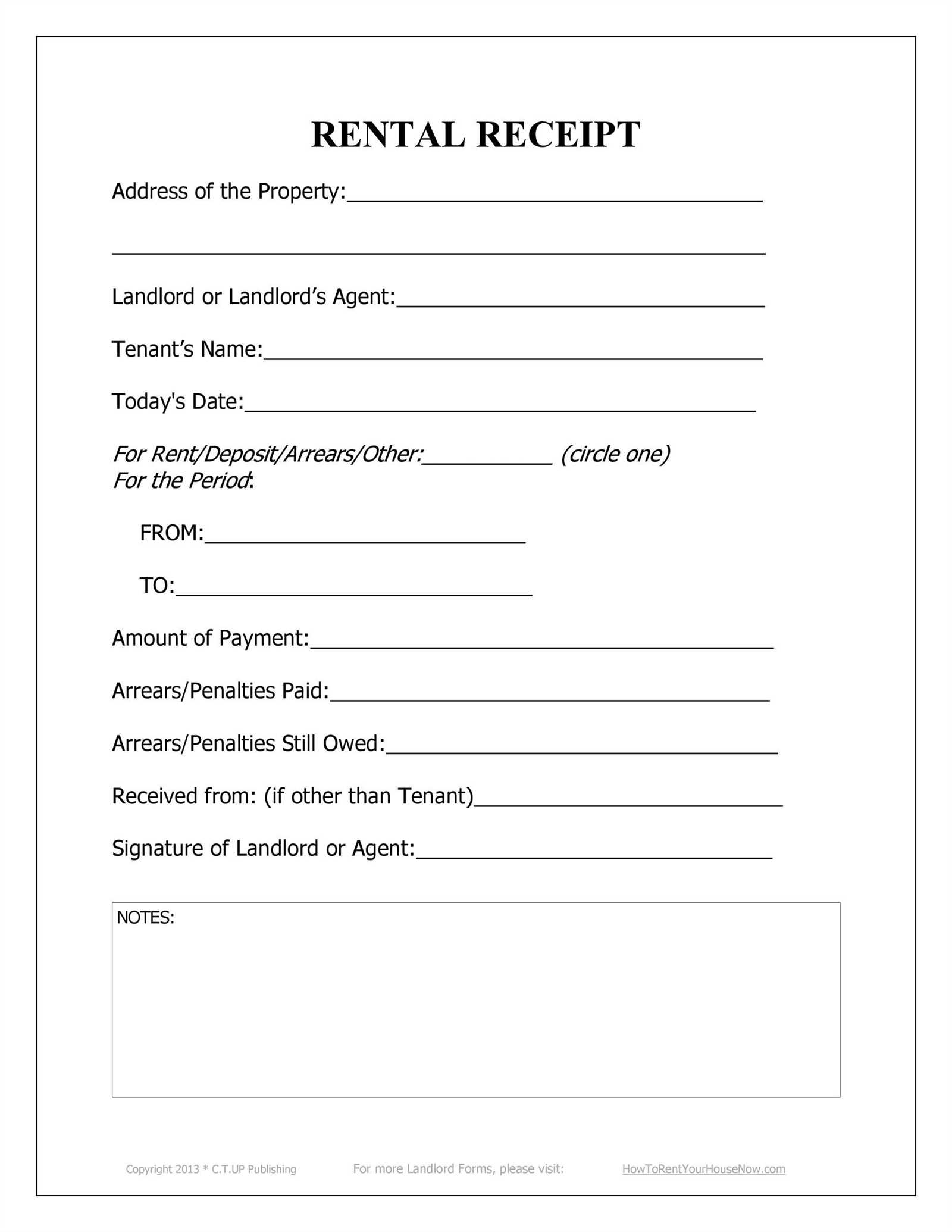

Key Elements of a Rent Receipt

A well-structured rent receipt provides proof of payment and protects both landlords and tenants. Ensure each receipt includes the following details:

- Date: The day the payment was received.

- Tenant’s Name: The person making the payment.

- Rental Address: The property’s full address.

- Amount Paid: The exact rent sum received.

- Payment Method: Cash, check, bank transfer, etc.

- Landlord’s Name and Signature: Proof of acknowledgment.

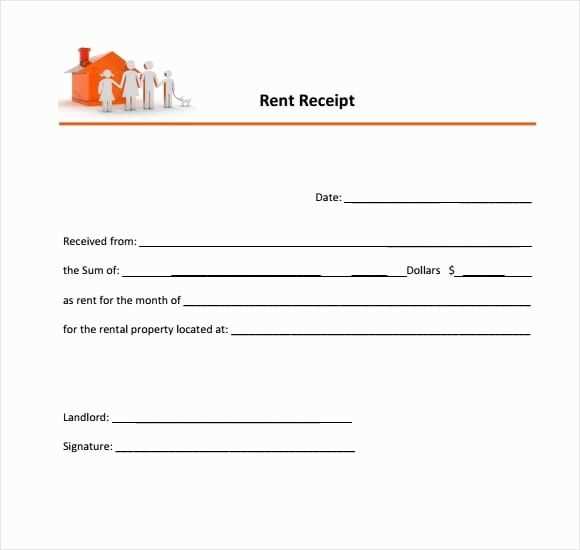

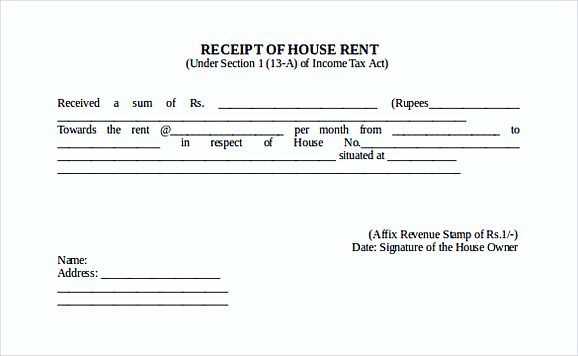

Sample Rent Receipt Format

Here’s a structured rent receipt template for immediate use:

Rent Receipt Date: [MM/DD/YYYY] Received from: [Tenant’s Name] Rental Property Address: [Full Address] Amount Paid: $[XXX.XX] Payment Method: [Cash/Check/Bank Transfer] Notes: [Optional: Payment for Month/Lease Period] Landlord’s Name: [Full Name] Landlord’s Signature: _______________

Best Practices for Using Rent Receipts

To maintain clear financial records:

- Provide receipts for every rent payment.

- Use duplicate copies–one for the tenant, one for records.

- Ensure digital receipts have a timestamp and secure storage.

- Include any late fees or outstanding balances if applicable.

A structured rent receipt simplifies financial tracking and reduces disputes. Use the template above to streamline rent documentation.

Rent Receipt Doc Template

Key Elements to Include in a Lease Payment Receipt

How to Format a Rental Receipt for Legal Compliance

Best Practices for Digital and Printable Payment Records

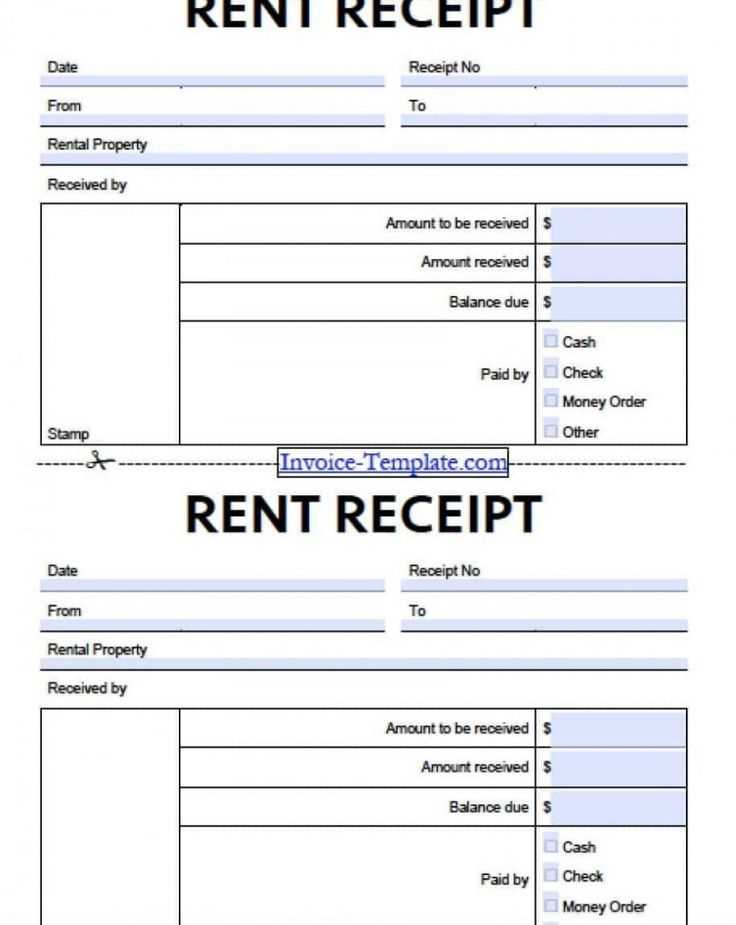

Include all essential details: A lease payment receipt must specify the payment date, amount, tenant’s name, and rental period covered. Clearly state the payment method and include the landlord’s full name and contact information.

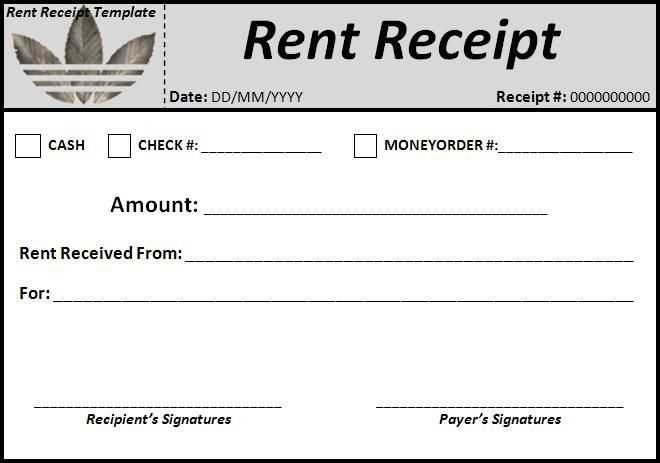

Use a clear format: Structure the receipt with distinct sections. The header should include “Rent Receipt” in bold, followed by the receipt number for tracking. The body must detail the payment specifics, and the footer should contain the landlord’s signature or digital authentication.

Ensure legal compliance: Add a statement confirming receipt of payment and specify any outstanding balances. Check local regulations to confirm additional requirements such as tax details or late fee records.

Optimize for both digital and print: Design a receipt that is easy to print but also adaptable for electronic use. Use PDF format for security and consistency, ensuring tenants receive an unaltered copy.

Maintain organized records: Store receipts in chronological order, whether digitally in a secure folder or physically in a dedicated file. This simplifies bookkeeping and ensures quick access when needed.