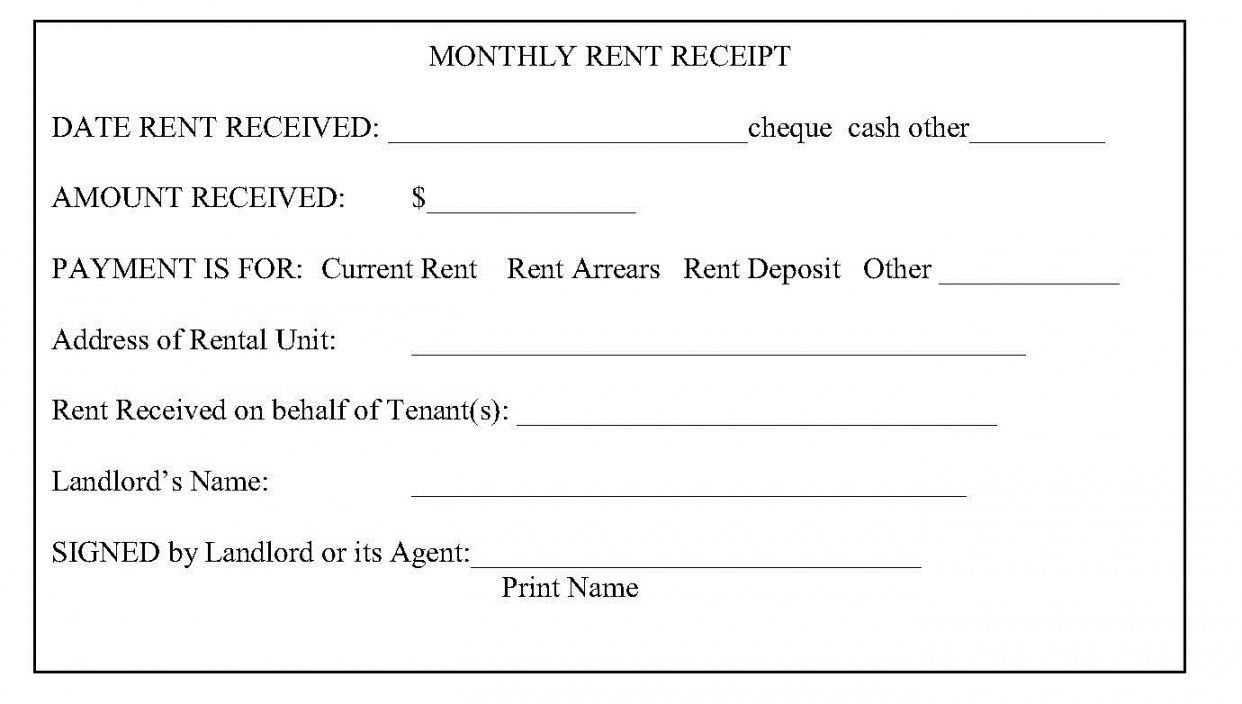

To create a simple and accurate house rent receipt template for Ontario, include the following key details: the tenant’s name, the landlord’s name, rental property address, amount paid, payment date, and rental period. These elements ensure that the document serves its purpose of providing clear proof of payment for both parties.

The rental receipt should be signed by the landlord to confirm the transaction. Including a unique receipt number helps maintain proper record-keeping. If payment is made via bank transfer, include the payment method for additional clarity.

For landlords, a rent receipt template simplifies bookkeeping and ensures compliance with Ontario’s rental regulations. Tenants can use this as a reference for their tax filings or in case of any disputes related to payments. Tailor the template to your specific needs while keeping it concise and easy to understand.

Here are the corrected lines:

Ensure the receipt includes the full name and address of both the landlord and tenant. Use the legal address of the property, not a mailing address. Include the rental period, specifying the start and end dates for clarity.

Specify the total rent amount paid, along with the payment method (e.g., cash, cheque, bank transfer). This provides transparency and makes it easier for both parties to keep records.

Provide a detailed description of any additional charges or fees, if applicable. This can include utilities, maintenance costs, or late payment penalties.

Clearly state the payment date or dates, confirming that the rent payment corresponds to the time period mentioned. This helps to avoid confusion about payment terms.

Finally, include both parties’ signatures with the date of issuance. This makes the receipt legally binding and ensures both parties acknowledge the agreement.

House Rent Receipt Template for Ontario

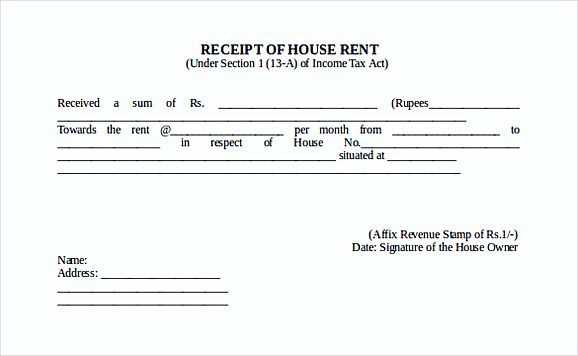

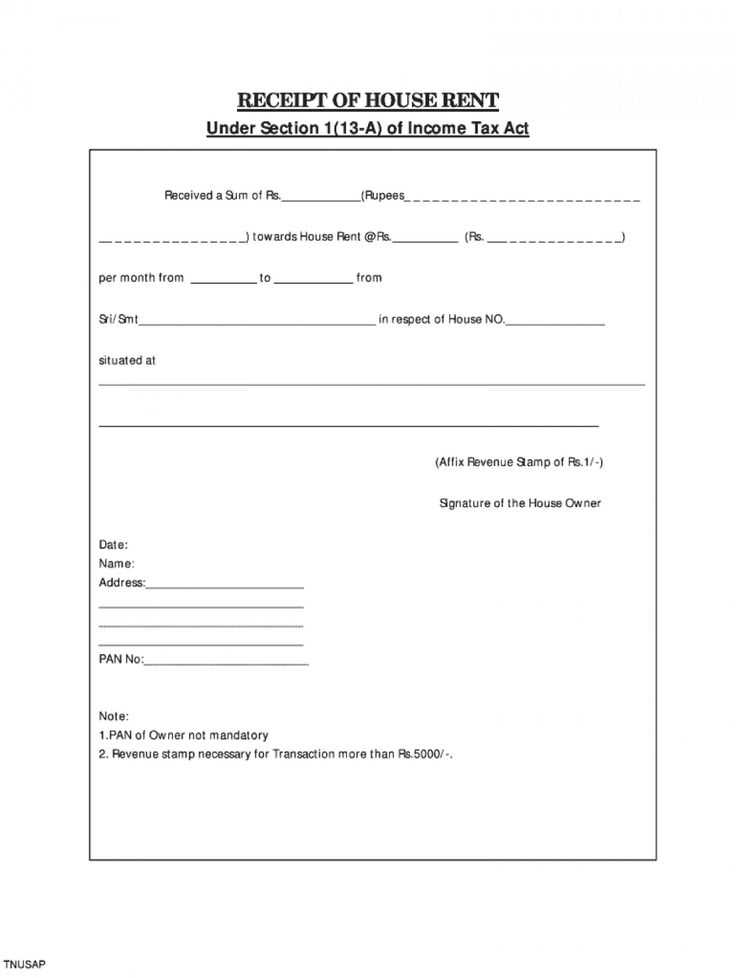

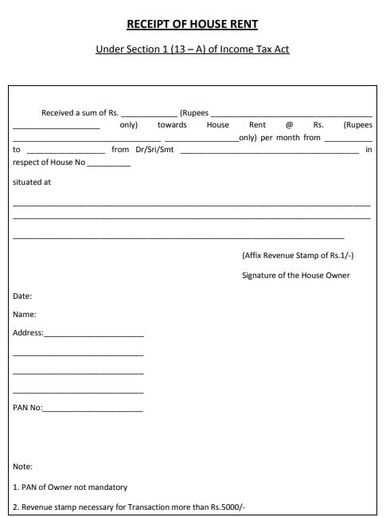

A house rent receipt in Ontario should include key details to ensure clarity and compliance with provincial standards. This template should outline the following elements:

Required Information

Ensure the receipt contains the tenant’s full name, address of the rental property, landlord’s name and contact details, rent amount paid, the date of payment, and the period for which the rent is paid. It’s also important to specify whether the payment was made by cheque, cash, or another method.

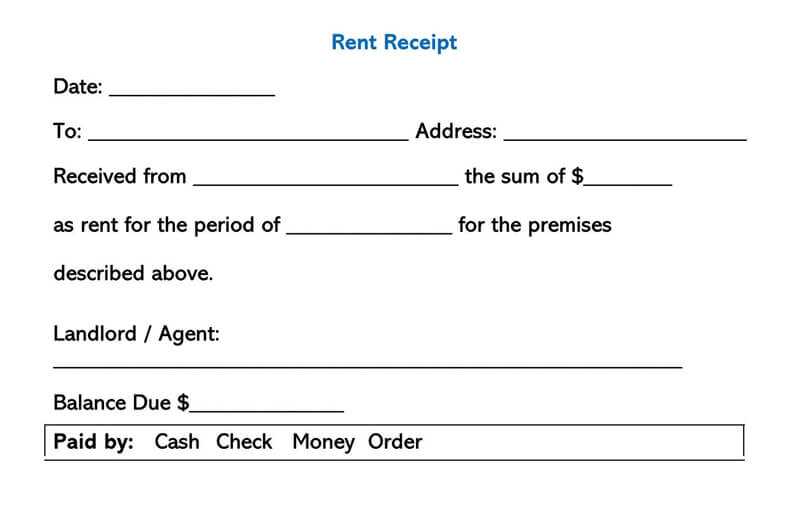

Receipt Format Example

Tenant Name: John Doe

Property Address: 123 Maple St, Ontario, ON

Landlord Name: Jane Smith

Amount Paid: $1200

Payment Method: Bank Transfer

Payment Date: February 10, 2025

Rent Period: February 1, 2025 – February 28, 2025

This format makes it easy to reference all necessary payment details and helps both landlords and tenants maintain clear records. Keeping a copy for each transaction is important for any future disputes or tax-related inquiries.

To create a valid rent receipt in Ontario, include the following details:

1. Tenant and Landlord Information

Clearly state the tenant’s name and the landlord’s details. Include the landlord’s full legal name or business name, as well as the address where the rent is paid.

2. Rent Payment Details

Record the rent amount paid, the period covered (e.g., monthly), and the payment method (cash, cheque, electronic transfer, etc.). Include the date the payment was received and ensure that the receipt is signed by the landlord or their representative.

In Ontario, a valid rent receipt must be issued each time a payment is made. Keep a copy for both the tenant and landlord records.

Clearly written receipts reduce confusion and simplify record-keeping. Include these key details for complete transparency and accuracy.

Tenant and Landlord Information

Start with the full names of both the tenant and landlord. Add their contact details such as addresses and phone numbers for easy reference in case of disputes or follow-ups.

Transaction Details

Be specific about the payment amount, including any partial payments if applicable. Mention the rent period covered by the payment and the date it was received. Clearly state if the payment includes additional charges like utilities, parking, or maintenance fees.

Receipt Number and Payment Method

Assign a unique receipt number to each payment for better tracking. Indicate the method of payment–whether cash, cheque, bank transfer, or another method–to ensure both parties can confirm the transaction’s authenticity.

Ensure the receipt includes the correct date of payment. A common mistake is omitting the date or providing an incorrect one. Always check that the date reflects when the rent was paid, not when the receipt is issued.

Verify the landlord’s and tenant’s information. Mistakes such as misspelling names or incorrect addresses can lead to confusion. Double-check these details before issuing the receipt.

Do not forget to include the rental period. The receipt should clearly state the start and end dates of the rental period the payment covers. This helps clarify the specific time for which the payment was made.

Be clear about the payment amount. Always ensure that the amount stated on the receipt matches the payment received. Including the correct currency (e.g., CAD) can avoid misunderstandings.

Avoid leaving out payment methods. Specify whether the payment was made in cash, by cheque, or via bank transfer. This adds transparency and creates a clear audit trail.

Do not skip adding a receipt number. This helps in tracking payments and avoids confusion if any disputes arise later. Numbering receipts in sequence is a simple but effective way to stay organized.

| Common Mistake | Correction |

|---|---|

| Incorrect or missing date | Ensure the date of payment is accurately recorded |

| Missing or incorrect names/addresses | Double-check the landlord’s and tenant’s details |

| Unclear rental period | Include the specific rental dates for clarity |

| Incorrect payment amount | Verify the amount matches the payment made |

| Unspecified payment method | Indicate the method used to pay |

| No receipt number | Assign a unique number to each receipt |

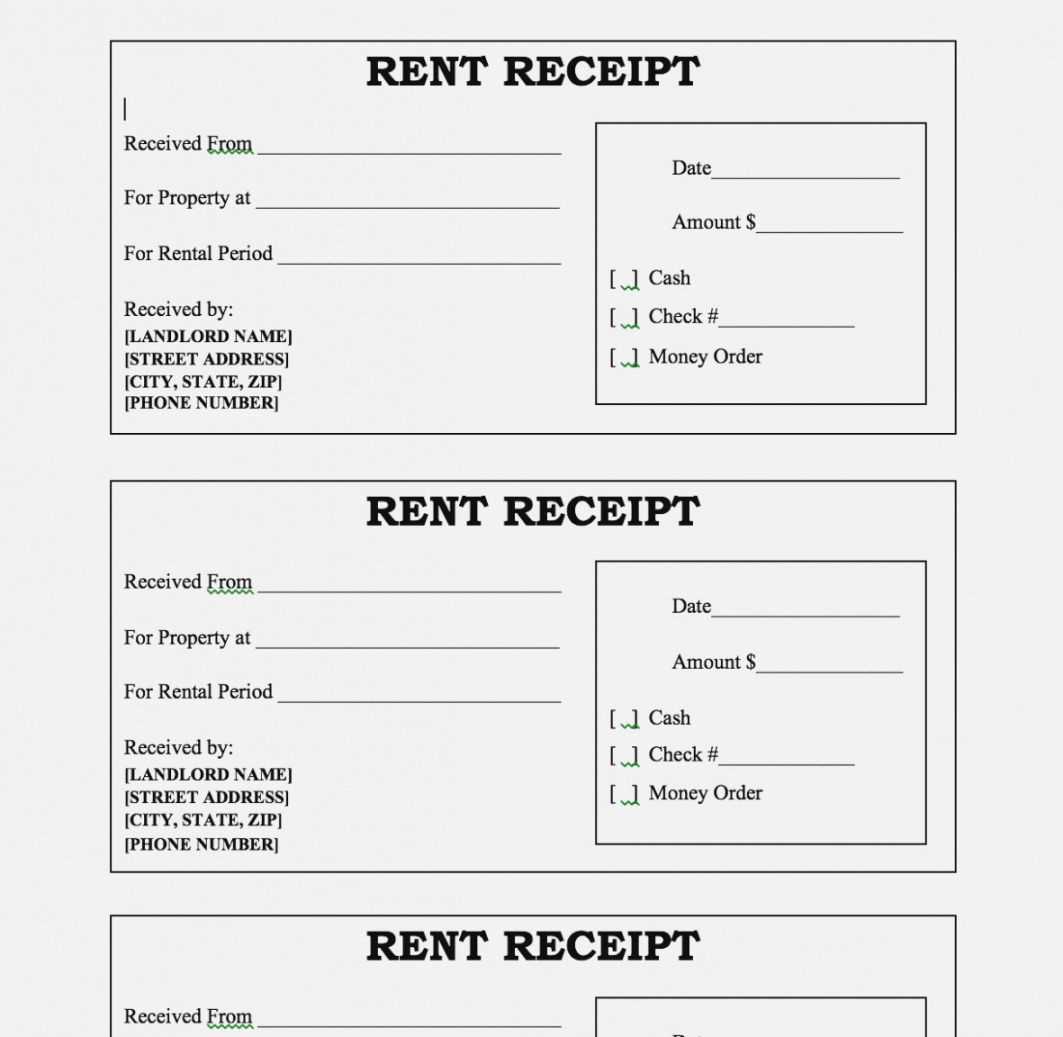

Ensure your house rent receipt template includes specific elements to meet Ontario’s standards. A clear structure helps avoid confusion for both landlords and tenants.

Key Elements of the Template

- Landlord and Tenant Information: Include full names and contact details for both parties involved.

- Rental Property Details: Specify the address of the rental property, including unit number if applicable.

- Payment Information: Include the date the payment was received and the amount paid. Mention whether the payment covers rent, utilities, or both.

- Payment Method: Note the method of payment (cash, cheque, or electronic transfer).

- Rental Period: Clarify the start and end dates for the rental period covered by the payment.

- Signature: Both parties should sign the receipt for acknowledgment of the transaction.

Tips for Clarity

- Use Clear Dates: Always use a clear format (e.g., day/month/year) to avoid misunderstandings.

- Provide an Itemized Breakdown: If applicable, break down the payment into rent, utilities, and other charges for transparency.

- Keep Copies: Both the landlord and tenant should retain a copy of the receipt for their records.