A properly structured rental receipt is necessary for both landlords and tenants in Ontario. It serves as proof of payment and helps track rental transactions. A well-designed template should include essential details such as the payment date, amount, rental period, and recipient information.

Landlords must provide a receipt upon request, even if payments are made electronically. The document should clearly state the payer’s name, the property address, and the payment method. Including a unique receipt number enhances record-keeping and reduces disputes.

For added convenience, templates can be customized with a landlord’s contact information and business logo. Digital formats, such as PDFs or spreadsheets, simplify storage and sharing. Ensuring accuracy in these records protects both parties and maintains compliance with rental regulations in Ontario.

Ontario Rental Receipt Requirements

A proper Ontario rental receipt must include key details to ensure compliance with provincial regulations and serve as valid proof of payment. Here’s what to include:

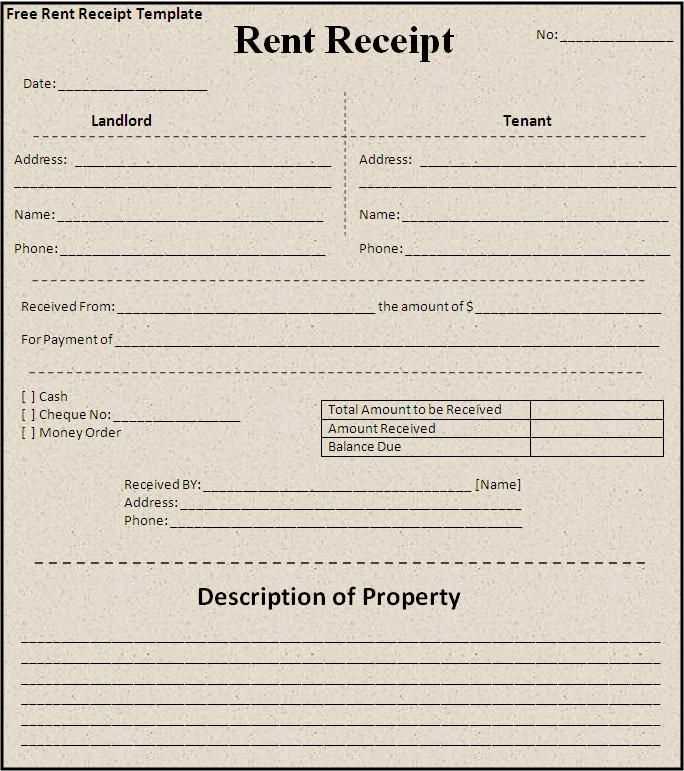

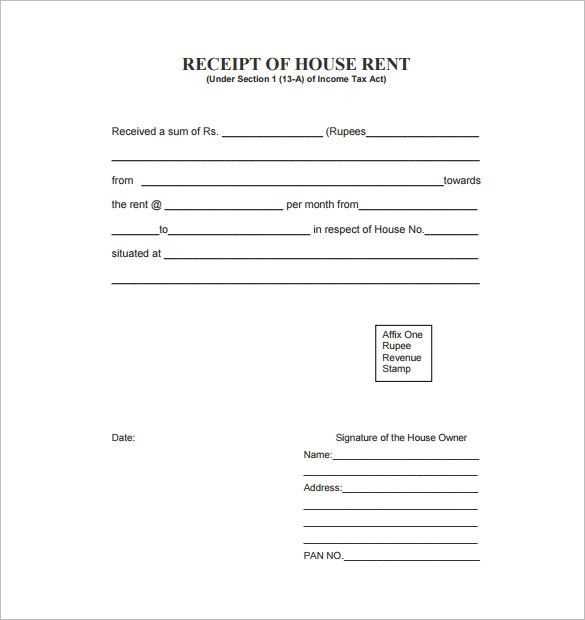

- Landlord and Tenant Information: Full names and contact details of both parties.

- Property Address: The complete rental unit address.

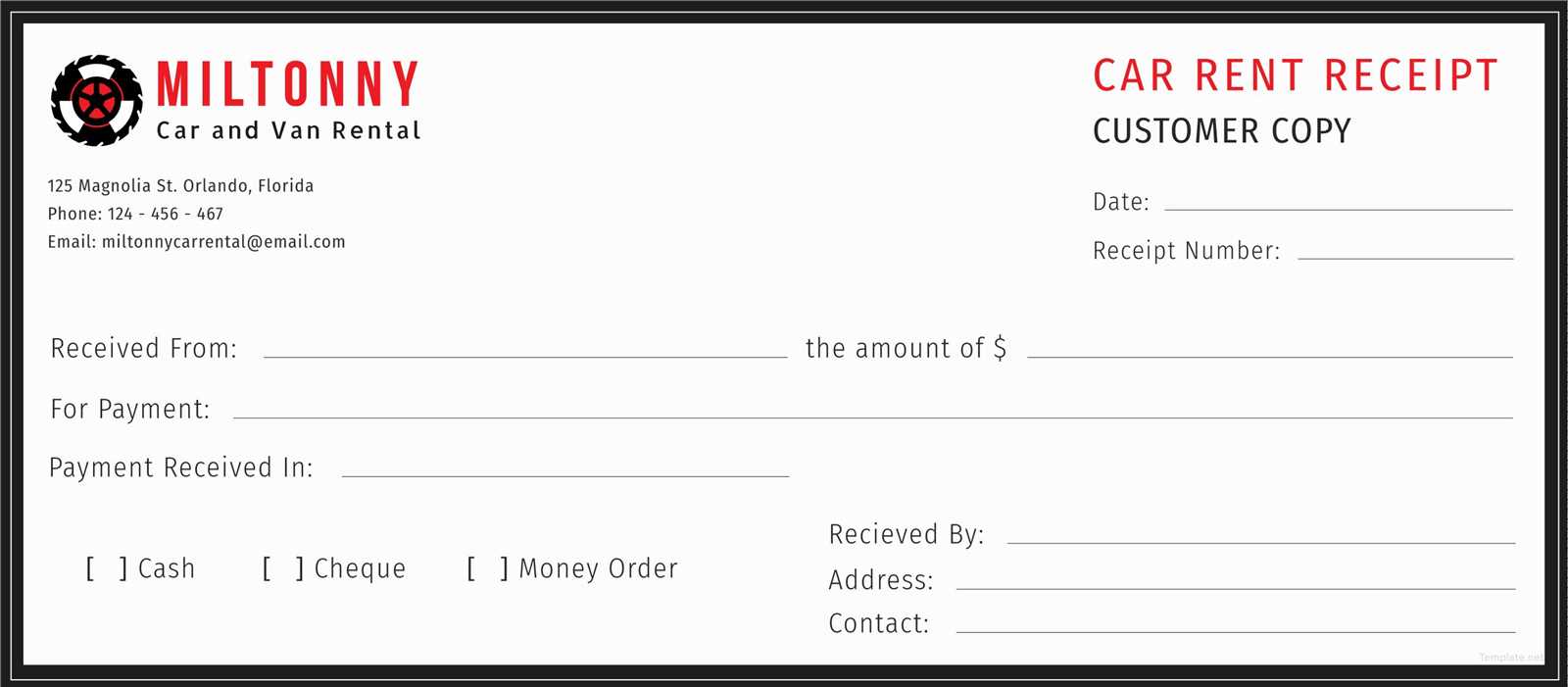

- Payment Details: Amount paid, payment date, and method used (cash, check, e-transfer, etc.).

- Rental Period: The specific month or period covered by the payment.

- Receipt Number: A unique identifier for record-keeping.

- Landlord’s Signature: Required for authenticity, especially for physical receipts.

Ensure receipts are issued upon request, as mandated by the Residential Tenancies Act. Digital or printed formats are both acceptable, provided they contain all necessary details.

Ontario Lease Payment Receipt Template

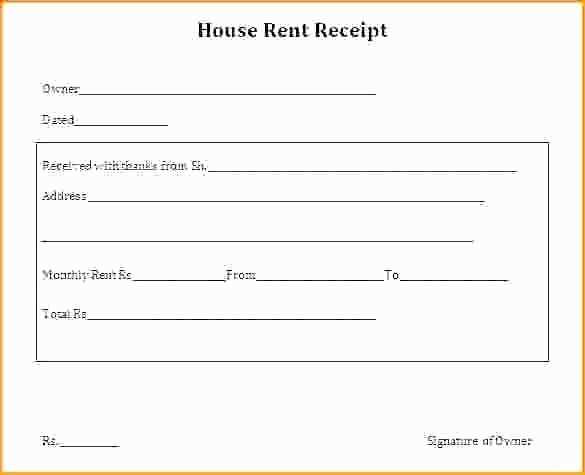

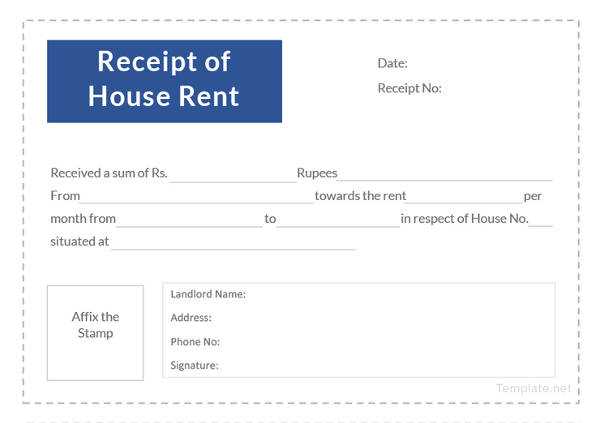

A properly structured lease payment receipt in Ontario should include essential details to ensure clarity and legal compliance. List the full names of both the landlord and tenant, the rental property’s address, and the exact payment date.

Specify the amount paid, payment method (e.g., cash, e-transfer, or check), and the rental period covered. Clearly state whether the payment is for rent, utilities, or any additional charges. Including a unique receipt number helps maintain organized records.

The landlord or property manager should sign the receipt and provide a copy to the tenant. Digital receipts are valid if they contain all required details and are sent through a verifiable channel. Keeping copies of all receipts protects both parties in case of disputes.

Include the full name of the landlord and tenant, along with the rental property’s address. This ensures clarity on both ends and avoids disputes.

Specify the payment date, the amount received, and the period covered by the payment. This confirms when the tenant paid and for which month or term.

Payment Method and Confirmation

Indicate whether the payment was made in cash, by cheque, e-transfer, or another method. If applicable, include a cheque number or transaction ID to provide a clear record.

Landlord’s Signature and Contact

A signed receipt carries more weight. The landlord’s signature, printed name, and contact details add legitimacy, especially in case of future inquiries.

A legally compliant lease receipt must include key details in a structured format. Begin with the landlord’s full name and contact information, followed by the tenant’s name and rental address. Clearly specify the payment date, amount, and method used.

Required Legal Elements

Include a breakdown of charges, separating rent from additional fees like utilities or parking. Indicate the rental period covered and ensure the currency is stated. If applicable, mention late fees or outstanding balances.

Signature and Record-Keeping

The receipt must contain the landlord’s signature or official stamp for authenticity. Both parties should keep copies for reference, ensuring compliance with Ontario’s rental regulations.

Landlords can choose between printable templates and digital solutions for generating rental receipts. Each option has distinct benefits depending on the preferred workflow and record-keeping practices.

Printable Templates for Easy Documentation

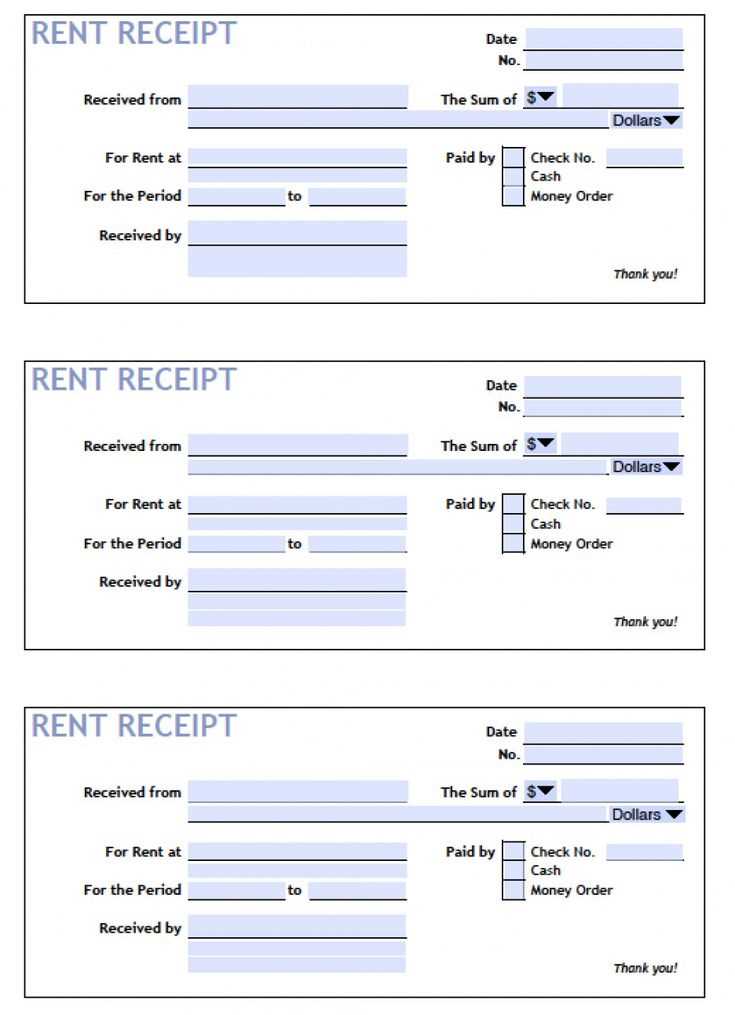

For those who prefer physical records, downloadable PDF or Word templates offer a structured format that can be filled out and printed. These templates typically include fields for tenant details, payment amounts, rental periods, and landlord signatures. Using pre-designed forms ensures consistency and legal compliance.

| Template Format | Best For | Key Features |

|---|---|---|

| Standardized paper records | Non-editable format, printable, secure layout | |

| Word | Customizable receipts | Editable fields, easy modifications |

| Excel | Automated calculations | Pre-set formulas, structured data entry |

Digital Receipts for Faster Processing

Electronic receipts streamline record-keeping and reduce paperwork. Online invoicing platforms, accounting software, and mobile apps allow landlords to generate, send, and store receipts instantly. Many systems integrate with payment processors, automatically recording transactions and issuing digital confirmations.

For added convenience, some platforms offer recurring receipt generation, cloud storage, and tenant access portals. Choosing the right digital tool depends on compatibility with existing financial systems and the level of automation required.

A proper Ontario rental receipt should always include key details to be legally valid and useful for record-keeping. Clearly state the tenant’s full name, the rental property address, the payment date, and the amount received. Specify the payment method (cash, check, e-transfer) and include the rental period covered by the payment.

For added clarity, mention any outstanding balances or overpayments. The landlord or property manager must sign the receipt or provide an electronic signature if issuing it digitally. Keep a copy for both parties to prevent disputes. A structured format ensures transparency and compliance with local regulations.