Use a monthly rent receipt template in PDF format to streamline record-keeping and ensure transparency in rental agreements. A well-designed template allows both landlords and tenants to maintain clear documentation of rental payments. With all essential information neatly organized, such a receipt simplifies the verification process and reduces disputes.

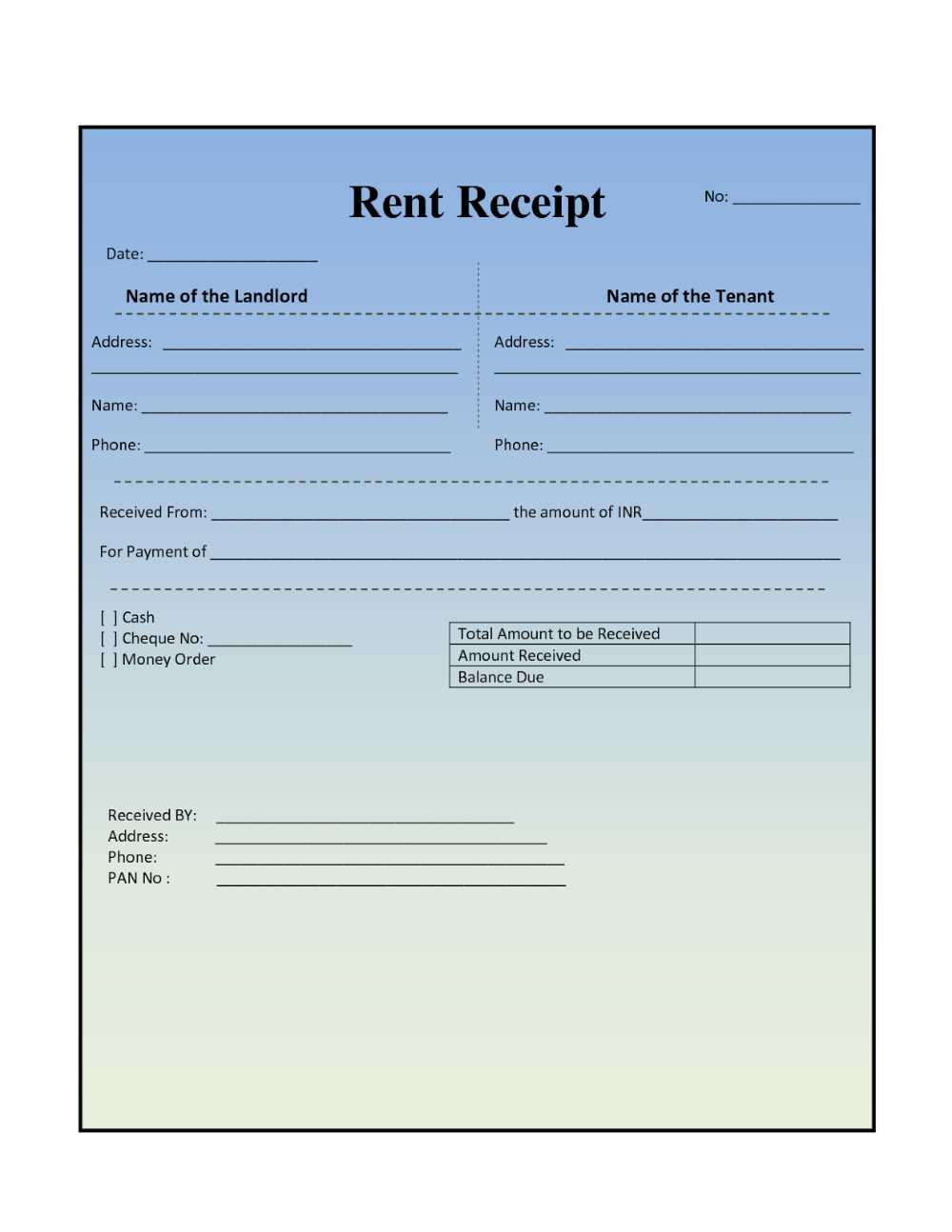

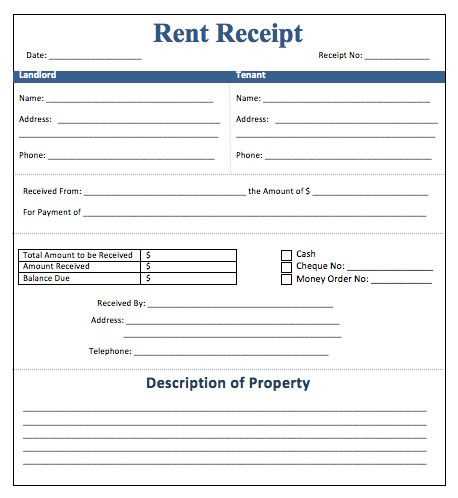

Ensure the template includes key details like the tenant’s name, the property address, the payment date, the amount paid, and the payment method. If applicable, note any late fees or partial payments. By keeping this information up to date, both parties can easily track their transactions and stay informed about their financial obligations.

Benefits of using a template include the ease of customization and the professional appearance it lends to rental transactions. The PDF format ensures that the receipt can be easily shared and saved for future reference without worrying about formatting issues. This simple yet effective tool minimizes the potential for confusion and fosters a smoother relationship between landlords and tenants.

Here are the revised lines with duplicates removed:

Ensure the rent amount is clearly listed at the top of the document to avoid any confusion. Remove unnecessary repetitions of the tenant’s name or address, keeping only one mention of each. If the payment method is mentioned multiple times, consolidate this into a single clear statement. Verify that dates appear only once, especially the start and end of the rental period. Double-check the contact details for the landlord, ensuring they’re accurate and not repeated throughout the document.

Key Adjustments:

The rental payment section should be straightforward, eliminating any redundant phrases. Only include the essential payment information, such as the amount, due date, and method of payment. Repetition of these details can confuse both the landlord and tenant. Remove phrases like “payment for the previous month” if the amount and dates are already stated clearly earlier in the receipt.

Final Check:

Ensure the total rent due and the signature line are placed at the end of the document, providing a clean and organized finish. Avoid adding any additional, unneeded sections or phrases that don’t contribute to the core content of the receipt.

- Monthly Rent Receipt Template PDF

For property owners and tenants, creating a precise and clear monthly rent receipt is crucial for both record-keeping and legal purposes. A rent receipt template in PDF format simplifies this process, ensuring all necessary details are included and easily accessible.

What to Include in a Monthly Rent Receipt Template

The rent receipt should contain the following key elements:

- Tenant’s name

- Landlord’s name or property management details

- Rental property’s address

- Amount of rent paid

- Payment method (e.g., cash, check, or online transfer)

- Receipt date

- Rental period (e.g., “Month of January 2025”)

- Signature (if required)

Advantages of Using a Template in PDF Format

Using a pre-designed PDF template ensures that all relevant information is consistently captured. PDF formats also offer the benefit of being easily printable and shareable, without the risk of altering the content. This makes them a reliable choice for both tenants and landlords.

| Section | Description |

|---|---|

| Tenant Information | Ensure that the tenant’s full name and contact details are correct. |

| Payment Details | List the payment amount and any reference numbers if applicable. |

| Signatures | Include spaces for both the tenant’s and landlord’s signatures for acknowledgment. |

By using a well-structured template, both parties can avoid misunderstandings and maintain organized records throughout the rental period.

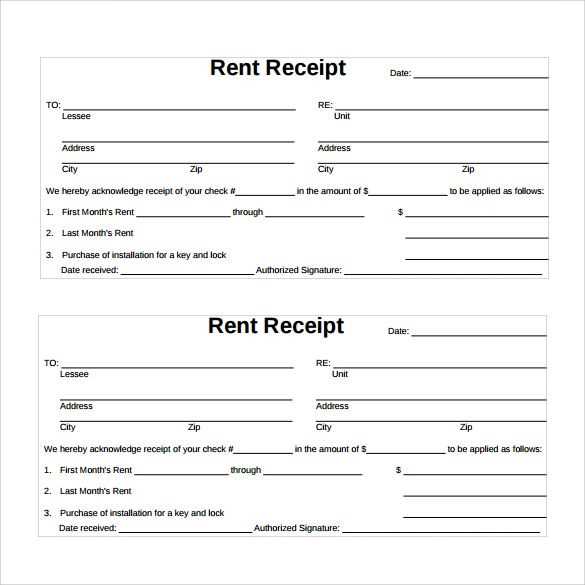

To create a rent receipt in PDF format, use a reliable PDF editor or online tool. Follow these steps:

Step 1: Gather the Necessary Information

- Tenant’s name

- Landlord’s name and contact details

- Rental property address

- Payment amount

- Payment date

- Payment method (e.g., cash, bank transfer)

- Receipt number (for tracking purposes)

Step 2: Create the Receipt Template

- Open a PDF editor or an online tool like Adobe Acrobat or Smallpdf.

- Create a document with clear sections for the landlord’s and tenant’s information.

- Include a section for payment details: date, amount, method, and any outstanding balance.

- Ensure the receipt has a footer with a statement such as “Payment received in full” if applicable.

- Save the template for future use or export it as a fillable form if desired.

Once completed, save the file as a PDF for easy sharing and record-keeping. You can send it via email or print it for physical distribution.

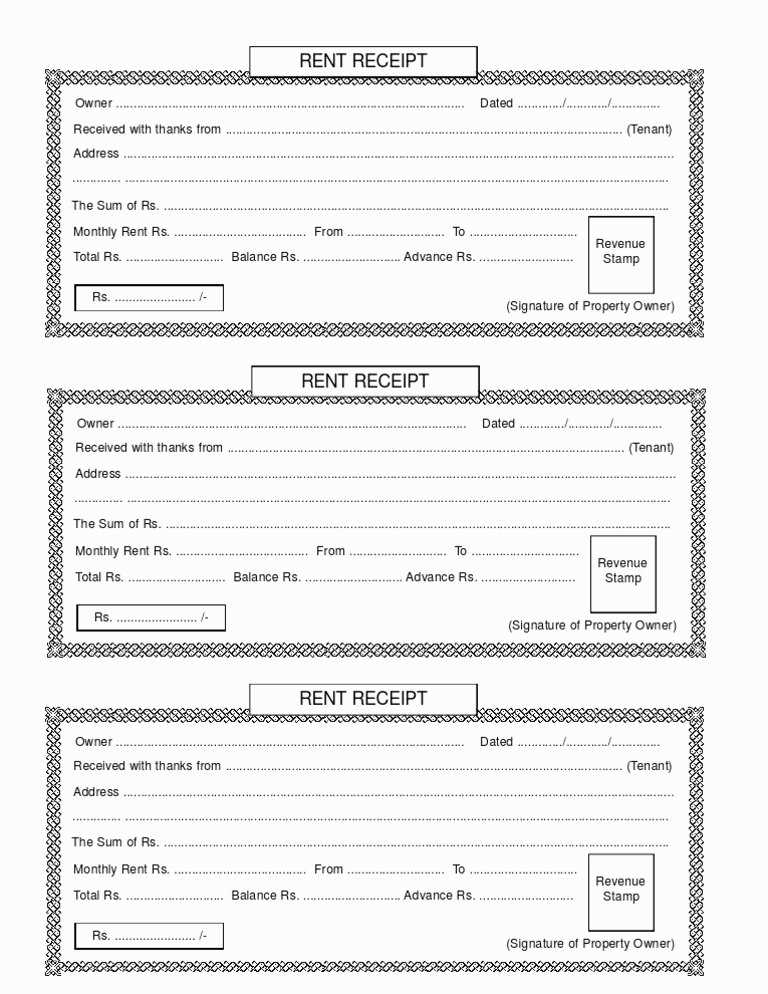

To ensure clarity and avoid disputes, a rent receipt must contain certain key details. Begin by listing the tenant’s name and the property address, making it clear who is renting and what space they are occupying. Next, state the payment amount, specifying the rent paid for the relevant period, along with the payment date. This helps track when the payment was made and prevents any confusion about overdue amounts.

Rental Period and Payment Method

Indicate the rental period (e.g., monthly, quarterly) to confirm which dates the payment covers. Specify the payment method, whether by check, bank transfer, or cash, to provide evidence of how the transaction occurred. This is especially helpful if the payment method becomes a point of discussion later.

Landlord’s Contact Information

Include the landlord’s full name and contact details. This gives tenants a clear point of contact for any future queries or issues related to the payment. Lastly, an official signature or company stamp adds a layer of authenticity, ensuring the receipt is recognized as valid.

Adjust the receipt format based on the type of lease agreement you’re managing. For residential leases, include tenant names, property address, rent amount, and payment date. Make sure to specify whether the payment covers utilities or other fees. For commercial leases, add details like the lease term, deposit information, and any specific clauses relevant to the agreement. Customizing the receipt ensures both parties have a clear understanding of the transaction and the terms tied to the payment.

Include Lease-Specific Terms

If the lease includes unusual payment structures such as escalations or periodic rent increases, clearly outline these in the receipt. For example, if the rent changes annually, note the effective date of the new rent amount on the receipt. This provides clarity and avoids disputes later.

Highlight Security Deposits and Adjustments

For leases with security deposits, always specify the deposit amount and mention if any deductions have been made. Include an additional section to account for late fees, prepayments, or adjustments that may apply to the current month’s rent. This adds transparency and prevents confusion about the payment breakdown.

Ensure all required details are present. Missing the tenant’s full name or the rental amount can lead to confusion. Double-check the date of payment and the rental period covered by the receipt.

Don’t forget to include the property address. Without it, the receipt lacks clarity and might not serve its intended legal purpose.

Avoid vague language. Be specific about what the payment is for, such as “monthly rent for January 2025” instead of simply “payment received.”

Make sure the receipt is signed by the landlord. An unsigned receipt may be deemed invalid in disputes or claims.

Check the payment method. Note whether the rent was paid via cash, cheque, or electronic transfer to ensure transparency.

PDF receipts offer a streamlined and secure method of managing rental payments. Unlike other formats such as Word documents or plain text files, PDFs maintain their integrity across different devices and operating systems. This means the layout and content remain consistent, eliminating formatting issues that can arise with other file types.

Additionally, PDF receipts are easily stored and shared. The compact size of PDFs makes them ideal for archiving without consuming excessive storage space. You can email, print, or upload them to cloud services without worrying about compatibility problems.

Security is another key advantage. PDF files can be encrypted and password protected, ensuring that sensitive financial information remains private. You also have the ability to digitally sign receipts, which adds an extra layer of authenticity and trust to the document.

Lastly, PDFs are widely recognized and accepted across industries. Using PDFs ensures that your rental receipts meet legal and professional standards, making it easier for tenants and landlords to manage financial records accurately and securely.

Always use encrypted platforms to share rent receipts. Sending them through email without encryption can expose sensitive information to unauthorized access. Choose services that offer end-to-end encryption, ensuring only the intended recipient can view the receipt.

When storing rent receipts, keep them in secure cloud storage with two-factor authentication. This adds an extra layer of protection in case your account credentials are compromised. Make sure the platform you use adheres to strict data security policies and offers automatic backups.

If you prefer offline storage, consider a fireproof and waterproof physical file box to store printed receipts. Use folders or binders to organize them by month or year for easy retrieval. Keep the box in a secure location, such as a locked cabinet.

For added security, avoid storing sensitive data, such as payment methods or personal details, in easily accessible places. Regularly update your passwords and enable multi-factor authentication on any account that holds your rent receipts.

Rental Receipt Structure

Use these key elements for a complete and clear rental receipt template:

- Tenant Information: Include the tenant’s full name and contact details.

- Landlord Information: List the landlord’s name and address.

- Property Details: Specify the rental property’s address and unit number (if applicable).

- Payment Amount: Clearly mention the total rent paid, specifying the amount in both numbers and words.

- Payment Period: State the time period the rent payment covers (e.g., February 2025).

- Payment Method: Mention whether the rent was paid by cash, check, or electronic transfer.

- Date of Payment: Include the exact date when the payment was made.

- Late Fees: If applicable, list any late fees incurred for overdue payments.

- Signatures: Include spaces for both the landlord’s and tenant’s signatures, confirming the transaction.