If you’re a landlord in Bangalore, providing a rent receipt to your tenants is a simple but significant step in maintaining clear financial records. A rent receipt serves as proof of payment for the tenant and protects both parties in case of any disputes. It’s important to use a format that includes all necessary details, such as the date of payment, amount, property address, and the names of both the tenant and landlord.

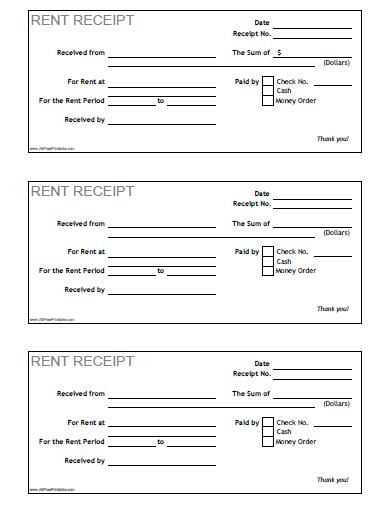

Creating a rent receipt template specific to Bangalore should be straightforward, ensuring compliance with local regulations. The receipt should clearly mention the payment method, whether it’s cash, cheque, or bank transfer, and include a unique receipt number for easy reference. This keeps the transaction transparent and helps maintain accurate documentation for tax purposes.

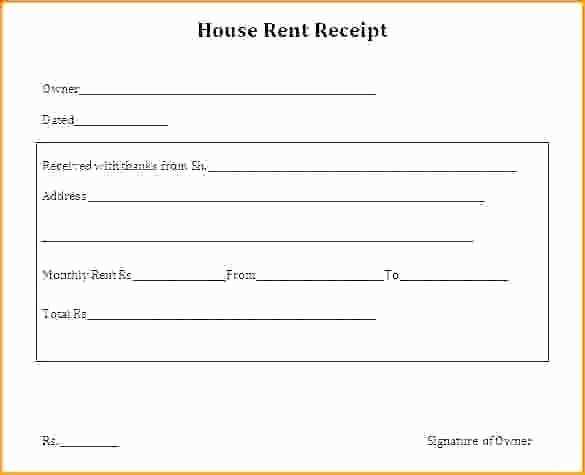

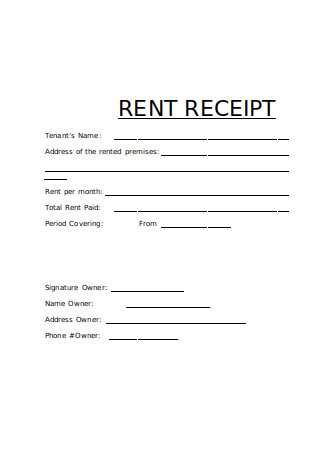

Use a simple, easy-to-read template that includes the following key details: Tenant’s name, landlord’s name, rental period, payment date, amount paid, payment method, and the property’s address. By including these elements, you ensure that both you and your tenant have a clear, formal record of each transaction. A well-structured receipt also provides added peace of mind in case of any future disputes.

Here are the corrected lines:

Ensure that your rent receipt includes the tenant’s full name, address, and the rental property’s details. The receipt should clearly state the rental period, payment amount, and the mode of payment. It is also crucial to mention the date on which the rent was paid and the due date for the next payment. Be sure to include the landlord’s contact details, and provide a unique receipt number for easy tracking.

Make sure the amount paid matches the lease agreement. Specify the currency (e.g., INR) and include any tax information if applicable. Lastly, avoid using vague terms like “Paid in full” and instead write “Received [amount] for [period] from [tenant’s name].” This ensures clarity and helps both parties keep accurate records.

- Rent Receipt Template Bangalore

When creating a rent receipt template for Bangalore, ensure it includes the following key details: landlord and tenant information, rental property address, payment amount, date of payment, and the rental period covered. The receipt should clearly state whether the rent is for a full month or a specific period. Also, specify the mode of payment (cash, cheque, online transfer) and include the receipt number for reference.

Landlord and Tenant Details: The names, addresses, and contact information of both parties should be included. If applicable, mention any terms or conditions related to the rental agreement.

Property Address: Provide the full address of the rental property to avoid any confusion about the location.

Payment Details: Clearly state the amount paid, the rent period, and the date of payment. If a late fee is applicable, mention it in this section.

Receipt Number: A unique receipt number helps keep track of all transactions, especially in case of disputes. It’s recommended to use a sequential numbering system.

This template can be easily modified for monthly, quarterly, or yearly rental agreements. Keep a copy for both the landlord and tenant for future reference.

Creating a rent receipt for Bangalore requires including specific details to ensure it’s legally valid and clear for both the tenant and landlord. Here’s how to do it.

Required Information

Include the following details on the receipt:

- Tenant’s name and address

- Landlord’s name and address

- Property address

- Amount paid (in numbers and words)

- Rent period (month and year)

- Date of payment

- Payment method (cash, bank transfer, cheque, etc.)

- Signature of the landlord or authorized person

Format Tips

Ensure the receipt is clear and professional. Use a simple layout, starting with the header that reads “Rent Receipt” or “Receipt for Rent Paid”. A well-structured document will include a receipt number for tracking purposes, along with the date the receipt is issued.

In Bangalore, rent receipts may also be needed for tax purposes or proof of residence. Make sure the details are accurate to avoid any confusion in the future.

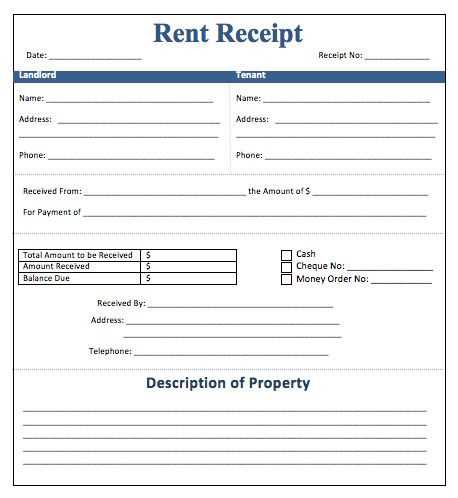

Rental receipts in Bangalore must include specific details to be legally valid. The receipt should state the names of both the tenant and the landlord, the property address, rental amount, payment date, and the rental period. If GST is applicable, the landlord must include their GST registration number. The absence of these details can invalidate the receipt in legal matters.

Required Details

The amount paid should appear in both numerical and written formats to prevent confusion. The receipt must also specify the payment period (monthly, quarterly, etc.) and list any advance payments or deposits. If there is an outstanding balance, it should be clearly stated.

Tax and Legal Considerations

The Rent Control Act and the Income Tax Act require proper documentation of rental transactions. Receipts must be issued for tax reporting and can serve as proof in case of a legal dispute. Both landlord and tenant should keep these receipts for at least six years. The landlord’s signature is necessary for the receipt’s authenticity.

When customizing receipt templates for rental agreements in Bangalore, it’s important to include specific details that reflect the terms of each contract. Here’s how you can ensure that your templates meet the necessary requirements:

- Include Key Rental Information: Always add the tenant’s name, the landlord’s name, property address, rental amount, payment due date, and the duration of the rental agreement.

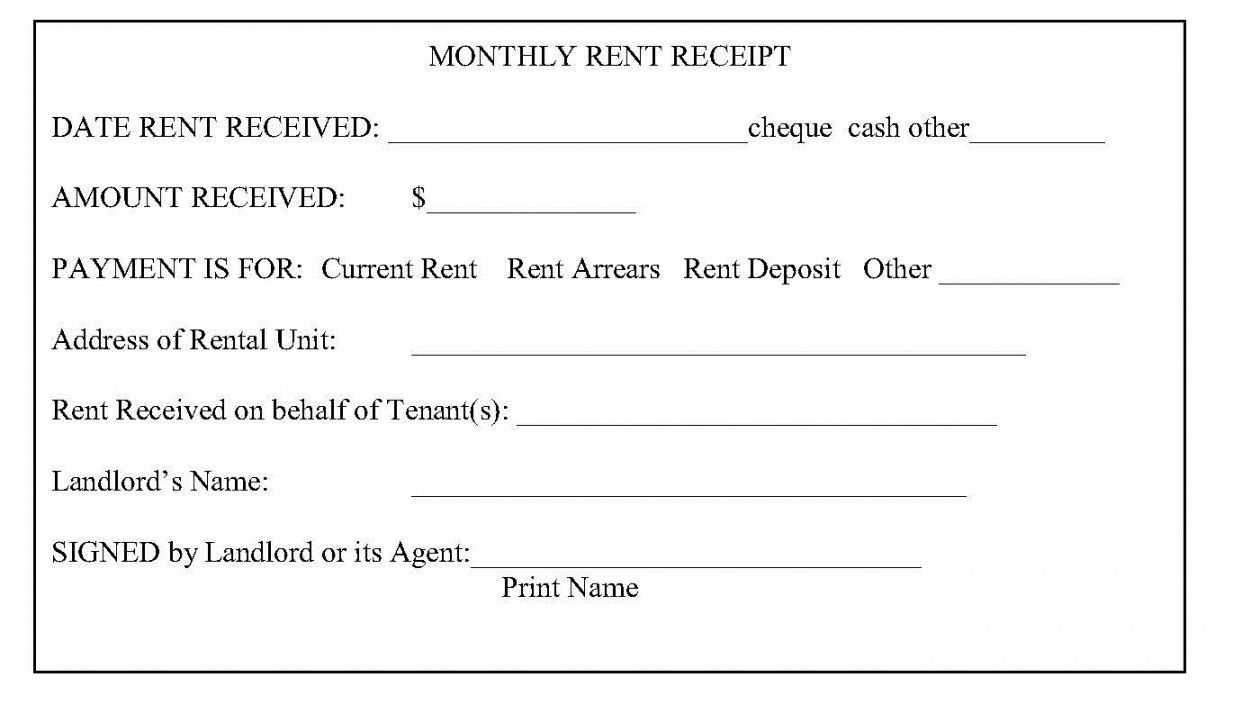

- Specify Payment Frequency: Clearly state whether the rent is paid monthly, quarterly, or annually. Customize the receipt to reflect these intervals accordingly.

- Payment Method Details: Indicate the method of payment, such as bank transfer, cheque, or cash. It’s important to note any transaction reference numbers for verification.

- Security Deposit: Include a separate section for the security deposit, indicating if it is refundable or non-refundable, along with the amount paid and any deductions if applicable.

- Legal Compliance: Make sure the receipt complies with local regulations, including any GST charges or other taxes applicable in Bangalore. This ensures the document remains legally valid.

Customize for Lease Type

- Fixed-Term Lease: For fixed-term leases, highlight the rental period with start and end dates, and include provisions for renewal or termination of the agreement.

- Month-to-Month Lease: For month-to-month agreements, ensure the receipt reflects the rent paid for that specific month and includes any terms related to notice periods or rent increases.

Additional Details

- Late Payment Penalties: If the agreement includes penalties for late payments, mention the late fees clearly on the receipt to avoid misunderstandings.

- Attachments: You may attach a copy of the rental agreement or any receipts from previous payments for record-keeping purposes.

Ensure that your rent receipt template clearly includes all the necessary details for both parties. The key information should include the tenant’s name, the landlord’s name, the address of the property, and the rental period covered by the payment. Also, indicate the amount paid, the payment method, and any other relevant payment details such as the check number or online transaction reference.

| Field | Description |

|---|---|

| Tenant Name | Full name of the person who paid the rent. |

| Landlord Name | Full name of the property owner. |

| Property Address | Complete address of the rented property. |

| Rental Period | The start and end dates for the rent payment period. |

| Amount Paid | The exact amount the tenant paid for rent. |

| Payment Method | How the rent was paid (e.g., cash, cheque, bank transfer). |

| Receipt Date | The date on which the receipt is issued. |

| Landlord Signature | Signature of the landlord or representative. |

Ensure accuracy and clarity in the template to avoid any potential disputes. Keep it simple yet detailed enough to cover all bases. A well-organized rent receipt helps build trust and transparency between the tenant and landlord.