To properly document rental income for tax purposes in Ontario, using a rent receipt template is a smart move. This receipt ensures both landlords and tenants keep clear records, which are necessary during tax season. A well-structured template will capture all key information for tax filing.

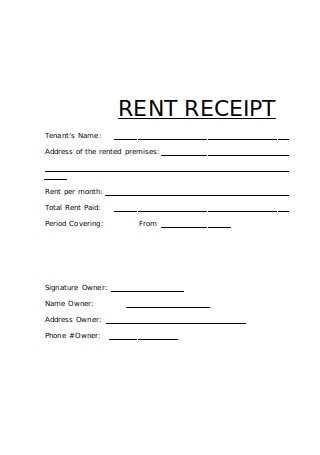

The rent receipt should include the tenant’s name, rental address, payment amount, payment date, and the rental period covered. Make sure to note whether the rent was paid monthly or in advance. Additionally, indicate the landlord’s name and signature to validate the receipt.

Using a template reduces the risk of errors and streamlines the process of submitting accurate rental income information. As a landlord, you are required to provide a rent receipt when requested by the tenant, especially for tax claims. A simple but clear record can save time and prevent misunderstandings.

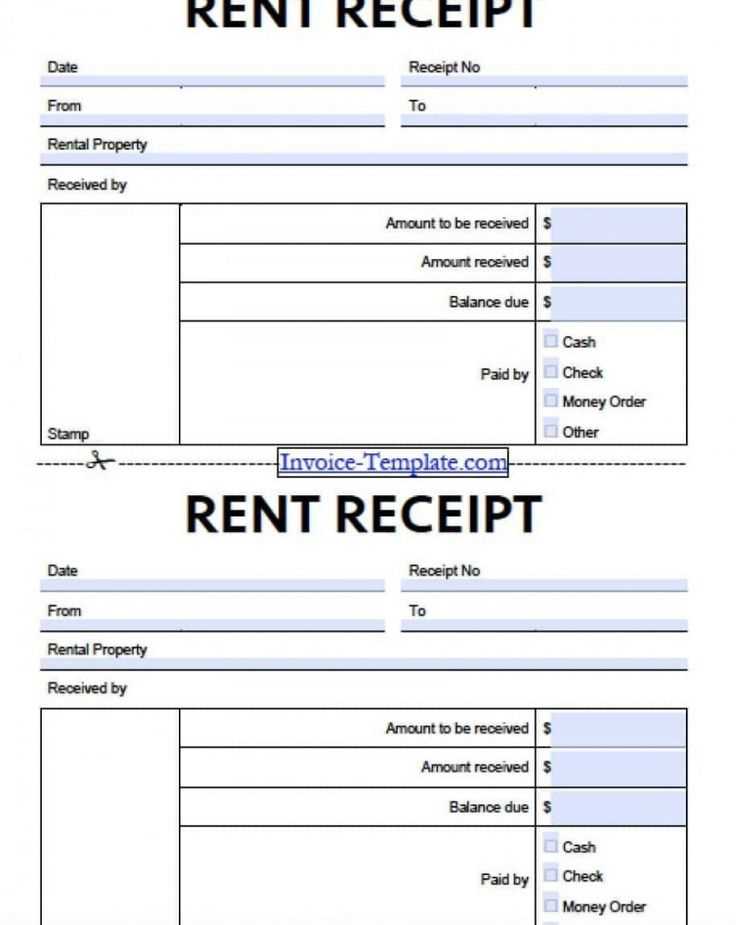

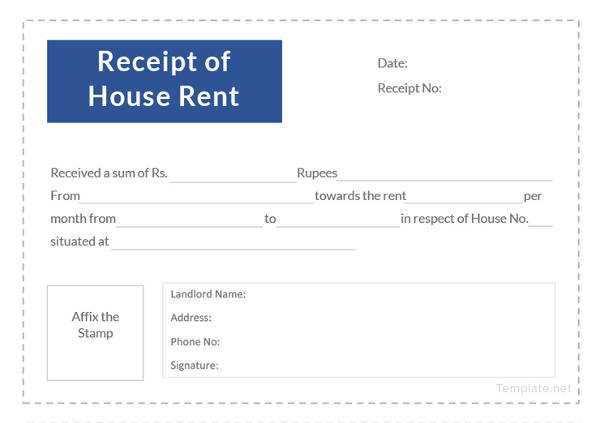

Rent Receipt for Income Tax Ontario Template

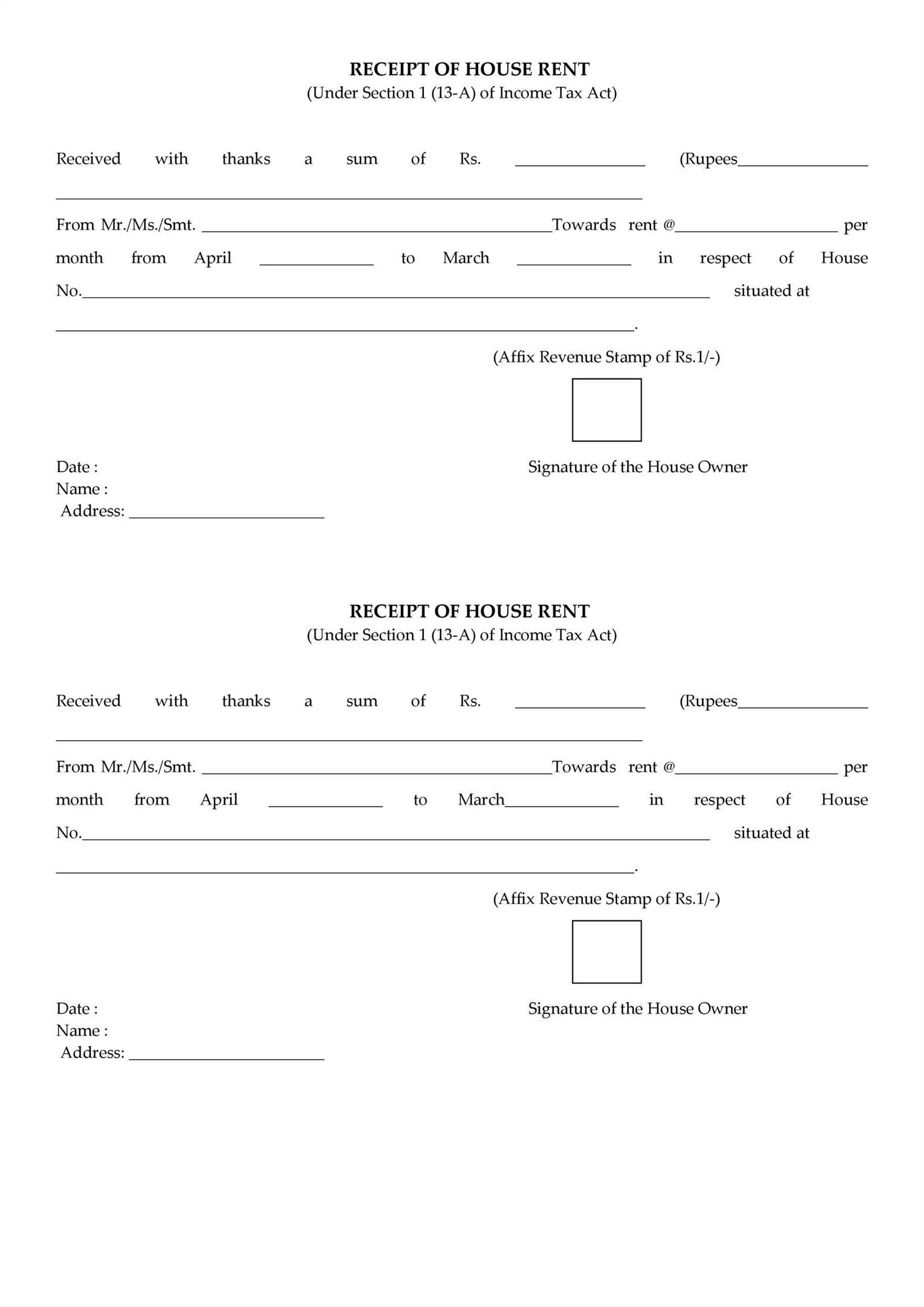

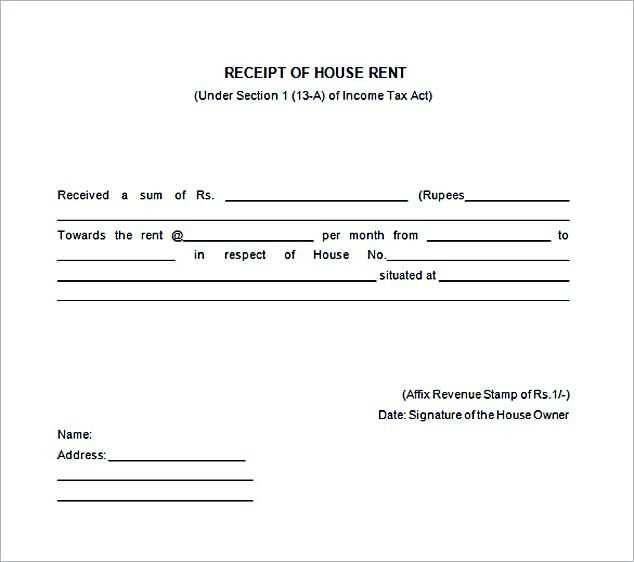

For landlords in Ontario, providing a rent receipt for tenants is key for tax filing. The receipt must clearly include the tenant’s name, the address of the rental property, the amount of rent paid, and the period the payment covers. You should also include the landlord’s contact information and a signature or a statement confirming the payment. Make sure to date each receipt accurately to avoid confusion when tenants report rental payments. A well-organized template can save time and help both parties keep clear records.

A simple rent receipt should include the following details:

- Tenant’s name

- Rental property address

- Amount paid

- Payment period (e.g., month or week)

- Date of payment

- Landlord’s name and contact information

- Signature or statement of payment confirmation

Ensure the receipt is legible and professional. You can create a template using word processing software or download ready-to-use versions online. Keep these receipts accessible for both the landlord’s and tenant’s tax filing purposes.

Creating a Rent Receipt for Tax Purposes

Include key details such as the tenant’s name, address of the rental property, and the rental period covered by the receipt. Clearly state the amount paid for the rent and the date on which the payment was made. If applicable, list any additional fees, such as utilities or maintenance charges, separately. This will ensure transparency and avoid confusion during tax filing.

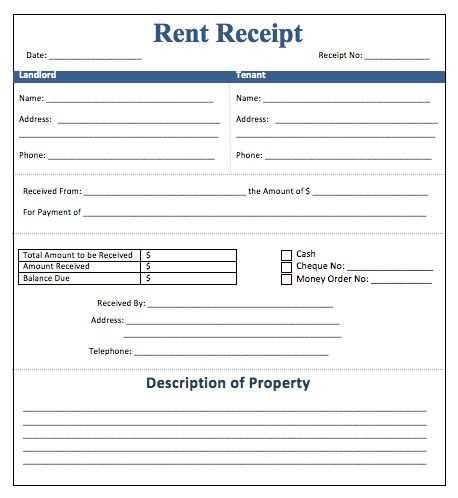

Format and Structure

Start by labeling the document as a “Rent Receipt” at the top. Below, include your full name, address, and contact information as the landlord. Specify the payment method used (e.g., cash, cheque, bank transfer). It’s crucial to include a receipt number for tracking purposes, particularly for tenants making multiple payments in a year.

Tax Considerations

Make sure the receipt reflects accurate information, as this will be used to verify rental income and deductions. Tax authorities often require that receipts contain the rental period and payment details to validate claims. For tenants who request receipts for tax filing, ensure they receive a copy upon payment. Keep a copy for your own records, which will help you during tax audits or income reporting.

Key Details to Include in the Template

Provide a clear breakdown of key information in the rent receipt template. These details ensure it meets tax reporting requirements and facilitates smooth transactions for both parties.

Tenant and Landlord Information

- Tenant’s Name: Full name of the individual renting the property.

- Landlord’s Name: Full name of the property owner or authorized representative.

- Address of the Rental Property: Include the complete address where the tenant resides.

Payment Details

- Amount Paid: Clearly state the rent paid for the period.

- Payment Date: Mention the specific date when payment was made.

- Rental Period: Define the start and end dates for which the rent was paid.

- Payment Method: Indicate whether the payment was made by cheque, bank transfer, or cash.

Make sure all entries are accurate and up-to-date, and keep copies for future reference or tax filing purposes.

Common Mistakes to Avoid When Issuing Receipts

Ensure accuracy in tenant details: Always double-check the tenant’s name and rental address. A mismatch could cause confusion or issues with tax filings. Verify that both the landlord’s and tenant’s information is correct before issuing a receipt.

Incorrect or Missing Dates

Dates play a critical role in rent receipts. Make sure you specify the date the payment was received, not just the date the receipt is issued. Avoid leaving dates blank or incorrectly listing the payment period.

Not Detailing the Payment Amount

Clearly list the exact amount paid for the rent, including any additional charges, like utilities or late fees. Avoid vague descriptions like “paid in full” without specifying the exact amount. This transparency helps prevent misunderstandings.

Failure to Include Payment Method: Always specify how the payment was made–whether via cash, cheque, or bank transfer. This can avoid disputes if any issues arise regarding payment verification.

Check for clear and legible information. A receipt full of typos or poorly formatted text might be questioned later. Use consistent fonts and layouts to make the document easy to read.