To create a clear and legally sound receipt for rent multiple deposits, focus on including all necessary details. Each deposit should be listed separately with the corresponding amount, date, and purpose. This will ensure transparency and avoid any confusion between the tenant and landlord.

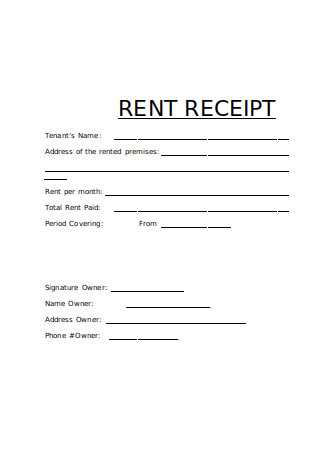

Include the tenant’s full name and the rental property address at the top of the receipt. Then, itemize each deposit: specify the deposit amount, the date it was received, and whether it’s for security, last month’s rent, or another purpose. This method makes it easy for both parties to track payments.

To avoid misunderstandings, provide a breakdown of how the deposits will be applied. Whether they’re refundable or applied to future rent payments, clarify the conditions for each deposit. A well-structured receipt can prevent potential disputes down the line.

Here is the revised version with minimal word repetition:

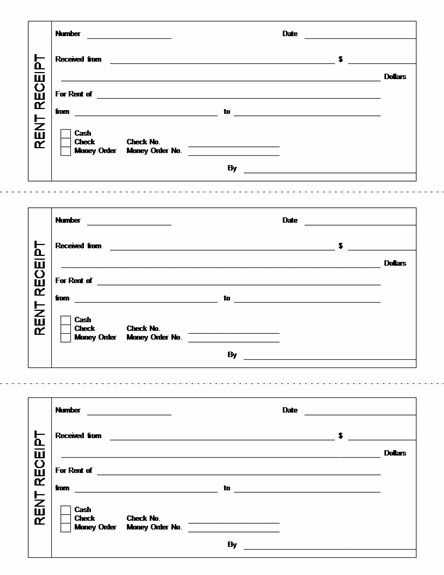

To create a rent receipt for multiple deposits, be clear about each transaction. List the date of payment, tenant details, the total deposit amount, and the breakdown of each payment. For multiple deposits, specify the portion of the total paid per deposit, and ensure each payment is documented separately.

Make sure to include any payment methods used (e.g., bank transfer, check, cash) and reference numbers for clarity. Include both the landlord’s and tenant’s signatures, along with a statement confirming receipt of the payment. This ensures both parties have a clear record of the transaction.

For added accuracy, consider organizing the information in a table format, separating deposits, dates, and amounts into distinct columns. This improves readability and prevents confusion in future disputes.

- Receipt for Multiple Rent Deposits Template

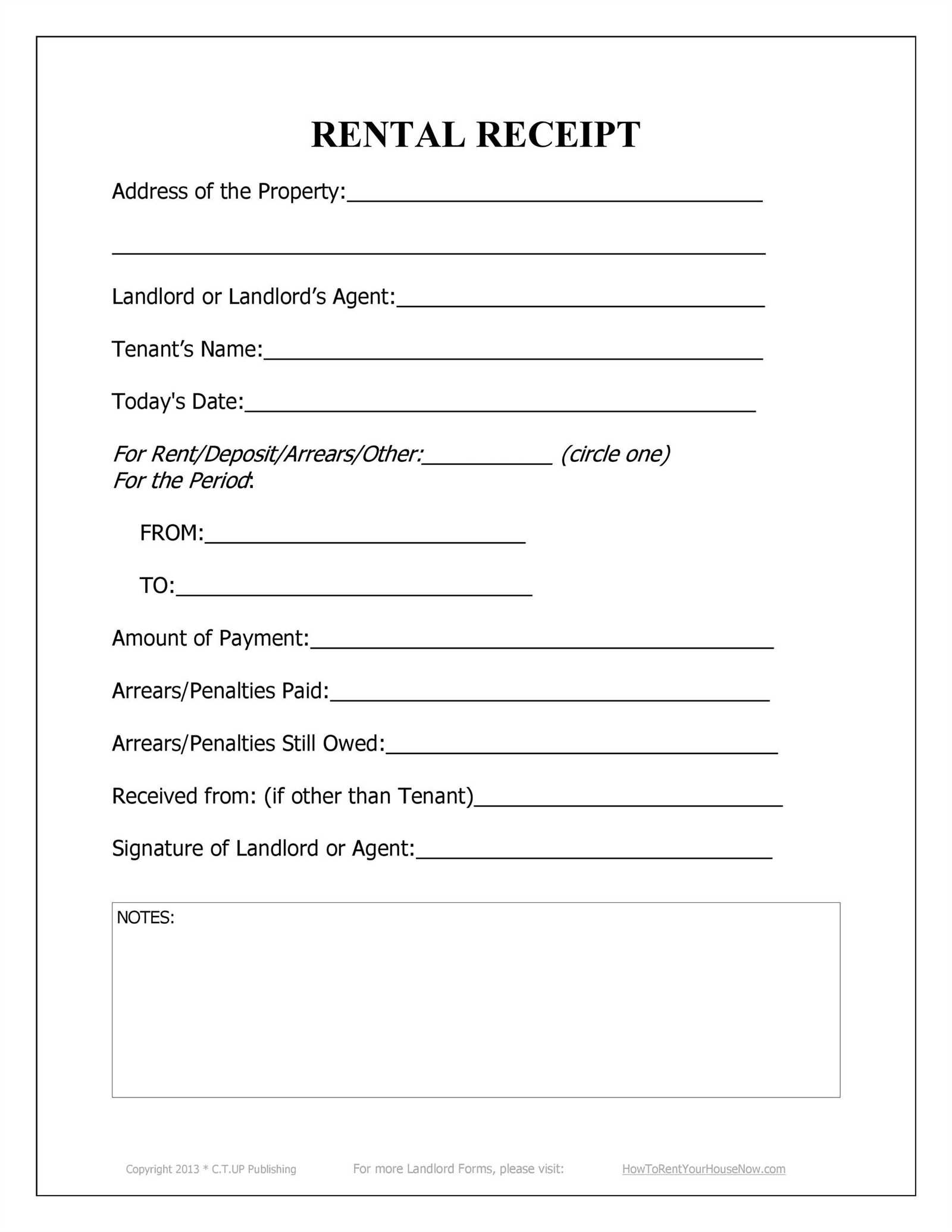

When creating a receipt for multiple rent deposits, it’s important to include clear details that track each payment individually. Each deposit should be listed with specific information, ensuring transparency for both the landlord and tenant. Below is a sample template that outlines the necessary fields to include in the receipt:

Key Information to Include

The receipt must clearly state the following details:

- The full name of the landlord and tenant

- Address of the rental property

- Date of each deposit

- Amount of each deposit

- Purpose of the deposit (e.g., security deposit, advance rent)

- Total amount received

- Signature of the landlord or their representative

Template Example

Use the following template to create a professional and accurate receipt for multiple rent deposits:

| Date | Deposit Amount | Purpose | Total Amount Received |

|---|---|---|---|

| MM/DD/YYYY | $XXX.XX | Security Deposit | $XXX.XX |

| MM/DD/YYYY | $XXX.XX | Advance Rent | |

| MM/DD/YYYY | $XXX.XX | Other (Specify) |

Ensure that each deposit entry is accurate and reflective of the actual transaction. The total amount received should match the sum of all deposits made. This template provides an organized way to maintain records, which can be helpful for both legal and financial purposes.

Clearly list each deposit amount, payment date, and the total sum in a logical order. This ensures that both parties are fully informed and have a clear reference for future transactions. Use a separate line for each deposit with details like the deposit number or reference code. This avoids confusion and helps in tracking individual payments.

Breakdown of the Receipt

Start with the header that includes the landlord’s and tenant’s details, along with the property address. After that, list each deposit made, with the corresponding amount, payment method, and the date it was received. Ensure the total is clearly marked at the bottom of the list.

Additional Information

If multiple payments are being made over time, specify how each deposit will be used–whether it’s for rent, maintenance, or other purposes. Clarify any terms for refunds or deductions. This makes the receipt more transparent and helps resolve any future disputes smoothly.

To accurately track multiple rent payments in a receipt, list each individual deposit separately with clear dates and amounts. Use a structured format to ensure transparency and clarity. Start by breaking down the payments by date, indicating whether each deposit was a partial or full payment. For example:

- Payment Date: January 5, 2025

- Amount: $500

- Payment Type: Partial Rent Payment

Follow this with additional payments, ensuring each one is itemized in the same way. This allows both the tenant and landlord to verify the full payment history. You can also include the balance remaining after each payment to maintain accurate records of any unpaid amounts. For example:

- Payment Date: January 15, 2025

- Amount: $700

- Payment Type: Full Rent Payment

- Remaining Balance: $0

Including this level of detail provides both parties with a clear view of the payment history, helping to prevent any misunderstandings. If you accept multiple payment methods, list each method (e.g., check, bank transfer, cash) to further clarify the transaction details. This can also be useful for record-keeping and accounting purposes.

Ensure that each receipt is clear about the specific deposit amount and corresponding rental period. The breakdown should include the type of deposit (e.g., security, pet, damage) and the amount allocated to each type. Avoid vague descriptions to prevent misunderstandings and legal disputes later on.

Maintain Clear Documentation

For each deposit received, issue a separate receipt indicating the date, amount, and purpose of the deposit. This allows both the tenant and the landlord to track and verify deposits for future reference. Include specific terms about the deposit refund process, such as time frames and conditions under which deductions may apply. This helps to avoid confusion when the tenant requests their deposit back after the lease ends.

Comply with Local Laws

Different jurisdictions may have specific rules about deposit handling and receipt issuance. Verify the deposit limits and refund requirements in your area. Some regions have strict guidelines on the maximum deposit amount or the timeframe for returning deposits after lease termination. Be sure your receipts reflect these legal requirements to avoid potential penalties or disputes.

- Double-check local laws regarding allowable deposit amounts and required disclosures.

- Ensure your receipts include any interest that may be owed on deposits, if required by law.

- Verify the documentation process for deposit returns, and include a clear statement on timelines and conditions for refunding any amount.

It’s advisable to keep a copy of each receipt for your records, alongside any communications regarding the deposits, to ensure proper tracking and legal protection in case of disputes.

Receipt for Rent Multiple Deposits Template

To properly document multiple deposits for rent, use a structured receipt template that avoids overuse of terms like “receipt” and “deposits.” Each deposit should be listed clearly, with a corresponding amount, date, and description. This allows both landlord and tenant to track payments efficiently. For example, “Deposit for Apartment 3B: $1,000 on February 1st” is clear and avoids redundancy.

Key Details to Include

Each entry should have the following information: the date the deposit was made, the specific amount, and any relevant notes about the rental period. Keep your entries brief but precise. Example: “Deposit for January 2025: $800.” This keeps everything concise while still conveying the necessary information.

Best Practices

Avoid unnecessary repetition by limiting the frequency of terms like “receipt” and “deposit” in the same sentence. Instead, focus on the details that matter, such as amounts and dates. For clarity, a summary of all deposits made over the rental period can be included at the end of the document, with each transaction listed by date.