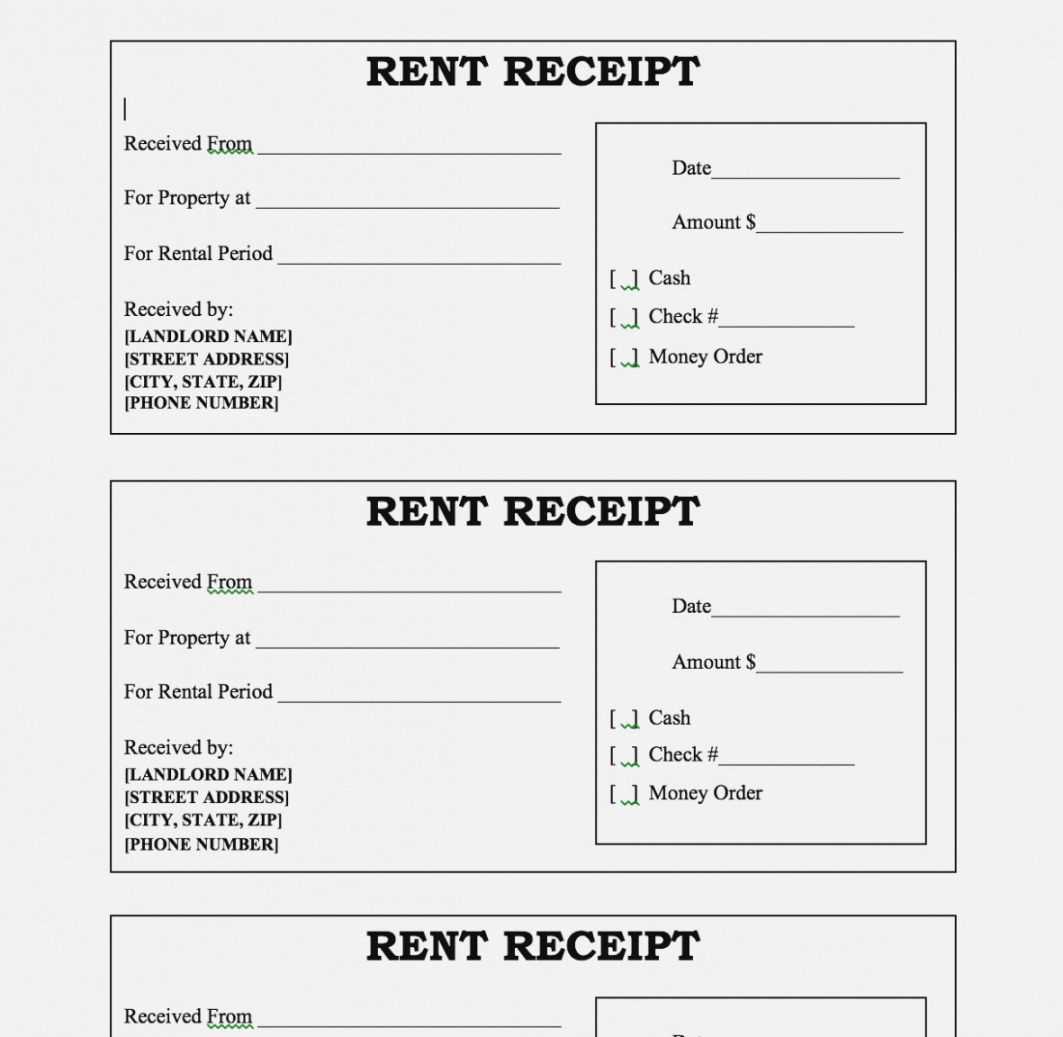

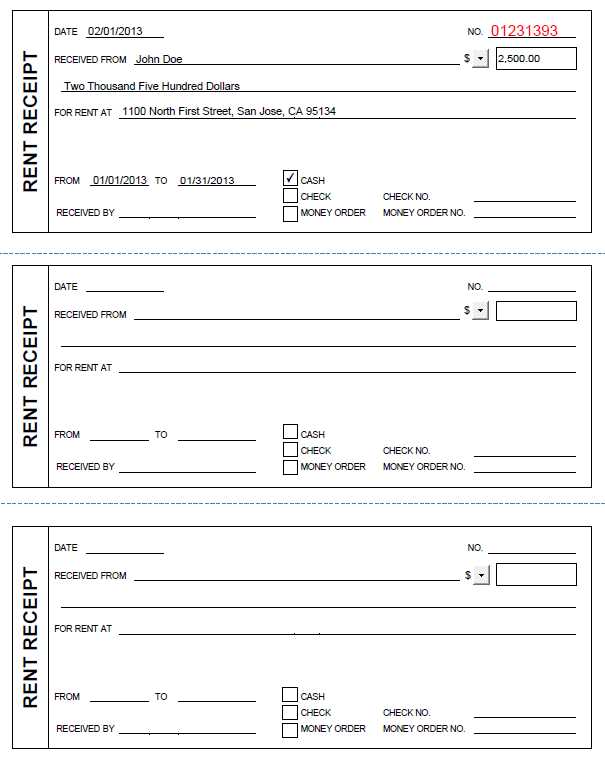

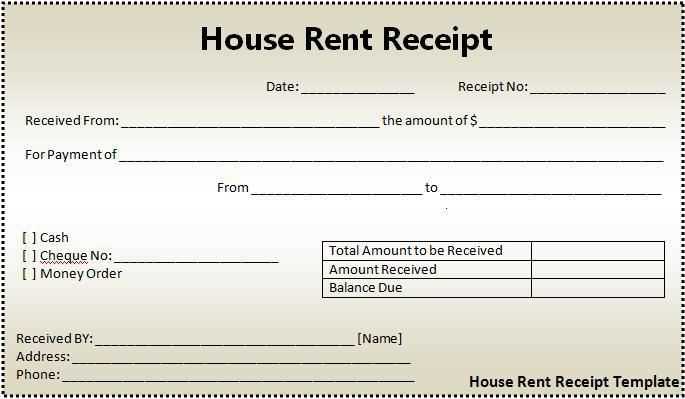

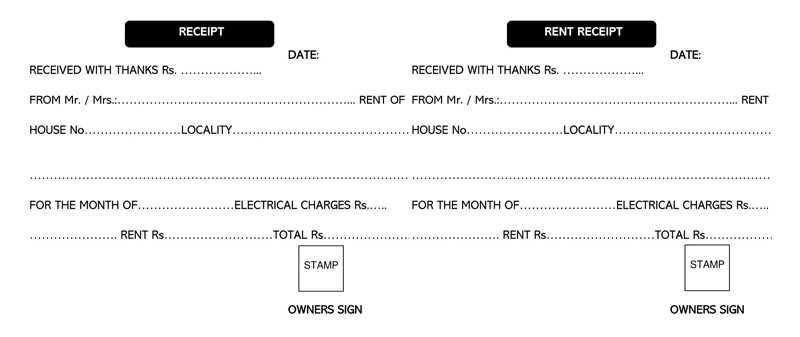

Need a quick and reliable way to document rent payments? A PDF rent receipt template provides a clear, professional record for both landlords and tenants. It ensures accurate tracking of payments, protects against disputes, and simplifies financial management.

Customizable fields make the process effortless. Include details such as tenant and landlord names, payment date, amount, and method of payment. Adding a unique receipt number enhances organization, while a signature field boosts credibility.

For added convenience, opt for a template with automatic calculations or fillable fields. Digital receipts eliminate paperwork, while printable versions suit those who prefer physical copies. Choose a format that aligns with your needs and keeps records well-organized.

Here’s the revised version with reduced word repetition, while maintaining the meaning:

For creating a PDF rent receipt, focus on structuring it clearly to avoid redundancy. Begin with the tenant’s full name and the rental period. Include the rental amount, payment date, and payment method to ensure clarity. Use a simple table layout for easy reading.

Template Example:

| Field | Details |

|---|---|

| Tenant Name | [Tenant’s Name] |

| Rental Period | [Start Date] to [End Date] |

| Amount Paid | $[Amount] |

| Payment Date | [Date] |

| Payment Method | [Cash/Card/Bank Transfer] |

Keep the language straightforward and professional, avoiding unnecessary details. Ensure the document is easy to print and share as a PDF.

- PDF Lease Payment Form Template

Creating a well-structured lease payment form ensures both landlords and tenants have clear records of payments. A PDF template allows for easy customization and consistency in documentation. It simplifies the tracking of transactions, offering clarity on amounts, due dates, and payment terms.

Key Elements to Include

- Tenant Information: Name, address, and contact details.

- Landlord Details: Full name, property address, and contact information.

- Payment Information: Amount due, payment method, and due date.

- Signature Lines: For both the tenant and landlord, confirming the transaction.

- Payment Terms: Any applicable late fees or early payment discounts.

Benefits of Using a PDF Template

PDF formats ensure easy sharing and printing, while preserving the layout. It prevents unauthorized changes to the document, providing both parties with a secure record. Moreover, filling out the form is user-friendly, requiring only basic text fields for each section.

Include the full names of both the tenant and landlord, along with their contact details. Specify the rental property’s address and clear descriptions of the rental terms, such as the lease duration, payment amount, and frequency. Clearly state the rent due date and acceptable payment methods. Ensure the document outlines responsibilities for property maintenance and repairs, highlighting the tenant’s duties in relation to property upkeep.

Outline any security deposit requirements, specifying the amount and conditions for its return. Include clauses on the terms for terminating the lease early or renewing it, including notice periods. Define the consequences of breaking the lease, such as penalties or fees. Be sure to list any additional fees, such as late payment charges or maintenance costs. Always clarify both parties’ rights and obligations in detail to avoid future disputes.

Customize your PDF payment record by adding specific details that reflect your needs. Start by inserting the payer’s name, address, and contact information at the top. This makes the document more official and easily identifiable. Next, include payment specifics such as the date, amount, and payment method. You can also create a unique reference number for each transaction to help track records better.

- Edit the header: Replace the default title with something personalized, like “Payment Receipt” or “Rent Payment Confirmation”.

- Modify the content fields: Adjust the template to include relevant information such as invoice number, due date, and property details.

- Include payment breakdown: If needed, add categories like rent, late fees, or utilities for clarity.

- Custom footer: Add your contact details or business information in the footer for easy reference.

Using software like Adobe Acrobat or online tools, you can make these changes quickly. After adjusting the template, ensure all the fields are aligned correctly and formatted for readability. Save the updated template for future use, making it easy to personalize each new payment record.

Receipts must meet specific legal standards to be considered valid documentation in many jurisdictions. They serve as proof of payment and are crucial for both parties involved, whether for tax reporting or dispute resolution. Ensure that the receipt includes all necessary information such as the date of payment, amount paid, names of both parties, and a description of the goods or services exchanged.

Legal Requirements

Different countries and regions have distinct rules regarding receipts. In some places, receipts must be issued for every transaction above a certain amount. In others, businesses are only required to issue receipts upon request. Verify local regulations to ensure compliance, particularly in relation to consumer rights and tax obligations.

Tax Compliance

Receipts are critical for tax purposes. Both the issuer and the recipient may need to retain receipts for accurate tax filing. Some jurisdictions require receipts to include tax identification numbers or other details necessary for accurate recordkeeping and reporting.

| Requirement | Description |

|---|---|

| Tax Identification Number | Some regions mandate including the business or individual’s tax number on receipts for verification purposes. |

| Transaction Amount | The exact amount paid, including taxes, must be clearly stated. |

| Date of Transaction | Receipts must indicate the date the transaction occurred. |

| Item Description | A brief description of the products or services provided must be listed. |

Make sure the receipt adheres to legal and tax rules to avoid complications with audits or disputes. Consistency and accuracy in issuing receipts can also protect both businesses and customers in the event of disagreements.

Organize files into well-structured folders. Label folders clearly with relevant categories such as “Receipts,” “Invoices,” or “Contracts.” This system ensures quick access and prevents clutter.

Use Cloud Storage for Backup

Store digital records in cloud services like Google Drive, Dropbox, or OneDrive. Cloud storage offers secure backup and easy access from any device. Ensure your account has two-factor authentication enabled to protect sensitive information.

Regularly Update and Clean Files

Delete unnecessary or outdated documents every few months. This keeps storage systems optimized and reduces the risk of storing irrelevant data. Use file management software to automate file sorting if possible.

- Archive older records in a separate folder or cloud archive to keep active files manageable.

- Use metadata tagging to make searching for files faster and more precise.

- Keep records in widely used formats, such as PDF, for long-term accessibility.

Ensure the accuracy of all fields, especially payment details. Misleading or incomplete information can lead to delayed transactions or errors in billing. Double-check the amounts, billing addresses, and payment method fields. Avoid ambiguous language in the payment instructions; clarity is key to preventing confusion for users.

Don’t skip validation checks for fields like card numbers or expiration dates. Missing or improperly configured validation can lead to incorrect data submission, making the process unnecessarily lengthy. Always confirm that the form can properly handle both credit and debit cards.

Never neglect the security measures in place. Ensure forms are secured with HTTPS encryption and follow best practices for data protection. Lack of proper encryption can compromise sensitive payment information, potentially leading to data breaches.

Be mindful of the user’s experience. A cluttered or confusing layout can frustrate users. Keep the design simple, logical, and easy to navigate. Avoid overloading the form with too many questions that aren’t immediately necessary.

Choosing between free and paid PDF rent receipt templates comes down to specific needs. Free templates offer simplicity and easy access, but come with limitations. Paid templates, on the other hand, often provide advanced features and customization options.

Free templates typically come with basic designs. They are easy to find online, often requiring no registration or purchase. However, these templates might lack professional design elements, and they could be more difficult to modify to meet specific requirements.

- Pros of Free Templates:

- Zero cost

- Instant access

- Good for basic needs

Paid templates offer more flexibility and better support. They can be customized in greater detail, often allowing users to modify logos, fonts, and colors. Paid templates may also come with extra features like automation, which can save time in the long run.

- Pros of Paid Templates:

- Customization options

- High-quality design

- Better support and updates

When deciding, consider your specific needs. If a basic receipt is sufficient, a free template may work well. If you need professional branding or advanced functionality, investing in a paid template can be a good choice.

Ensure your rent receipt template is clear and structured with the appropriate sections. Start with tenant details like name and address, followed by rental period and amount paid. Include payment method for transparency. The date of the transaction should be specified to avoid confusion.

Include a breakdown of the rent amount. If applicable, list any additional charges like utilities or maintenance fees, as this will provide both parties with a clear understanding of the transaction. Use simple formatting with bullet points or lines for easier reading.

Keep the language concise. The goal is clarity, so avoid unnecessary jargon. Make sure all required fields are filled out, including any disclaimers or legal notes, to meet local or national standards for rent receipts.

Lastly, save the receipt in a PDF format to ensure easy distribution and storage. This format keeps the layout intact, preventing unwanted changes and preserving the document’s professionalism.