If you’re a landlord in India, issuing a rent receipt is a simple yet crucial task to maintain clarity in financial transactions. A rent receipt template provides a clear record of rent paid by tenants, helping both parties avoid misunderstandings and offering proof for tax purposes.

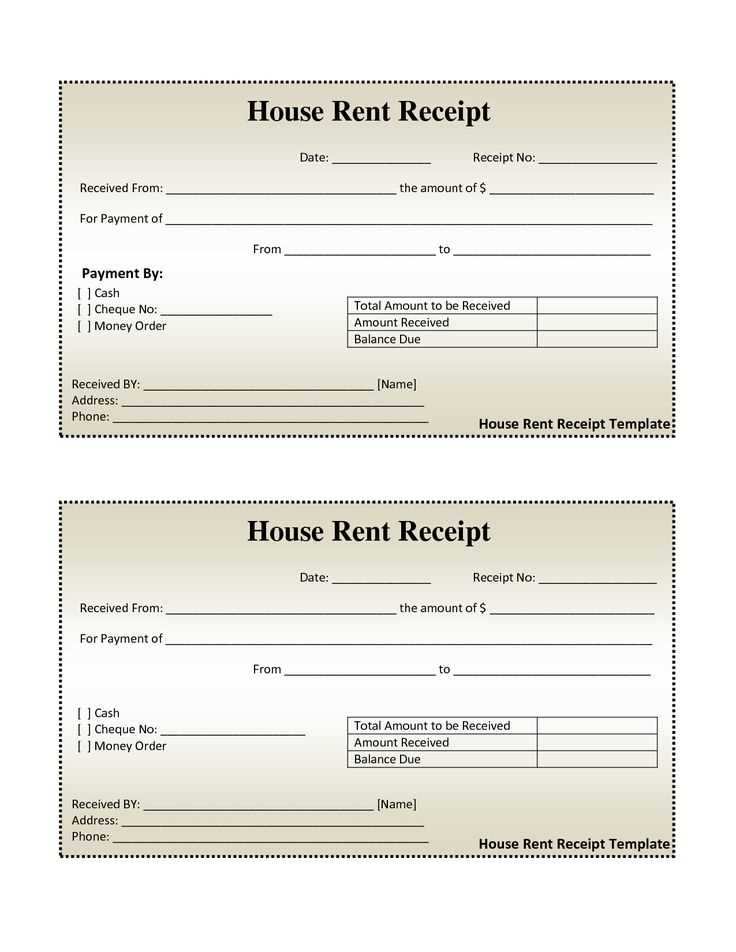

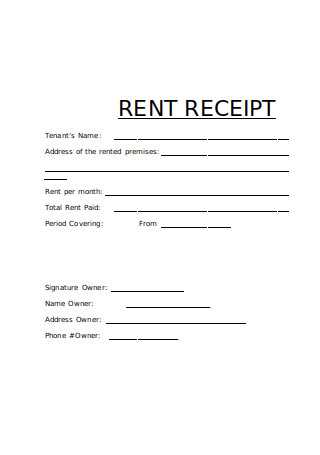

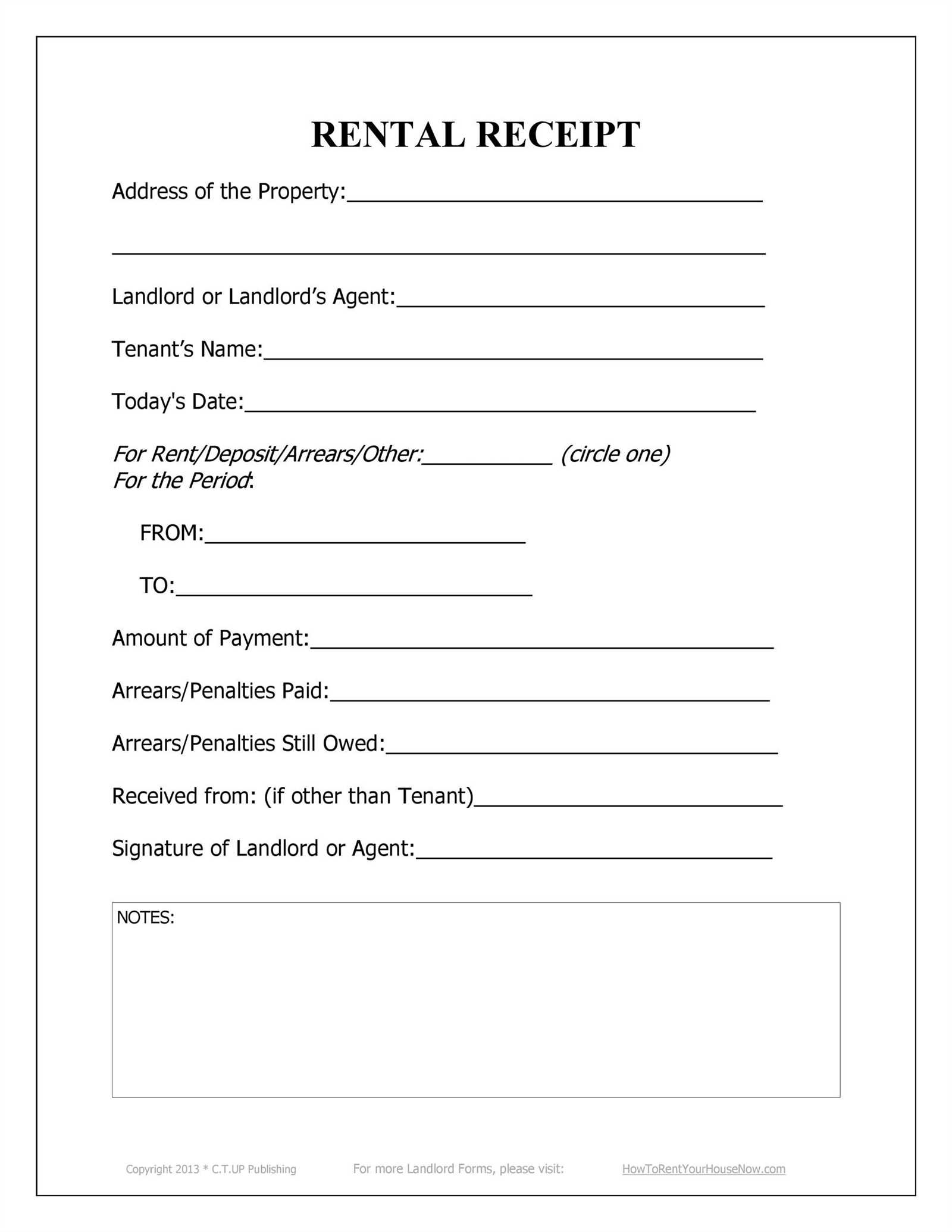

Choose a template that includes basic information such as the tenant’s name, the address of the rented property, the rent amount, the period for which the rent is paid, and the date of payment. These key details protect both landlords and tenants, ensuring transparency.

To make your rent receipt more professional, add a unique receipt number for each transaction, and always include a signature or stamp if possible. This step enhances the receipt’s credibility and prevents disputes in the future.

By using a standard template, landlords save time while ensuring they meet all legal and tax requirements. Whether you’re renting out residential or commercial property, having a proper rent receipt helps maintain smooth financial dealings and strengthens your relationship with tenants.

Here’s the revised version:

To create a clear and reliable rent receipt template for India, ensure the following key elements are included. This ensures compliance with local regulations while providing a straightforward and useful document for both tenants and landlords.

Key Components of an Indian Rent Receipt

The rent receipt should have the following details:

- Landlord’s Name: Clearly mention the full name of the landlord.

- Tenant’s Name: Include the tenant’s full name as per the rental agreement.

- Property Address: Provide the complete address of the rented property.

- Amount Paid: Clearly state the rent amount paid, including the currency (INR).

- Date of Payment: Specify the date when the rent was paid.

- Payment Mode: Mention the mode of payment (e.g., cash, bank transfer).

- Signature: Both parties should sign the receipt for authenticity.

- Receipt Number: Include a unique number for easy tracking of receipts.

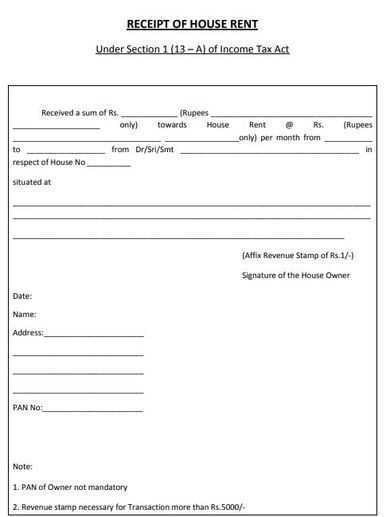

Sample Rent Receipt Template

Here is a basic format you can follow for a rent receipt:

| Landlord’s Name | Tenant’s Name | Property Address | Amount Paid (INR) | Date of Payment | Payment Mode | Signature |

|---|---|---|---|---|---|---|

| John Doe | Jane Smith | 123, ABC Street, City | 10,000 | 06/02/2025 | Bank Transfer | ___________________ |

Ensure the template is customized with your details before use. Keep it simple, professional, and clear to avoid any confusion during future reference.

- Indian Rent Receipt Template

A rent receipt in India must contain key details to ensure it serves as a valid document for both landlord and tenant. It should reflect the transaction clearly, avoiding any ambiguity.

Key Components

The rent receipt should include the following details:

- Tenant’s name: Full name of the tenant paying the rent.

- Landlord’s name: Full name of the person receiving the rent.

- Rental property address: Complete address of the rented property.

- Amount paid: The total amount of rent paid, clearly stating the currency (INR).

- Payment date: Date when the payment was made.

- Rental period: The time frame for which rent is being paid (e.g., for the month of January 2025).

- Mode of payment: Whether the payment was made via cash, cheque, bank transfer, etc.

- Signature: Signature of the landlord or an authorized person.

- Receipt number: A unique receipt number for reference purposes.

Formatting Tips

Ensure the rent receipt is clear and legible. Use a simple format with the details above in a structured manner. Avoid cluttering the document with unnecessary information. It’s best to keep the layout professional yet straightforward, providing all relevant data without confusion.

To create a rent receipt template in India, begin by including the basic details: the landlord’s name, tenant’s name, and rental property address. Ensure you specify the rent amount paid, the date of payment, and the payment mode (cash, cheque, or online transfer). You must also mention the rental period–whether it’s monthly, quarterly, or for a specific duration.

For clarity, add a receipt number and a statement confirming the receipt of the payment. If applicable, include any deductions or extra charges, such as maintenance fees or late payment charges. The format should be simple and easy to read, with each section clearly labeled. To make it more official, include the landlord’s signature and date of issuance.

Finally, make the template customizable for future use. Leave blank spaces for the varying amounts, dates, and other details that change with each payment. Using a clear and organized layout will help both parties track payments efficiently.

Every rent receipt should clearly display certain details to ensure transparency and proper documentation. Include the following key information:

- Landlord’s Name and Contact Information: The full name, phone number, and email address of the landlord should be easy to find on the receipt.

- Tenant’s Name: Always include the tenant’s full name to specify who made the payment.

- Payment Amount: Clearly state the total amount paid by the tenant for the rental period. Specify the currency used, especially if it’s not in local currency.

- Rent Period: Indicate the start and end date of the rental period for which the payment was made.

- Payment Date: Include the exact date the payment was received, not just the date of issuing the receipt.

- Mode of Payment: Whether it was cash, cheque, bank transfer, or another method, mention how the payment was made.

- Receipt Number: Assign a unique receipt number for tracking purposes. This helps in case of disputes or for record-keeping.

- Property Address: Include the address of the rented property to confirm what is being rented.

Adding these details guarantees clear, concise, and professional documentation for both parties involved in the rental agreement.

Rent receipts hold legal validity in India as evidence of rental payments. They serve as proof for both landlords and tenants, especially in cases of disputes or tax assessments. These receipts are recognized by the Income Tax Department and can be used to claim deductions under Section 80GG of the Income Tax Act for individuals living in rented accommodation.

Key Elements of a Valid Rent Receipt

A rent receipt must include the tenant’s name, the landlord’s name, the rent amount, the address of the rented property, the rental period, and the payment date. A proper receipt is signed by the landlord, and it may include a stamp if required in specific cases. A handwritten or printed receipt is valid, but the latter is often preferred for clarity and to prevent disputes.

Legal Relevance in Disputes

In case of disputes regarding non-payment or rent increases, the rent receipt acts as a legal document that may help in resolving the matter. Tenants should retain these receipts as they provide proof of payment. Courts recognize these receipts in legal proceedings, such as eviction cases or cases of rent arrears.

Customizing a rent receipt based on the payment period is straightforward. The key is to ensure that the information clearly reflects the terms agreed upon between the landlord and tenant.

- For Monthly Payments: Make sure to include the specific month or months covered by the payment. For example, “Rent payment for the month of February 2025.” If the tenant pays in advance or arrears, mention those details to avoid confusion.

- For Quarterly Payments: Indicate the exact time frame of the payment. For instance, “Quarterly rent payment for the period from January 1, 2025, to March 31, 2025.” Ensure that both the start and end dates are clear to both parties.

- For Yearly Payments: Clearly state that the payment is for the entire year. You can write something like, “Annual rent payment for the period from April 1, 2025, to March 31, 2026.” This avoids confusion about multiple payments within the year.

- For Lump-Sum Payments: If a lump-sum payment covers multiple months, specify the months included. For example, “Lump-sum rent payment covering the months of February, March, and April 2025.” This ensures the receipt reflects the full scope of the payment.

By detailing the specific period covered by the payment, the receipt will be clear and accurate, preventing any potential misunderstandings. Always double-check the dates and amounts before finalizing the receipt.

Ensure the receipt includes the correct tenant details, including full name and address. Mistakes here can lead to confusion or legal disputes later.

Always double-check the rent amount mentioned on the receipt. Even minor discrepancies can cause problems with financial records or tax filings.

Include the accurate date of payment. Failing to mention the exact date might create issues if there’s any question about payment history or deadlines.

Do not forget to mention the mode of payment. Whether it’s cash, cheque, or bank transfer, clarity is crucial for both parties’ records.

Make sure the landlord’s name, signature, and contact details are clearly provided. This confirms the authenticity of the receipt and serves as proof of transaction.

Leave out unnecessary information or details that don’t relate directly to the rent transaction. A clean and straightforward receipt avoids confusion.

Use a template that follows legal guidelines. Incorrect formatting or missing information might make the receipt invalid for official purposes.

Always issue the receipt promptly after receiving the payment. Delays could raise doubts about the transaction or lead to misunderstandings between parties.

Rent receipts serve as proof of payment for tenants and can be vital for tax and legal purposes. For landlords, keeping accurate rent records ensures compliance with tax regulations. Each rent receipt should include the date, amount paid, the rental period, and both parties’ details. These receipts can be submitted as evidence of income during tax filings.

Tenants can also use rent receipts to claim tax deductions on housing rent allowance (HRA) or as part of legal disputes regarding payment history. Ensure that the receipt is signed by the landlord, as this verifies the transaction and strengthens its legitimacy in legal matters.

For legal purposes, in case of disputes, rent receipts provide tangible proof of payment or non-payment. These can also be used to support claims in court or during arbitration, ensuring that both the landlord and tenant have an accurate record of rental transactions.

Keep all receipts organized and in a secure place for future reference. These documents can serve as a safeguard in case of audits or legal challenges. Regularly issuing and retaining rent receipts helps maintain clear and precise records, which are beneficial for both parties involved.

Indian Rent Receipt Template

Creating a rent receipt template in India requires including key details to ensure accuracy and legal validity. The receipt should clearly display the landlord’s and tenant’s names, the property address, the rental amount, the payment period, and the date of payment. This will make the document legally sound and easy to reference in case of disputes or audits.

Key Components to Include

First, make sure the rent receipt contains the full address of the property being rented. This avoids confusion and verifies the location. Next, the rental amount should be listed in both figures and words for clarity. Indicate whether the payment covers a monthly, quarterly, or annual period. Don’t forget to note any additional charges, such as maintenance fees, if applicable.

Formatting for Simplicity

Keep the layout simple and easy to read. Use a clean and professional font and organize the details in a clear structure. This helps both parties understand the receipt’s contents without hassle. A typical rent receipt will also feature a “Received by” line with the landlord’s signature or initials, confirming receipt of the payment.