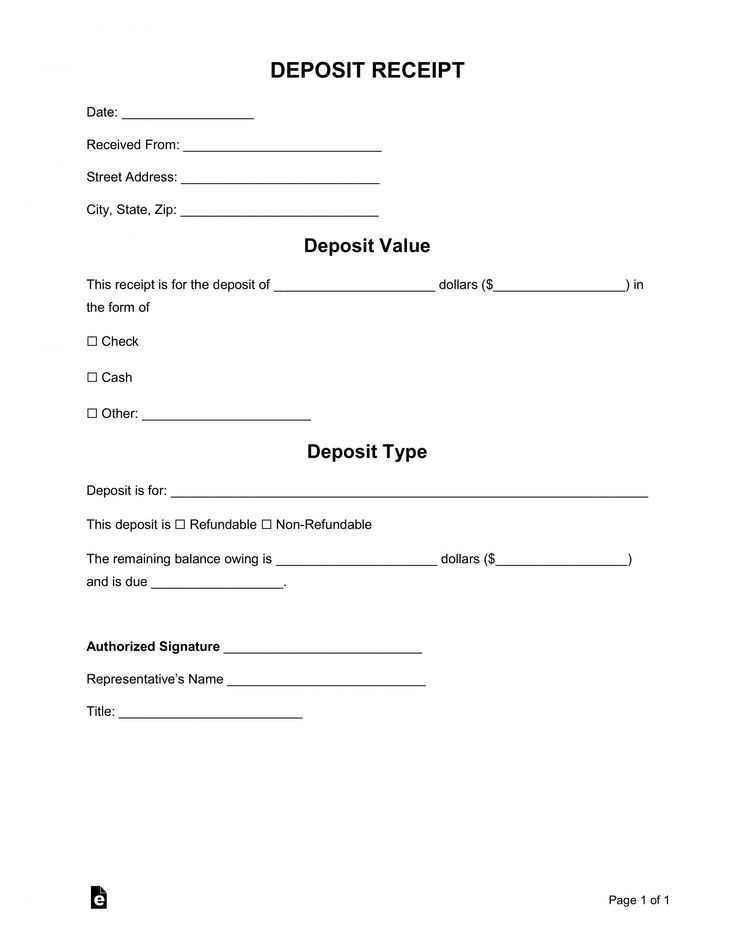

When renting a property, providing a clear and accurate receipt for the deposit ensures both the tenant and the landlord are on the same page. A well-crafted receipt eliminates confusion and creates a paper trail that can be useful in case of disputes. Use the template below to ensure that your receipt meets all necessary legal and financial requirements.

The deposit receipt should include the date of the transaction, the amount received, and the details of the rental property. Always make sure that both the landlord and tenant have signed the document, as it serves as proof of the deposit paid. Keep a copy for your records, and offer the tenant a copy as well.

Ensure the receipt contains the tenant’s name, address of the rental property, and the agreed-upon amount for the deposit. This will help avoid any potential misunderstandings. Including the terms of the rental agreement regarding the return of the deposit can also offer both parties clarity on the process.

Here’s the revised version:

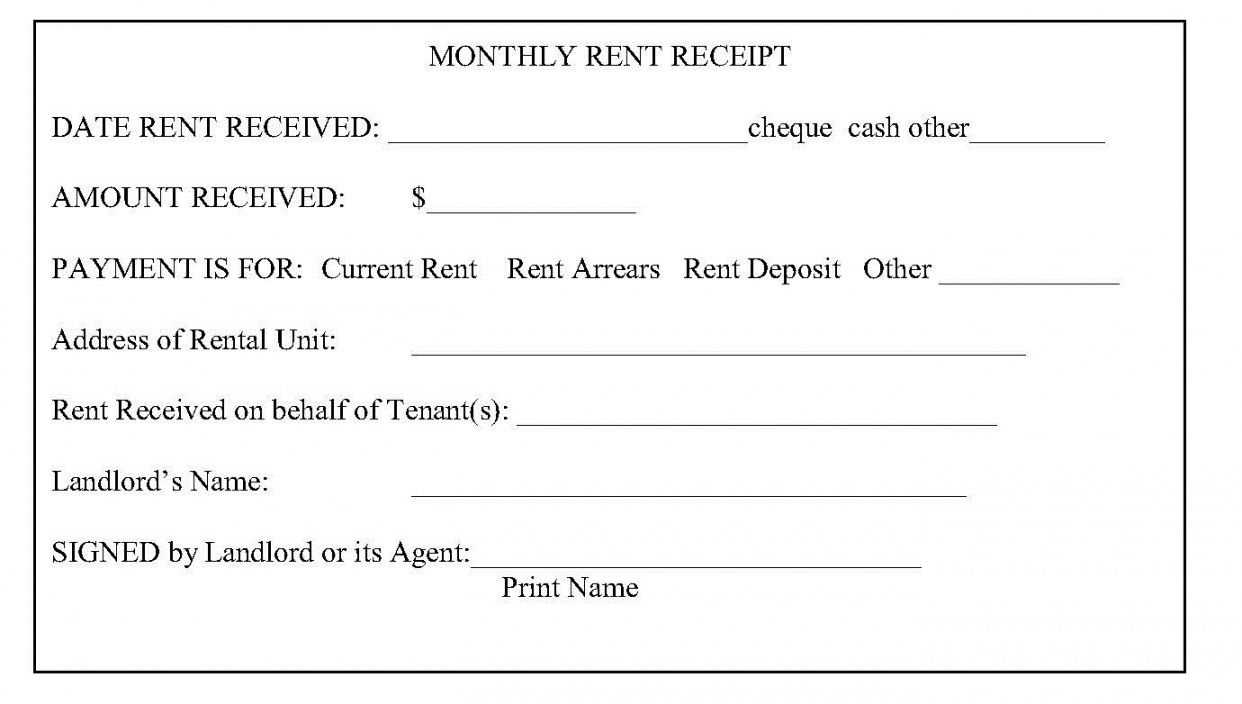

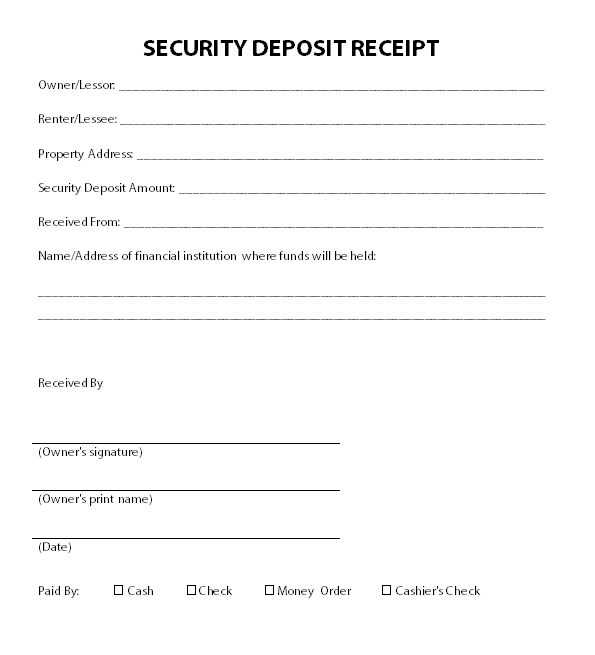

The deposit receipt for rent serves as proof of the transaction between the tenant and the landlord. Make sure to include the following details when preparing the receipt:

- Landlord and Tenant Information: Include the names and contact details of both parties.

- Property Address: Specify the rental property’s address clearly.

- Deposit Amount: State the exact amount received as a deposit.

- Payment Date: Note the date on which the deposit was paid.

- Rental Period: Mention the rental period the deposit covers, if applicable.

- Refund Terms: Include any conditions for refunding the deposit after the lease ends.

- Signatures: Both landlord and tenant should sign the receipt to confirm agreement.

Example Format:

- Landlord: John Doe

- Tenant: Jane Smith

- Property Address: 123 Main St, Apartment 4B

- Deposit Amount: $1,200

- Payment Date: February 12, 2025

- Refund Terms: Deposit to be refunded within 30 days after lease ends, subject to property inspection.

Using this format ensures clarity and reduces misunderstandings between the parties involved. Make sure to provide a copy of the receipt to the tenant for their records.

- Receipt of Deposit for Rent Template

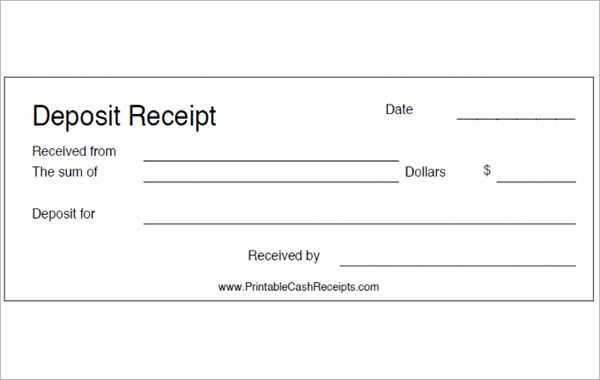

Use this template to create a clear and straightforward receipt for a rental deposit. This document should detail the amount paid, the purpose of the deposit, and any relevant terms. Here’s a simple format you can follow:

Receipt Details

Include the date the deposit was received, the amount, and the payment method. Clearly specify that the payment is for the rental deposit of a property. It’s crucial to indicate whether this deposit is refundable or non-refundable based on your agreement with the tenant.

Additional Information

Provide information about how the deposit will be used, such as if it will cover damages, unpaid rent, or other charges. Mention any terms and conditions that apply, such as the deadline for returning the deposit after the tenant vacates the property. Always ensure both parties have a signed copy for reference.

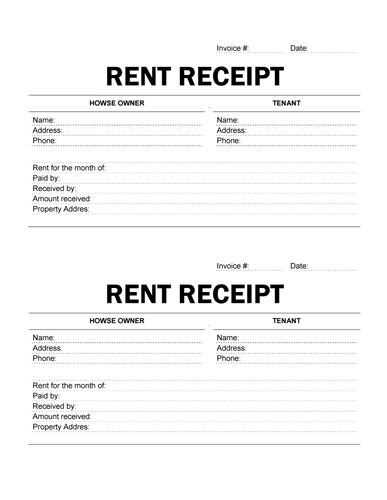

To create a clear and straightforward rent receipt, include the following details:

1. Tenant and Landlord Information: Clearly list the tenant’s name and address, along with the landlord’s name and contact information. This helps both parties identify the agreement easily.

2. Payment Amount: Specify the exact amount paid by the tenant. Include the currency to avoid any confusion.

3. Payment Date: Record the date on which the payment was made. If it’s a partial payment, mention the date and amount paid so far.

4. Rent Period: Mention the period the payment covers, such as “Rent for the month of February 2025.” This ensures that both parties are clear about which timeframe the payment applies to.

5. Payment Method: Indicate how the payment was made (e.g., cash, check, bank transfer). If it’s via bank transfer, include the transaction reference number for easy tracking.

6. Receipt Number: Assign a unique receipt number to each payment for better tracking and record-keeping. This can help resolve any future disputes.

7. Signature: The landlord’s signature confirms receipt of the payment. You can also include a line for the tenant’s signature if needed.

8. Additional Notes: If necessary, add a section for any additional remarks, like late fees or early payment discounts.

Include the following key details in the deposit receipt to ensure clarity and accuracy for both parties:

- Tenant’s Full Name: Clearly list the tenant’s full legal name.

- Landlord’s Full Name: Include the landlord or property manager’s full name.

- Deposit Amount: State the amount of the deposit, both numerically and in words.

- Property Address: Specify the full address of the rental property.

- Payment Method: Note how the deposit was paid (e.g., cash, check, bank transfer).

- Deposit Purpose: Clearly state the purpose of the deposit (e.g., security deposit, advance rent).

- Date of Payment: Indicate the exact date the deposit was received.

- Receipt Number: Assign a unique receipt number for tracking and reference.

- Tenant’s Acknowledgment: Provide space for the tenant’s signature, confirming receipt of the deposit.

- Landlord’s Acknowledgment: Include a space for the landlord’s signature to acknowledge receipt.

These details will provide a clear and enforceable record of the deposit transaction, protecting both the tenant and landlord.

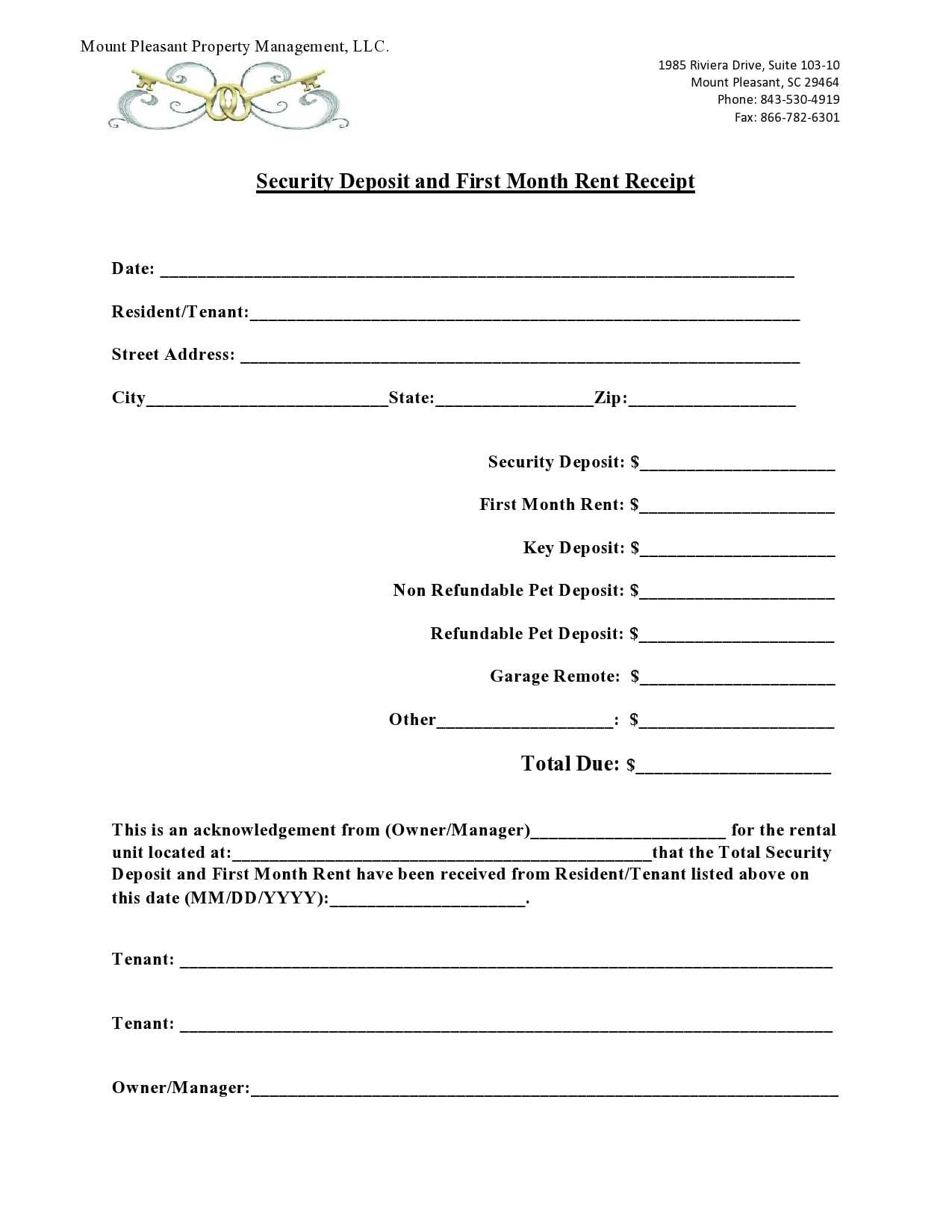

Make sure to provide a deposit receipt with clear details to protect both landlord and tenant. The receipt should specify the amount paid, the purpose of the deposit, and the payment date. This is critical for transparency and to avoid future disputes over the deposit.

The receipt should also outline the terms under which the deposit may be returned, including any deductions for damages or unpaid rent. Make it clear how long the landlord has to return the deposit after the tenant vacates the property. Many jurisdictions have specific timeframes, such as 30 days, within which this must occur.

Ensure that the receipt includes the names of both parties involved in the transaction. This confirms the agreement between the landlord and the tenant. Including the address of the rental property helps to establish the context of the deposit.

Do not forget to keep a copy of the receipt for your records. Both parties should have a copy to prevent misunderstandings and provide evidence in case of legal disputes.

| Item | Description |

|---|---|

| Deposit Amount | Specify the exact amount paid by the tenant |

| Purpose of Deposit | Clarify that it is for rental security or another purpose |

| Return Terms | Detail the conditions under which the deposit is refundable |

| Landlord and Tenant Information | Include names and contact details for both parties |

| Property Address | Clearly state the address of the rental property |

Issuing a comprehensive deposit receipt not only complies with local laws but also sets clear expectations for both parties involved. Ensure that the receipt covers all required details to prevent future disputes and ensure fairness.

Receipt of Deposit for Rent Template

Include a clear breakdown of the deposit amount. Specify the rental property address, tenant name, and the date the deposit was received. Make sure to note the deposit’s purpose, such as security or damage protection, and clarify any conditions under which it may be refunded.

List the payment method used for the deposit, such as bank transfer or cash. Provide both the total amount and any applicable taxes or additional fees. If applicable, mention any previous deposits or adjustments made by the tenant.

Always include a statement confirming the tenant’s understanding of the terms regarding the deposit’s return, specifying the conditions under which deductions may be made (for example, damages or unpaid rent). Also, state the time frame for returning the deposit once the rental agreement ends.

Conclude with both the landlord and tenant signatures, along with the date of agreement. This ensures both parties acknowledge the transaction and the terms set out in the receipt.