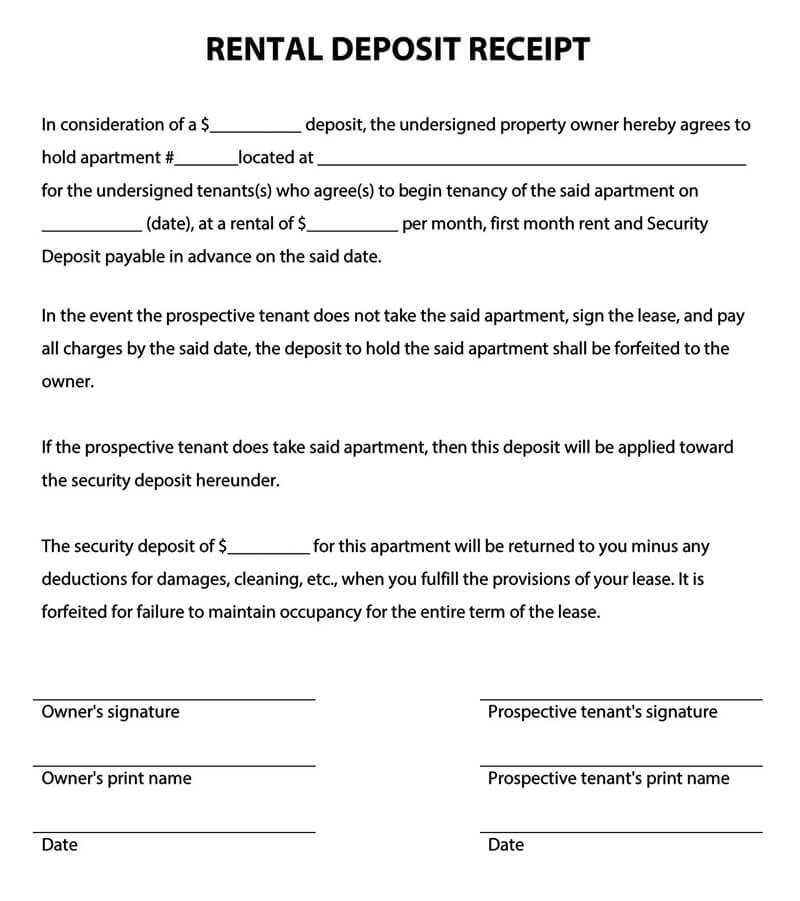

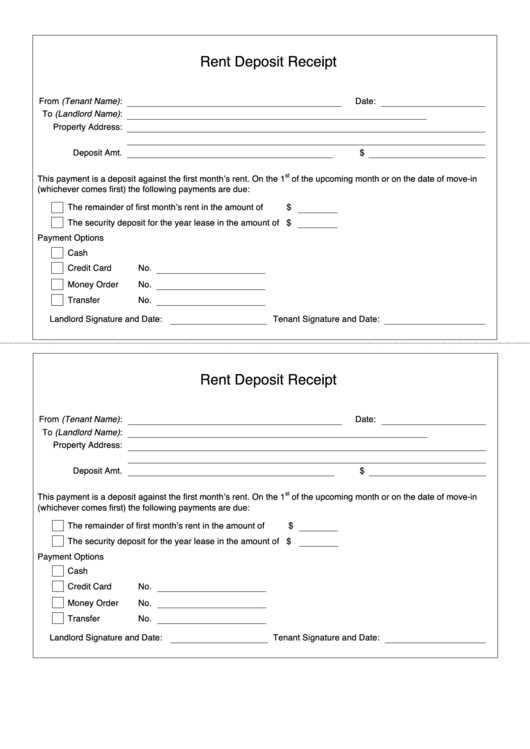

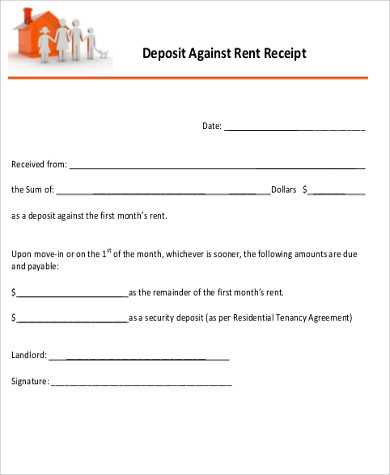

To ensure clear communication and smooth transactions, it’s important to use a rent and deposit receipt template that includes all necessary details. This template serves as proof of payment, protecting both tenants and landlords from misunderstandings. It should include the amount paid, the date of payment, the rental period, and any conditions related to the deposit.

Include spaces for both the tenant’s name and the landlord’s name, as well as the rental property address. Clearly note the amount paid for both rent and deposit, specifying the payment method if applicable. If the deposit is refundable, include this detail along with any conditions for its return, such as deductions for damages or unpaid rent.

The template should also feature a signature section for both parties, affirming that the terms of the transaction have been understood and agreed upon. By using a well-structured receipt, you ensure both parties have a record of the transaction and are protected should any disputes arise later.

Sure! Here’s the updated version with minimal repetition:

Include clear and concise headings in your receipt template to enhance readability. Label each section properly, such as “Rental Amount” and “Deposit Details”, to help both parties quickly locate essential information.

Clearly state the rental amount, payment frequency, and due date. This prevents confusion later. Include a line for the deposit amount and specify whether it’s refundable or not.

Specify the payment method accepted (e.g., bank transfer, cash, check) along with any transaction reference numbers for future reference. It’s helpful to include space for the date the payment was made.

Make sure to state the length of the rental period. Adding a “Start Date” and “End Date” clearly indicates the rental duration, which avoids disputes later.

It’s also important to include a section for both parties to sign, ensuring mutual agreement. Don’t forget to leave room for contact information for easy communication in case of issues or inquiries.

Lastly, consider using a professional, simple layout that allows for easy customization. This way, the receipt can be adapted for different rental scenarios without unnecessary complexity.

- Rent and Deposit Receipt Template

A rent and deposit receipt serves as a formal document to acknowledge payments made for renting property. It outlines the amount of rent paid, the deposit amount, and the rental period. Ensure the template includes key details such as the tenant’s name, the property address, the total amount paid, and the dates of payment. A well-structured receipt reduces misunderstandings and provides clear evidence of the transaction.

Key Information to Include

In a rent and deposit receipt, include the following elements:

- Tenant’s Name: Full name of the tenant making the payment.

- Landlord’s Name: Full name or business name of the landlord.

- Property Address: Address of the rental property.

- Payment Amount: Specify the rent and the deposit amounts separately.

- Date of Payment: Date the rent and deposit were received.

- Rental Period: Start and end dates of the rental agreement.

- Payment Method: Cash, check, bank transfer, etc.

- Signature: Landlord’s or agent’s signature for validation.

Template Example

Here is an example layout for a rent and deposit receipt template:

------------------------------------------ Rent and Deposit Receipt ------------------------------------------Tenant Name: [Tenant's Full Name]Landlord Name: [Landlord's Full Name or Business Name]Property Address: [Rental Property Address]Payment Details: Rent Amount: [Amount]Deposit Amount: [Amount]Total Paid: [Total Amount]Payment Date: [Date]Rental Period: [Start Date] to [End Date]Payment Method: [Cash/Check/Bank Transfer]Signature: ___________________________Date: [Date]

Using this format ensures that all critical information is captured clearly, providing both parties with a reference for future transactions. Customize the template to fit specific needs or preferences, but always keep it concise and accurate.

Begin by clearly stating the names of both parties involved. Include the landlord’s and tenant’s full names, addresses, and contact information. This will help both parties easily identify the receipt’s relevance and validity.

Include Specific Transaction Information

Make sure the receipt clearly states the amount paid, the method of payment, and the date the payment was made. If applicable, include a breakdown of the amount, such as rent, deposits, or additional fees. This adds transparency to the receipt and helps avoid any misunderstandings later on.

Provide Clear Identifiers for the Transaction

Use a unique receipt number for easy reference. Including the property address or unit number can further clarify which rental agreement the receipt is related to. The date and purpose of the payment should also be listed to specify what the payment covers.

| Details | Information |

|---|---|

| Landlord Name | [Full Name] |

| Tenant Name | [Full Name] |

| Property Address | [Address] |

| Amount Paid | [Amount] |

| Payment Method | [Cash, Bank Transfer, etc.] |

| Date of Payment | [Date] |

| Receipt Number | [Unique Number] |

| Payment Purpose | [Rent, Deposit, etc.] |

Make sure to include a statement confirming the payment was received. This provides a formal acknowledgment and secures both parties. Also, avoid including unnecessary information that doesn’t pertain directly to the payment, keeping the document clear and to the point.

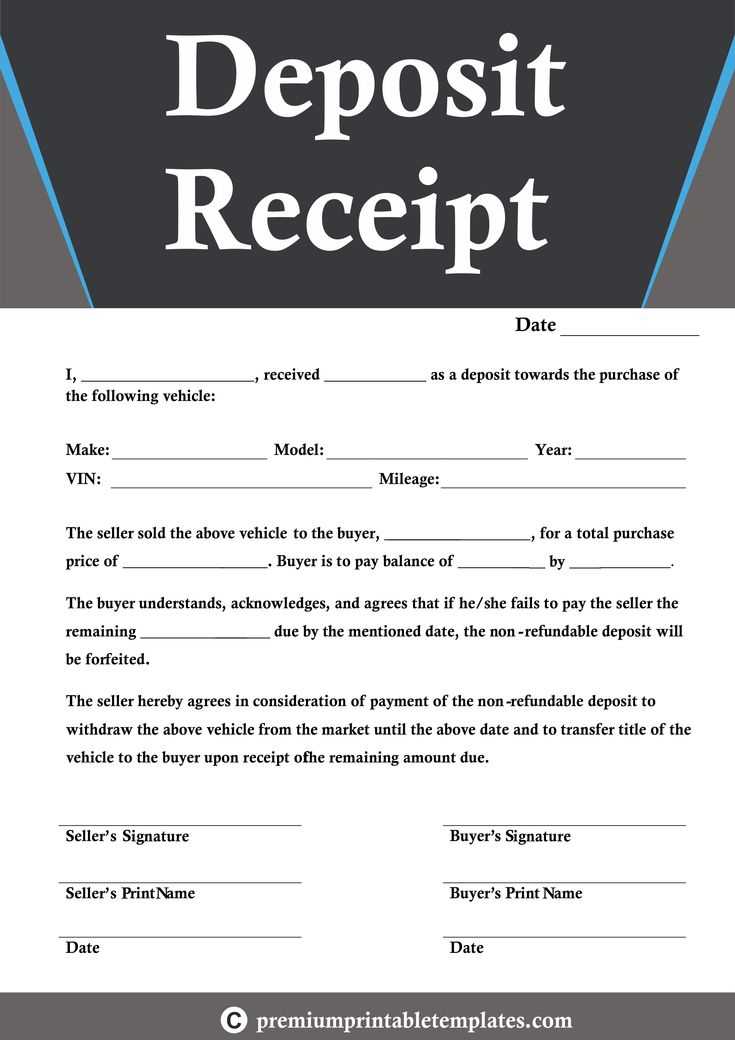

The deposit document should clearly state the amount of the deposit paid. Include the exact sum in both words and figures to avoid confusion.

Identifying information such as the full names of both the tenant and the landlord is crucial. It ensures that the document is valid and correctly attributed to the parties involved.

Next, include the address of the property for which the deposit is made. This provides clarity on the purpose of the deposit and ties it to a specific location.

Date of the deposit must be listed, marking the exact day the transaction was completed. This helps track any issues related to timing or refund claims.

Clarify the deposit terms, specifying conditions for its return or deductions. Define what damages or issues may lead to partial or full retention of the deposit.

It’s helpful to specify any amount deducted from the deposit if applicable. This transparency reduces misunderstandings regarding the final settlement.

Lastly, provide signatures of both parties to confirm agreement. This serves as official acknowledgment of the terms outlined in the document.

Rent and deposit receipts are crucial legal documents for both landlords and tenants. They serve as proof of payment and are often required in case of disputes. A receipt must include clear details such as the date of payment, the amount paid, the property address, and the terms of the rental agreement. Including the name of the payer and payee is also a common practice to avoid ambiguity.

From a legal standpoint, the receipt should reflect the specifics of the lease agreement. This includes outlining whether the deposit is refundable and under what conditions it may be withheld. It’s also recommended to state if the deposit covers damages, unpaid rent, or other fees. In some jurisdictions, landlords are legally required to provide receipts for any deposit paid, so tenants should always request one for their records.

For tenants, holding onto the receipt is important for securing their right to a refund at the end of the lease term. If the landlord fails to return the deposit or provides incorrect or incomplete receipts, tenants have grounds to challenge the claim. Legal action might be required if disputes arise regarding the amount or conditions of the deposit refund.

Both parties should keep copies of the receipt as evidence in case of court involvement. A well-documented receipt protects both the tenant and landlord from legal challenges and provides a clear paper trail for any potential disputes.

Ensure your rental receipts are clear and structured. Begin with the landlord’s name, contact details, and the rental property address at the top. This provides immediate identification and clarity.

Next, include the tenant’s name and contact details. Ensure this is accurate and matches the lease agreement. This helps avoid confusion and ensures both parties are clearly identified.

The receipt should clearly list the rental amount paid, the payment date, and the rental period it covers. This helps prevent any misunderstandings and provides a record of payment for both parties.

Always mention the payment method used–whether it was cash, check, bank transfer, or another form. This adds transparency and records the transaction clearly.

Be sure to include the security deposit amount, if applicable, and any adjustments or deductions made, providing a brief explanation if necessary. This prevents future disputes regarding the deposit.

End the receipt with a section for the landlord’s signature and the date of the transaction. This signature serves as proof of receipt and confirms the payment was received in full.

Ensure the receipt is easy to read by maintaining a clean layout. Use a standard font and sufficient spacing to separate different sections for a neat appearance.

Ensure all details are clear and accurate, as vague or incomplete terms can lead to misunderstandings. Here are some common errors to avoid:

- Unclear Payment Terms: Specify the rent amount, due date, and late payment penalties. Ambiguity can create disputes later.

- Missing Signatures: Both parties must sign the document. Failure to do so can make the agreement unenforceable.

- Overlooking Maintenance Responsibilities: Clearly outline who is responsible for property upkeep. If this isn’t addressed, you may face unexpected repair costs.

- Incorrect Lease Term: Clearly define the start and end dates. A vague or incorrect term may cause confusion or disputes when it’s time to vacate.

- Not Including Security Deposit Details: Be specific about the deposit amount and conditions for return. A lack of detail can lead to legal issues over the deposit.

- Neglecting to Address Subletting: If subletting is allowed, define the rules. Otherwise, include a clause that prohibits it to avoid complications.

- Not Following Local Laws: Make sure your lease complies with local rental laws. Inaccurate clauses can lead to legal issues down the line.

Adjusting a rental receipt template requires focusing on the specific details of each situation. Here are the key steps to tailor your document accordingly:

- Identify the type of rental: Determine if it’s for residential, commercial, or equipment rental. Each scenario involves different terms, such as duration, payment frequency, and any additional conditions (e.g., maintenance for equipment).

- Modify payment terms: Specify the amount due, payment method, and due dates. For long-term rentals, include a section for monthly rent, while short-term agreements may require a daily rate or total charge for the duration of the lease.

- Define deposit requirements: Add clauses for refundable or non-refundable deposits. Make sure to clarify the conditions for deposit return (e.g., after property inspection or equipment condition check).

- Include special conditions: For specific types of rental, such as vacation homes or commercial spaces, include details like insurance requirements, maintenance responsibilities, or subletting policies.

- Set dates and times: Specify the rental start and end dates clearly. For recurring rentals, you may want to note the renewal period, such as monthly or yearly.

- Clarify any additional charges: List extra costs that may apply, such as late fees, utilities, or repair costs. Ensure these charges are explained in a transparent manner.

- Customize signatures: Ensure space for both landlord and tenant signatures. Depending on the scenario, you might need to include the signature of a witness or a guarantor.

By adjusting these aspects based on the rental situation, your receipt template will be fully aligned with the specific rental agreement requirements.

Make sure to include the rental period clearly on the receipt, specifying the start and end dates. This prevents confusion about payment timelines and sets expectations for both parties.

Outline the total rent amount and any deposits, making a distinction between the two. List each payment separately with its corresponding date to ensure transparency. It’s also useful to note any specific terms related to the deposit, such as conditions for refunding it after the rental period.

Include the name of the property owner or landlord, along with their contact details. This ensures that in case of disputes, communication can be easily initiated. Also, include the tenant’s name and address to validate the receipt.

Make sure to specify the method of payment–whether it’s by cash, check, or electronic transfer. This documentation helps prevent misunderstandings about how payments were made.

Lastly, add a space for signatures from both the landlord and tenant. Having both parties sign confirms agreement to the terms outlined and serves as a record of the transaction.