If you’re renting out a property, a rental receipt is one of the simplest yet most necessary documents to provide. It serves as proof of payment and can be used for future reference by both landlords and tenants. A well-organized rental receipt ensures transparency and clarity, preventing any misunderstandings down the line.

The Pg rent receipt template simplifies the process of documenting payments. It includes the tenant’s name, rental period, payment amount, and payment method. You can also include additional details, such as late fees or deposits, for a more complete record. Customizing the template for your property’s specific needs adds a personal touch, ensuring that all required information is captured.

Be sure to save a copy of the receipt for both parties. Having a reliable template for every transaction not only keeps everything organized but also helps maintain a smooth landlord-tenant relationship. With a clear and concise receipt, you can avoid any future payment disputes while keeping a professional and hassle-free approach to rent collection.

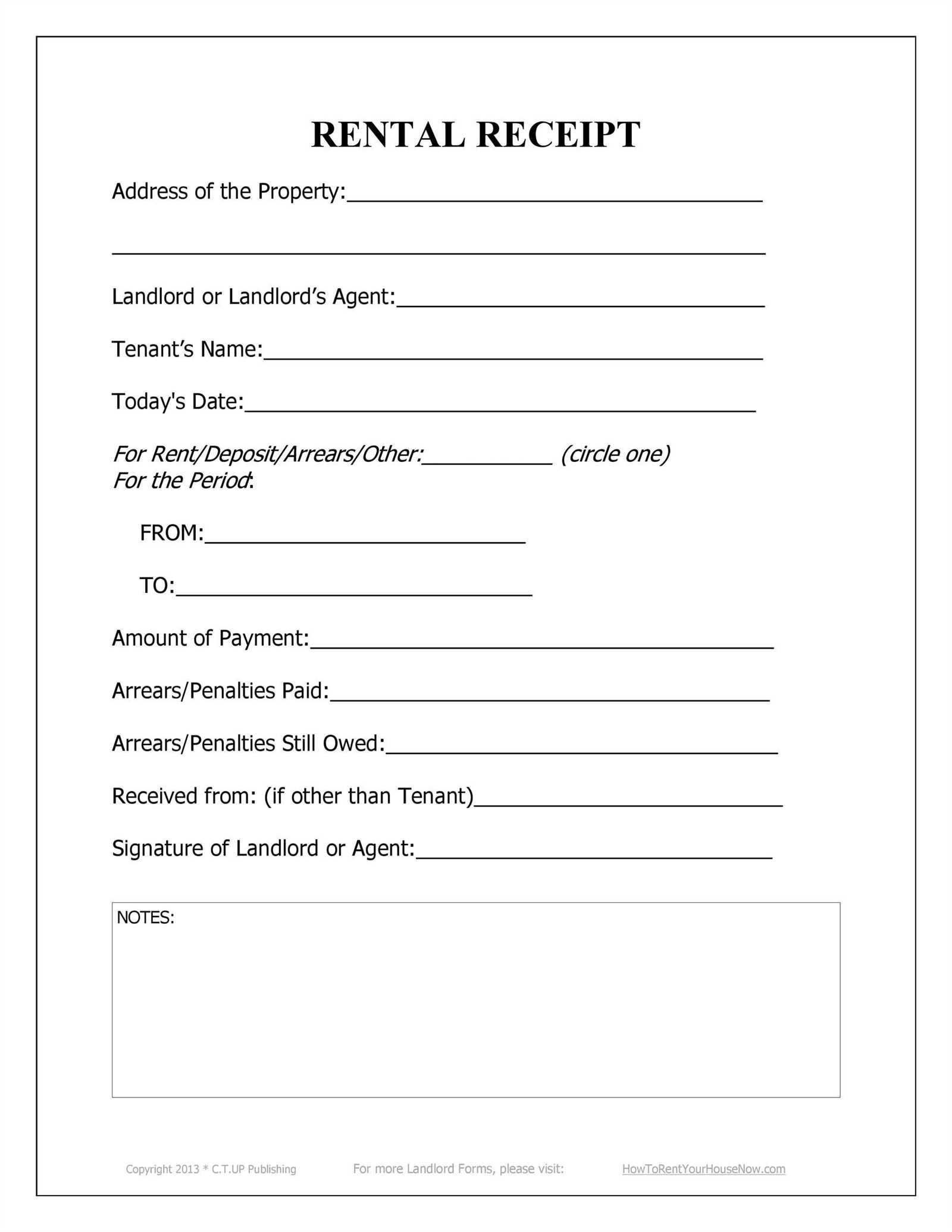

How to Create a Basic Rent Receipt Template

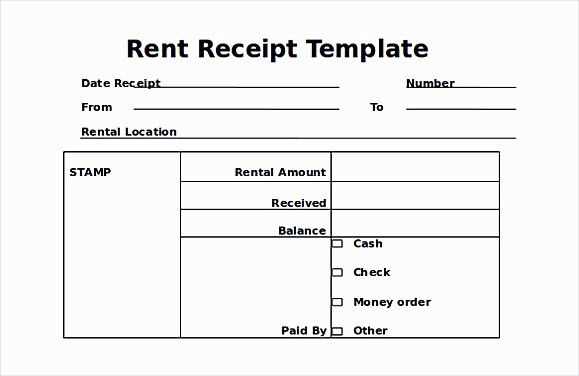

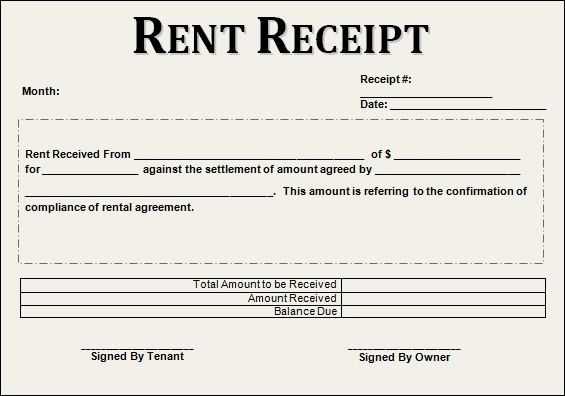

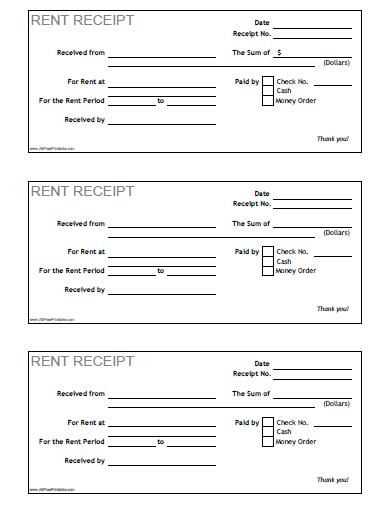

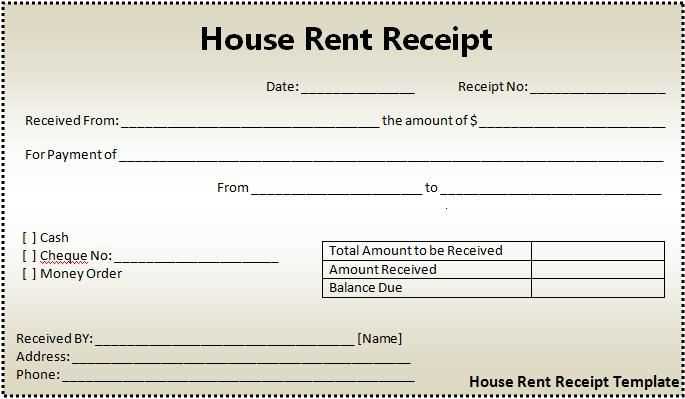

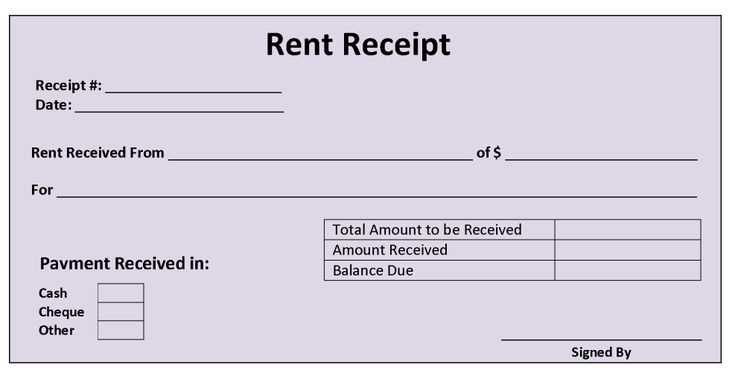

Begin by structuring your rent receipt with the tenant’s name, rental property address, and the amount paid. Clearly mention the payment date and the rental period the payment covers. Ensure the payment method (e.g., cash, check, or online transfer) is specified to avoid confusion.

Include a unique receipt number for record-keeping. This helps both the landlord and tenant track payments easily. Specify whether the payment is for rent, late fees, or any other charges to make it clear.

Add a section for the landlord’s name and contact details to establish who is issuing the receipt. It’s also helpful to include any additional notes that may apply, such as whether the payment is for a partial month or if there are any outstanding amounts.

Conclude with a line for the landlord’s signature to confirm the transaction. This small detail adds legitimacy and ensures both parties acknowledge the receipt as valid.

Customizing Your Rent Receipt for Different Payment Methods

Adjust your rent receipt template to clearly reflect the payment method used. This ensures transparency and accuracy for both the tenant and landlord. Start by indicating the payment type (e.g., cash, credit card, bank transfer, check) in a prominent location on the receipt. Include specific details like transaction numbers or confirmation codes for non-cash payments, helping to verify the transaction and avoid future confusion.

For Bank Transfers

When a tenant pays via bank transfer, list the bank account details along with the transfer reference number. This provides a clear audit trail. You can also include the exact date and time of the transfer to further confirm the payment. Ensure the amount matches the agreed-upon rent and any additional fees, like late charges, if applicable.

For Cash Payments

For cash transactions, specify the amount received in words and figures. A signature from both the tenant and landlord can further confirm that the payment has been made. If the cash payment was part of a larger sum (e.g., an installment), mention the balance due and the due date for the next payment.

Pro Tip: Make sure each payment method is easily identifiable to prevent any confusion between different types of payments. Tailor the receipt template for each payment scenario to maintain clarity and organization.

How to Include Important Legal and Tax Information

Clearly state the rental property’s address and the rental amount to avoid ambiguity. Include the tenant’s and landlord’s names, along with their contact information. Specify the rental period with start and end dates to ensure accuracy.

Indicate the payment terms, such as the due date and method of payment. If applicable, mention any late payment penalties or fees. Always include a clause detailing the security deposit and its terms, such as refund conditions and deductions for damage.

Provide a statement outlining the landlord’s legal obligations regarding repairs and maintenance, and any local tax requirements related to the rental income. This helps both parties understand their rights and responsibilities in relation to the property and its upkeep.

Make sure to include a disclaimer about the validity of the receipt, confirming that it serves as a proof of payment. If necessary, note the applicable tax rate or any exemptions that might apply under local laws.