Creating a rent receipt is a straightforward process that ensures both tenants and landlords have clear records of payments made. Use a simple template to document the transaction. Include the renter’s name, the address of the property, the amount paid, and the payment method.

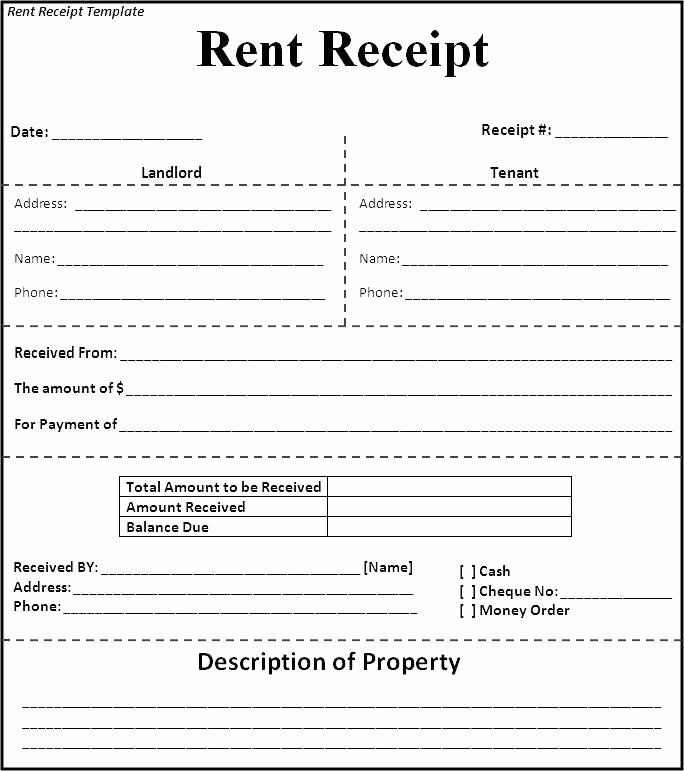

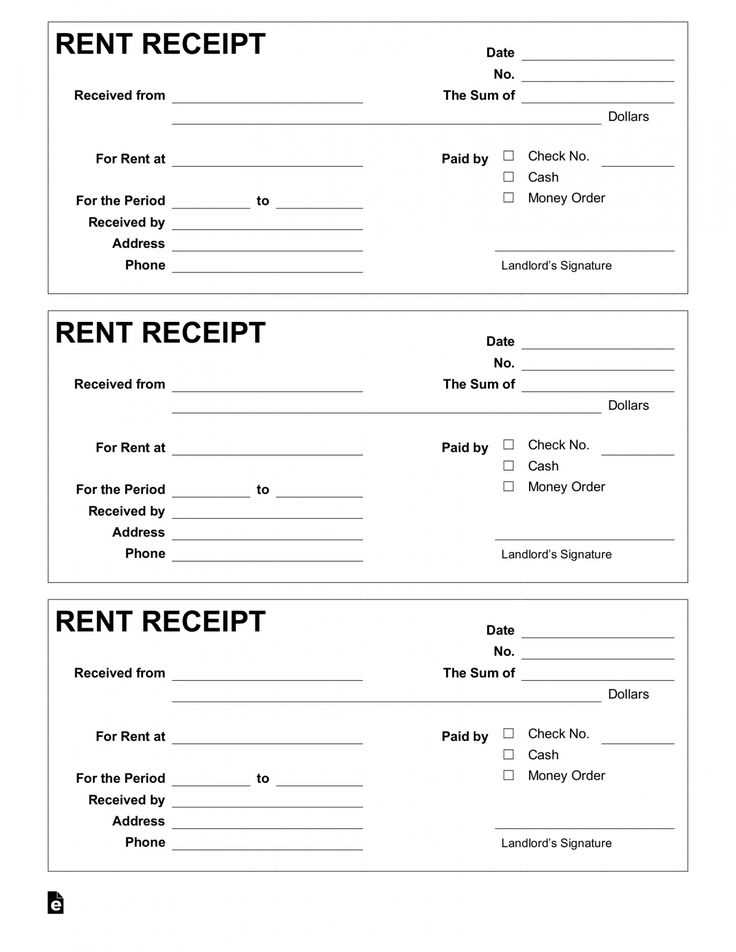

Start with clear headers: The top of the receipt should include a title like “Rent Receipt” for easy identification. Next, list the date of the payment and the rental period it covers.

Details to include: Specify the full name of the tenant, the rental property address, the payment amount, and a brief description of the payment method (cash, bank transfer, etc.). Ensure to include both the amount paid and any outstanding balance if applicable.

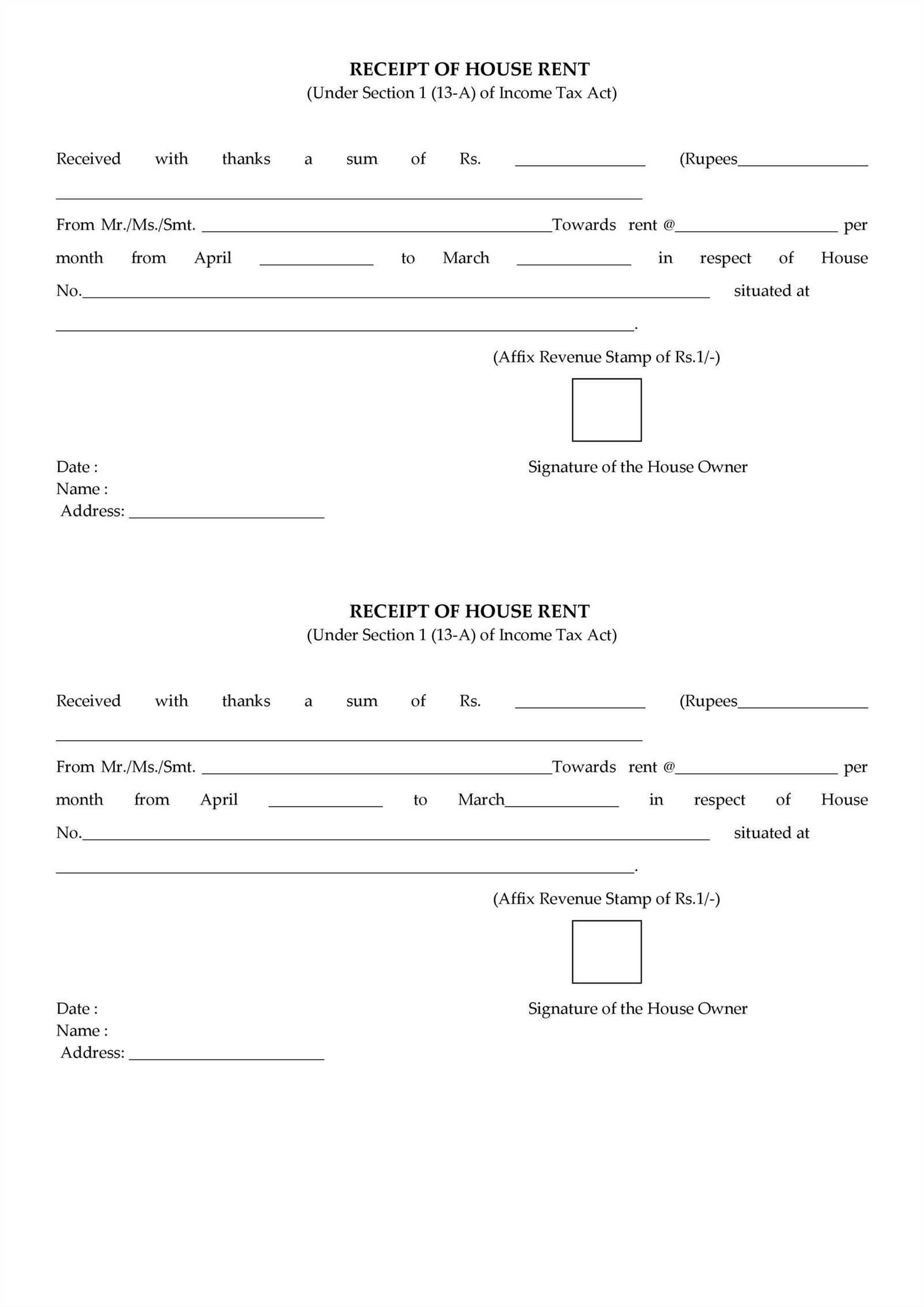

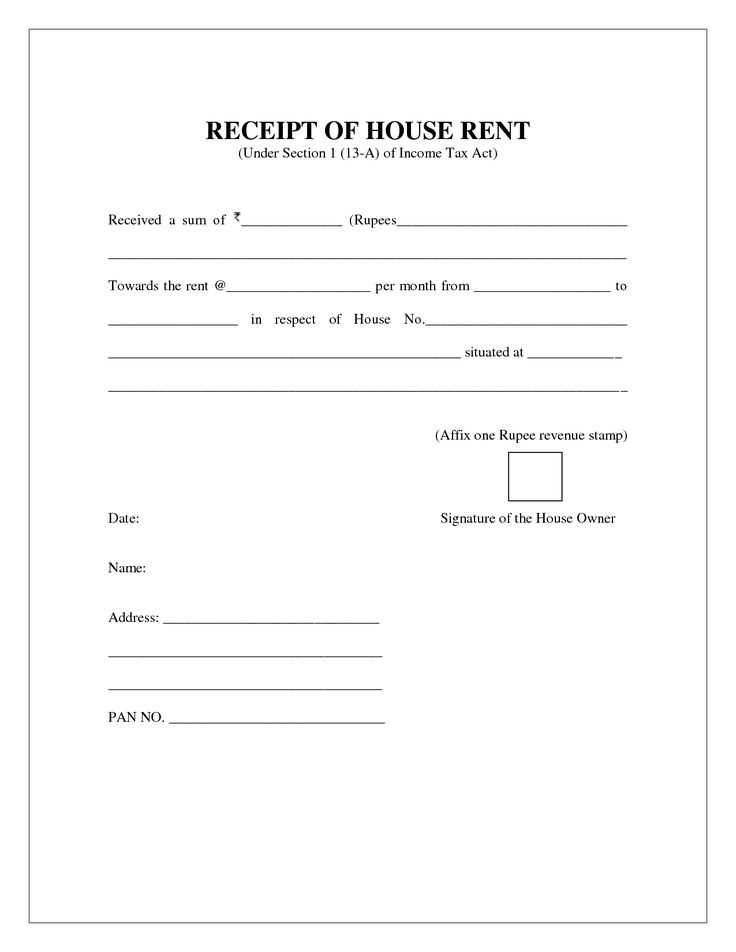

Conclude with a signature: The receipt should end with the landlord’s signature or business stamp, indicating that the transaction is complete. This adds validity to the document and serves as proof of the rental payment.

Of course! Here’s the corrected version:

When preparing a rent receipt, it is crucial to include all necessary details for both the tenant and the landlord. A clear format ensures both parties are protected and have a record of the transaction.

Key Elements of a Rent Receipt

Ensure the following elements are present on the receipt:

| Element | Description |

|---|---|

| Tenant Name | Full name of the person paying rent. |

| Landlord Name | Full name of the person receiving the rent. |

| Rental Property Address | Full address of the rented property. |

| Amount Paid | The exact amount of rent being paid. |

| Payment Date | The date the rent is paid. |

| Payment Method | Method used for payment (e.g., check, cash, bank transfer). |

| Signature | Signature of the landlord or an authorized person. |

Formatting Tips

Organize the information clearly. Consider aligning the text to the left and using bold headings for each section. Include a line or space between the date and the rent details for readability. A simple format will be easy to read and professional.

- Rent Receipt Format Template

To create a professional and clear rent receipt, include the following components in your template:

- Landlord’s Information: Name, address, and contact details.

- Tenant’s Information: Full name and contact details.

- Receipt Number: Assign a unique number for tracking purposes.

- Payment Date: Specify the exact date of payment.

- Rental Period: Mention the start and end date of the rental period.

- Amount Paid: Clearly state the amount received, including any security deposit or additional charges.

- Payment Method: Indicate whether the payment was made via check, bank transfer, or cash.

- Landlord’s Signature: A signature or confirmation from the landlord adds authenticity.

Sample Rent Receipt Template

- Receipt Number: 001

- Tenant: John Doe

- Landlord: Jane Smith

- Rental Period: January 1, 2025 – January 31, 2025

- Amount Paid: $1,200

- Payment Method: Bank Transfer

- Payment Date: February 1, 2025

- Landlord’s Signature: ____________________________

Start by assessing your specific requirements for a rent receipt form. If you are a landlord, ensure that the form includes key details like tenant name, rental amount, payment dates, and any relevant property information. For tenants, look for forms that clearly outline the payment period and the method of payment used. Consider what kind of documentation you need to keep track of, whether it’s for personal record-keeping, tax purposes, or legal protection.

Assess Your Documentation Requirements

If you’re preparing receipts for tax or legal purposes, opt for a more detailed form with fields for deposit amounts, rent adjustments, or late fees. For regular rental agreements, a simpler form may suffice, focusing primarily on the rent amount and dates. It’s important that the form aligns with your unique needs, offering flexibility for updates and additions where necessary.

Legal and Tax Considerations

Ensure the form you choose complies with local laws and tax regulations. Some regions may require specific language or additional clauses to be included in the receipt, particularly if it involves property management services or special tenant agreements. Having a form that meets these legal standards reduces the risk of complications down the line.

For a receipt to serve its purpose, include the following details: date of transaction, amount paid, payment method, and both the renter’s and landlord’s information. Ensure the total rent amount is clearly visible and any additional charges, such as late fees, are listed separately. A description of the rental property or service, including the address or unit number, must be included. Additionally, the receipt should display any taxes applied, alongside the total amount with and without taxes for clarity.

Transaction Specifics

Always provide a unique receipt number for reference, especially if a dispute arises. Include the period covered by the rent payment, specifying whether it is monthly, weekly, or for a different term. This ensures both parties have a clear understanding of the billing cycle.

Signature Section

If necessary, leave space for signatures from both parties to confirm the transaction. This adds an extra layer of verification and serves as proof in case of discrepancies.

To modify a rent receipt template, first review the existing template and identify areas that need adjustment. Make sure the basic information such as the tenant’s name, landlord’s details, property address, rent amount, and payment date are included. Modify these fields if any of the information has changed or needs to be updated.

Adjusting Payment Details

If the rent amount or payment method changes, update the corresponding fields. For example, if you switch from cash payments to online transfers, replace the payment method description with something more specific. Additionally, include any late fees, discounts, or adjustments as needed. These changes should be clearly noted so that both parties can track the financial details accurately.

Adding Custom Terms or Notes

Consider adding any special clauses or terms directly related to the rental agreement. This may include rental discounts, payment schedules, or maintenance responsibilities. Custom fields can be added to the template, ensuring that the receipt reflects any unique agreements between you and your tenant.

Finally, check the formatting and ensure the document is easy to read. Adjust font sizes, spacing, and alignment if needed to improve clarity and make the receipt visually organized.

Opting for digital receipts can streamline your record-keeping process. They’re easily stored on your device, reducing physical clutter. With a few taps, you can search and retrieve a specific receipt without digging through paper piles. Plus, many digital receipts are automatically organized by date, vendor, and category, making them ideal for budgeting or tax purposes.

On the other hand, paper receipts are still a go-to for some, especially in cases where digital systems aren’t available or desired. They’re tangible and don’t rely on technology, which can be a benefit in specific situations. If you don’t mind storing and sorting paper receipts, they can still serve their purpose effectively for tracking purchases.

In terms of environmental impact, digital receipts hold a clear advantage. They eliminate paper waste, helping reduce environmental strain. Businesses can save on printing costs, and customers enjoy a cleaner, more eco-friendly option. However, a paper receipt can be handy when digital alternatives aren’t an option or when quick, immediate documentation is needed.

Landlords must provide tenants with a rent receipt when a payment is made. This receipt serves as proof of payment and helps avoid any disputes about rental transactions. It is legally required in many jurisdictions to include certain information on the receipt to make it valid. This typically includes the tenant’s name, the landlord’s name, the date of the payment, the amount paid, the rental period it covers, and a statement indicating that the payment was received in full.

In some areas, rent receipts may also need to include details about the method of payment, such as cash, check, or bank transfer, to ensure transparency and accuracy. Providing a receipt ensures that both parties are clear about the terms of the rental agreement and payment schedule. Not issuing a receipt could lead to legal consequences for landlords, including fines or disputes over payment records.

For tenants, it is advisable to keep rent receipts for the duration of the lease agreement and beyond, as they may be needed for tax purposes, financial records, or in case of any legal claims related to the rental agreement.

Keep receipts organized by categorizing them monthly or by tenant. This makes retrieval faster and more efficient, especially if there are multiple tenants or units involved.

- Store receipts digitally to reduce paper clutter. Scanning receipts and using cloud storage ensures easy access and prevents loss due to physical damage.

- Use consistent labeling for each receipt. Include the tenant’s name, payment date, and rental period to ensure clarity and avoid confusion.

- Keep backups of your digital records. Cloud-based storage may fail, so having a secondary backup on an external drive or another platform provides added security.

- Regularly update your records. Immediately file receipts after payments to avoid backlog and mistakes in your records later on.

- Ensure proper security for digital records. Use passwords and encryption to protect sensitive information from unauthorized access.

By implementing these practices, you can streamline the management of rent receipts and maintain an accurate, accessible record system. This will make tax filing and other financial processes much simpler and more reliable.

Provide a clear and simple breakdown of the rent receipt template to ensure all necessary details are included. A well-structured receipt helps both landlords and tenants maintain accurate records. Follow the template below for a reliable and transparent format:

Required Elements

Include these key components to ensure your rent receipt is complete and professional:

- Tenant’s Name: The full name of the person paying rent.

- Landlord’s Name: The landlord or property manager’s full name.

- Property Address: The address of the rented property.

- Amount Paid: Specify the total rent amount received.

- Payment Date: Date the payment was made.

- Payment Method: Indicate how the rent was paid (e.g., cash, bank transfer, check).

- Receipt Number: Unique reference number for tracking purposes.

Sample Rent Receipt Template

| Tenant’s Name | Landlord’s Name | Property Address | Amount Paid | Payment Date | Payment Method | Receipt Number |

|---|---|---|---|---|---|---|

| John Doe | Jane Smith | 123 Main St, Apartment 4B | $1200 | February 7, 2025 | Bank Transfer | 00123 |

This simple template includes all the necessary information to validate rent payments and provide a record for both parties. Customize the table to suit your specific needs, and make sure all fields are filled out accurately each time a payment is made.