Essential Components of an HRA Rent Receipt

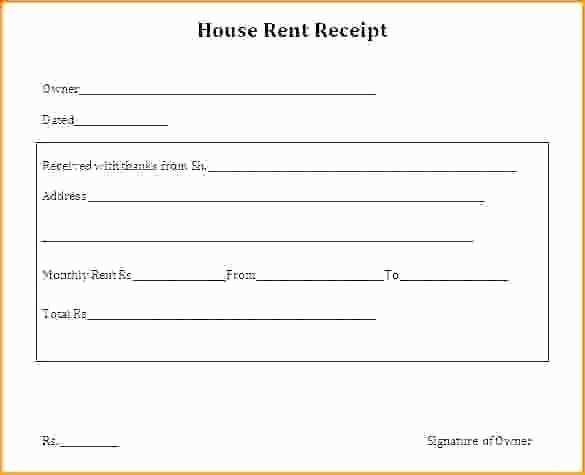

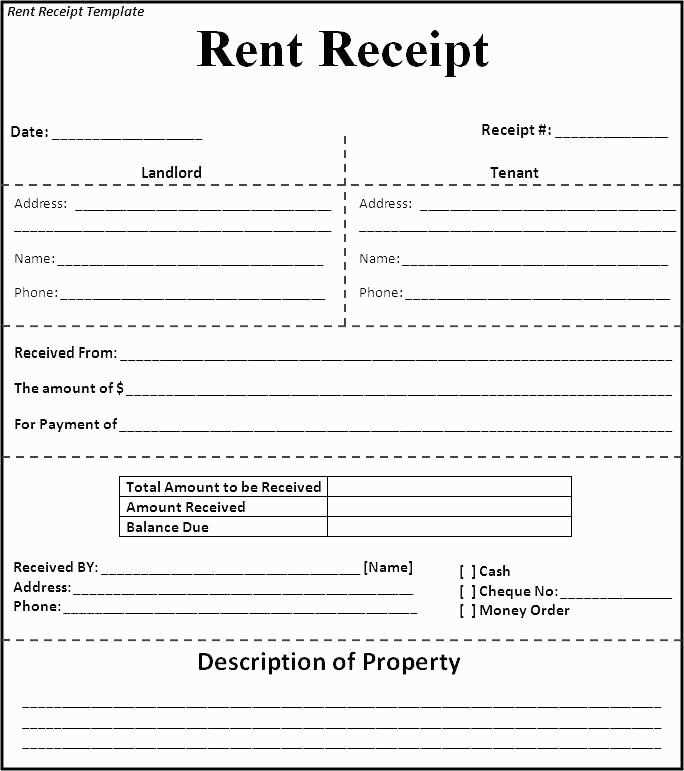

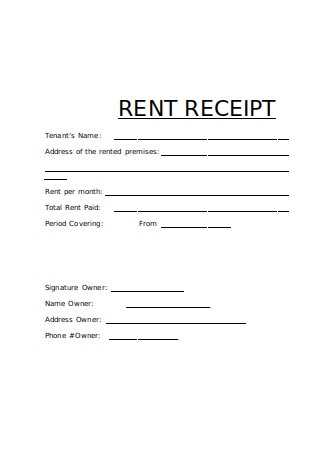

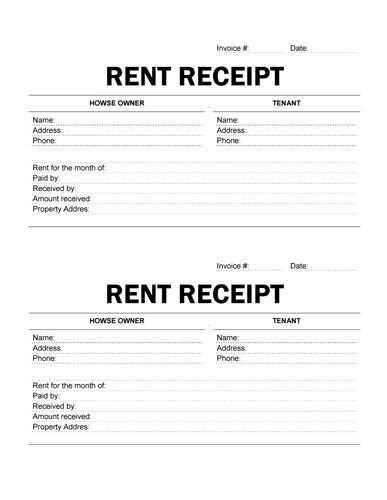

A proper HRA rent receipt includes specific details to ensure validity for tax exemptions. Ensure the following elements are present:

- Tenant and Landlord Information: Full names and addresses.

- Rental Period: Clearly mention the duration covered.

- Amount Paid: Exact rent amount along with the payment date.

- Payment Mode: Cash, bank transfer, or check details.

- Landlord’s Signature: Required for authenticity.

How to Use a Rent Receipt for HRA Claims

For tax benefits under House Rent Allowance (HRA), follow these steps:

- Collect Monthly Receipts: Keep receipts for each payment made.

- Ensure PAN Details: If annual rent exceeds ₹1,00,000, the landlord’s PAN is mandatory.

- Submit to Employer: Provide receipts when filing HRA claims.

Template Example

Use this format for a structured receipt:

Rent Receipt ---------------------------- Received from: [Tenant Name] Landlord: [Landlord Name] Property Address: [Address] Rent Amount: ₹[Amount] Rental Period: [Month/Year] Payment Mode: [Cash/Bank Transfer] Date of Payment: [DD/MM/YYYY] Signature: __________________

Using a consistent format simplifies documentation and ensures compliance with tax regulations.

HRA Rent Receipt Template: Practical Guide

Key Elements Required in an HRA Rental Record

Ensure the receipt includes the tenant’s name, landlord’s name, rental address, payment amount, and period covered. Specify the payment date and mode (cash, check, bank transfer). Add a unique receipt number for tracking. A signature from the landlord or property manager validates authenticity.

How to Format a Rent Receipt for Compliance

Use a structured layout with clear sections. Place tenant and landlord details at the top, followed by payment specifics. Align dates correctly to avoid discrepancies. If applicable, include tax details such as PAN for Indian tax compliance. Ensure clarity to prevent rejection in financial audits.