If you’re a landlord in Australia, using a clear and accurate rent receipt template is important for keeping track of payments. A good template helps ensure that all necessary information is recorded properly for both you and your tenant. This document serves as proof of payment, which can be useful for both tax purposes and resolving disputes.

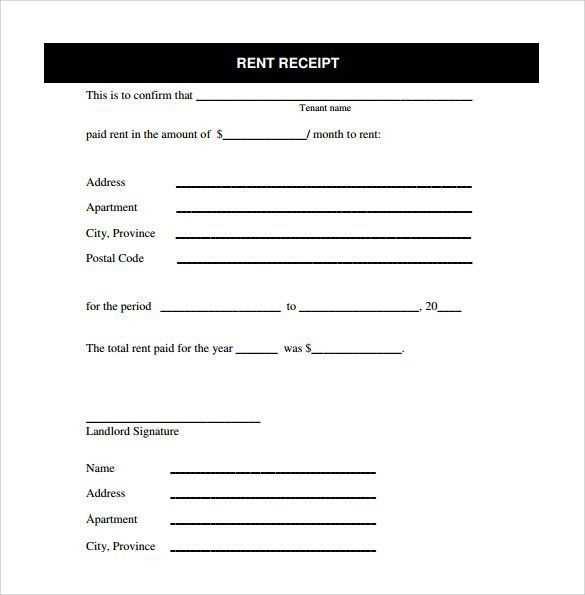

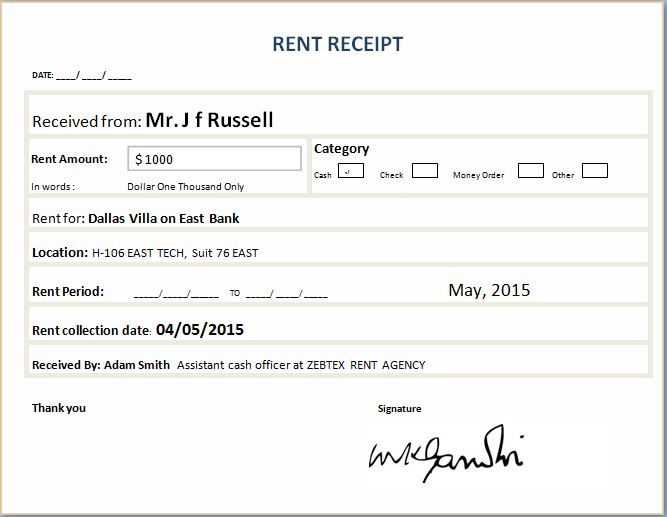

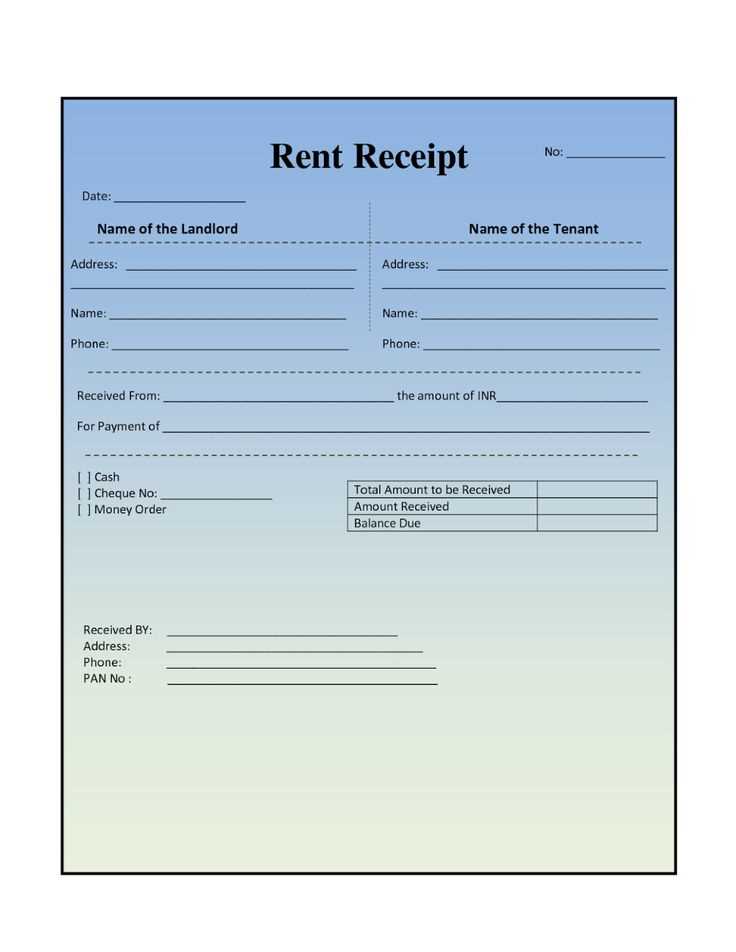

For a complete rent receipt, include details such as the tenant’s name, rental property address, the payment amount, the date of the transaction, and the rental period covered. It’s also important to include the payment method, whether cash, cheque, or bank transfer. Including these specifics not only makes the receipt clear but also protects both parties in case of any disagreements.

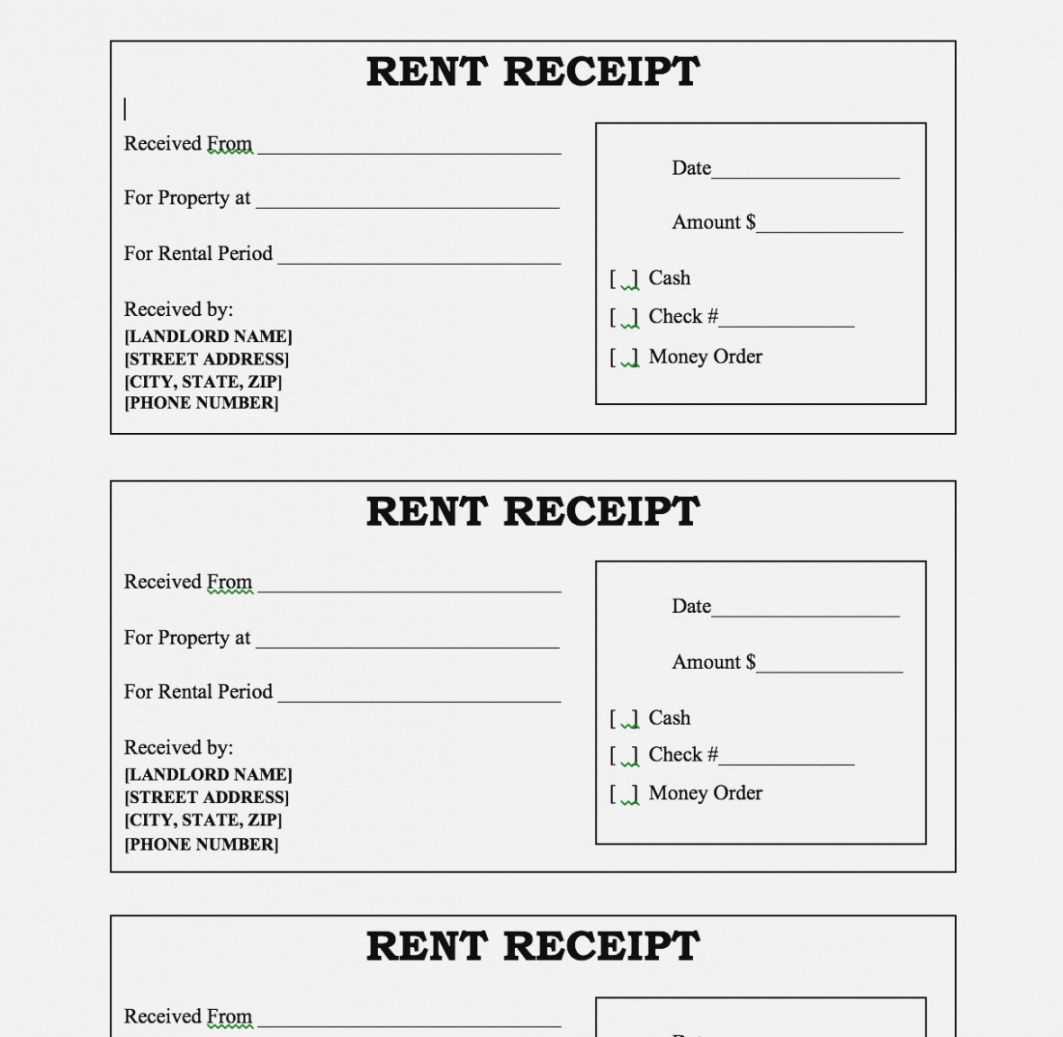

Make sure your template is simple and professional. A well-organized format that includes all necessary fields can be easily customized to suit your needs. It’s a good idea to keep a copy of each receipt for your own records, and if possible, send a digital copy to your tenant for easy access.

Here’s the improved version with reduced repetitions:

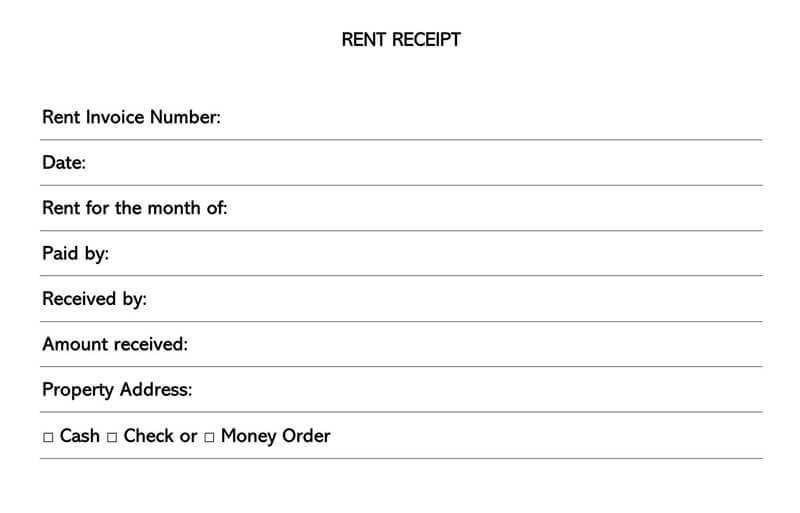

To create a rent receipt template, include the tenant’s name, rental address, payment date, rent amount, and payment method. The receipt should also have a clear statement that rent was paid for the specified period. Add the landlord’s details, including full name and contact information. If applicable, specify any adjustments for late payments or discounts. Make sure to include a unique reference number for tracking purposes.

Key Details to Include

Each rent receipt must list the tenant’s name and the property address clearly. The date of payment and the rental period covered should be prominently displayed. The rent amount should be itemized, including any fees or adjustments. It is advisable to add a note about the method of payment–whether it’s cash, bank transfer, or another method.

Additional Considerations

Ensure that the landlord’s contact information, including email or phone number, is easy to locate for any follow-up. Adding a signature or digital acknowledgment can also enhance the validity of the receipt. Keep in mind the importance of including clear terms for refunds or disputes to prevent confusion later on.

- Rent Receipt Template for Australia

For landlords in Australia, providing a rent receipt is not just a good practice, it’s a requirement for record-keeping. The receipt should contain key details to ensure transparency for both the landlord and the tenant. A basic rent receipt should include the following elements:

- Date of Payment: Include the exact date the payment was made.

- Tenant’s Details: The full name of the tenant should be noted on the receipt.

- Landlord’s Details: Include the full name and contact information of the landlord or property manager.

- Amount Paid: Clearly state the amount of rent paid for the specific period.

- Payment Method: Indicate whether the payment was made via cash, cheque, bank transfer, etc.

- Property Address: List the address of the rented property.

- Period Covered: Specify the start and end dates for which the payment applies (e.g., February 1 to February 28).

- Receipt Number: A unique identifier for each receipt for easy reference.

By following this format, tenants will have a clear and legal record of their rent payments. This helps in case of disputes or when applying for other rental properties. Make sure to provide a copy of the receipt to the tenant immediately after payment is made.

To create a legally valid rent receipt, include specific details that both the landlord and tenant can refer to. Start by adding the tenant’s name and the landlord’s contact information. Clearly state the address of the rental property and the amount paid. Ensure the payment date is noted, along with the payment method used, whether it’s cash, bank transfer, or cheque.

Details to Include in a Rent Receipt

Each receipt should feature a unique receipt number for tracking purposes. This will help in organizing records and prevent confusion. The receipt should also state whether the payment covers a partial or full month’s rent. Finally, a signature from the landlord or authorized representative adds authenticity and confirms that the transaction was completed.

Why Accuracy Matters

Accurate information prevents future disputes. Both parties should verify all details before finalizing the receipt. This includes checking payment amounts, dates, and other relevant information. Proper documentation ensures that rent payments are legally recognized and supports tax filings if needed.

Ensure your rent receipt includes all necessary details to make it valid and useful for both parties. Start with the tenant’s name and address to identify who made the payment. Include the landlord’s name or property management company’s details as well. Specify the payment date and the amount received. This confirms that payment was made on time and in full.

Key Information to List

| Detail | Description |

|---|---|

| Tenant’s Name | Full legal name of the tenant making the payment. |

| Landlord’s Name | Full name of the landlord or property management company. |

| Payment Date | The exact date when the payment was received. |

| Amount Paid | The total amount paid by the tenant for the rental period. |

| Rental Period | Clearly state the time frame the rent covers (e.g., from Jan 1 to Jan 31). |

| Payment Method | Specify whether the payment was made by bank transfer, cash, check, etc. |

Other Useful Details

Including a reference number or receipt number can help track payments. If there are any partial payments or remaining balances, note them down. This reduces confusion in the future. Also, including a note about whether the payment covers a security deposit, late fees, or other charges ensures clarity for both parties.

Ensure accuracy when issuing rent receipts to avoid disputes and confusion. Here are common mistakes to steer clear of:

1. Missing Key Information

- Always include the tenant’s name, address, and contact details, along with the property details.

- List the rental period (e.g., weekly, monthly) and the amount paid clearly.

- Don’t forget to include the receipt date and the payment method used.

2. Incorrect Amounts or Overpayments

- Double-check the amount received before issuing the receipt.

- If a partial payment was made, clearly state the outstanding balance to avoid misunderstandings.

3. Failing to Use Consistent Formatting

- Stick to a simple, consistent format for all receipts.

- Ensure the receipt is easy to read, using clear fonts and spacing.

4. Providing Receipts for Non-Rent Payments

- Only issue rent receipts for rental payments, not for other fees (e.g., late fees or damages).

- Consider issuing separate receipts for these additional charges to keep records clear.

5. Not Keeping Copies

- Maintain a copy of each rent receipt for both your records and your tenant’s.

- This will protect both parties in case of a dispute.

To properly issue a rent receipt in Australia, ensure the document includes the rental property’s address, tenant’s name, payment amount, and payment date. A receipt should also mention the rental period covered by the payment. Provide a clear description of the method used for payment, such as cash, cheque, or bank transfer. This ensures the tenant has an accurate record of their transaction.

Required Details

- Tenant’s name

- Landlord’s or agent’s name

- Property address

- Payment date

- Payment amount

- Rental period covered

- Payment method

Issuing the Receipt

Make sure the receipt is signed or otherwise verified by the landlord or property agent. It’s beneficial to offer both digital and paper copies to the tenant for easy record-keeping. This not only serves as proof of payment but also helps in managing future disputes or audits.