Providing a properly formatted rent receipt is a smart way to document monthly payments and avoid potential disputes. Whether you are a tenant or a landlord, using a clear and organized template ensures transparency and accuracy in financial records.

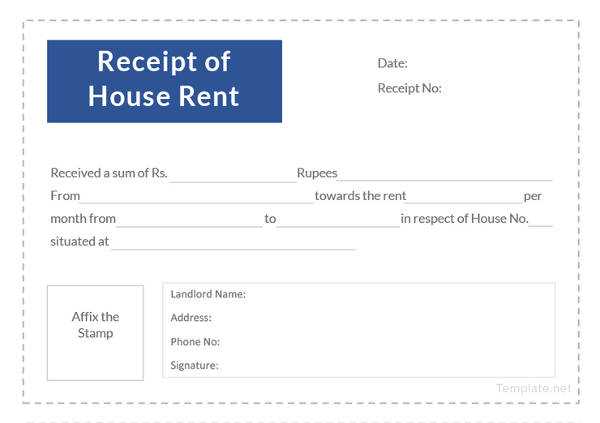

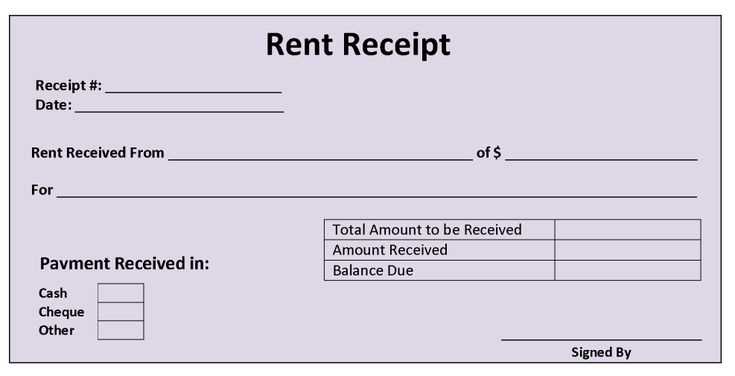

A typical rent receipt should include key details such as the rent amount, payment date, rental period, and property address. It’s also important to add the landlord’s and tenant’s full names along with signatures for verification. Including the mode of payment–whether cash, bank transfer, or cheque–adds another layer of clarity.

For added convenience, consider using a pre-designed template that saves time and reduces the chance of missing essential information. A digital format can be especially useful for those who prefer quick access and easy sharing. Keep a copy for personal records to stay organized and prepared during tax filings or audits.

Here’s a version without repetitions:

Ensure the rent receipt clearly shows the tenant’s full name and address. Use a simple layout with sections for the date of payment, the rental amount, and payment method. Specify the rental period covered by the payment, and include the property address in a clear format. A brief mention of any additional charges, such as maintenance or utilities, should be included, if applicable.

Provide a unique receipt number to keep track of transactions easily. Make sure to include the landlord’s signature or a note of their acknowledgment of the payment. Adding the landlord’s contact information can help in case there are questions or discrepancies later. This makes the document both clear and professional.

Make the receipt available in both hard copy and digital formats for convenience. Digital receipts can be sent via email to ensure fast and secure delivery. Always keep a copy of the receipt for future reference and potential audits.

- Indian House Rent Receipt Template: Comprehensive Guide

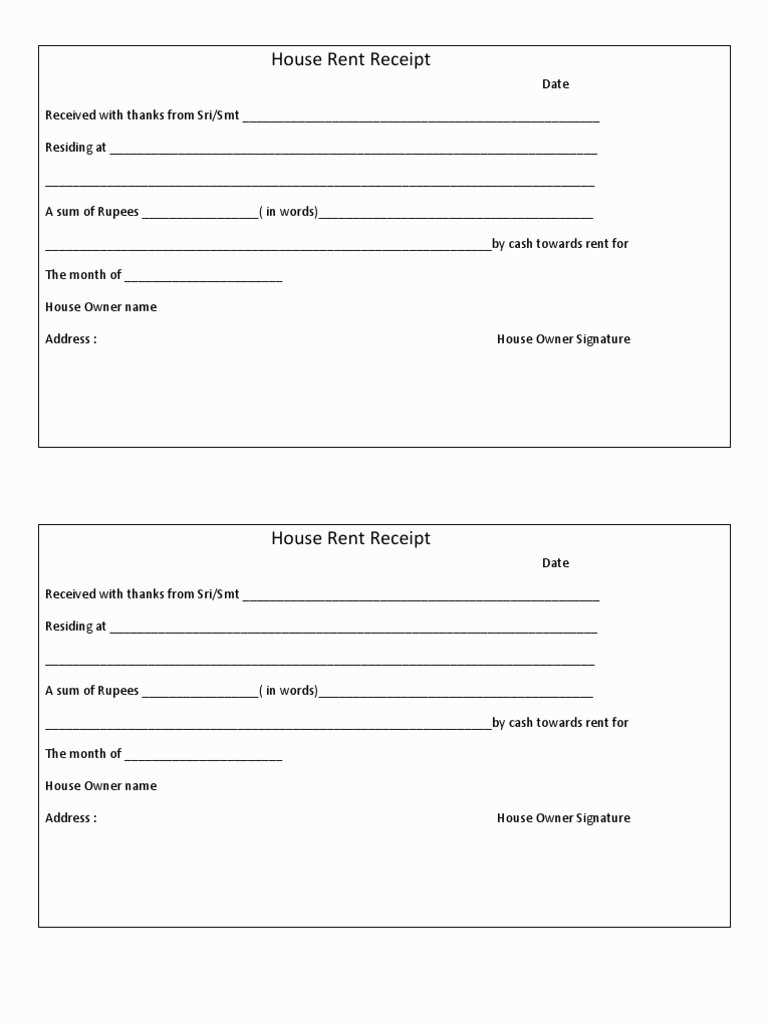

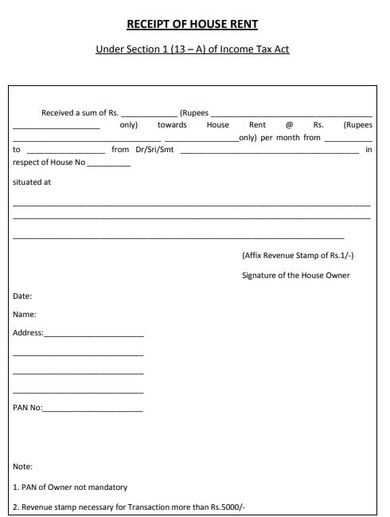

For landlords and tenants in India, maintaining a clear record of rental payments is necessary. A rent receipt serves as proof of payment, and it should include key details to avoid future disputes. Start by specifying the tenant’s name, address, and the duration for which the rent has been paid. Clearly state the amount received, along with the date of payment, and ensure that both parties sign the receipt to confirm the transaction. Keep the format simple but thorough, listing the rent amount in both figures and words. Additionally, include the property’s address for clarity, and if applicable, mention any security deposit details or adjustments. This template will help streamline the rent payment documentation process and maintain transparency between the parties involved.

Landlords should also consider creating separate receipts for each month to ensure proper tracking of payments. Tenants should keep these receipts as they may be required for income tax filings or to resolve any potential disputes in the future. Always ensure that the document is legible and free of errors to avoid confusion. Regularly updating the format and content of the rent receipt is beneficial for both parties, offering clear and reliable proof of payments made.

A well-structured rental receipt helps both landlords and tenants keep clear records of payments. Here are key components to include:

- Receipt Number: Assign a unique number to each receipt for easy tracking and reference.

- Tenant Information: Include the full name and contact details of the tenant. This ensures clarity in case of disputes.

- Landlord Information: Provide the landlord’s name, contact number, and address for transparency.

- Payment Date: Clearly state the date the rent payment was received to avoid confusion about payment periods.

- Amount Paid: Specify the total amount received, along with the currency used (e.g., INR).

- Payment Method: Mention how the payment was made (e.g., bank transfer, cash, cheque).

- Rental Period: Define the specific time period the payment covers, such as the start and end dates of the rental term.

- Property Address: Include the full address of the rented property for accurate reference.

- Security Deposit (if applicable): Indicate any additional payments, like a security deposit, to clarify financial details.

- Signature: Both parties should sign the receipt to verify its accuracy.

Including these elements will ensure that your rental receipt is clear, accurate, and serves as an effective record for both parties.

To create a personalized rent receipt, follow these steps carefully for accuracy and clarity. Ensure the receipt is clear and provides all necessary details for both parties.

1. Gather Required Information

Begin by collecting the details needed for the rent receipt. This includes the tenant’s full name, rental property address, payment amount, payment date, and the payment method used (e.g., cash, cheque, or bank transfer). If applicable, note any discounts or additional charges.

2. Include Landlord Information

Next, make sure to add the landlord’s name and contact details. This helps tenants reach out if they have any questions or concerns about the payment.

3. Specify Payment Details

Clearly state the payment amount and the corresponding rental period. For instance, specify the month or term the payment covers. Ensure that this information matches the agreed-upon rental agreement.

4. Add a Unique Receipt Number

Assign a unique receipt number for each transaction. This will help you track payments and maintain organized records.

5. Use a Standard Format

Choose a consistent layout for your rent receipt. This makes it easier for both the landlord and tenant to review payment records. A table format can be useful for organizing payment details clearly.

| Receipt No. | Tenant Name | Amount Paid | Rental Period | Payment Date | Landlord Contact |

|---|---|---|---|---|---|

| 001 | John Doe | ₹15,000 | January 2025 | 10th Jan 2025 | Jane Smith, 9876543210 |

6. Sign and Date the Receipt

Finally, sign and date the receipt. This ensures that both parties acknowledge the transaction. You may also want to include a line for the tenant’s signature as proof of payment.

Double-check tenant details like names and contact information. Mistakes here could cause confusion or delays in communication. Ensure that the tenant’s full legal name matches the one on their identification documents.

Always include the exact payment amount. Round figures or vague terms like “approximately” can lead to misunderstandings. Specify the amount paid in numbers and words for clarity.

Ensure the payment date is correct. It’s easy to forget to update this field, especially if payments are processed in bulk. Incorrect dates can cause issues when reconciling payments or filing taxes.

Verify the rental period covered by the payment. Clearly state the start and end dates to avoid ambiguity. For example, “Rent paid for the period from 1st to 31st January 2025” prevents confusion.

Avoid leaving out or inaccurately recording payment methods. Whether cash, cheque, or bank transfer, specify how the payment was made. This can prevent any disputes about missing payments.

Ensure your signature and landlord information are visible. A missing signature or incomplete landlord details can render the receipt invalid or create issues if it’s needed for legal purposes.

Do not forget to use a consistent format for all receipts. Maintaining uniformity in your templates helps both tenants and landlords stay organized. Keep track of receipts in an easily accessible format for future reference.

How to Optimize Repetitions and Adjust Style in Rent Receipt Templates

To minimize repetition in your Indian house rent receipt template, streamline content by focusing on key information. Avoid unnecessary phrases that do not contribute directly to the essential details of the transaction. For example, instead of repeatedly stating “received from” or “for the period,” use a single clear header to introduce payment details.

Adjust the style by incorporating bullet points for clarity, ensuring each section is easy to read and quick to reference. Opt for concise sentences that convey all necessary data without redundancy. Include only relevant information such as rent amount, date, and tenant’s name, eliminating filler content.

Suggestion: You can structure each receipt with a clean format: start with the landlord and tenant information, followed by payment details, and wrap up with a signature line for verification.

For further refinements, consider using bold or italic text to highlight critical numbers or dates, making the receipt visually clearer and easier to navigate. Adjust the font size to distinguish sections and improve readability, keeping everything user-friendly.

Let me know if you’d like more specific tips on adjusting the style further or reducing repetitions even more!