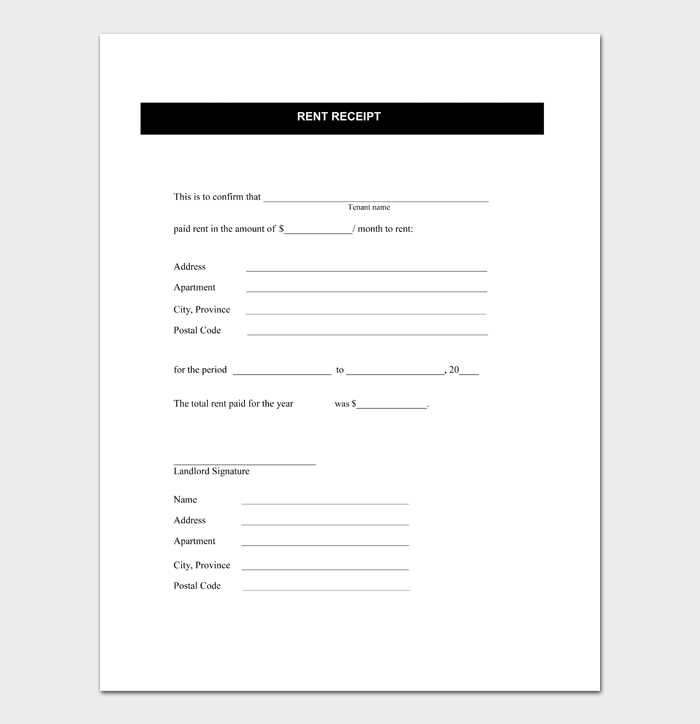

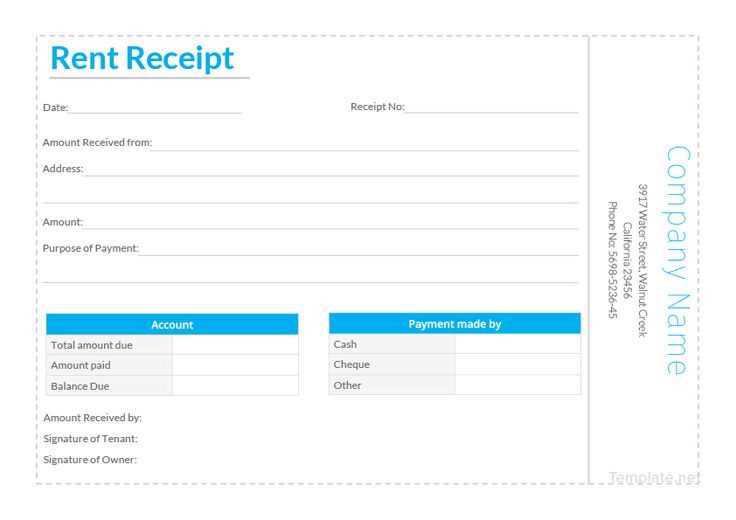

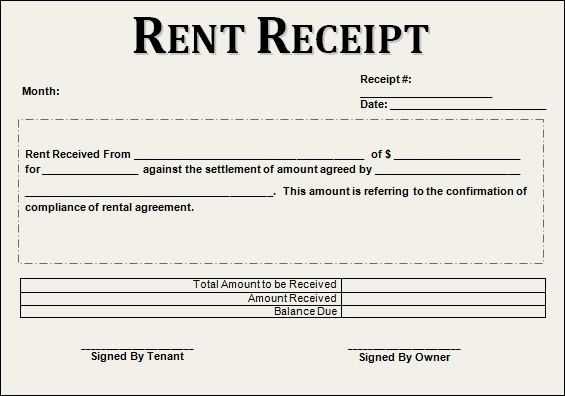

A well-structured rent advance receipt helps landlords and tenants keep accurate financial records. It should include key details such as payment amount, date, payer’s name, recipient’s name, and property address. Adding a unique receipt number ensures better tracking.

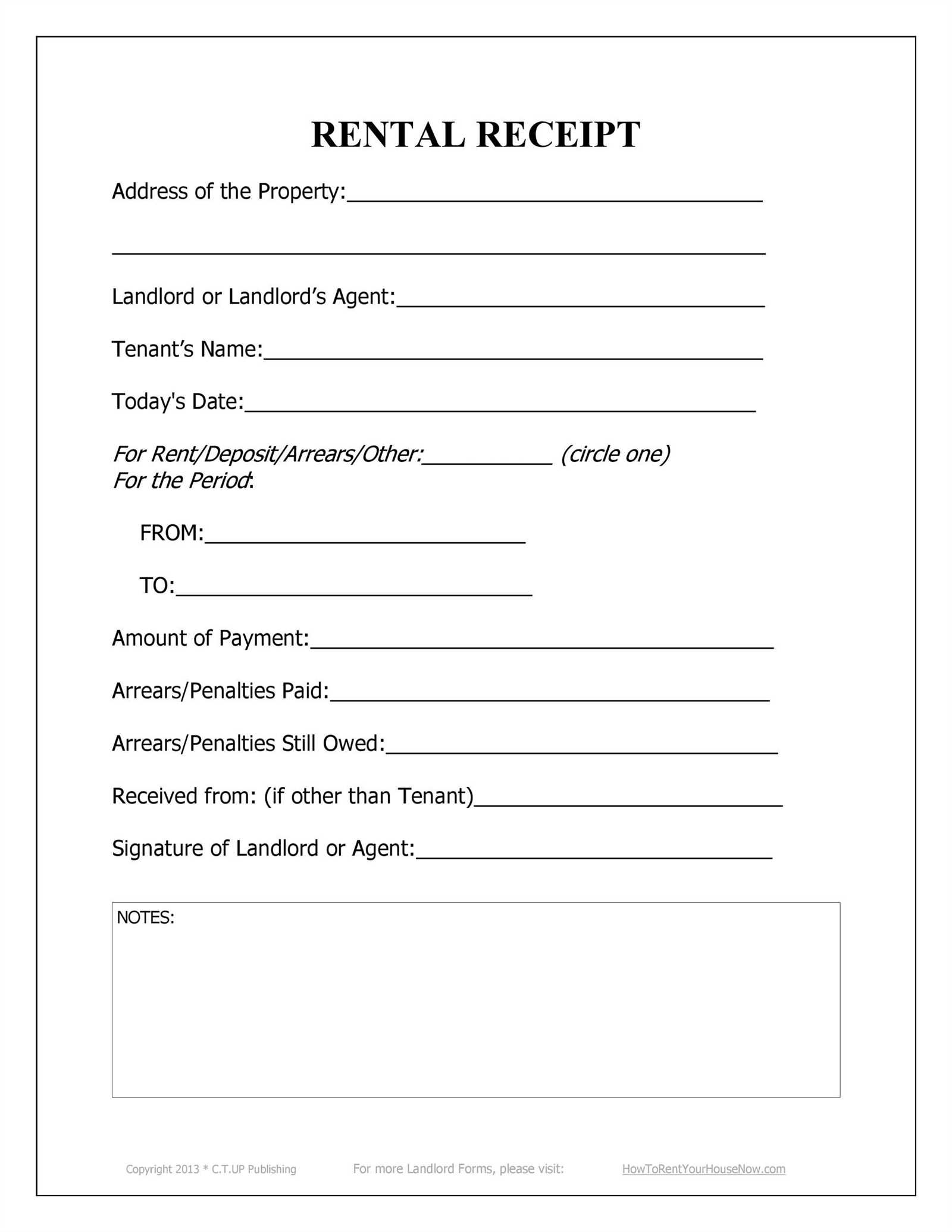

Clarity and accuracy are essential for avoiding disputes. Always specify whether the advance covers a specific period or serves as a security deposit. If multiple payments are involved, outline the schedule to prevent misunderstandings.

For added security, both parties should sign the receipt. A digital or printed copy ensures that records remain accessible. Using a standardized template simplifies the process, saving time while maintaining consistency in documentation.

Here’s a version without excessive repetition:

When creating a rent advance receipt template, keep it clear and concise. Focus on including essential information such as the tenant’s name, the amount paid, the date of payment, and the rental period. The layout should be simple, with each detail separated clearly for easy reading.

Key Elements to Include

Make sure to include the full name of the landlord and tenant. Specify the payment method and reference any receipts or transaction numbers. Add a brief statement acknowledging the receipt of the payment. It’s helpful to indicate the rent period this advance covers, whether it’s for a month, quarter, or longer. Lastly, ensure the landlord signs and dates the document for validation.

Formatting Tips

Use bold text for headings and section titles to improve readability. Ensure the text size is consistent, and leave enough space between sections to avoid clutter. It’s also helpful to include a footer with the landlord’s contact details in case of any questions or concerns.

- Rent Advance Receipt Template

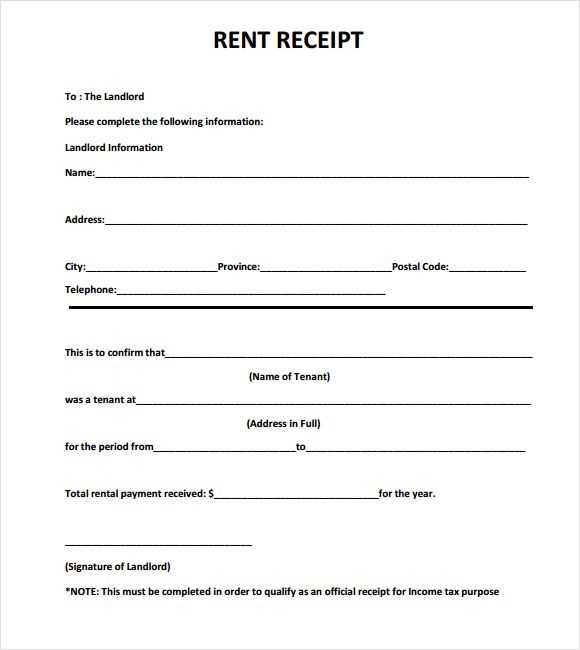

A rent advance receipt template should include key information to make the transaction clear and legally binding. Start by listing the tenant’s name and landlord’s name at the top, followed by the address of the rental property. Clearly state the amount of rent paid in advance and the date of payment. Add a reference to the lease agreement and specify the rental period it covers.

It’s important to note the payment method (e.g., check, bank transfer, or cash) and provide a space for both parties to sign, acknowledging the receipt. Include a receipt number for record-keeping purposes. If the advance payment is refundable, mention the conditions under which it would be returned.

For clarity, a rent advance receipt template should also contain a statement of the remaining balance after the advance is applied. This ensures both the tenant and landlord have a clear understanding of the outstanding amount for future payments.

For a clear and accurate record of advance payments, include the following elements:

- Recipient Details: The full name and contact information of the party receiving the payment.

- Payment Amount: The exact sum paid in advance, ensuring it is stated clearly.

- Payment Date: The date on which the payment is made, which serves as a reference point for future transactions.

- Payment Method: Specify the method used for the payment (e.g., bank transfer, cheque, or cash).

- Purpose of Payment: Clearly outline what the advance payment is for, such as rent, services, or goods.

- Balance Due: Mention any remaining balance if applicable, to avoid confusion.

- Signature: Include the signature of the payer and recipient to confirm the agreement.

- Agreement Reference: If the payment is related to a larger contract, reference that agreement for clarity.

These elements ensure that the payment record is complete, transparent, and legally binding.

Begin by including the title “Prepaid Rent Receipt” at the top of the document. Ensure the date of payment is clearly stated, along with the payment amount and the rental period it covers. Include both the payer’s and the landlord’s names, along with their contact information, for easy identification.

Specify the rental property’s address and any relevant details, such as the rental agreement number, to avoid confusion. A clear description of what the prepaid amount covers–whether it’s rent, security deposit, or any other charges–should follow. This helps ensure the purpose of the payment is unmistakable.

Ensure that the receipt includes a statement confirming that the rent has been paid in advance, followed by the amount received. The payment method should also be recorded, whether it’s via check, bank transfer, or cash. Finally, provide a signature line for the landlord or authorized representative, along with the date of the receipt’s issuance.

Ensure rental prepayments are clearly documented in writing. A rental prepayment agreement should detail the amount, due date, and conditions for refunds. Both parties need to agree on how the prepayment will be applied to the rental term, specifying whether it will count towards rent or be held as a deposit. In some jurisdictions, landlords must return prepayments if the tenant vacates early, unless specified otherwise in the agreement.

It’s essential to check local laws regarding limits on prepayments. Some areas restrict the amount a landlord can request upfront. Make sure to adhere to these regulations to avoid disputes. Additionally, tenants have the right to request a receipt for any prepayment made, and landlords must provide this to ensure transparency.

Ensure the lease agreement explicitly addresses what happens in case of disputes over prepayments. Clearly outline procedures for returning funds, or what happens if either party breaks the agreement. In case of an eviction, the landlord may be required to refund any unused portion of the prepayment, depending on the jurisdiction.

Lastly, it’s critical to distinguish between a prepayment and a security deposit. These are two separate financial obligations with different legal implications, so make sure the terms are clearly defined in the contract.

Digital receipts offer fast, secure, and convenient storage, which allows tenants and landlords to access them anytime. They eliminate the risk of losing physical documents and can be easily backed up. Paper receipts, on the other hand, require physical storage and are vulnerable to damage or loss, making them less reliable for long-term record-keeping.

Key Differences

When choosing between digital and paper rental receipts, consider these factors:

| Aspect | Digital Receipts | Paper Receipts |

|---|---|---|

| Storage | Stored electronically; easily accessible on devices | Requires physical storage space |

| Security | Encrypted and backed up on cloud or digital platforms | Vulnerable to theft, loss, or damage |

| Environment Impact | Eco-friendly, reduces paper waste | Uses paper, contributing to waste |

| Access | Accessible on multiple devices anytime | Requires physical retrieval and can be misplaced |

| Convenience | Can be sent via email or text, reducing delays | Printed and delivered by hand, leading to delays |

Recommendations

Opt for digital receipts if you prioritize convenience and security. They offer immediate access and prevent the challenges of physical storage. However, if you need a traditional approach, paper receipts can still be useful, but ensure they are stored in a safe, organized manner to avoid loss or damage.

Ensure that you correctly list all required details in your advance payment documentation. Missing or incomplete information can lead to confusion or disputes later. Here are key points to avoid:

1. Inaccurate Amounts

Double-check the amount mentioned in the receipt against the agreed-upon terms. A mismatch can result in complications when reconciling payments. Always confirm the exact sum paid and ensure it’s written correctly in the document.

2. Missing Dates

Omitting the payment date or the due date for the full amount can cause confusion for both parties. Including precise dates helps clarify expectations and makes tracking easier.

3. Lack of Detailed Descriptions

Simply stating “advance payment” without specifying what the payment is for can create misunderstandings. Include details about the services or goods covered by the advance to avoid any ambiguity.

4. Absence of Signatures

Without signatures from both parties, the document may not hold legal weight in some situations. Ensure that both the payer and payee sign the receipt for validation.

5. Missing Payment Methods

Not stating the method of payment (e.g., bank transfer, cash, check) can complicate record-keeping. Always specify how the payment was made to track financial transactions accurately.

Adapt the receipt’s format based on the specifics of the rental agreement. For fixed-term leases, include the lease period, specifying the start and end dates. In the case of month-to-month agreements, adjust the language to reflect the ongoing nature, noting the payment due date each month. If there are special conditions such as late fees or maintenance charges, clearly itemize these in the receipt for transparency.

For shared accommodation agreements, specify the tenant’s share of the rent, especially if utilities or other services are included in the payment. In agreements with multiple tenants, list the amount each tenant contributed to avoid confusion.

If a deposit is collected in addition to rent, ensure the receipt clearly states whether it is refundable or non-refundable. Adjust the language accordingly depending on whether it’s intended to cover damages or simply serve as security.

For rent-to-own or lease-to-own agreements, outline the portion of the rent that contributes towards the purchase price of the property. Clearly state how much is applied to the purchase amount and what remains as rental income.

Make sure your rent advance receipt template includes clear and precise details. The amount, date, and property information should be visible. It’s helpful to state the purpose of the payment, whether it’s for the first month, a security deposit, or any other specific reason. Also, ensure that both the tenant and landlord’s contact information is included. This will help avoid confusion or issues later on.

Important Details to Include

Include the tenant’s full name, address, and contact number. The landlord’s details should also be clearly written. Ensure that the payment amount, any taxes or additional charges, and the total amount paid are stated accurately. Also, note the method of payment, whether cash, check, or bank transfer. Finally, provide a signature section for both parties to acknowledge the receipt.

Formatting Tips

Keep the receipt clean and professional by using a clear, legible font. Make sure the format is easy to read, with each section well-organized. A proper layout can make a huge difference when it comes to clarity, especially for future reference or potential disputes.