A rent payment receipt should clearly outline the payment details, ensuring transparency between the tenant and landlord. Include the tenant’s name, the rental property address, payment date, and the amount paid. This simple document prevents any confusion about payment history and provides a clear record for both parties.

To create a rent payment receipt, first state the date of payment. Specify whether it’s for a particular period, such as monthly or quarterly, and list any additional details, like late fees or discounts applied. A detailed breakdown of the payment helps clarify any adjustments or special conditions in the agreement.

Always ensure to include the landlord’s contact information and a unique receipt number for easy reference. This small detail enhances record keeping and allows for smooth follow-up, should there be any disputes or verification requests in the future.

Here’s the corrected version:

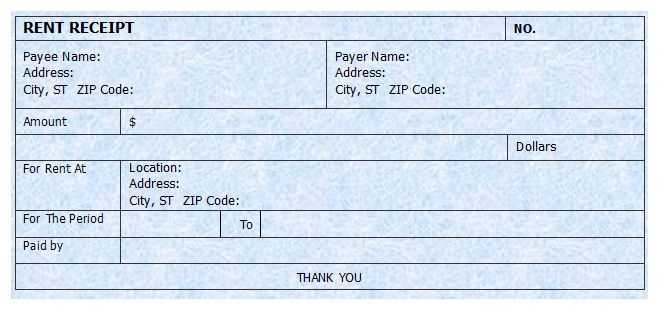

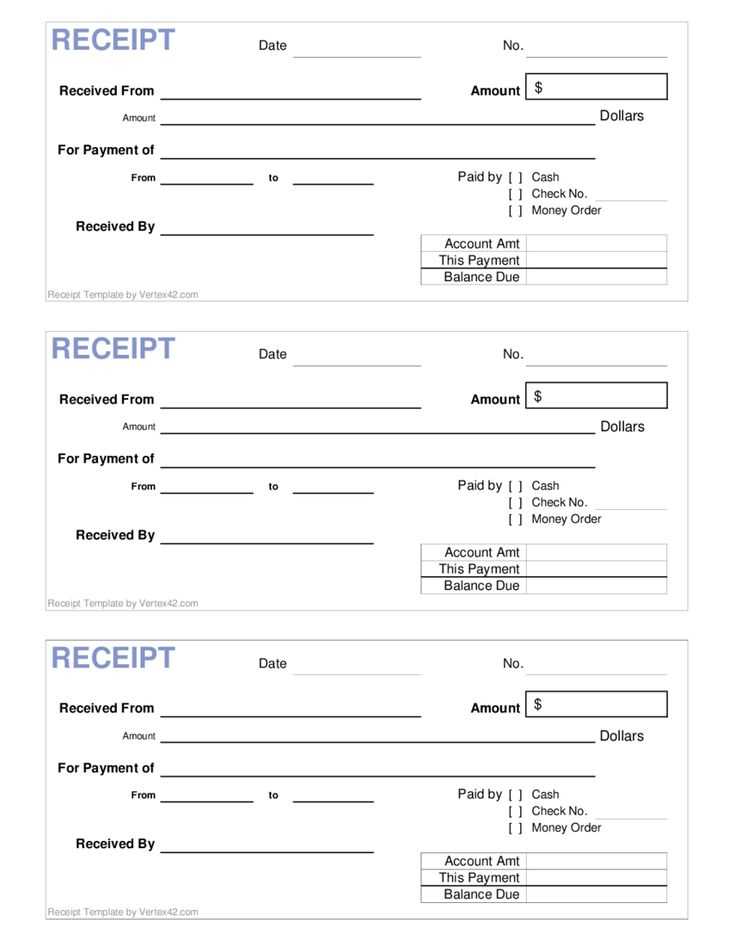

To create a professional rent payment receipt template, focus on clarity and accuracy. Include the tenant’s name, address, and contact information at the top. Then, clearly state the payment amount, the due date, and the payment method. Don’t forget to list the payment date and specify if the payment covers rent for one or more months. You can also include a reference number for easy tracking.

| Field | Description |

|---|---|

| Tenant Name | Full name of the tenant. |

| Property Address | The address of the rental property. |

| Payment Amount | Amount paid by the tenant. |

| Payment Date | The exact date when the payment was made. |

| Rent Period | Indicate the months covered by the rent payment. |

| Payment Method | Cash, cheque, or online transfer. |

| Reference Number | A unique reference for the payment (optional). |

This structure will ensure that both parties can easily track and verify payments. Avoid cluttering the template with unnecessary details, keeping it simple and straightforward.

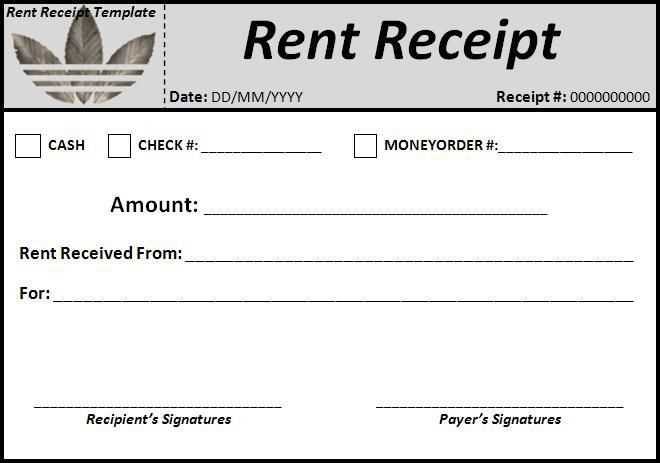

- Rent Payment Receipt Template

A rent payment receipt template should include all necessary details for clarity and record-keeping. Here’s a guide on what to include in a basic template:

- Tenant’s Name: Clearly display the name of the tenant making the payment.

- Landlord’s Name: Include the name of the landlord or property management company receiving the payment.

- Payment Amount: List the exact amount paid for the rent, including the currency used.

- Payment Date: Specify the date the payment was made to ensure both parties have accurate records.

- Rental Period: Indicate the time frame the payment covers (e.g., January 2025, or from March 1st to March 31st).

- Payment Method: Mention how the payment was made (e.g., bank transfer, check, cash, etc.).

- Receipt Number: Assign a unique number to each receipt for easy reference.

- Property Address: Specify the address of the property being rented.

Ensure the receipt is clear, precise, and easy to read. Both the tenant and the landlord should keep copies for their records. This template ensures transparency and can prevent future disputes.

Include basic details such as the tenant’s name, rental property address, payment amount, date of payment, and payment method. This ensures clear documentation of the transaction.

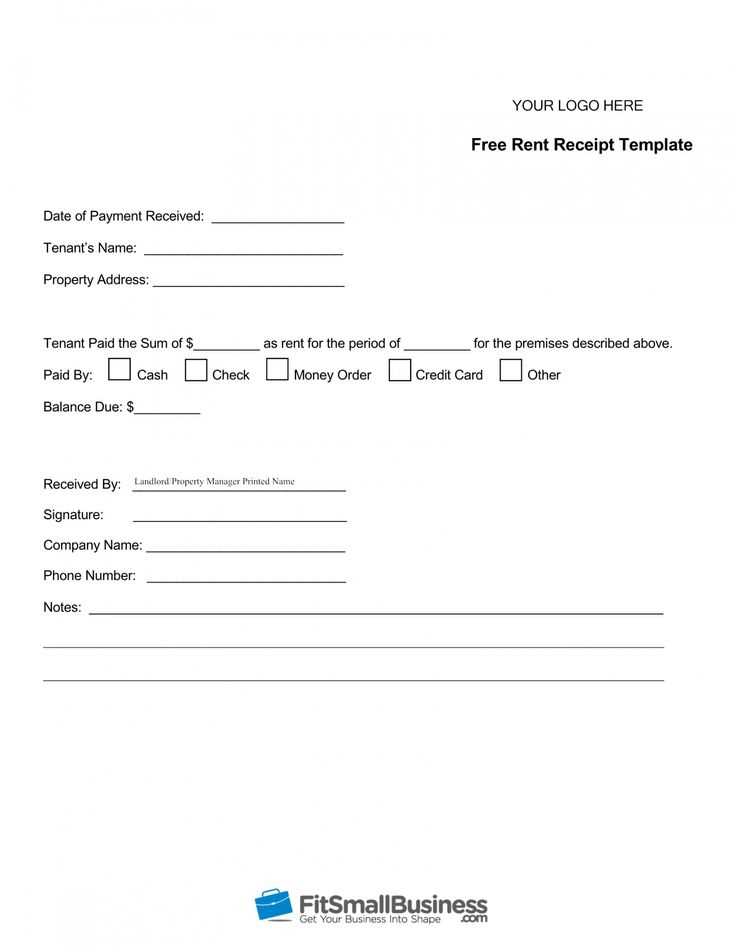

Step 1: Tenant and Property Information

Start by noting the tenant’s full name and the address of the rental property. This avoids any confusion if multiple properties are being rented out.

Step 2: Payment Details

Specify the amount paid, the date of payment, and the period the payment covers (e.g., rent for February 2025). Also, mention the payment method, whether it was by check, bank transfer, or cash.

Finally, sign the receipt or have the property manager sign it for validation. This confirms the accuracy and authenticity of the transaction for both parties.

A payment receipt should contain specific details to ensure clarity and accuracy. Here are the key elements to include:

- Receipt Title: Clearly label the document as “Payment Receipt” to distinguish it from other types of documents.

- Payment Date: Include the exact date the payment was received to keep a proper record.

- Payment Amount: Specify the exact amount paid, including the currency, to avoid any confusion.

- Tenant or Payer Name: State the full name of the person who made the payment.

- Payee Details: Include the name and contact information of the entity receiving the payment.

- Invoice or Reference Number: Attach a unique reference number for tracking purposes, especially in case of discrepancies.

- Payment Method: Specify how the payment was made (e.g., cash, check, credit card, bank transfer).

- Service or Rent Period: Indicate the time period for which the payment is being made, e.g., monthly rent for January 2025.

- Outstanding Balance: If applicable, note the remaining balance or the next due payment amount.

Including these details helps both parties maintain clear financial records and provides a solid basis for resolving any potential issues later.

Ensure all information is accurate. Double-check the payer’s name, amount paid, and payment method. Incorrect details may lead to confusion or disputes later on.

Don’t leave out important dates. A receipt should clearly show the payment date to avoid ambiguity. Missing this information can cause issues during audits or future references.

Be clear with the payment description. Specify the purpose of the payment, whether it’s rent, deposit, or another service. Vague descriptions can cause misunderstandings between landlord and tenant.

Avoid using incorrect or incomplete invoice numbers. This can make tracking payments difficult, especially if multiple transactions occur in a short period.

Don’t skip signing the receipt. An unsigned receipt can be questioned or dismissed as unofficial, causing complications if proof of payment is needed later.

Never overlook adding a payment method. Whether the payment was made by cash, check, or bank transfer, clarifying this helps both parties keep accurate records.

Be cautious with formatting. Clear, legible fonts and a clean layout ensure that all details are easy to read and interpret, reducing the chance of mistakes.

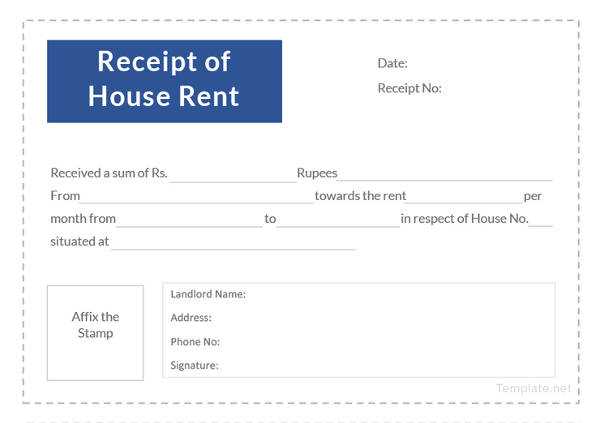

Rent Payment Receipt Template

Design a simple and clear rent payment receipt template to streamline the process for both landlords and tenants. Begin with the tenant’s and landlord’s names, followed by the rental property address. Include the date of the payment and the amount paid in clear, bold numbers. Make sure to specify the payment method (e.g., cash, bank transfer, check). If applicable, break down any additional fees such as late payment charges or maintenance costs.

Basic Details

The receipt should clearly list the tenant’s name, address of the rented property, and the rental period covered by the payment. This ensures both parties are aligned on what the payment corresponds to. Be sure to specify the date the payment was made and a unique receipt number for future reference.

Payment Breakdown

Clearly separate the rent amount from any other charges. If the payment includes late fees, repairs, or other costs, list each item separately with its respective amount. This clarity helps prevent confusion or disputes later.

Example:

Amount Paid: $1200

Late Fee: $50

Total: $1250

Lastly, leave space for the landlord’s signature or a stamp, confirming the receipt of the payment. This signature provides further validation and a professional touch to the document.