If you’re managing rental payments, having a reliable rent cash receipt template is a must. This simple tool helps both landlords and tenants keep accurate records of payments made and received. A well-organized receipt ensures transparency and avoids any misunderstandings about rent transactions.

Choose a template that includes all the necessary details: tenant and landlord information, payment amount, date, and property details. Make sure to add a unique receipt number for easy tracking. This small but powerful step prevents confusion and serves as a clear reference for both parties.

Using a consistent format for your receipts builds trust with your tenants and keeps your rental business running smoothly. It’s a quick way to maintain financial organization and avoid potential issues down the road.

Here are the revised lines with reduced word repetition:

To enhance the clarity of your rent cash receipt, eliminate unnecessary word repetition while keeping it concise. Use straightforward language to present details. Replace redundant terms with more specific alternatives where possible. Below is an example showing how to rewrite common phrases in a more direct manner.

| Original Text | Revised Text |

|---|---|

| Received payment for the rent payment made on this date. | Payment for rent received on this date. |

| The amount of rent due was calculated as per the rental agreement terms. | The rent due amount follows the rental agreement terms. |

| The receipt was issued for the payment of rent for the month of January. | This receipt confirms the rent payment for January. |

| Rent has been paid for the period from January 1st to January 31st. | Payment covers rent from January 1st to 31st. |

By simplifying your sentences and eliminating repetitive words, you improve the document’s readability. These adjustments make the receipt clearer and more professional.

- Rent Cash Receipt Template

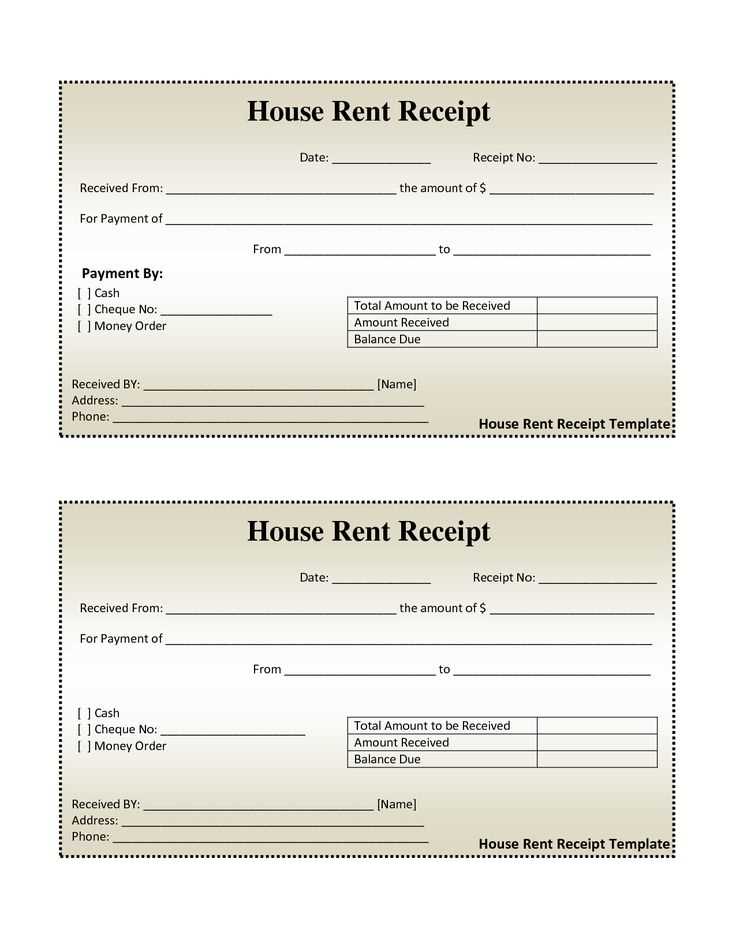

To create a clear and functional rent cash receipt template, focus on the key details: the amount paid, the date, the tenant’s name, and the address of the rented property. A simple layout with these elements ensures transparency and accuracy for both parties.

Start by including the tenant’s name and the property address at the top. This clearly identifies the involved parties and the location of the rental. Below that, list the payment amount in both numerical and written forms, reducing any chances of confusion.

Make sure to specify the payment date and payment method (cash, check, etc.). This helps track transactions easily. It’s also a good idea to leave space for additional notes, like a brief mention of any outstanding balances or agreements for future payments.

Finally, a receipt number at the bottom adds a professional touch and makes it easier to refer back to the transaction if needed. Keep the template simple and easy to update for each payment received.

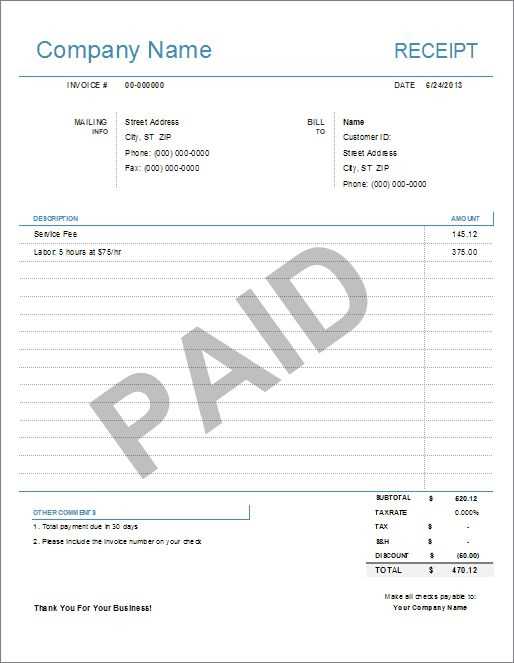

To create a custom receipt template for rent payments, include these key details: the landlord’s and tenant’s full names, the rental property address, payment amount, payment date, and the payment method used (e.g., cash, bank transfer). Add a unique receipt number for tracking purposes. You should also specify the rental period (e.g., month or year) and clarify whether the payment covers the entire rent due or just a partial amount.

Use simple and clear formatting to ensure all critical details are easy to read. For the header, include your business or personal name along with your contact details. Beneath that, insert a section for the tenant’s name and address information, then provide space for the payment details such as the amount, payment date, and method. This structure creates an easy-to-understand format that both parties can reference quickly.

If you want to go the extra mile, add a section for any additional comments or notes, such as overdue balances, late fees, or future payment terms. This helps maintain clarity and avoids confusion down the line.

Finally, save your template in a convenient format (PDF or Word) so you can easily adjust it for each new transaction. Use templates in word processing software like Microsoft Word, Google Docs, or specialized rental management tools to streamline the process.

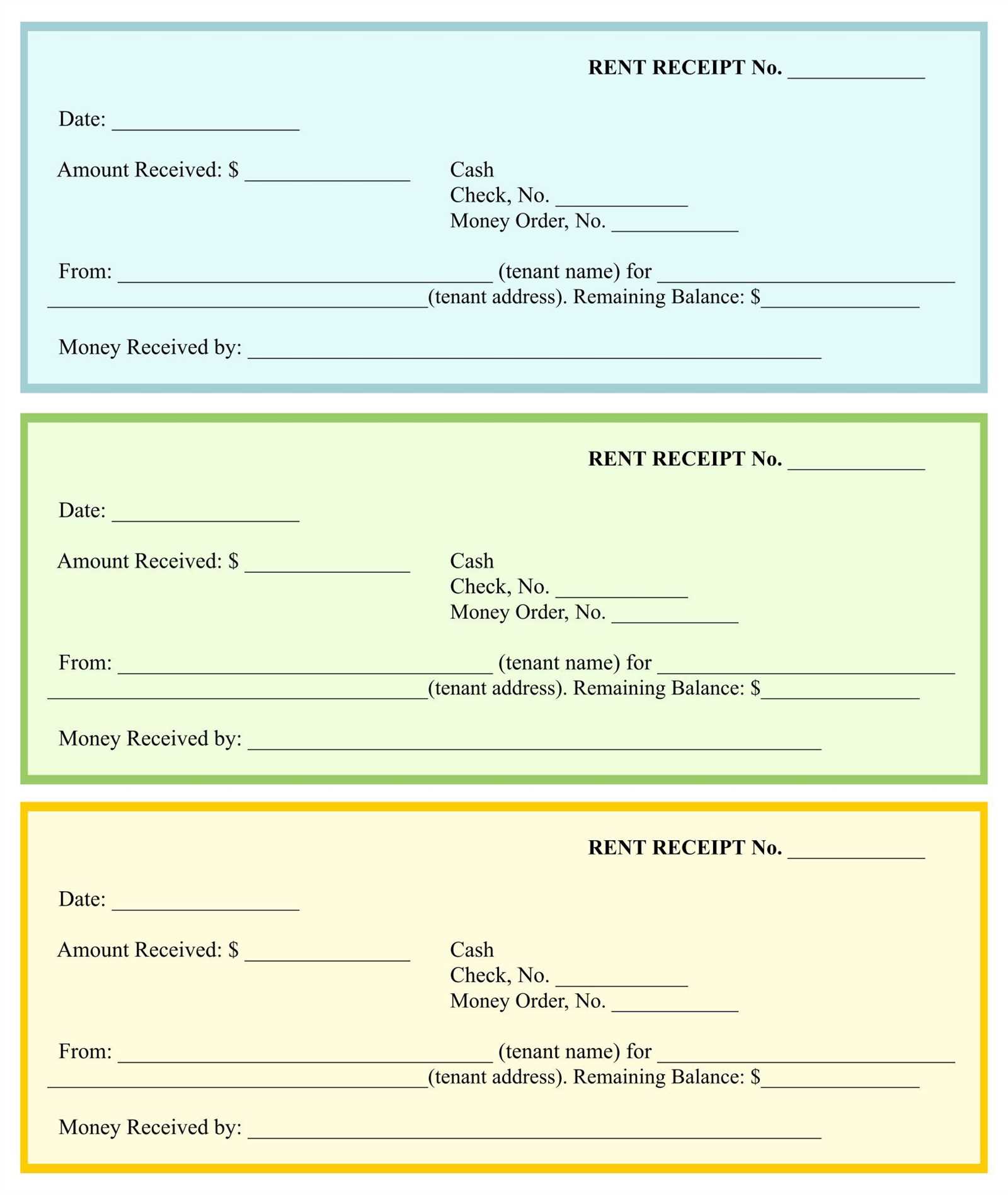

Clearly display the rental period–specify the start and end dates of the payment period. This helps both the landlord and tenant confirm the time frame for which the rent is paid.

Include the tenant’s full name and the rental property address. This ensures there is no confusion about who is renting the property and where the payment applies.

State the amount of rent paid. Be specific about the figure, and avoid any ambiguity by listing the exact payment amount, including any additional charges or deductions (such as late fees).

List the payment method used. Whether it’s cash, check, or bank transfer, clarifying this reduces any potential misunderstandings about how the transaction occurred.

Provide the receipt number for tracking. This unique identifier makes it easier for both parties to reference past transactions and simplifies record-keeping.

Sign the receipt. A signature from the landlord or property manager serves as official confirmation of the payment received and adds a layer of accountability.

Ensure all relevant details are filled out correctly before issuing a cash receipt. This includes the tenant’s full name, the rental period, and the exact amount paid. Incorrect or missing information could lead to confusion and disputes later on.

- Leaving out the date – Always include the date of the transaction. Without it, it becomes unclear when the payment was made, which could create problems for both the landlord and tenant.

- Incorrect payment method details – If the payment was made in cash, specify the amount received. If using a check or bank transfer, note the reference number or transaction ID to avoid ambiguity.

- Failing to sign the receipt – Both parties should sign the receipt. A signature proves that both the landlord and tenant acknowledge the transaction took place, and serves as proof in case of disputes.

- Not providing a copy – Never forget to give the tenant a copy of the receipt. Both parties should have a record of the payment for future reference.

- Inconsistent or unclear wording – Avoid vague phrases or unclear language. Be specific about the rental payment, including details such as rent for a specific month or late fees, if applicable.

- Overlooking partial payments – If the tenant has made only a partial payment, make sure this is clearly noted. Specify how much remains due and any potential late fees that could apply.

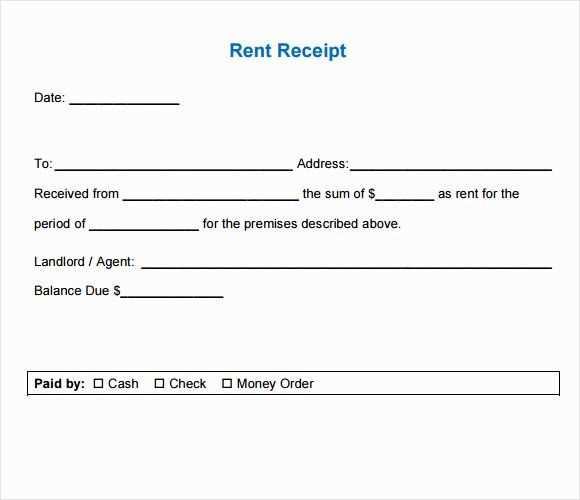

For a clear and simple rent cash receipt template, begin by listing the tenant’s name and the rental property’s address at the top of the document. Include the date of the transaction, the amount paid, and the rental period covered by the payment. This ensures both parties have a record of the payment’s details.

Next, specify the payment method used, such as cash, check, or bank transfer. This helps avoid confusion and serves as a reference in case of disputes. Always indicate whether the payment was made in full or if it is a partial payment.

Ensure there’s a section for the landlord’s signature and the tenant’s signature. Both parties should sign the receipt as acknowledgment of the transaction. Include a line for any additional notes or comments, such as adjustments for late fees or other charges, if applicable.

Finally, keep a copy of the receipt for your records. Providing a duplicate for the tenant ensures transparency and allows both parties to easily access the details of the transaction in the future.