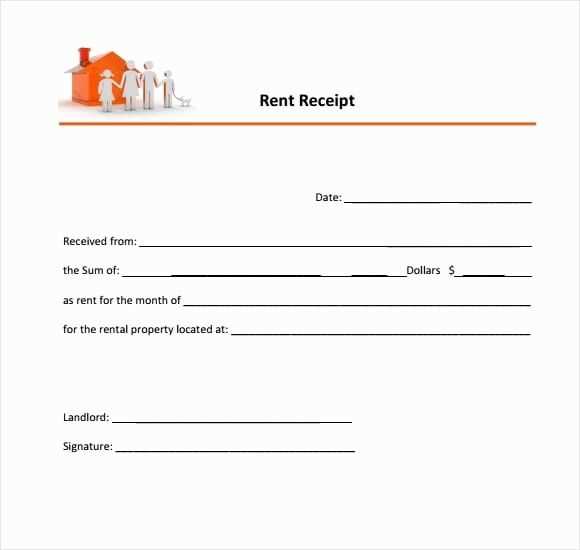

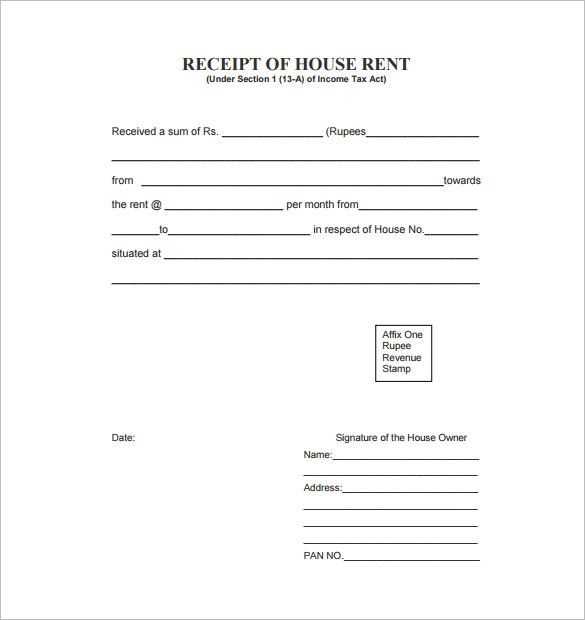

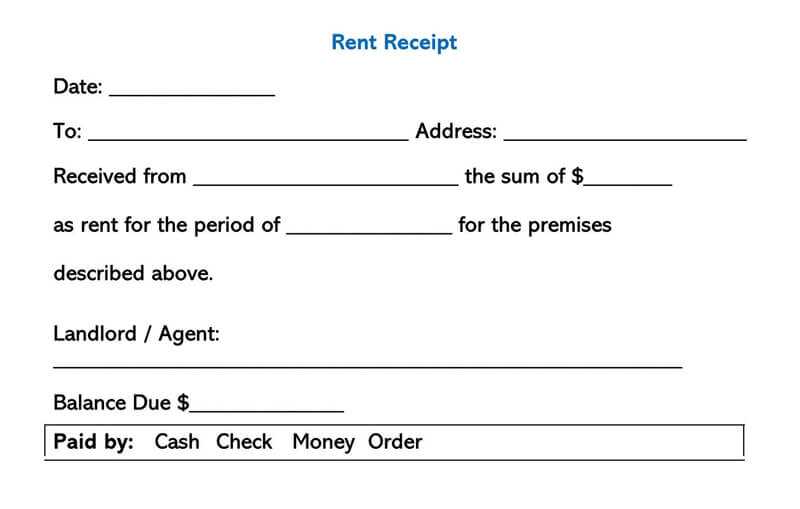

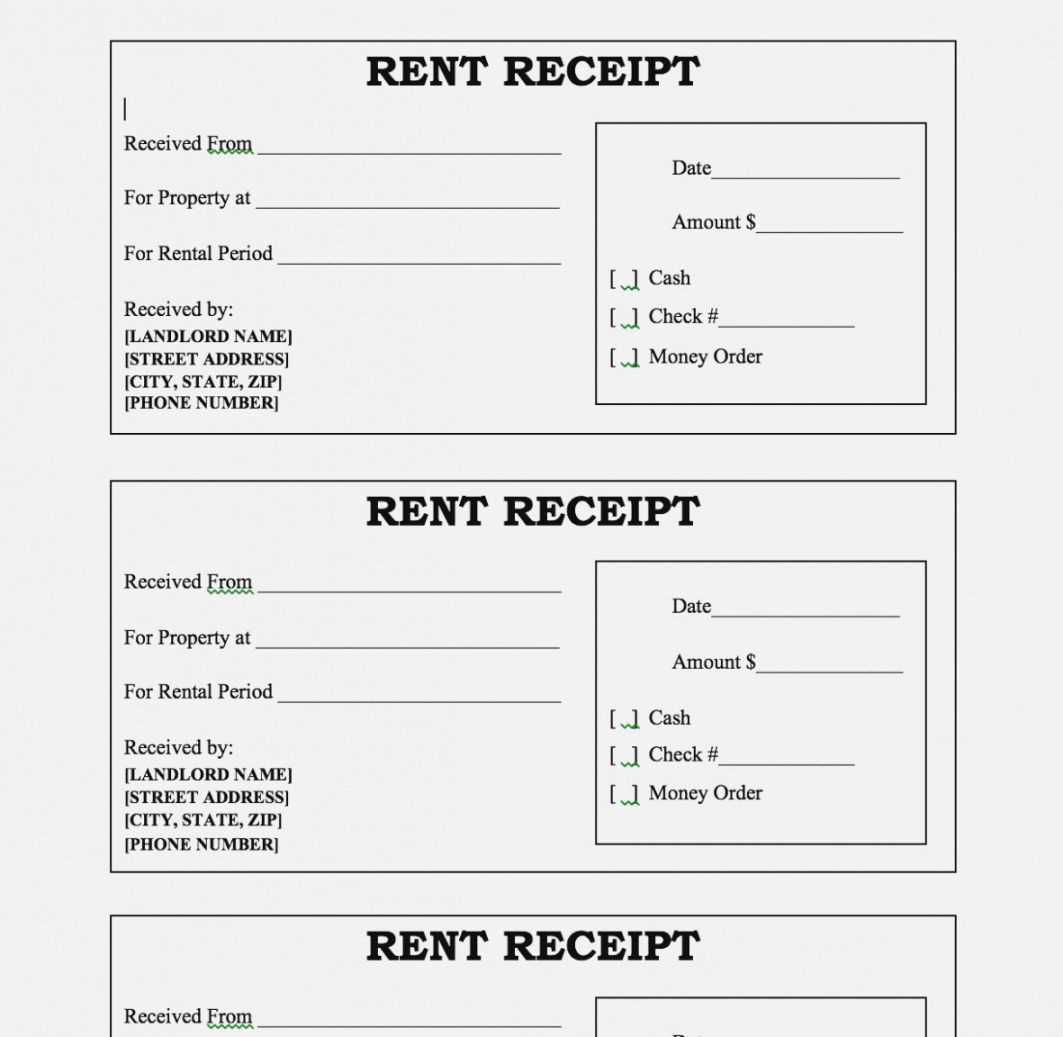

A well-designed property rent receipt is a key document for both landlords and tenants. It provides clear proof of payment, ensuring transparency in rental transactions. This receipt template should include specific details such as tenant’s name, property address, payment amount, payment date, and landlord’s contact information. Without these details, the receipt may lack legal clarity.

The rent receipt serves as an official acknowledgment from the landlord that payment has been received. A simple yet structured template will allow landlords to quickly issue receipts while ensuring they meet any necessary legal requirements. You can customize the template with additional information like the rental period and payment method, which might be useful in certain cases, especially for record-keeping or tax purposes.

For tenants, the receipt is a useful tool to track their payments, confirm they are up to date with their rent, and avoid any future disputes. By keeping a copy of each receipt, they can easily reference past transactions when needed. The clarity provided by such a template makes these documents much easier to manage for both parties.

Here’s the revised version:

A clear and accurate rent receipt template is crucial for both tenants and landlords. It helps avoid misunderstandings and provides a solid record of payments made. Ensure you include the following details:

Key Elements to Include:

Tenant’s name – Make sure this is accurate to avoid any confusion about the rent payment. Include the address of the rental property and the payment period (e.g., monthly, quarterly).

Details of the Payment

Specify the amount paid and the payment method (e.g., cash, bank transfer). If applicable, list any late fees or additional charges. Always add the date of payment and indicate if the payment covers rent for one or more periods.

Also, remember to include the landlord’s name and contact details for future reference. This ensures both parties have clear communication going forward.

After filling out these sections, leave space for both parties to sign. This helps verify that the transaction took place. Consider keeping a digital copy of the receipt for easy access.

- Property Rent Receipt Template: A Practical Guide

A property rent receipt template should include key details to ensure transparency between landlords and tenants. Start with the receipt’s title: “Rent Receipt,” followed by the tenant’s name and the rental property’s address. This ensures clarity on both ends. The receipt must also specify the date the payment was made and the amount received. This is particularly important for both accounting and future reference.

Details to Include in the Template

Ensure the receipt contains the following core information:

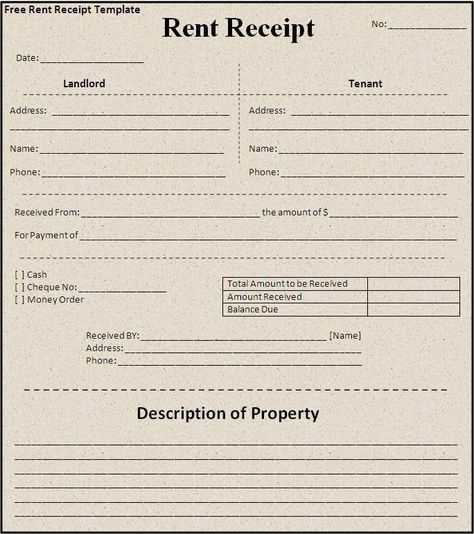

- Tenant’s Name: Clearly state who made the payment.

- Landlord’s Name: Include the name of the individual or entity receiving the payment.

- Property Address: Specify the rental property’s address to avoid confusion.

- Payment Amount: List the exact amount paid, in words and numbers, to prevent misunderstandings.

- Payment Date: The date when the payment was made is crucial for tracking purposes.

- Payment Method: Indicate whether the payment was made by check, bank transfer, cash, etc.

- Rental Period: Clearly state the period covered by the rent (e.g., “for the month of January 2025”).

Why Use a Template?

A template helps streamline the process, reducing the chances of missing critical details. It also provides a professional, standardized format that both landlords and tenants can rely on. A well-structured template prevents confusion and can serve as evidence if there’s a dispute later on. Make sure to keep a copy for your records as a landlord, and encourage tenants to keep theirs for future reference.

Begin by including the basic details of the transaction. At the top, write “Rent Receipt” in bold. Below that, include the property address and the name of the landlord.

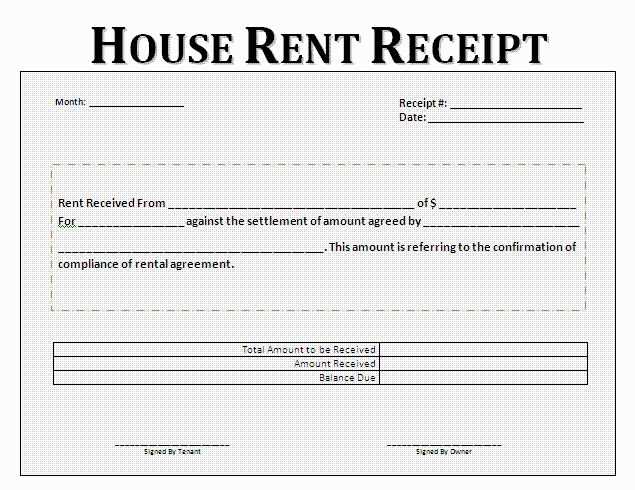

Next, add the tenant’s name, along with the rental period the receipt covers. Specify the amount paid and the date of the payment. If the payment is for more than one month, break down the amount accordingly.

Payment method is a key element to document. Whether it’s cash, check, or bank transfer, clearly indicate the payment method used. If the payment was partial, note the outstanding balance.

Don’t forget to include a space for the landlord’s signature at the bottom, confirming the payment was received. A simple “Received by” line works well for this purpose.

Finally, add a brief statement such as “Thank you for your payment” or a similar acknowledgment, making the receipt feel professional and complete.

A rent receipt should clearly document the payment transaction. Here are the key elements to include:

1. Tenant and Landlord Details

Include the full names of both the tenant and landlord. The address of the rental property is also important for reference. This helps avoid any confusion if the receipt is ever questioned.

2. Payment Date

Always note the exact date the payment was made. This confirms the timing and helps track payments over time.

3. Rent Amount

State the exact amount of rent paid. If partial payments or adjustments were made, clearly mention that as well.

4. Payment Method

Include the payment method used–whether cash, check, bank transfer, or any other method. This provides clarity on how the transaction was processed.

5. Rental Period Covered

Specify the period for which the rent is being paid (e.g., from January 1 to January 31). This helps both parties confirm that the payment matches the due period.

6. Receipt Number

If possible, assign a unique receipt number. This makes it easy to track multiple payments or identify specific transactions in your records.

7. Signature

Both the tenant and landlord should sign the receipt. This confirms that both parties acknowledge the payment was made and received.

These elements will ensure that the rent receipt is clear, professional, and useful for both parties involved.

Rental receipts play a key role in protecting both tenants and landlords in case of disputes. These documents serve as proof of payment, clarifying whether rent has been paid on time and in the correct amount. Without a rental receipt, it can be difficult to prove that rent was paid, which could lead to unnecessary conflicts or legal complications.

For landlords, issuing rental receipts provides a clear record of transactions, ensuring compliance with local regulations. This documentation can be helpful if tax authorities require evidence of rental income, or if there are disagreements regarding payment history. A rental receipt should always include the date of payment, the amount, the rental period, and the names of the tenant and landlord.

- Proof of Payment: Rental receipts confirm that the tenant has made a payment, preventing future claims of non-payment.

- Tax Documentation: Landlords may need rental receipts for tax filings, to demonstrate income from rent.

- Dispute Resolution: Should a dispute arise, a receipt can serve as evidence in legal proceedings, simplifying the process of resolving conflicts.

- Clear Record-Keeping: Receipts help both parties maintain organized records for future reference.

Both landlords and tenants benefit from the clarity that rental receipts provide. For tenants, a receipt ensures they won’t be wrongfully accused of non-payment, while for landlords, it confirms that rent has been paid and helps with tax documentation. Keep receipts for every transaction to avoid complications down the line.

Hey! How’s it going?

Hey! How’s it going today?

Use a reliable property receipt template to ensure consistency and accuracy in your records. You can find customizable templates online or create your own using tools like Google Docs or Microsoft Word. Fill in the necessary fields such as tenant name, rental property address, payment amount, and payment date. Include any additional details like late fees, deposits, or rent period for clarity.

Utilizing Online Tools for Receipt Creation

There are numerous online platforms that allow for quick creation of property receipts. Apps like QuickBooks, Rentec Direct, and Wave offer property management tools with built-in receipt generation features. These platforms also allow you to save receipts directly to your account, ensuring secure and organized storage. Once you fill in the necessary information, you can generate a professional receipt ready for download or email to your tenant.

Storing Receipts Securely

For easy access and protection against data loss, store your receipts in a cloud storage system. Google Drive, Dropbox, or OneDrive offer free and reliable storage solutions. Create folders by property or tenant to keep everything organized. Enable two-factor authentication to further secure your files. Regularly back up your documents and ensure they are easily searchable through clear naming conventions.

Ensure you clearly specify the date the payment was made and the rental period covered by the payment. This avoids confusion between the tenant and landlord regarding due dates and payment terms.

Detail the amount received, including any applicable fees or discounts, if relevant. This helps both parties track payments accurately and prevents misunderstandings.

Include a clear description of the rental property, such as the property address or unit number. This provides specific context for the transaction and differentiates it from other rental agreements.

Provide both parties’ names and contact information to ensure that the receipt is linked to the correct landlord and tenant, and can be referenced later if necessary.

Always include a payment method (e.g., cash, bank transfer, check) to clarify how the payment was made. This adds transparency and serves as a reference in case any disputes arise.

Sign the receipt with both the landlord and tenant signatures, ensuring the transaction is acknowledged by both parties.