Use the Rent Receipt Template B form to maintain clear and accurate records for rental transactions. It ensures that both landlords and tenants have a reliable proof of payment. This template includes all necessary details, such as the date of payment, amount paid, rental period, and tenant’s information, offering transparency and reducing any potential disputes.

For landlords, providing a rent receipt is an excellent practice to build trust with tenants and stay organized with financial records. It also serves as official documentation for tax purposes, especially when claiming rental income or expenses. The Rent Receipt Template B is easy to customize, ensuring that landlords can include any additional terms or conditions specific to their rental agreements.

Tenants should request a receipt for every payment to have evidence of their rent paid. This is crucial for maintaining a clear financial history and can be helpful in future lease agreements or when dealing with rental disputes. The template guarantees that the receipt format remains consistent, offering an efficient solution for both parties.

Here’s the revised text, without repetitions of words:

Ensure the rent receipt template is clearly organized. Include details such as tenant name, address, payment amount, and date. Each section should be concise and easy to understand. Avoid using redundant phrases and keep sentences direct. Specify the rental period and any additional charges if applicable. When preparing the document, check for accuracy in all figures and terms. Always use a professional font and ensure it’s legible. The template should be user-friendly while maintaining a formal tone. Double-check that both tenant and landlord information are correct and up to date.

- Rent Receipt Template B Forms: A Practical Guide

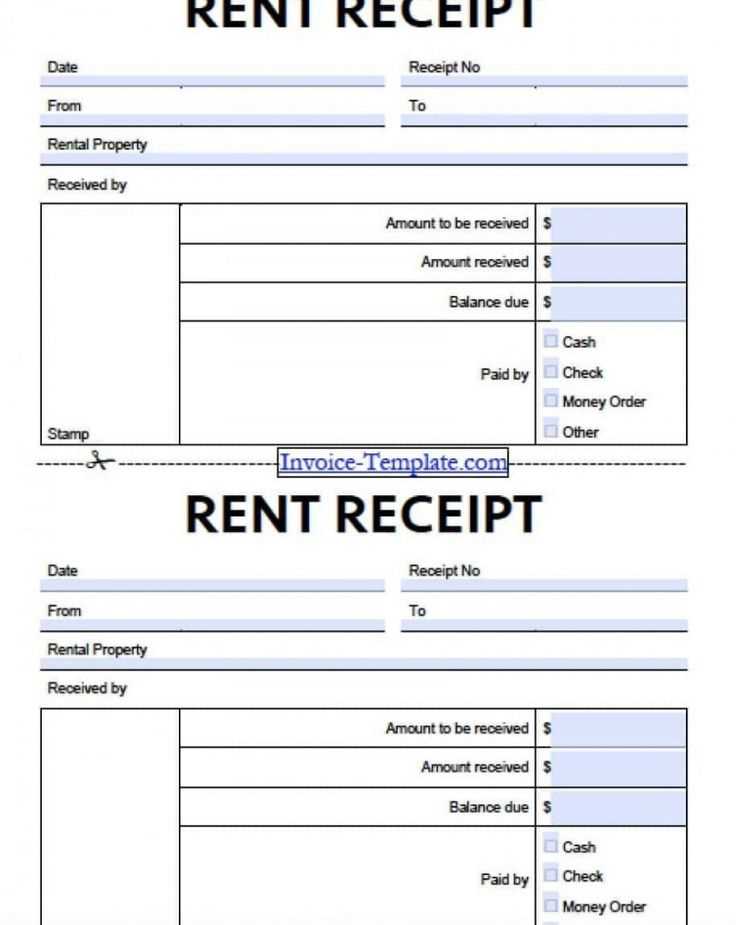

To create a rent receipt using Template B forms, ensure that it includes key details like tenant and landlord information, payment dates, rental amount, and payment method. A clear, concise format reduces confusion and helps both parties keep accurate records.

Required Information for Rent Receipt

When filling out Template B, make sure to include the following:

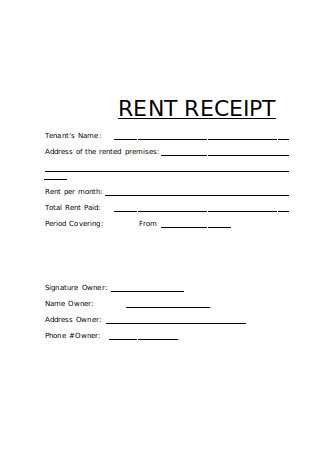

- Tenant Name: Full name of the individual or entity paying rent.

- Landlord Name: Full name of the property owner or leasing agent.

- Property Address: Address of the rental property.

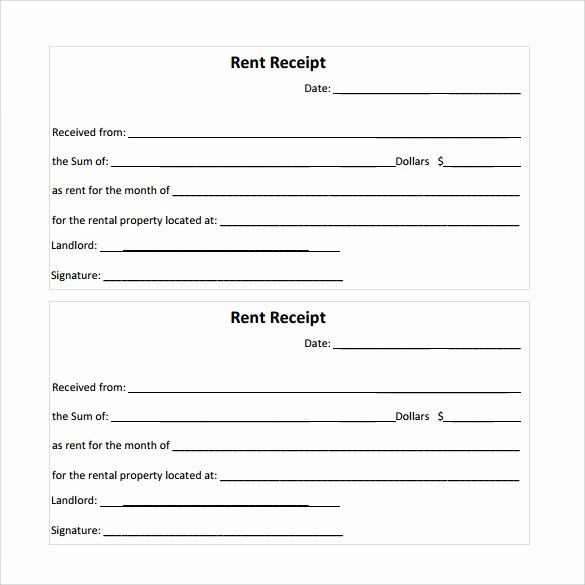

- Payment Date: Specific date the rent was paid.

- Amount Paid: Exact dollar amount received for rent.

- Payment Method: Indicate if payment was by cash, check, or other method.

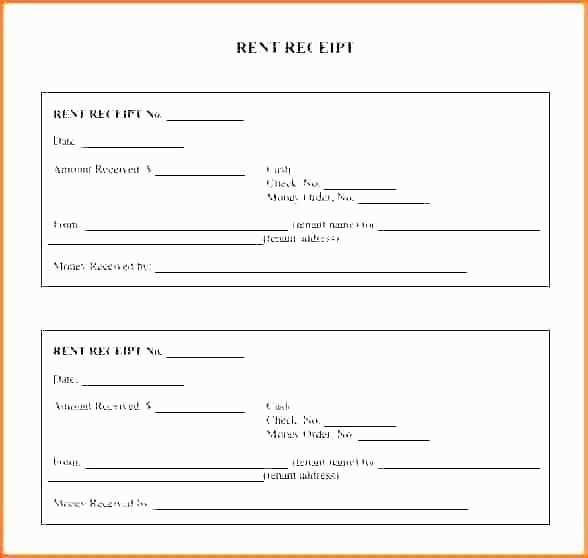

- Receipt Number: A unique identifier for the receipt to ensure easy tracking.

Example Rent Receipt Template B

| Details | Information |

|---|---|

| Tenant Name | John Doe |

| Landlord Name | Jane Smith |

| Property Address | 123 Maple Street, Springfield, IL |

| Payment Date | February 1, 2025 |

| Amount Paid | $1,200.00 |

| Payment Method | Check |

| Receipt Number | 20250201 |

By including these details, both tenant and landlord can track rental payments accurately, reducing the likelihood of misunderstandings or disputes. The use of Template B forms can streamline this process, ensuring proper documentation is maintained.

Fill in the rent receipt template B accurately by ensuring each field is completed with the correct details. Begin with the tenant’s name and address, followed by the landlord’s information. The receipt should include the property address to avoid confusion. Mention the payment amount received and the date it was paid. Be clear if the payment is for a partial period, such as a partial month or specific time range.

Provide Clear Payment Information

Specify whether the rent payment was made via cash, check, or another method. Include transaction details if applicable, such as check number or payment reference. This transparency will prevent any disputes regarding the transaction. If a late fee is included, ensure this is listed separately along with the regular rent amount.

Final Details and Signature

Conclude with the total rent paid and confirm the landlord’s signature. A handwritten or digital signature adds authenticity to the receipt. If possible, provide a copy to the tenant for their records. This step confirms both parties are aligned on the payment terms.

1. Date of Payment: Clearly specify the date the payment was received to create a record of when the transaction took place.

2. Tenant’s and Landlord’s Details: Include the names and addresses of both parties involved in the transaction. This ensures that the receipt can be traced back to the right individuals.

3. Payment Amount: Mention the exact amount paid for rent, specifying the currency and any additional fees that might have been included in the payment.

4. Rental Period: Clearly state the rental period covered by the payment (e.g., from January 1st to January 31st). This ensures the payment is linked to the correct timeframe.

5. Property Address: Provide the full address of the rental property, including the unit number (if applicable), to avoid any confusion about which property the payment relates to.

6. Payment Method: Indicate how the payment was made (e.g., cheque, cash, bank transfer), as this adds clarity to the record of the transaction.

7. Landlord’s Signature: Include a section for the landlord’s signature, confirming the receipt of payment. This adds credibility to the document and acknowledges the transaction was completed.

Ensure all fields are filled correctly on Rent Receipt B. Missing details, like the tenant’s name, property address, or payment amount, can create confusion and may result in disputes later. Double-check every entry to prevent errors.

1. Incorrect Payment Amounts

Make sure the payment amount matches the actual rent received. A mismatch can lead to disagreements or misunderstandings. If the tenant pays in installments, note the exact amount for each payment.

2. Missing Signature

Both the landlord and the tenant should sign the receipt. An unsigned receipt may not hold legal weight in case of disputes. Always collect signatures to ensure the document’s validity.

3. Failing to Specify the Date

Including the date of payment is crucial. Without it, the receipt may appear incomplete or unreliable. Always record the exact date the payment was made to avoid confusion.

4. Overlooking Payment Method

Clearly note how the rent was paid–whether by cash, bank transfer, check, or another method. This detail can be essential in case of any payment verification needs.

5. Using an Inappropriate Template

Using an outdated or incorrect template can cause issues. Make sure you’re using an up-to-date version of Rent Receipt B that meets local legal requirements to avoid potential problems.

6. Skipping Tenant Details

Never forget to include the tenant’s full name and contact information. This is a key part of the receipt and helps clarify who made the payment.

7. Not Keeping Copies

It’s easy to overlook, but always keep a copy of the receipt for both parties. This ensures you have a record of the transaction in case you need it later for reference or disputes.

Receipt Template B Forms: Key Tips

Ensure your rent receipt template follows a clear and concise format. Here’s a streamlined approach to create an efficient rent receipt.

Include Essential Information

- Tenant’s name and address

- Landlord’s name and contact details

- Payment date and amount received

- Payment method (cash, check, etc.)

- Property address

Clear Identification of Payment Period

Specify the period covered by the payment (e.g., February 1 to February 28) for clarity.

By incorporating these details, the receipt becomes more transparent, minimizing potential confusion. Also, ensure the format is easy to read and follow. A well-structured receipt can prevent unnecessary disputes in the future.