Use a pre-paid rent receipt template to clearly document rent payments made in advance. This ensures both tenant and landlord have a written record of the transaction, helping avoid any confusion about payment status in the future.

The template should include the tenant’s name, the address of the rental property, the date of payment, and the amount paid. Include a line for the rent period covered by the prepayment, making it clear that the payment was made ahead of time for a specific period.

Ensure the receipt is signed by both the tenant and the landlord to confirm mutual agreement on the terms. This helps maintain transparency and acts as a reference for any future disputes or clarifications. Use simple language and check that all fields are filled out correctly to keep things straightforward.

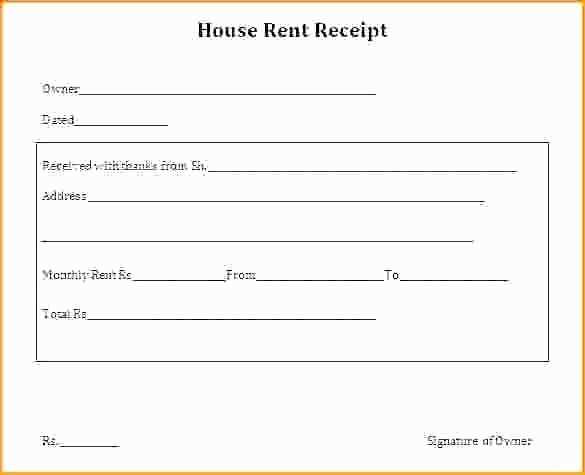

Pre Paid Rent Receipt Template

To create a clear and functional pre-paid rent receipt template, start by including the landlord’s and tenant’s full names and contact details at the top. Specify the rental property address, ensuring all relevant details are correct. The payment date and the amount paid should be clearly listed, including the period covered by the prepayment. It’s crucial to note the method of payment, such as check, bank transfer, or cash. Lastly, ensure the landlord or property manager signs the receipt to validate the transaction.

Here’s a basic structure for your pre-paid rent receipt:

Landlord’s Name: [Full Name]

Tenant’s Name: [Full Name]

Rental Property Address: [Address]

Payment Date: [MM/DD/YYYY]

Amount Paid: [$ Amount]

Payment Method: [Method (e.g., Check, Bank Transfer)]

Rent Period Covered: [From MM/DD/YYYY to MM/DD/YYYY]

Landlord’s Signature: ______________________

This format ensures that both parties have a record of the transaction for future reference. Adjust the template as needed to suit specific rental agreements or legal requirements in your area.

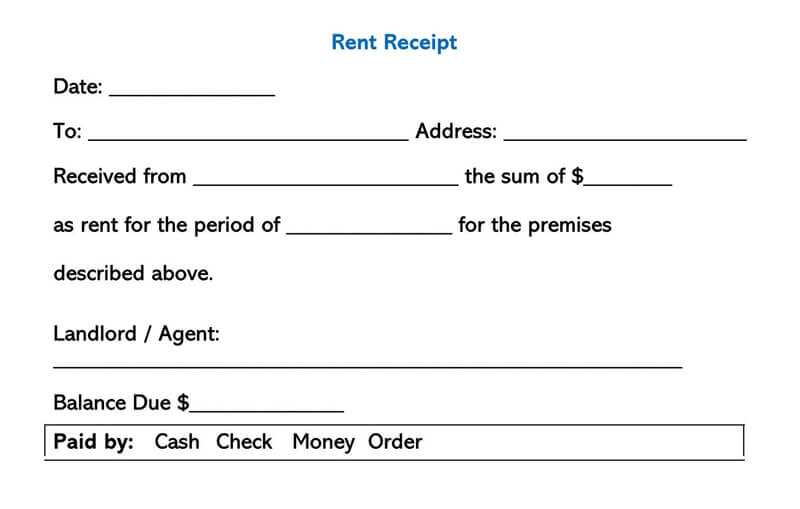

Understanding the Key Components of a Receipt

A receipt must contain clear and accurate details to be effective. Here’s a breakdown of the key components you should include:

1. Date and Time

Include the exact date and time of the transaction. This helps both parties track when the payment was made and can be useful for reference or future inquiries.

2. Payment Details

List the amount paid, the payment method (cash, credit card, etc.), and any transaction reference numbers if applicable. This makes it easy to trace the payment if needed.

3. Tenant and Landlord Information

- Tenant’s Name: Ensure the full name of the tenant is clearly stated.

- Landlord’s Information: Include the landlord’s name, address, or company name if relevant.

4. Rental Period

Specify the rental period that the payment covers. This helps avoid confusion about which month or period the rent applies to.

5. Signature (if required)

Both parties should sign the receipt, confirming that the transaction took place. If the receipt is electronic, consider including a digital signature option for added security.

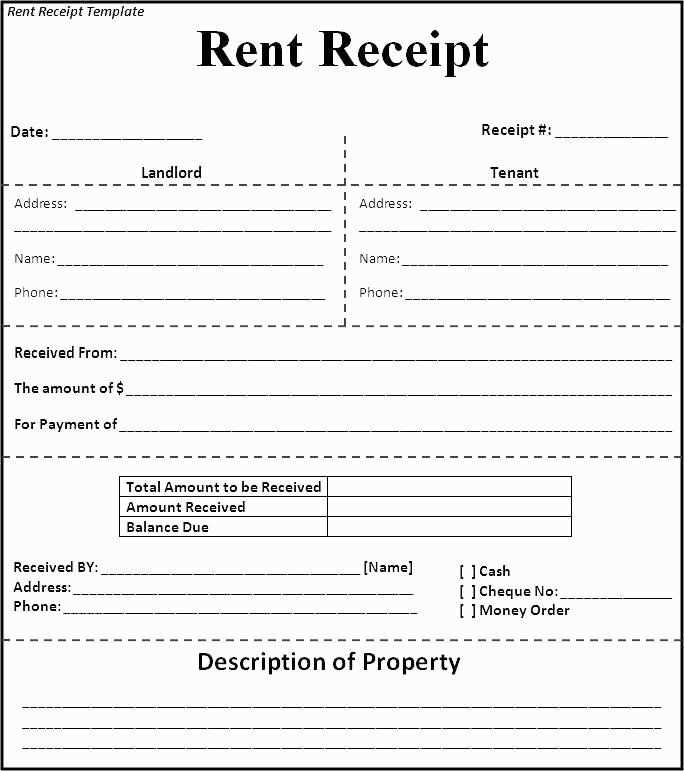

Customizing Your Pre Paid Rent Receipt

Tailor your pre-paid rent receipt to fit your specific needs by including relevant details. Adjust the format to match your style while maintaining clarity and accuracy.

Include Tenant and Property Information

- List the tenant’s full name and contact details.

- Provide the property’s address clearly.

- Ensure that the rental period (start and end dates) is included.

Specify Payment Details

- State the amount paid, with clear reference to the currency.

- Note the payment method, such as cash, check, or bank transfer.

- Include any deposits or additional charges if applicable.

For added convenience, include a unique receipt number and the date of payment to avoid confusion. This simple customization ensures transparency and smooth record-keeping for both parties.

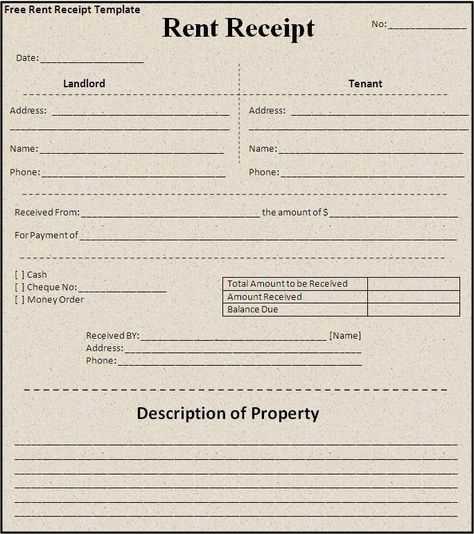

Legal Considerations for Pre Paid Rent Receipts

When issuing a pre-paid rent receipt, ensure that it accurately reflects the terms agreed upon between the landlord and tenant. Include details such as the amount, payment date, rental period, and any applicable terms for refunds or adjustments. A well-drafted receipt can help prevent legal disputes over payments.

Clear Payment Documentation

The receipt must clearly state that the payment is for rent in advance, specifying the exact months or rental period covered. Without this clarity, the tenant may argue that the payment was a deposit or payment for other services. In some jurisdictions, pre-paid rent may also require a specific format to be legally valid, so check local regulations.

Tax Implications

Landlords should be aware of potential tax implications associated with pre-paid rent. In many areas, pre-paid rent is considered taxable income at the time it is received. Keeping detailed records of pre-paid rents helps landlords comply with tax obligations and avoid potential audits or fines.