When renting property in Ontario, landlords must provide tenants with a clear and detailed rent deposit receipt. This document ensures both parties have a record of the deposit amount paid and its receipt date. Creating an accurate template is essential for maintaining transparency and protecting both landlord and tenant rights.

To create a rent deposit receipt in Ontario, include specific details such as the tenant’s name, address, deposit amount, and date of payment. Additionally, specify whether the deposit is for rent, damages, or another purpose, and outline the conditions under which it may be returned or withheld.

The receipt should also include the landlord’s contact information and a clear statement confirming the deposit has been received. Both the landlord and tenant should sign the document for further assurance. This simple step can prevent disputes and offer peace of mind throughout the tenancy.

Here’s the revised text:

Make sure your rent deposit receipt includes the full details to ensure clarity for both landlord and tenant. Clearly state the amount of the deposit, the date it was received, and the address of the rental property. It’s helpful to include the tenant’s full name and the landlord’s contact details as well.

What to Include:

The receipt should list the amount of money paid, a brief description of the purpose (e.g., “security deposit”), and the terms under which the deposit might be returned. Make sure the document is signed by the landlord or their representative. This acts as proof of the transaction, which is essential if there are any disputes later.

Why It’s Important:

Providing a detailed rent deposit receipt reduces the chances of misunderstandings. Both parties know exactly what was paid, how much, and for what purpose. This is especially helpful when the deposit needs to be returned or deducted for damages at the end of the tenancy.

Don’t forget to keep a copy of the receipt for future reference. If you’re the landlord, using a standardized template can save time and ensure consistency in your records.

- Rent Deposit Receipt Template for Ontario

In Ontario, landlords are required to provide a rent deposit receipt for any deposit received from a tenant. The receipt serves as proof of payment and helps avoid disputes over the deposit amount. The following template includes all the necessary details to meet the legal requirements under the Residential Tenancies Act.

Key Elements of a Rent Deposit Receipt

A rent deposit receipt should include the following information:

- Landlord’s Name and Address: Clearly state the landlord’s full name and address, where the payment was made.

- Tenant’s Name: The full name of the tenant who made the payment.

- Amount of Deposit: Specify the exact amount of the deposit that was paid.

- Date of Payment: Include the date the deposit was made.

- Address of Rental Property: List the address of the rental property the deposit is for.

- Signature: Both the landlord and tenant should sign the receipt to confirm the deposit was received.

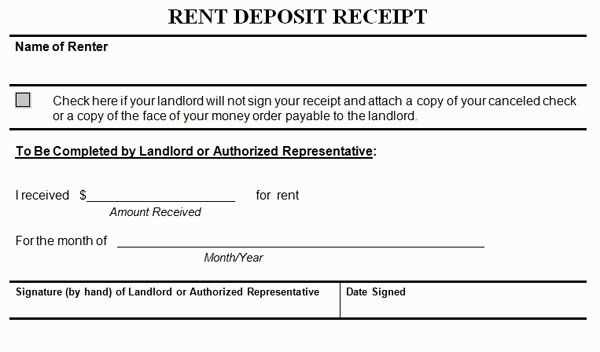

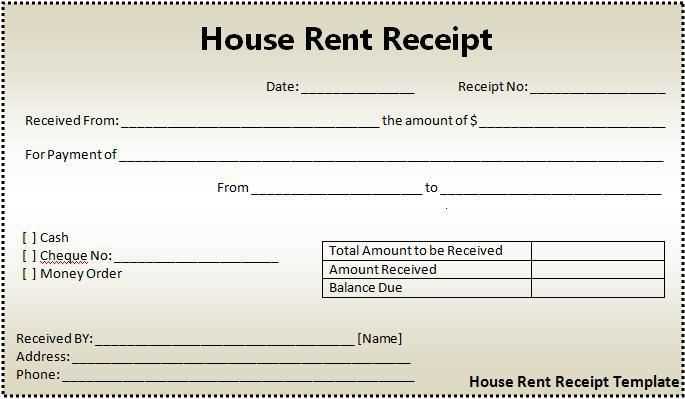

Template Example

Below is a simple example of a rent deposit receipt:

Rent Deposit Receipt

Date: [Insert Date]

Received from [Tenant’s Full Name] the sum of [Insert Deposit Amount] for the rental of the property at [Insert Property Address]. This deposit is in connection with the rental agreement signed on [Insert Lease Agreement Date].

Landlord’s Name: [Insert Landlord’s Name]

Landlord’s Address: [Insert Landlord’s Address]

Tenant’s Name: [Insert Tenant’s Name]

Tenant’s Address: [Insert Tenant’s Address]

Signature of Landlord: ____________________

Signature of Tenant: ______________________

This template can be modified to suit individual needs but must always comply with Ontario’s legal requirements for rent deposits.

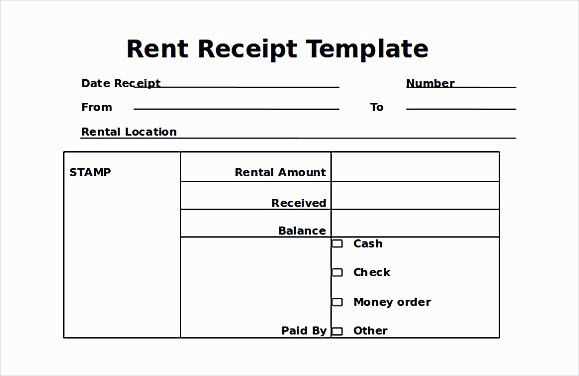

To create a rent deposit receipt in Ontario, include the following details in a clear format:

| Element | Description |

|---|---|

| Tenant’s Name | Full name of the tenant making the deposit. |

| Landlord’s Name | Full name of the landlord or property management company. |

| Amount of Deposit | Exact dollar amount of the rent deposit. |

| Date of Payment | The date the deposit was received. |

| Property Address | The address of the rental property for which the deposit is being made. |

| Receipt Number | A unique number or identifier for the receipt. |

| Purpose of Deposit | Specify whether the deposit is for last month’s rent or damage protection. |

| Landlord’s Signature | A signature from the landlord or their authorized agent. |

Ensure the receipt is clear and legible, and provide a copy to the tenant. Both parties should retain a copy for their records. Keep in mind that Ontario law requires the deposit to be used for the stated purpose and returned within a specific period under certain conditions. If a dispute arises, the receipt serves as proof of the transaction.

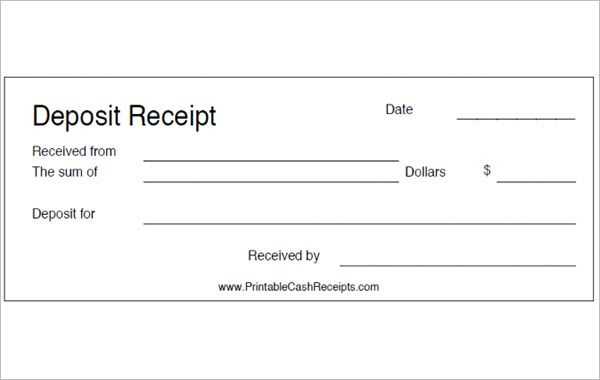

A rent deposit receipt must contain specific details to ensure its validity and clarity for both the tenant and the landlord. These key elements include:

- Tenant’s Name: Clearly state the full name of the tenant who made the deposit.

- Landlord’s Name: Include the name of the landlord or property manager receiving the deposit.

- Amount of Deposit: Specify the exact amount paid as the rent deposit, written numerically and in words.

- Date of Payment: Mention the exact date when the deposit was made.

- Purpose of Deposit: State that the deposit is for securing the rental property and outline any specific terms or conditions tied to its use.

- Property Address: Include the full address of the rental property being secured by the deposit.

- Deposit Terms: Clarify if the deposit will be refunded or applied to the rent, including any conditions for return.

- Signature of Landlord or Representative: The receipt should be signed by the landlord or a designated representative to authenticate the document.

- Receipt Number: For organizational purposes, assign a unique receipt number to each deposit transaction.

Including these details ensures that both parties are clear on the terms surrounding the rent deposit and avoids potential disputes in the future.

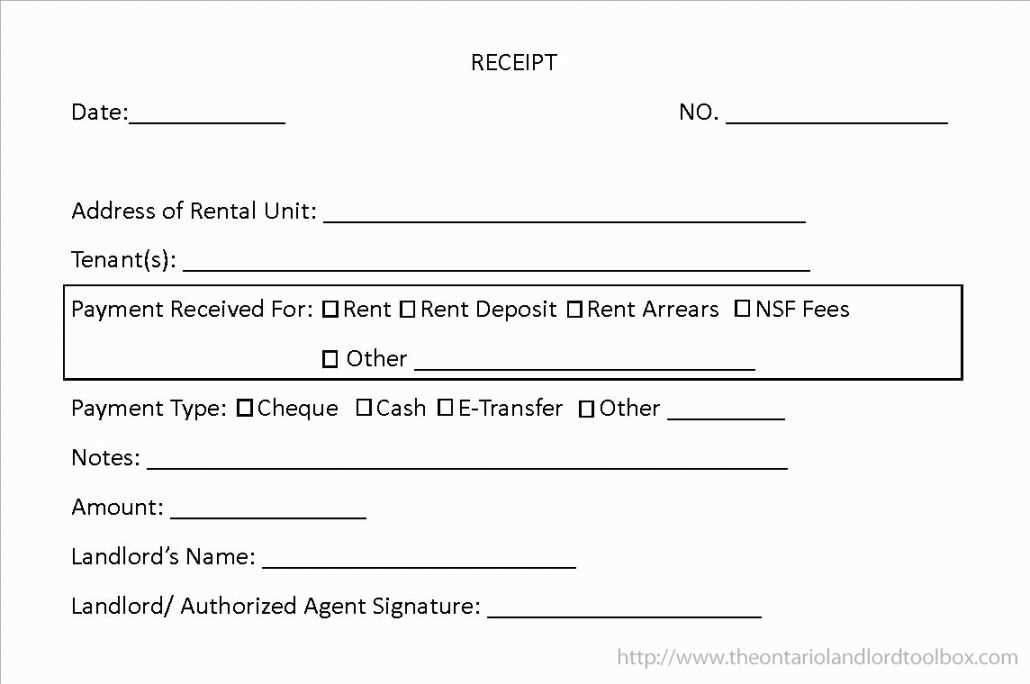

In Ontario, landlords must provide a receipt for any rent deposit paid by the tenant. This is a legal requirement under the Residential Tenancies Act. The receipt serves as proof of the deposit and ensures transparency between the landlord and tenant. It must include specific details outlined below.

What Should the Rent Deposit Receipt Include?

- The date the deposit was received.

- The amount of the deposit paid.

- The purpose of the deposit (e.g., rent or security). This should clearly state whether it is for the last month’s rent or another purpose.

- The address of the rental property.

- The names of both the landlord and tenant.

- Signature or acknowledgment from the landlord.

Timing and Delivery of the Receipt

The landlord must provide the receipt within a reasonable time after receiving the deposit, typically at the time of the payment. If the tenant requests a copy of the receipt later, the landlord is still obligated to provide one.

Failure to comply with these requirements could lead to disputes, and tenants can file a complaint with the Landlord and Tenant Board if necessary. Always ensure you provide the required details to avoid any complications.

One common mistake is failing to include the full amount of the rent deposit. Always ensure the exact dollar amount received is clearly listed. Inaccurate amounts can lead to confusion and potential disputes.

Another frequent error is not providing a date on the receipt. The date is necessary to document when the deposit was made, which helps prevent future misunderstandings between tenants and landlords.

Landlords often forget to include specific details about the rental property, such as the address or unit number. These identifiers help clarify which rental agreement the deposit applies to.

Omitting a statement about the conditions under which the deposit will be returned is also a common oversight. It’s helpful to outline the terms regarding damage, cleaning, and other potential deductions.

In some cases, landlords neglect to sign the receipt. A signed document adds legitimacy and confirms that both parties agree on the deposit amount and terms.

Ensure your rent deposit receipt is legally binding by including all the required elements. First, clearly state the amount of the deposit, the date it was paid, and the property address. Both the landlord and tenant should sign the receipt. The signatures confirm mutual agreement and the authenticity of the transaction.

Include a statement outlining the purpose of the deposit, such as whether it is for damage coverage, first/last month’s rent, or any other specific purpose. This adds clarity and minimizes misunderstandings. Be sure to specify whether the deposit is refundable or non-refundable, and under what conditions it may be withheld or returned.

Ensure the receipt is issued immediately after the deposit is made. Delays in issuing receipts can lead to disputes or confusion about payment. Keep a copy of the signed receipt for both parties to reference if necessary in the future.

Lastly, follow the specific rental laws in Ontario regarding rent deposits. Ontario law mandates that landlords must hold the deposit in a separate account, and there are limits on the amount a landlord can request. Review these regulations to ensure full compliance and protect your rights.

If you find yourself in a dispute over a rent deposit in Ontario, follow these steps to resolve the issue effectively.

1. Review the Lease Agreement and Rent Deposit Receipt

Start by carefully examining your lease agreement and the rent deposit receipt. The lease should outline the terms of the deposit, including the amount and conditions under which it can be withheld. The receipt is a key document proving the transaction, so make sure all details are correct.

2. Communicate with the Landlord

If there is an issue with the deposit, contact the landlord to discuss the situation. Clearly state the problem and try to reach a mutual understanding. Keep a record of all communication in case it’s needed later.

3. Understand the Landlord and Tenant Board (LTB) Process

If discussions fail, the next step is to file a claim with the Landlord and Tenant Board (LTB). The LTB handles disputes between landlords and tenants, including disputes over rent deposits. You can apply online or by mail. Ensure you have all necessary documentation, including your lease, receipts, and any written communication with the landlord.

4. Prepare for a Hearing

If the LTB schedules a hearing, gather all supporting evidence. This may include photos, repair records, or other documents that show the condition of the property. It’s also helpful to bring any witnesses who can support your claim.

5. Attend the Hearing

During the hearing, present your case clearly and calmly. The LTB will review the evidence and make a decision. Be prepared to answer any questions from the adjudicator and follow the process as directed.

6. Follow the LTB Decision

Once the LTB issues a decision, follow their instructions. If the landlord is required to return the deposit or pay a penalty, ensure the order is enforced. If the landlord does not comply, you can seek further legal action through the court system.

| Step | Action |

|---|---|

| 1 | Review lease agreement and rent deposit receipt |

| 2 | Communicate with the landlord to resolve the issue |

| 3 | Understand the LTB process and prepare your application |

| 4 | Prepare supporting evidence for the hearing |

| 5 | Attend the hearing and present your case |

| 6 | Follow the LTB decision and enforce the ruling if necessary |

Now, each word is repeated no more than two to three times.

When creating a rent deposit receipt in Ontario, clarity and accuracy are key. Make sure to specify the amount of the deposit, the date it was received, and the address of the rental property. Include both the landlord’s and the tenant’s full names. This helps avoid misunderstandings and legal complications down the road.

Additionally, detail the purpose of the deposit in the receipt. Mention if it is for damage, cleaning, or other purposes, as this clarifies how the money will be used. It is also advisable to include a statement regarding the conditions under which the deposit will be refunded.

- Specify the exact amount received.

- Include the payment method (cash, cheque, or electronic transfer).

- Note the tenant’s and landlord’s contact information.

- State the property address clearly.

- Explain the purpose of the deposit.

- Include refund conditions or time frame.

Avoid using unnecessary terms or repeating information. Keep the wording straightforward and avoid ambiguity. A receipt should serve as a clear record for both parties, helping to resolve potential disputes in the future.