Use a clear and simple rent receipt template to maintain a professional and transparent record of rental payments. This document benefits both the tenant and the landlord by providing proof of payment for accounting or legal purposes. A well-structured template ensures there are no misunderstandings between both parties and allows for easy reference in the future.

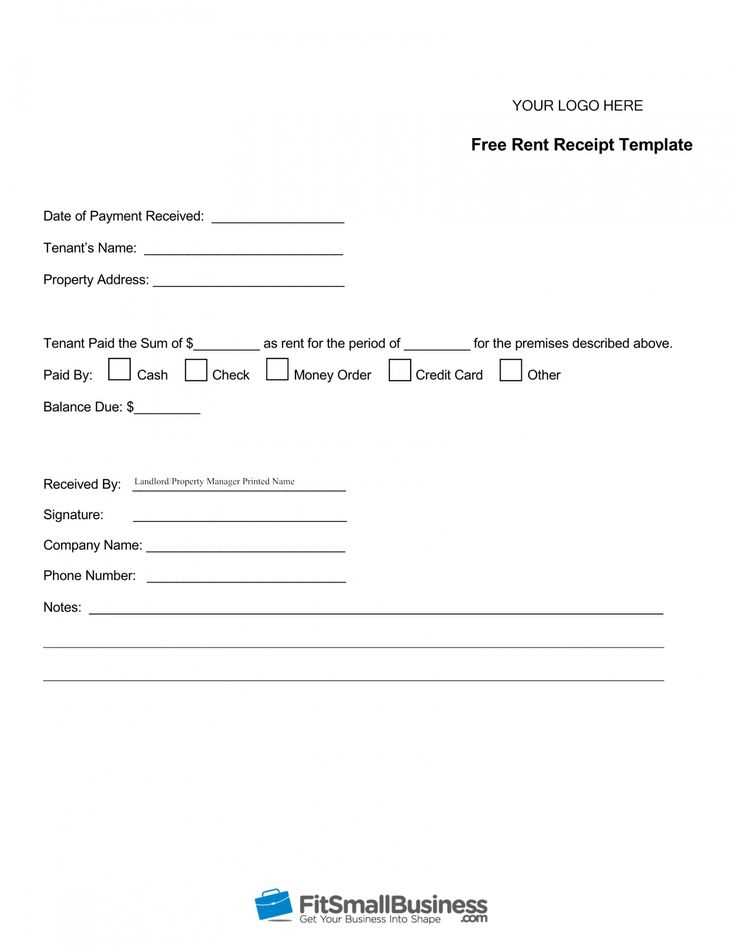

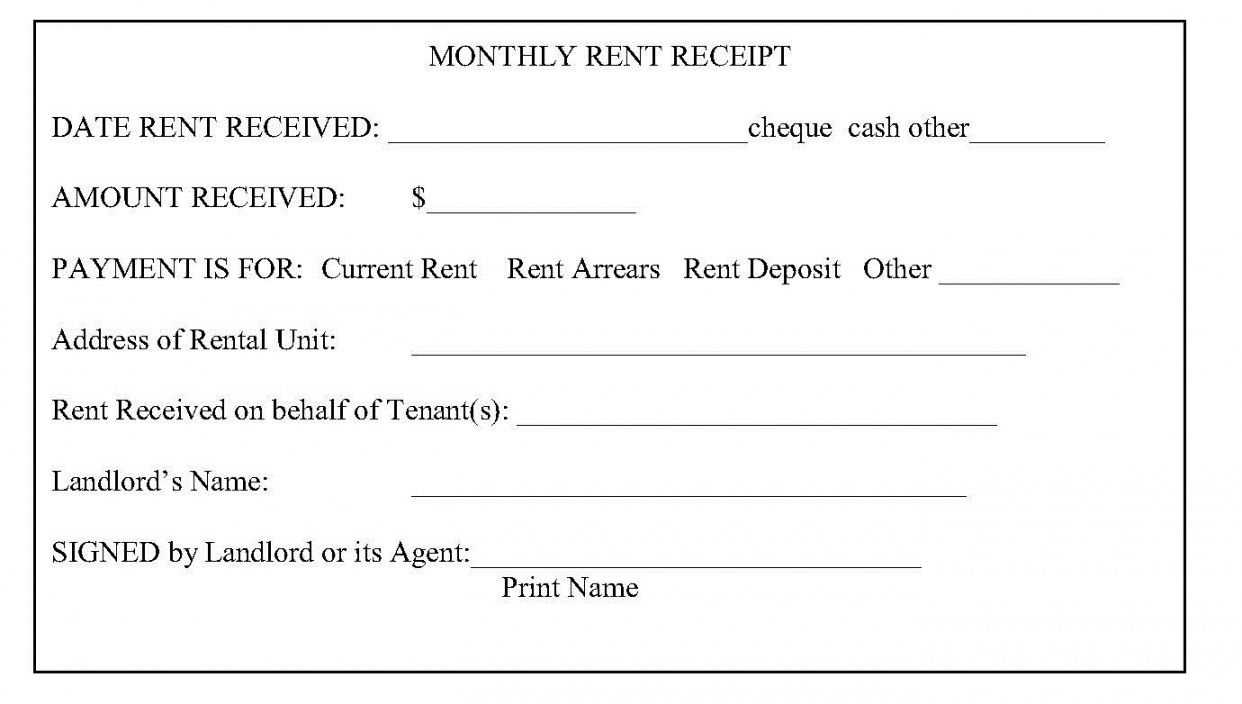

To create an effective rent receipt, include key details such as the tenant’s name, landlord’s name, payment date, and amount paid. A template should also clearly state the rental period covered by the payment and any specific payment method used. Including this information makes the receipt both useful and legally binding if necessary.

Consider customizing your receipt with additional notes such as late fees or security deposits, depending on the terms of the lease agreement. Having this document easily accessible for both parties allows for smoother communication and minimizes any potential confusion in the future.

Here are the corrected lines based on your suggestions:

Ensure all fields are clearly marked for easy completion. Use separate fields for tenant name, address, and the rental period. Specify the payment method clearly, such as cash, check, or bank transfer. Indicate any late fees or special conditions at the bottom of the form, making them visible to avoid confusion. Be precise about the due date for each rental payment. Include a section for both tenant and landlord signatures to confirm the transaction. Add the date when the payment was received and ensure this is documented correctly for both parties.

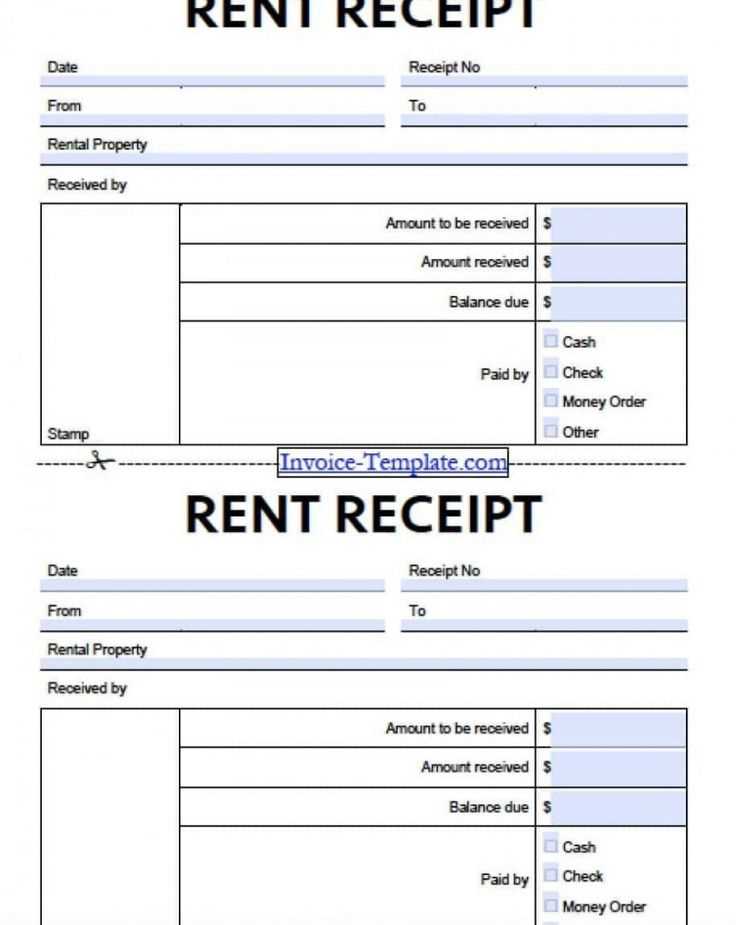

Print Rent Receipt Template for Tenant and Landlord

To create a clear and professional rent receipt, it’s crucial to include all necessary details that both the tenant and landlord can easily reference. This helps avoid any confusion regarding payments. Below is a suggested layout for a rent receipt template.

Essential Elements of the Rent Receipt

- Landlord’s Name and Address: Clearly include the full name of the landlord and their contact information.

- Tenant’s Name and Address: Include the tenant’s full name and the property address for clarity.

- Date of Payment: Indicate the exact date the payment was made, helping both parties track payment history.

- Amount Paid: Specify the amount of rent paid and any additional charges if applicable.

- Payment Method: Include how the payment was made (cash, bank transfer, check, etc.).

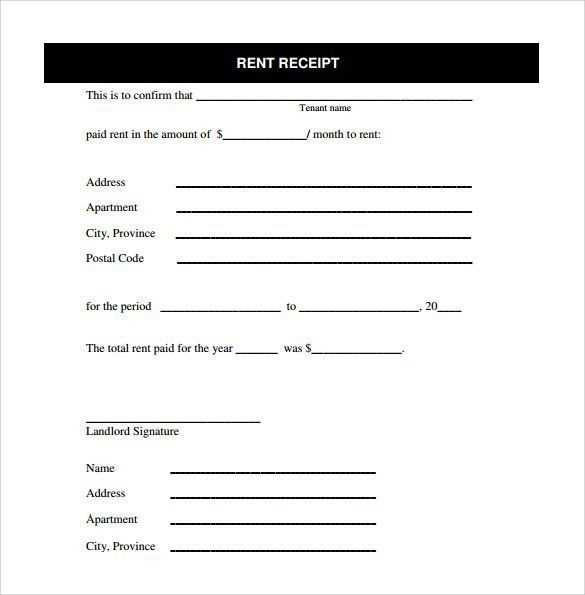

- Rental Period: Mention the period for which the payment is being made (e.g., February 1–28, 2025).

- Receipt Number: A unique receipt number for easy tracking.

Template Format Example

This is a simple layout for the rent receipt template:

- Receipt No: [Unique Number]

- Landlord: [Full Name]

- Tenant: [Full Name]

- Address of Rental Property: [Full Address]

- Payment Date: [Date]

- Amount Paid: [Amount]

- Payment Method: [Payment Method]

- Rental Period: [Start Date – End Date]

- Signature of Landlord: [Signature]

This format ensures transparency and ease of reference for both the landlord and tenant, maintaining clear records for future reference.

Adjusting a rent receipt template for various lease agreements requires considering key details specific to each lease. Begin by reviewing the lease agreement terms such as rent amount, payment due date, and payment intervals. These should be clearly reflected in the receipt template to ensure accuracy.

Including Lease-Specific Details

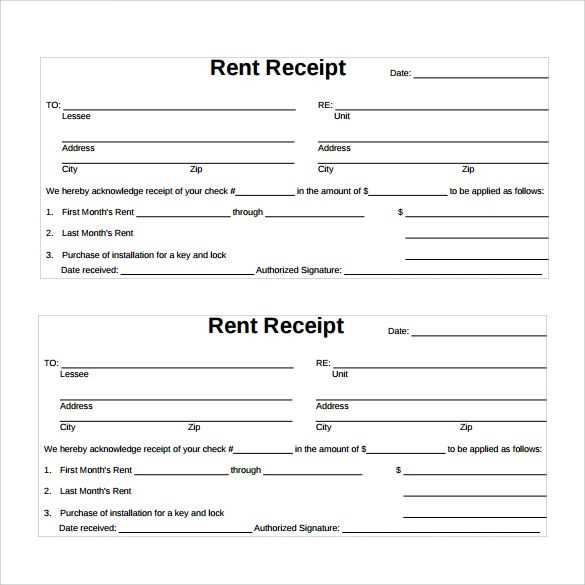

Each lease agreement may involve unique clauses like rent payment dates, late fees, or payment methods. For example, if the lease requires quarterly payments, the receipt should list the payment schedule accordingly. This clarity helps both tenants and landlords stay informed.

Adding Rent Breakdown for Complex Agreements

In cases where rent includes additional charges like utilities or maintenance fees, it is helpful to include a breakdown of those costs. A customizable template should allow space for detailing these charges separately from the base rent amount, ensuring transparency for both parties.

Receipts must contain specific information to ensure their validity and legality. This includes the date of payment, the amount paid, and a description of the service or rental period. Both the landlord and tenant must have clear records of the transaction, so these details are necessary for legal and tax purposes.

Mandatory Information on Rent Receipts

The following details should be present on every rent receipt:

| Item | Details |

|---|---|

| Date of Payment | The exact date the payment was made. |

| Amount Paid | The total amount received, including any deposits or additional fees. |

| Tenant’s Name | The name of the tenant making the payment. |

| Landlord’s Name | The name of the landlord or property manager receiving the payment. |

| Property Address | The address of the rented property. |

| Rental Period | The start and end date of the rental period being paid for. |

| Payment Method | The method of payment, such as cash, check, or electronic transfer. |

Why These Details Matter

Including all required information ensures that the receipt serves as a legal proof of payment, which can protect both the landlord and tenant in case of disputes. It is also crucial for tax reporting, as landlords may need to show proof of income. Missing or incomplete details can complicate any legal or financial matters that may arise later.

Organizing rent receipts can be simplified with a few practical strategies. First, use a consistent format for each receipt. A standard template ensures that all relevant details, such as payment date, amount, and tenant information, are included every time. This consistency will make it easier to spot discrepancies or missing information.

Automate the Process

Consider using software or apps designed for rental property management. These tools can automatically generate and send receipts, saving time and reducing the chance of errors. Many platforms also allow you to track payments, making it easier to reference past transactions when needed.

Maintain Organized Digital and Physical Records

While digital copies are convenient and easy to search, having a physical backup can be helpful, especially in case of technical issues. Store receipts in both formats for maximum security. Organize digital receipts in folders, and label physical copies clearly with the date and tenant name to make future reference straightforward.

Keep track of payment frequency and patterns. This helps identify any missed payments or inconsistencies and improves communication with tenants if issues arise. By staying organized, you avoid unnecessary stress at tax time or when resolving disputes.

When preparing a rent receipt template for tenants and landlords, it is important to include clear and relevant details. The template should feature the tenant’s name, address of the rented property, rental period, and the amount paid. This ensures both parties have a clear record of the transaction.

Include the payment method (cash, bank transfer, check, etc.) to add transparency. A receipt number or reference number helps track payments, especially for large rental portfolios. Be sure to state whether the rent covers a partial or full period.

Don’t forget to add both the tenant’s and landlord’s signatures. This simple inclusion can prevent future misunderstandings and legal disputes. Also, be mindful of the local laws regarding receipt formats or required language.

Finally, always keep a copy for your records. This will help maintain clarity and organization for both tenants and landlords in case questions arise in the future.