If you’re a landlord in Canada, using a rent receipt template can simplify your tenant transactions and ensure clear documentation. A proper rent receipt not only helps you stay organized, but it also protects both parties legally. Whether you’re dealing with monthly payments or one-time rent charges, a standard template saves time and avoids mistakes.

Make sure your rent receipt includes the tenant’s name, address of the rental property, rental period, the amount paid, and the date of payment. This will serve as both a record for the tenant and proof of payment in case of disputes. A simple and clean format works best, but don’t forget to add your contact details for future correspondence.

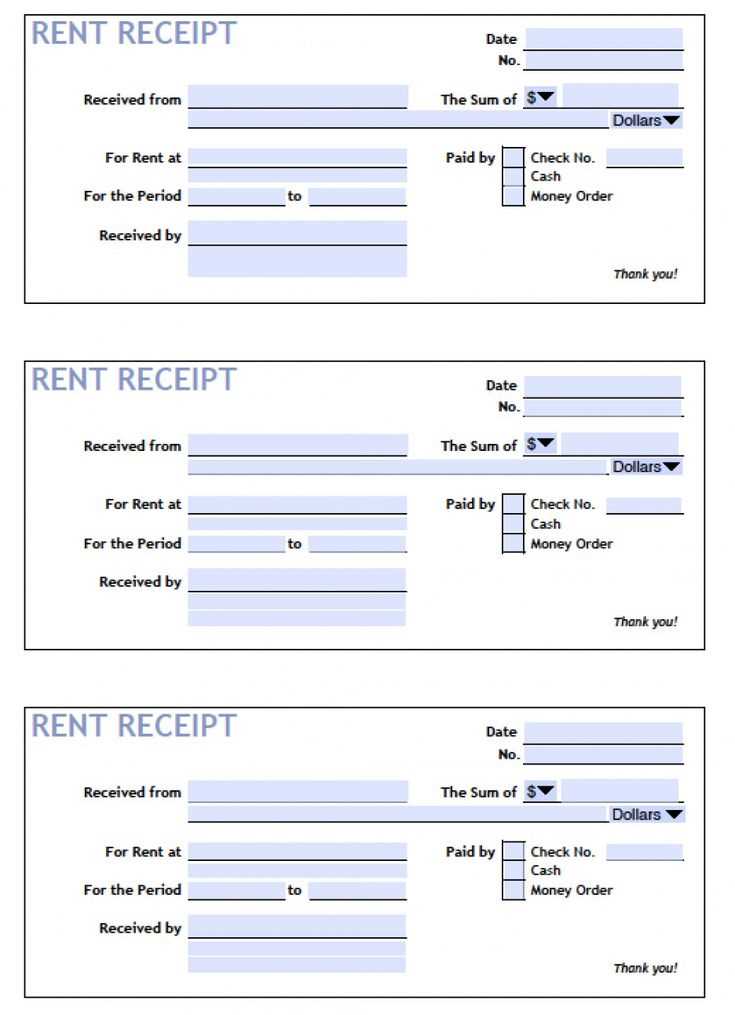

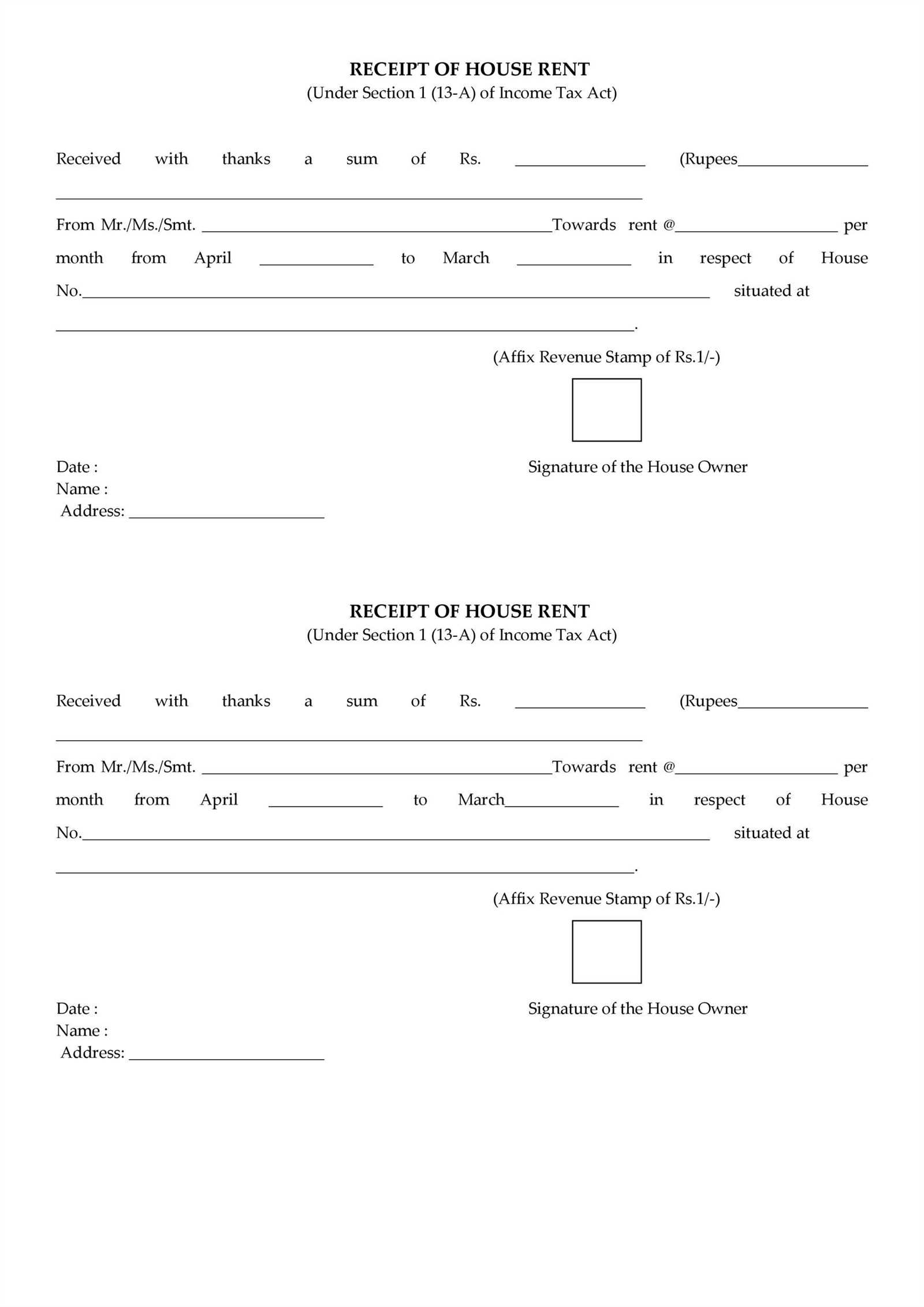

For ease of use, you can find pre-made rent receipt templates online or create your own in a word processor. Many templates are designed to meet Canadian rental standards, which will help you avoid missing crucial details. Customize it as needed, but always maintain clarity and accuracy in every receipt.

Here is the revised version with the repetitions removed:

When creating a rent receipt template for Canada, it’s important to ensure clarity and accuracy. The template should include essential details such as the tenant’s name, rental property address, payment amount, and payment date. Avoid unnecessary repetition of these key details across the document.

Key Components of a Rent Receipt

Make sure to include the following information in your rent receipt:

- Tenant’s full name

- Rental property address

- Amount paid

- Date of payment

- Payment method (e.g., cheque, bank transfer, etc.)

- Landlord’s signature or name

Additional Considerations

If the payment is partial, indicate the remaining balance and payment schedule. Always double-check that the amount corresponds with the agreed-upon rent, and that the payment date is correctly reflected.

- Rent Receipt Template Canada: A Practical Guide

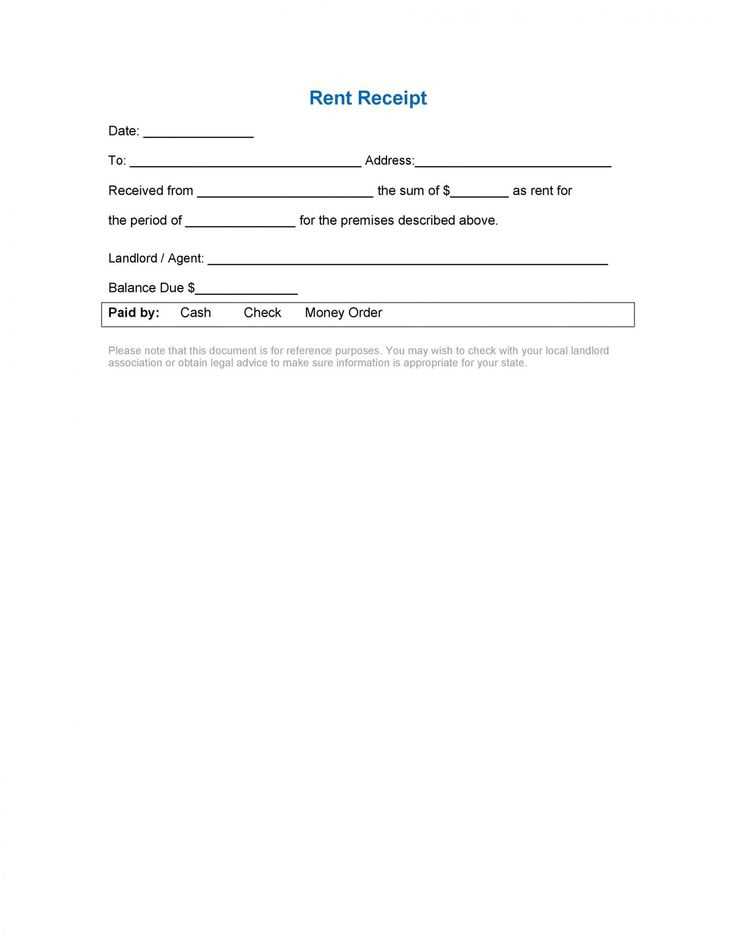

A rent receipt serves as a formal record of rent payments made by tenants. In Canada, it is essential for both tenants and landlords to have a clear, consistent method for documenting these transactions. Here’s a breakdown of what should be included in a rent receipt template:

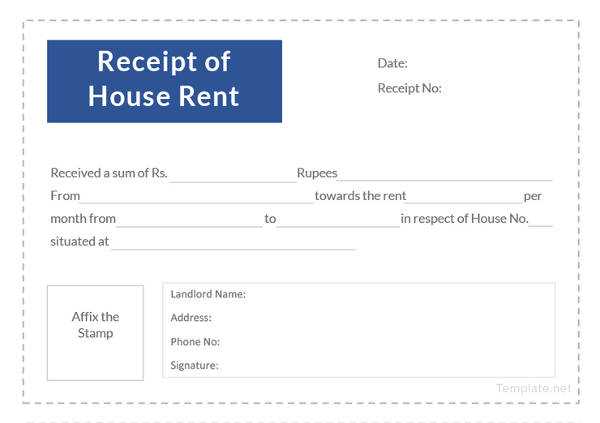

- Landlord’s Information: The name, address, and contact details of the landlord or property manager.

- Tenant’s Information: The tenant’s name and the rental property address.

- Payment Details: The amount of rent paid, the payment method (e.g., cheque, cash, or e-transfer), and the date the payment was made.

- Rental Period: The start and end dates of the period for which the rent is being paid. This ensures clarity on whether the payment covers weekly, monthly, or another rental cycle.

- Receipt Number: A unique identifier for each receipt issued. This is especially useful for tracking payments and resolving disputes.

- Landlord’s Signature: A space for the landlord or their agent to sign, confirming the payment.

The rent receipt should be clear, easy to understand, and free of any ambiguity. Both the tenant and landlord should retain a copy of each rent receipt for their records. Using a template ensures consistency and minimizes the chance of errors. You can easily create a simple template in Word, Excel, or use specialized software designed for rental property management.

Having a standardized rent receipt not only protects both parties but also ensures compliance with Canadian rental laws. Some provinces, like Ontario, may have specific requirements regarding the format or content of receipts, so it’s a good idea to familiarize yourself with local regulations.

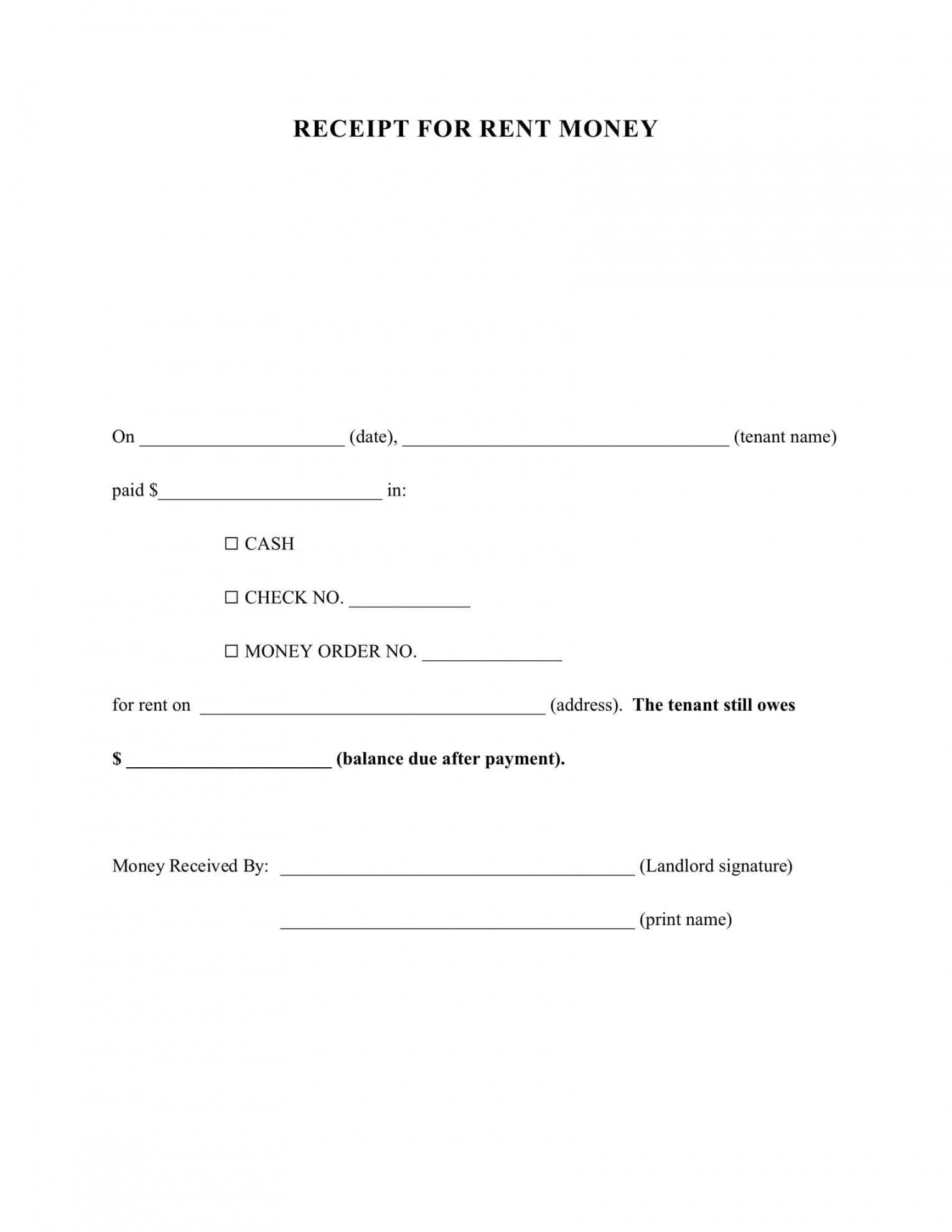

To avoid any issues, always provide receipts for cash payments, as they are more difficult to verify without proper documentation. By maintaining an accurate record of all transactions, you can prevent misunderstandings and keep a smooth landlord-tenant relationship.

To create a legally valid rent receipt for tenants in Canada, ensure that it includes specific information required by local laws. A rent receipt serves as proof of payment for both the landlord and the tenant, protecting both parties in case of disputes or future legal matters.

1. Include Tenant and Landlord Details

Start by clearly listing the full names of both the tenant and the landlord. Include the address of the rental property to avoid confusion. This helps identify the parties involved in the transaction and provides clarity about the rental agreement.

2. Specify Rent Payment Information

Clearly state the rent amount, the period for which the payment is made (e.g., monthly, weekly), and the payment date. If the payment was made by cheque, cash, or electronic transfer, specify this as well. It’s also beneficial to include any late fees, if applicable, along with the total amount paid.

Lastly, make sure to sign and date the receipt. This serves as official documentation of the transaction and is vital for both legal and financial purposes.

Your Canadian rent receipt must include key details to make it valid and helpful for both parties. Ensure the following information is present:

1. Tenant and Landlord Details

- Tenant’s Full Name: The person who is paying the rent.

- Landlord’s Full Name or Business Name: The individual or company receiving the rent payment.

2. Payment Information

- Amount Paid: Clearly state the total amount of rent paid.

- Payment Date: The exact date the rent payment was received.

- Payment Method: Indicate how the payment was made, such as cash, cheque, or bank transfer.

3. Rental Period

- Covered Dates: Mention the specific time period the rent covers (e.g., January 1–31, 2025).

4. Property Address

- Rental Property Address: Include the full address of the rented property.

5. Receipt Number and Signature

- Receipt Number: Assign a unique number for record-keeping.

- Landlord’s Signature: A signature or printed name of the landlord or authorized agent.

Ensure the receipt contains the correct date. A common mistake is to use the wrong date, which can create confusion for both the tenant and the landlord. Always double-check the date to avoid discrepancies with payment records.

Accurate amounts are a must. Double-check the rent amount and any additional charges to avoid errors. Incorrect amounts can lead to disputes or misunderstandings and may complicate tax reporting.

Do not omit the landlord’s or tenant’s full name and address. Both parties’ contact information should be clear and complete to avoid any legal issues. Ensure you use the full name of the landlord and tenant, not just initials or nicknames.

Clearly state the purpose of the payment. A common mistake is to issue receipts without specifying that the payment is for rent. Include a clear description of the rent being paid and the period it covers.

Failing to include payment method details can lead to confusion. Always state whether the payment was made in cash, by cheque, or through electronic transfer. This adds transparency and helps in keeping a proper record.

Avoid using vague descriptions for the transaction. The receipt should specifically mention the rent, including any additional costs (like utilities) that might be included in the total amount paid.

Check that the receipt includes both the landlord’s and tenant’s signatures if required. Some jurisdictions may ask for both parties to sign to acknowledge the transaction.

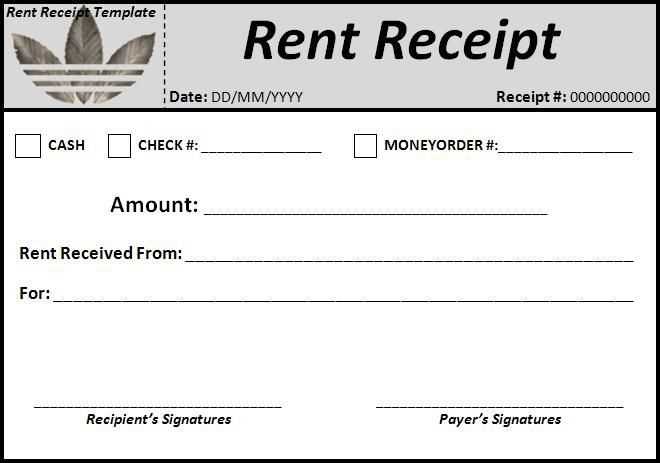

Use a clear and professional template. A poorly formatted receipt may raise doubts about the legitimacy of the transaction. Stick to standard templates that contain all required details and are easy to read.

Finally, don’t forget to provide a copy of the receipt to the tenant. Keep a copy for your own records as well. Both parties should have documentation for their reference in case of future disputes.

| Common Mistakes | Consequences |

|---|---|

| Incorrect date | Confusion and potential disputes |

| Missing or incorrect amounts | Misunderstanding of payment amounts and taxes |

| Omitting names or addresses | Legal complications or disputes |

| Unclear transaction purpose | Difficulty in tracking payments and verifying rent |

| Not listing payment method | Potential confusion on payment records |

How to Create a Rent Receipt Template for Canada

Designing a rent receipt template for Canada requires clarity and accuracy. Start by including the landlord’s and tenant’s names, along with the rental address. Indicate the payment date and the amount paid, specifying whether it covers a full or partial month. Include details about the payment method, such as cash, cheque, or bank transfer. Be sure to state whether the rent is paid weekly, monthly, or otherwise.

Key Components to Include

For transparency, list the payment period–either the exact start and end dates or the month covered. Make the rental amount clear, showing both the numeric figure and the words to avoid confusion. Include a unique receipt number for record-keeping. The landlord’s signature, along with the date of issuance, adds an extra layer of legitimacy.

Lastly, retain a copy for future reference and ensure the template is customizable to suit various rental agreements. Having a clear and professional rent receipt simplifies documentation for both parties and aids in managing rental payments efficiently.