A clear and well-structured rent deposit receipt helps both tenants and landlords keep track of financial transactions. This document serves as proof of payment, outlining the amount received, payment method, and relevant details about the rental agreement.

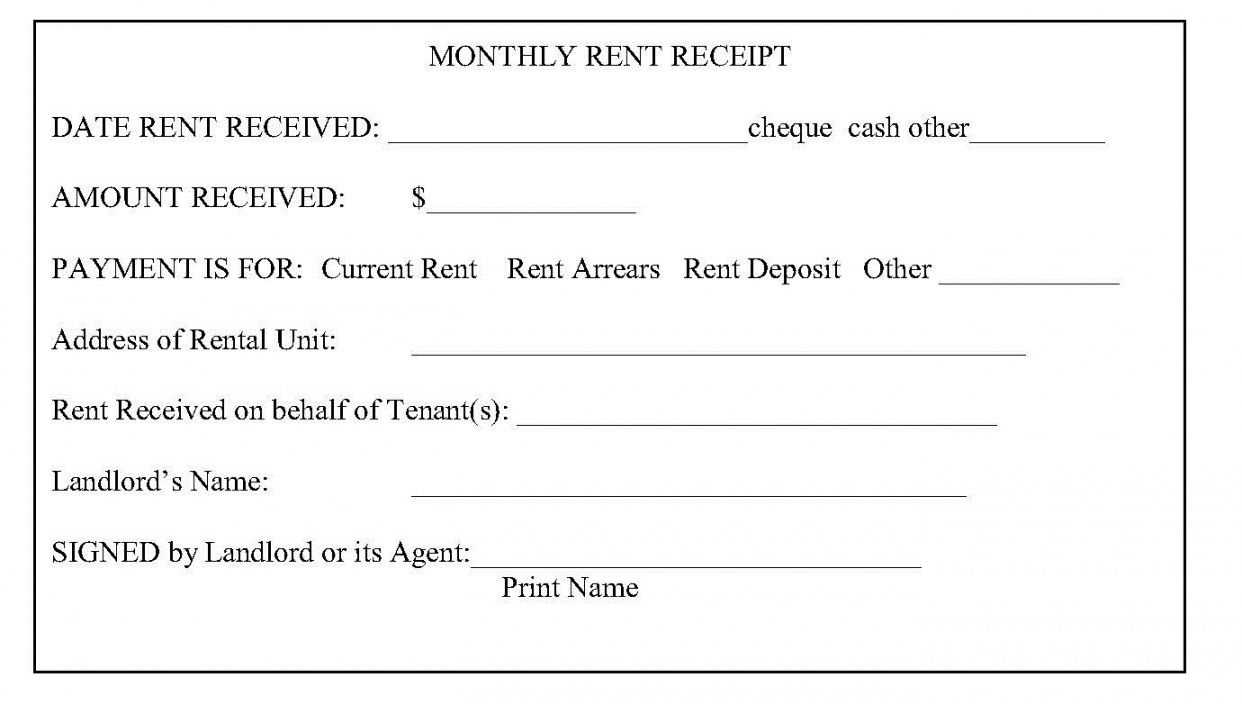

Include essential details such as the tenant’s name, landlord’s name, rental address, deposit amount, payment date, and method of payment. Clearly stating these elements reduces misunderstandings and provides both parties with legal protection.

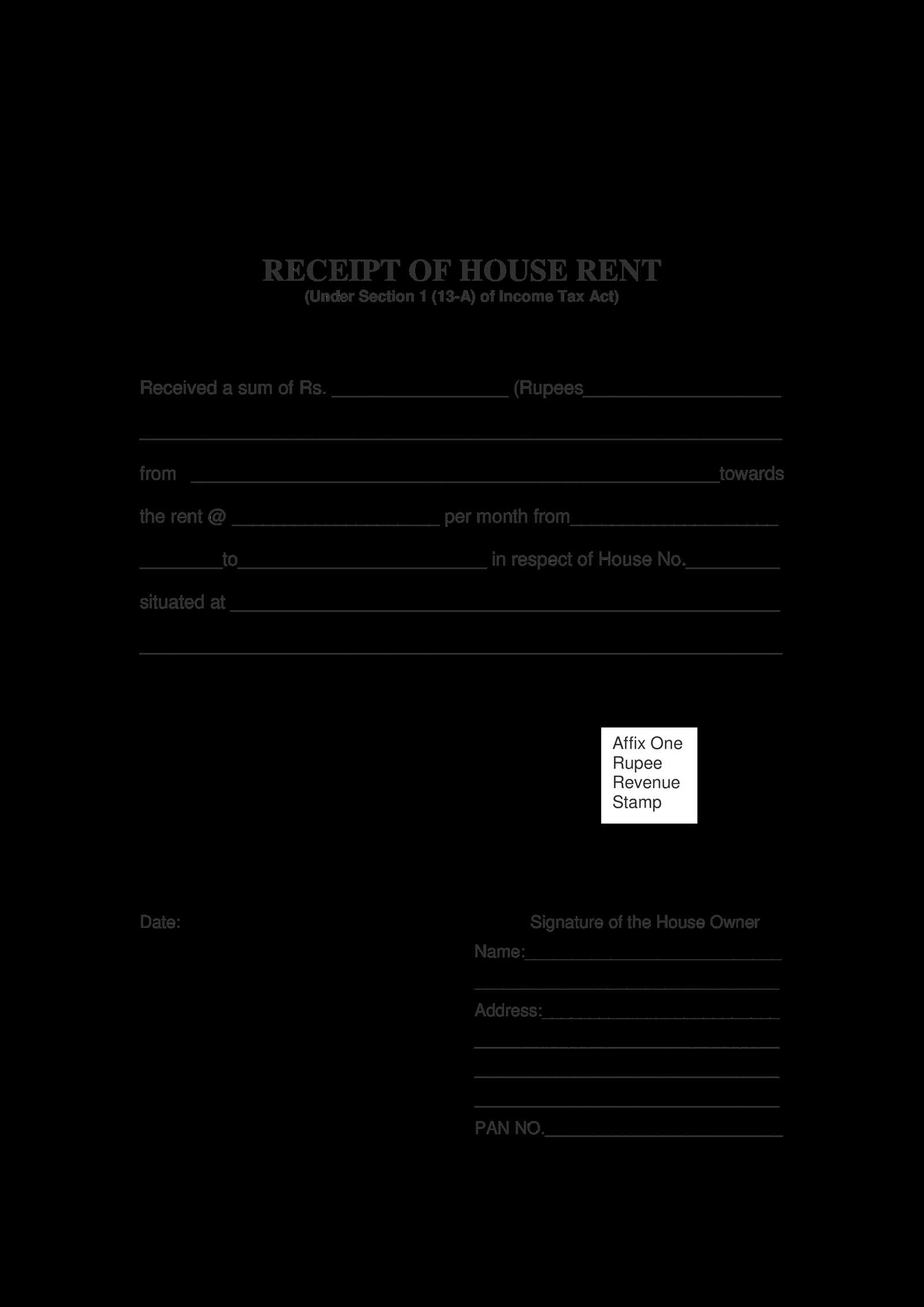

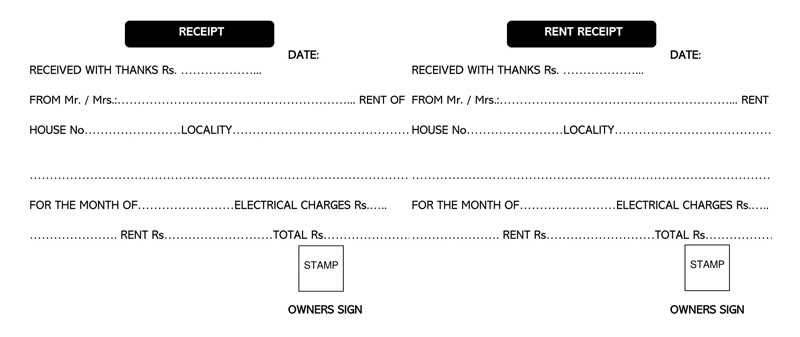

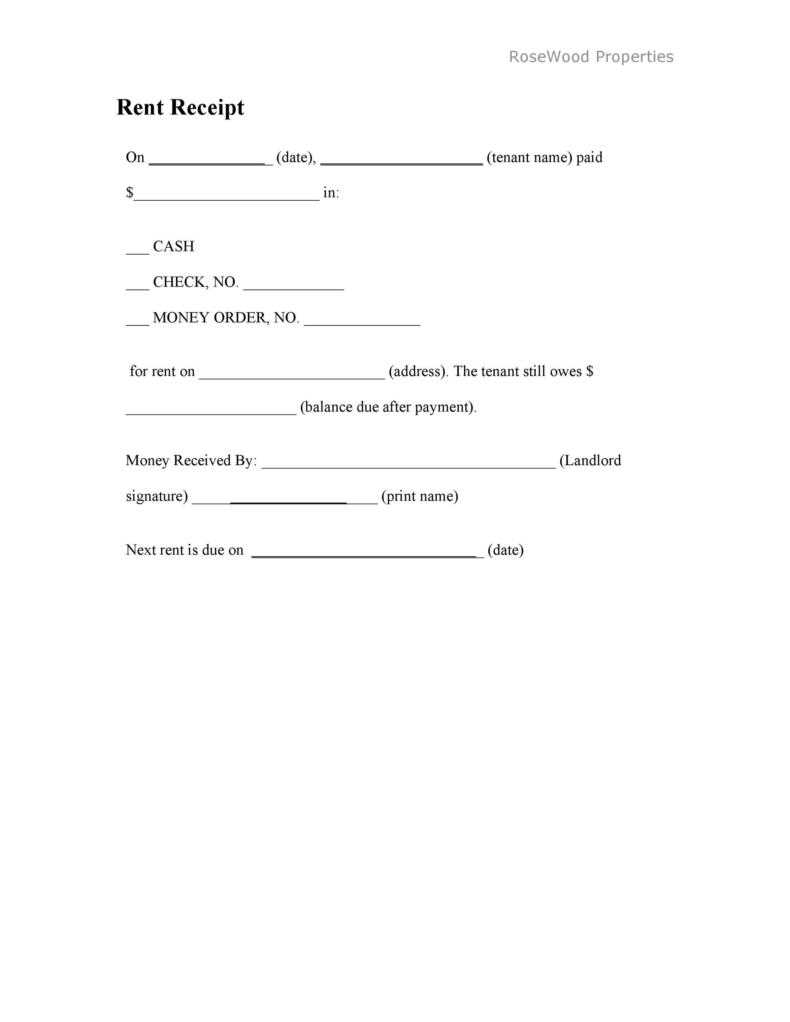

For added clarity, a simple template should follow a standard format. Begin with a title like “Rent Deposit Receipt”, followed by the names of both parties. Specify the amount received in both numerical and written form, ensuring accuracy. Add a note confirming the purpose of the deposit–whether it covers potential damages or unpaid rent.

Conclude with the landlord’s signature and contact information. Providing a signed receipt reassures the tenant and serves as an official record for future reference. A well-prepared document saves time and prevents disputes, making it a valuable part of any rental process.

Here’s the revised version with reduced repetition:

Provide a rent deposit receipt that clearly outlines key details. Include the tenant’s name, rental property address, payment amount, and date. Specify the payment method, such as bank transfer, check, or cash.

| Detail | Information |

|---|---|

| Tenant Name | John Doe |

| Property Address | 123 Main Street, Apartment 4B |

| Deposit Amount | $1,200 |

| Payment Date | February 9, 2025 |

| Payment Method | Bank Transfer |

Include a statement confirming receipt of the deposit and mention any conditions for its refund. Both parties should retain a signed copy for reference.

- Rent Deposit Receipt Simple Template for Tenants

Use a clear and structured format for your rent deposit receipt to ensure transparency. Include key details to avoid disputes and provide proof of payment.

Essential Information to Include

- Date: The exact date the deposit was received.

- Tenant’s Name: Full legal name of the tenant.

- Landlord’s Name: Full legal name of the landlord or property manager.

- Property Address: The complete address of the rental unit.

- Deposit Amount: The exact amount received, stated in the agreed currency.

- Payment Method: Cash, check, bank transfer, or other methods.

- Purpose of Deposit: Security, last month’s rent, or other specified reasons.

- Landlord’s Signature: Confirmation that the payment has been accepted.

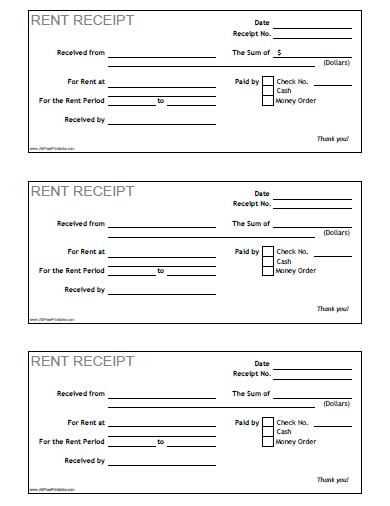

Simple Receipt Template

Copy and fill in this template to create a complete receipt:

Rent Deposit Receipt Date: [MM/DD/YYYY] Tenant Name: [Full Name] Landlord Name: [Full Name] Rental Address: [Full Address] Deposit Amount: $[Amount] Payment Method: [Cash/Check/Bank Transfer] Purpose: [Security Deposit/Last Month’s Rent] Landlord Signature: __________ Tenant Signature (if required): __________

Providing a detailed receipt protects both parties and ensures a smooth rental process.

Full Names and Contact Details: List the landlord’s and tenant’s legal names along with their addresses and phone numbers. This ensures clarity on both ends.

Property Address: Specify the exact rental property location to avoid any misunderstandings about the covered premises.

Deposit Amount and Payment Method: Clearly state the amount received, the currency, and whether it was paid via cash, check, or bank transfer.

Date of Payment: Record the exact date the deposit was received to establish a verifiable timeline.

Purpose of Deposit: Explain what the deposit covers, such as damages, unpaid rent, or key replacement.

Terms for Refund: Outline the conditions under which the deposit will be returned or deductions may apply.

Landlord’s Signature: Include a signature or digital confirmation from the landlord to validate the receipt.

Copy for Tenant: Always provide the tenant with a copy for their records to prevent disputes.

Use a clear structure with distinct sections for easy reading. Begin with the receipt title, followed by the date and a unique receipt number for tracking. Include the payer’s and recipient’s full names and contact details.

Specify the payment amount in both numerical and written forms to prevent misunderstandings. Clearly state the payment method, whether cash, check, or electronic transfer. Add a description of the payment purpose, such as “Security Deposit for Apartment [Address].”

Ensure all amounts are itemized if necessary. For example, separate the deposit from other charges. If applicable, mention any balance due or confirmation of full payment. Use consistent fonts and spacing for readability.

Conclude with the recipient’s signature or business stamp to validate the receipt. If sent digitally, include a note confirming its authenticity. Keep copies for record-keeping.

Include the full name of the tenant and landlord, the rental property address, and the exact payment amount to ensure clarity. Specify the payment date and method, whether cash, check, or electronic transfer, to create a verifiable record.

Use clear language to state whether the payment covers rent, a security deposit, or other fees. If the receipt confirms a deposit, mention whether it is refundable and under what conditions. Ensure compliance with local laws by checking if interest must be paid on held deposits.

Sign the receipt or include the issuing party’s name and contact details for legitimacy. Keep a copy for your records and provide one to the tenant for reference in case of disputes. Digital receipts should include a timestamp and be stored securely to prevent unauthorized alterations.

Missing Key Details

Ensure the receipt includes the tenant’s full name, rental address, deposit amount, payment date, and payment method. A vague or incomplete document can lead to disputes or misunderstandings. Always use precise terms and avoid abbreviations that could create confusion.

Lack of Signatures

Without signatures from both parties, the receipt may not hold legal weight. Always require the landlord and tenant to sign the document to confirm the transaction. This simple step can prevent conflicts about payment acknowledgment.

Avoid handwritten receipts that are difficult to read. Typed documents ensure clarity and professionalism. If issuing a digital receipt, send it as a PDF to prevent unauthorized edits. Clear formatting and structured content make the receipt easy to reference when needed.

Choose a printable PDF template if you prefer a structured format that can be filled out by hand or digitally. Many templates include fields for tenant name, rental period, payment amount, and method, ensuring all details are clearly documented.

For a more flexible option, use a digital rental receipt template in Word or Google Docs. These formats allow quick edits and customization, making them ideal for landlords who need to adjust details frequently.

Spreadsheet templates in Excel or Google Sheets offer automatic calculations and tracking. They work best for landlords managing multiple tenants, providing a clear overview of payment history.

Whichever format you choose, ensure the template includes date, amount, payer and payee details, and payment confirmation. A well-structured receipt prevents disputes and keeps records organized.

A deposit receipt serves as undeniable proof that a tenant has paid the required amount before moving in. Presenting this document can resolve disputes and confirm financial transactions.

Submitting Proof to the Landlord

- Provide a copy of the receipt when asked for payment verification.

- Ensure the document includes the date, amount, and both parties’ names.

- Request a signed acknowledgment if handing over a paper copy.

Using the Receipt for Financial Records

- Keep a digital and printed version for personal records.

- Use it when applying for reimbursement if the deposit is deducted incorrectly.

- Show it to a new landlord when proving rental history.

When retrieving the deposit, present the original receipt if the landlord disputes the amount. A well-kept record prevents unnecessary conflicts and ensures smooth financial dealings.

So the meaning is preserved without overusing the phrase “rent deposit receipt.”

Include key details on the receipt, such as the tenant’s name, address, the amount paid, and the date of the transaction. Ensure you note the payment method, whether it was cash, check, or bank transfer. This ensures clarity and transparency for both parties.

In addition, the receipt should specify any terms or conditions related to the deposit, such as if it’s refundable or non-refundable, and under what circumstances it may be withheld. This helps prevent misunderstandings later on.

It is important to keep a copy of the receipt for future reference. Both the tenant and landlord should have one. This serves as proof of the transaction and can be used if any disputes arise regarding the deposit.

Lastly, consider providing a brief explanation about how the deposit will be returned. Outline the time frame, and mention if deductions may be made for damages or unpaid rent. This sets expectations from the outset.