When managing rental properties, having a rent receipt is key to maintaining transparency between landlords and tenants. A simple receipt helps both parties keep track of payments, avoids misunderstandings, and provides a clear record in case of disputes.

Ensure that the receipt includes important details like the tenant’s name, the rental period, the amount paid, and the date of payment. This makes it easier for both you and the tenant to verify transactions. A well-structured template can save time, keep your records organized, and help streamline the payment process.

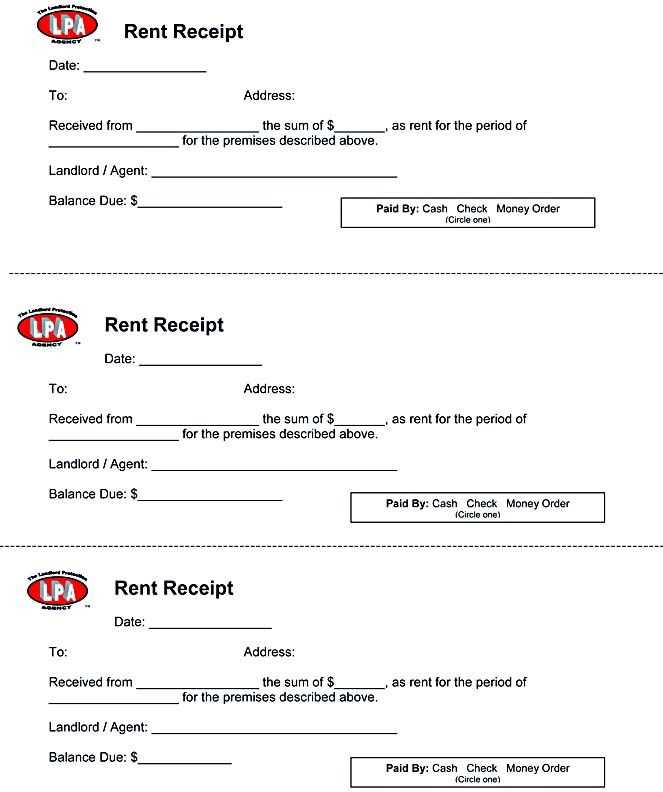

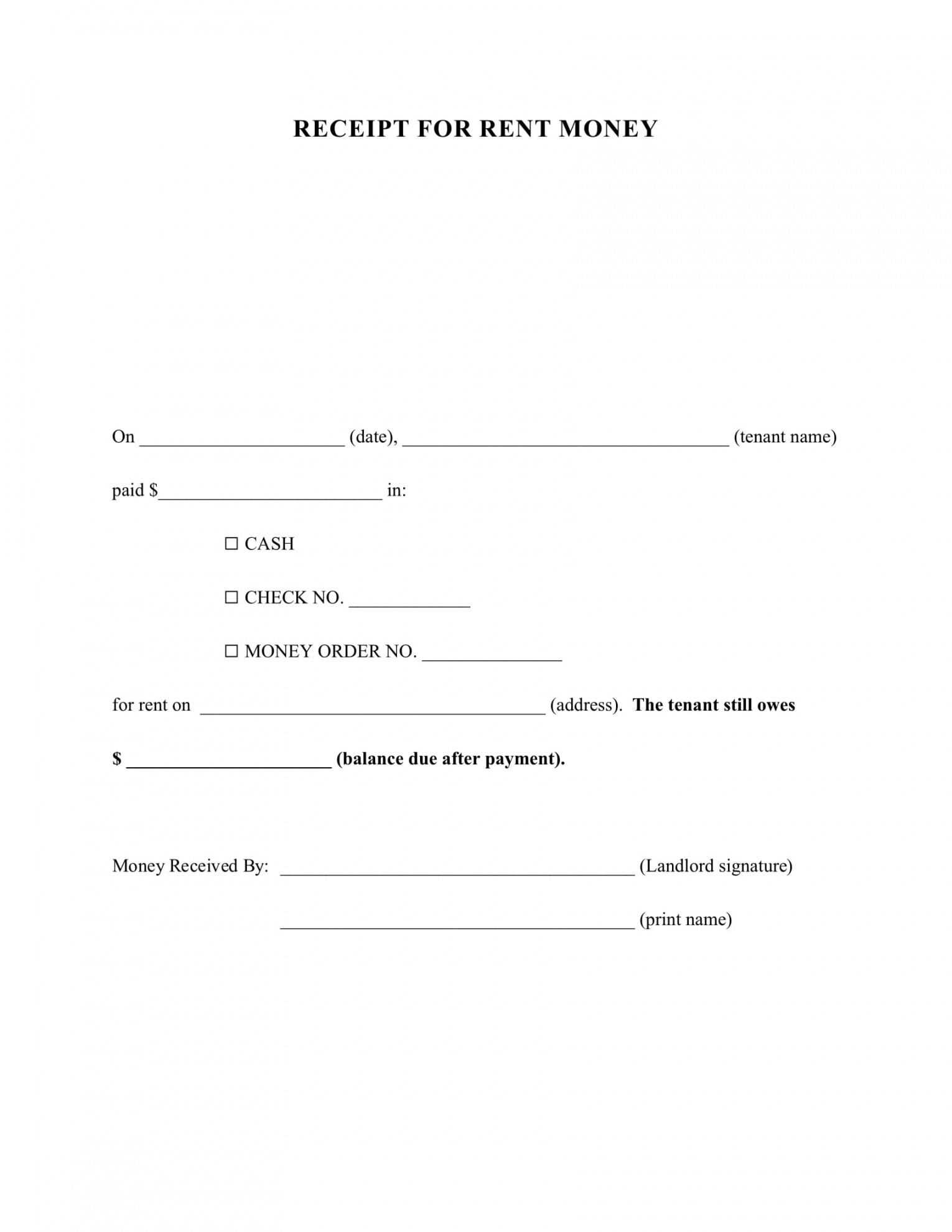

Use a template that clearly specifies whether the payment was made by cash, check, or another method. This provides further clarity on the transaction, which is valuable for both accounting purposes and for any legal concerns that may arise down the line.

To avoid any confusion, make sure your receipt template is easy to understand and use. Include a space for the landlord’s signature as well, confirming the receipt of the payment. This adds a layer of formality and security to the transaction.

Here are the revised lines where words are not repeated more than 2-3 times:

For creating a clean and efficient landlord receipt for rent, ensure each detail is clear and concise. The payment amount, tenant’s name, and rental period should be specified with no unnecessary repetition.

Key Elements to Include

| Details | Description |

|---|---|

| Tenant Name | Full name of the person making the payment. |

| Payment Amount | Specify the exact amount received, without any extra wording. |

| Rental Period | State the start and end dates clearly. |

| Payment Method | Indicate if the payment was made via cash, check, or bank transfer. |

Example of a Simplified Rent Receipt

Tenant: John Doe

Amount Paid: $1,200

For: April 2025 Rent

Payment Method: Bank Transfer

Receipt Date: April 5, 2025

By following this approach, you maintain clarity and avoid unnecessary duplication, ensuring the document is easy to read and understand.

- Landlord Rent Receipt Template

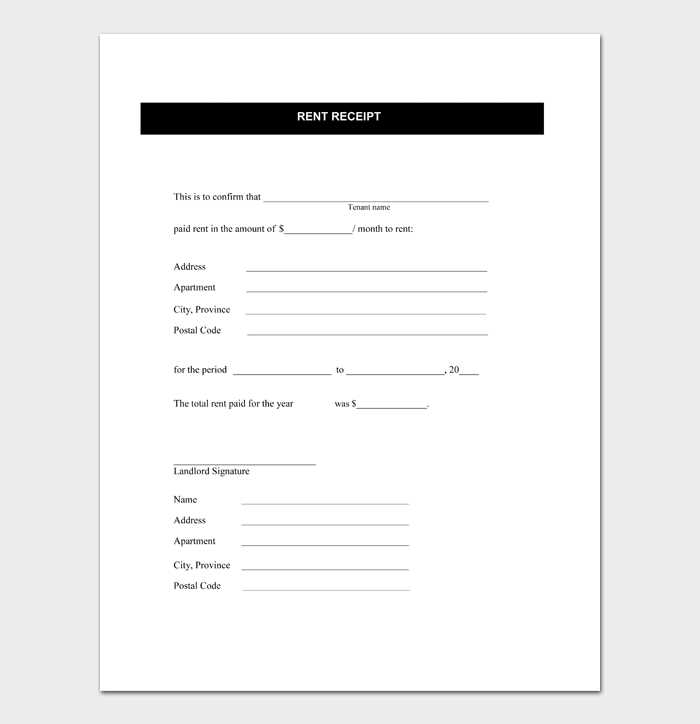

A rent receipt template is crucial for landlords to maintain accurate records of rental payments. It serves as proof of payment for tenants and helps landlords keep track of rental income. A standard template should include the following details:

- Landlord’s Information: Include your name, address, and contact details.

- Tenant’s Information: The tenant’s name and address should be listed clearly.

- Payment Date: Specify the exact date the payment was made.

- Amount Paid: Clearly state the total amount of rent received for that period.

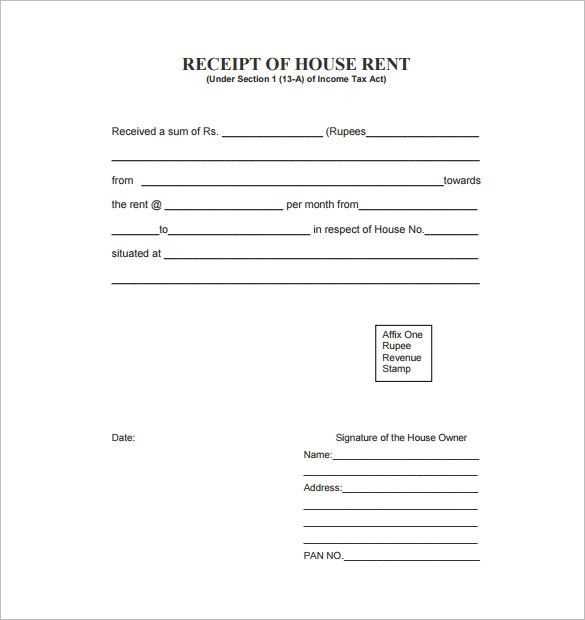

- Payment Method: Note how the payment was made (e.g., cash, check, bank transfer).

- Rental Period: Indicate the start and end dates of the rent period covered by the payment.

- Signature: Both landlord and tenant should sign to confirm the transaction.

Sample Template:

- Landlord: John Doe

- Tenant: Jane Smith

- Payment Date: February 13, 2025

- Amount Paid: $1,200

- Payment Method: Bank Transfer

- Rental Period: February 1, 2025 – February 28, 2025

- Landlord’s Signature: __________________________

- Tenant’s Signature: __________________________

By including these specific details, both parties can ensure the receipt is accurate and legally binding. Adjust the template to suit specific needs, but make sure it remains clear and concise.

Include the date and amount of the payment at the top of the receipt. This ensures clarity on the exact transaction details. Specify the method of payment, whether it’s cash, check, or bank transfer, to avoid any ambiguity.

Clearly identify the period the payment covers, such as “January rent” or “February utilities.” This helps both parties track payments accurately and avoids confusion over which period the payment applies to.

Note any remaining balance or the total amount due for the next period. This keeps both the landlord and tenant informed about financial obligations moving forward.

If applicable, include details on any discounts or late fees applied. Transparency in this area ensures there are no misunderstandings between the parties.

Ensure the rent receipt includes the tenant’s name, address, and rental period. Clearly state the amount paid and the payment date to confirm it aligns with the lease agreement. Specify the payment method used, whether cash, check, or bank transfer, to provide transparency.

Include both the landlord’s name and their contact details for verification. A signature or other proof of receipt, like a stamped document, strengthens its authenticity. The receipt should also note the address of the rental property, avoiding any ambiguity about the location in question.

List any additional charges, such as utilities or maintenance, separate from the rent amount to avoid confusion. This helps avoid any disputes over what the tenant has paid. Keep the receipt format clear and consistent to prevent any misunderstandings in the future.

Ensure the receipt is clear by using a straightforward layout with ample space for important details. Include key information such as the payer’s name, property address, payment amount, date, and payment method. Label each section clearly and maintain consistent formatting throughout.

Group related details together. For example, payment breakdowns (e.g., rent, utilities) should be easy to distinguish from other sections. Use bold or underlined text for headers to help users quickly identify relevant areas of the receipt.

Consider using a clean font and appropriate font sizes. Avoid cluttering the template with excessive details or graphics. The focus should remain on the transaction details to provide a hassle-free experience for both the landlord and tenant.

Ensure there’s space for both the landlord’s and tenant’s signatures, making it possible for both parties to acknowledge the transaction. Adding a receipt number can help with record-keeping and provide an extra layer of clarity.

Offer a printable version in PDF format for easy physical documentation, and consider incorporating an option for digital storage or emailing for tenants who prefer electronic records.

To create a clear and professional landlord receipt for rent, include key details. Begin with the tenant’s full name and the rental property address. Clearly state the date of the payment, followed by the amount received. Specify the rental period covered by the payment, such as “for the month of February 2025.” Ensure you indicate the payment method, whether it was made by check, cash, or bank transfer.

It’s also helpful to include a receipt number for easier tracking of payments. If applicable, note any late fees or adjustments. A landlord’s contact information should also be included, allowing the tenant to reach out with questions or concerns. Don’t forget to include both the tenant’s and landlord’s signatures at the bottom for validation.