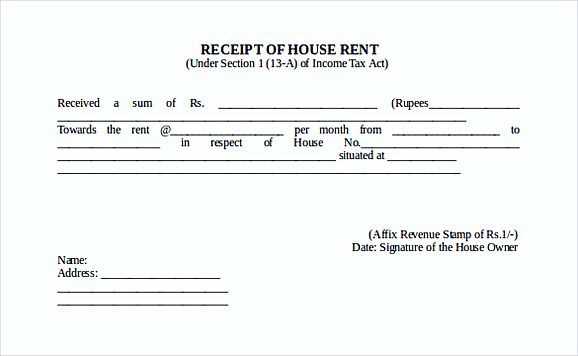

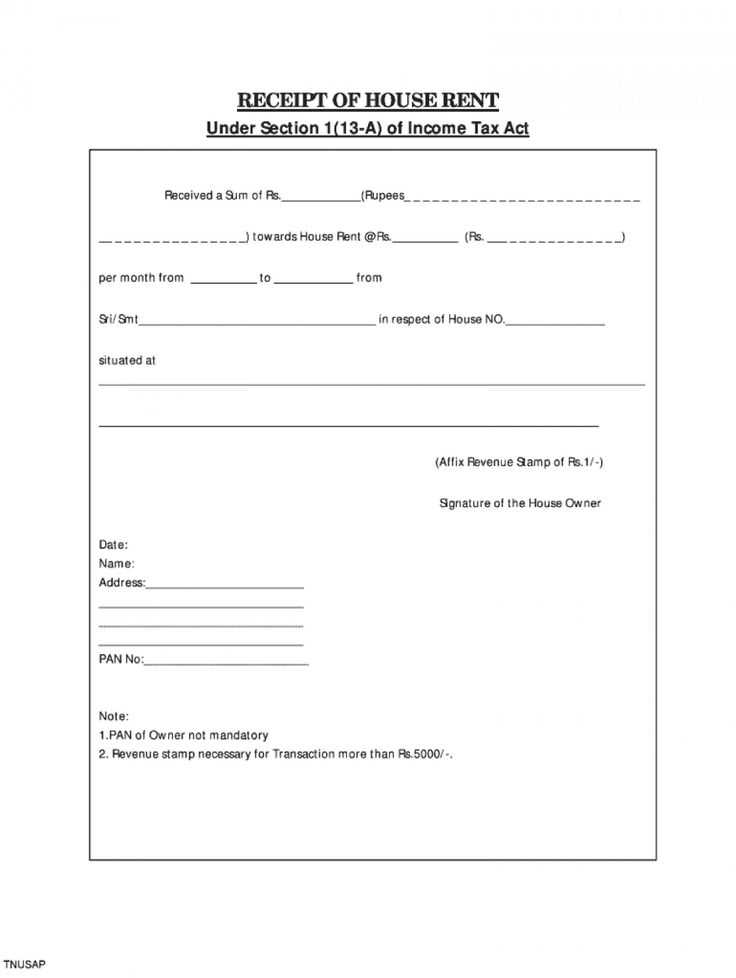

If you’re renting out property in India, providing a clear and formal rent receipt is crucial. A rent receipt serves as proof of payment and can help avoid disputes between tenants and landlords. Below is a format template you can use to create rent receipts that are valid and meet legal requirements in India.

Key Elements: The rent receipt should include the tenant’s and landlord’s details, rental amount, payment date, and rental period. Make sure the receipt is signed by the landlord and includes the property’s address. You should also mention whether the rent payment includes taxes like GST if applicable.

Template Example:

Tenant Name: [Insert Tenant Name]

Landlord Name: [Insert Landlord Name]

Property Address: [Insert Property Address]

Rental Amount: INR [Insert Rent Amount]

Payment Date: [Insert Date of Payment]

Rental Period: [Start Date] to [End Date]

Payment Mode: [Cash/Bank Transfer/Cheque]

Ensure that all details are accurate and complete. Providing a receipt in this format will help maintain transparency and prevent potential misunderstandings in rental agreements.

Here are the corrected lines:

Ensure that the rent receipt contains the following essential details: the tenant’s name, the landlord’s name, rental amount, payment period, and property address. Each section must be clearly labeled to avoid confusion. Make sure the date of payment is specified, as this will serve as a key reference in case of any future disputes.

Details to Include:

Each line on the receipt should be distinct, without overlapping information. List the rental amount in both words and figures for clarity. Include a mention of the method of payment–whether it’s cash, bank transfer, or cheque–to further validate the transaction. If applicable, indicate any advance payments or deposits made by the tenant.

Formatting Tips:

Use a clean, readable font and maintain consistency in the formatting across all entries. It’s a good idea to leave enough space for both parties to sign the document at the bottom. This ensures that the rent receipt is both professional and legally binding.

- Rent Receipt Format Template for India

A rent receipt in India should clearly outline the details of the transaction between the landlord and tenant. Start with the tenant’s name, followed by the address of the rented property. Mention the rental amount received, the date of payment, and the period for which the rent is paid. Also, indicate the mode of payment–whether it was cash, cheque, or bank transfer.

Include the landlord’s name and address at the top. The receipt should also have a serial number for record-keeping purposes. It’s important to mention whether the rent is inclusive or exclusive of maintenance charges. If there is any advance rent paid, specify it separately in the receipt.

Ensure both parties sign the document at the bottom for validity. You may add a note specifying that the receipt is issued for the payment made on the stated date. This simple format helps in maintaining transparency and can be used as proof of payment for both parties.

To draft a rent receipt, include the tenant’s name, the landlord’s details, and the rental period. The first line should state the amount of rent paid, including both the numeric value and words for clarity. The payment date must be clearly mentioned, followed by the property address and the month for which the rent is paid. Specify the payment method, such as cash, cheque, or bank transfer. If applicable, mention any additional charges like maintenance fees.

Always include the receipt number for record-keeping purposes. If the rent amount has changed, specify the previous and new amounts with dates. Include the landlord’s signature or stamp, along with the tenant’s acknowledgment if needed. Avoid ambiguity by using precise language, and ensure that both parties have a copy for future reference.

Finally, for tax purposes, mention whether the rent includes GST (Goods and Services Tax) or if it is exempt. This detail is important for both the landlord’s and tenant’s financial documentation.

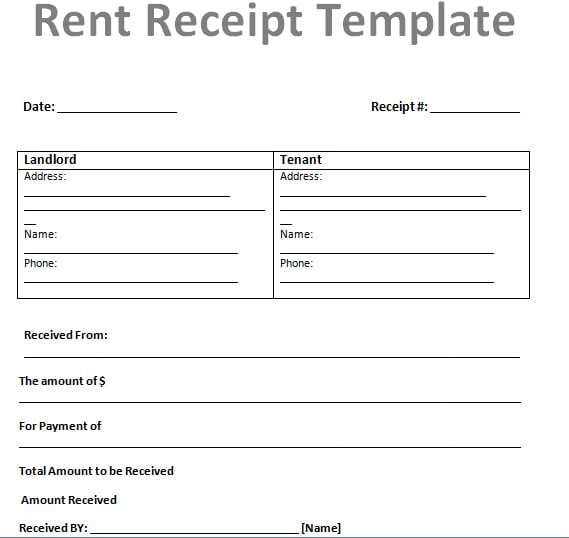

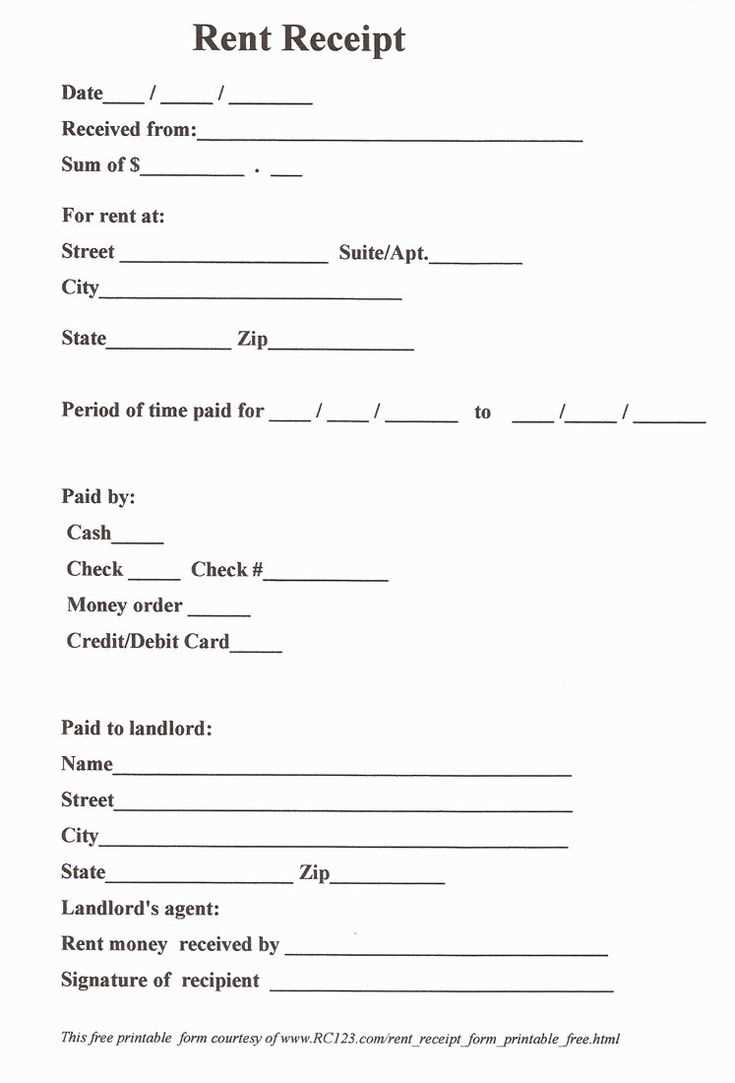

A valid rent receipt must contain the following key elements to ensure legal compliance and authenticity:

| Element | Description |

|---|---|

| Receipt Date | Include the exact date the rent payment was made. This is necessary for tracking payments and resolving any potential disputes. |

| Landlord’s Details | Provide the full name and address of the landlord or property owner. This helps identify the party receiving the payment. |

| Tenant’s Details | Include the tenant’s full name and address. This identifies the individual making the payment and ensures accountability. |

| Property Details | Specify the property address or description. This verifies the location for which the rent is being paid. |

| Amount Paid | Clearly state the amount of rent being paid, preferably in both numerical and written formats for clarity. |

| Payment Mode | Indicate how the payment was made (e.g., cash, bank transfer, cheque) to avoid any confusion about the method used. |

| Duration of Rent | Specify the rental period the payment covers (e.g., monthly, quarterly), which helps establish the timeframe of the transaction. |

| Signature | Both the tenant and landlord should sign the receipt, confirming the transaction took place. A signed receipt holds greater legal weight. |

These elements ensure the rent receipt is legally valid and can be used as proof of payment for various purposes, including tax filing and dispute resolution.

Adjust your receipt format based on the payment method used. For cash transactions, include the exact amount received and specify the currency. For bank transfers, note the transaction reference number and bank details for clarity. With credit or debit card payments, record the last four digits of the card number and the authorization code for tracking. Mobile wallet payments like Paytm or Google Pay should have the payment ID and transaction timestamp. This ensures transparency and helps both the tenant and the landlord maintain accurate records.

Consider adding a payment method icon or logo to further distinguish between methods. For cheque payments, mention the cheque number, bank name, and date of issue. Ensure each method is clearly labeled, helping tenants quickly identify payment type and avoid confusion. Customizing receipts like this will streamline the documentation process and provide a professional touch to your rental agreements.

To create a clear rent receipt template in India, follow these guidelines:

- Tenant Details: Include the tenant’s full name and address. This helps in identifying both parties involved in the rental agreement.

- Landlord Information: Provide the landlord’s name, address, and contact details. This ensures transparency and clarity for both parties.

- Rental Amount: Clearly state the amount paid by the tenant for the rental period. Be specific about the currency (INR) and mention if it’s for monthly or yearly payment.

- Payment Date: Mention the exact date the payment was received. This is important for tracking purposes and legal compliance.

- Payment Mode: Indicate how the payment was made (cash, cheque, bank transfer, etc.). This adds credibility to the transaction.

- Period Covered: Clearly state the rental period for which the payment is made (e.g., “For the month of January 2025”).

- Signature: Both the landlord and tenant should sign the receipt to confirm the payment and agreement. This helps avoid future disputes.

Make sure the template is clear and professional. Keep it concise and use a simple format to ensure both parties can refer to it easily in case of discrepancies.