If you are looking for a simple and reliable rent receipt template for ClearTax, you’re in the right place. A rent receipt serves as proof of payment and helps both landlords and tenants maintain clear records for tax and legal purposes. With ClearTax’s platform, you can easily manage your rent receipts and stay compliant with tax regulations.

Using a ClearTax rent receipt template ensures all necessary details are included, such as the tenant’s name, property address, rent amount, payment date, and any other specifics relevant to the agreement. This template streamlines the process, making it quick and hassle-free to generate receipts without missing key information.

Once you fill out the template, ClearTax allows you to generate a professional-looking rent receipt instantly. You can also customize it to reflect any special terms or conditions, ensuring that the receipt meets both your needs and legal standards.

For a seamless experience, always ensure that the template matches the current tax guidelines in your area. With ClearTax, you get up-to-date templates that make staying organized and compliant a straightforward task.

Here is the revised text, minimizing repetition while maintaining clarity and structure:

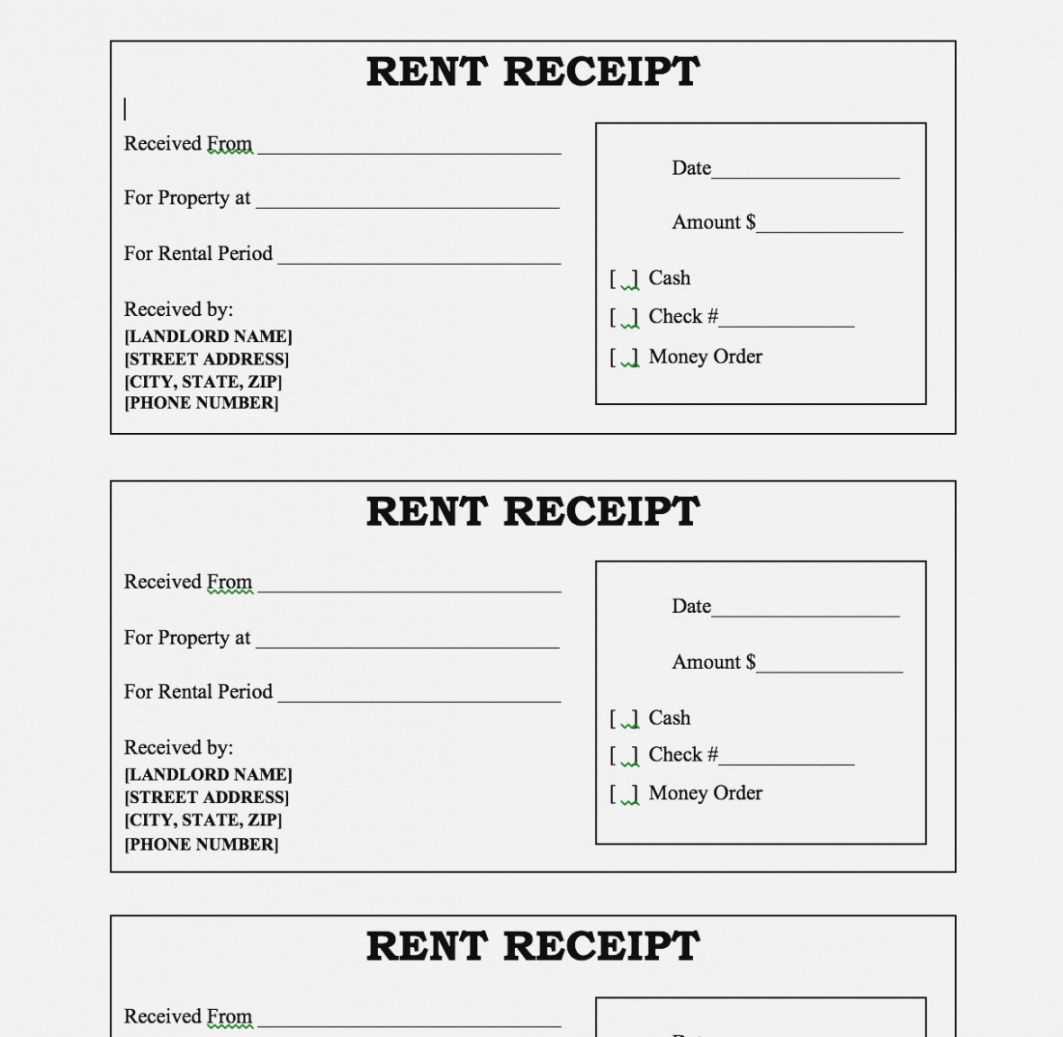

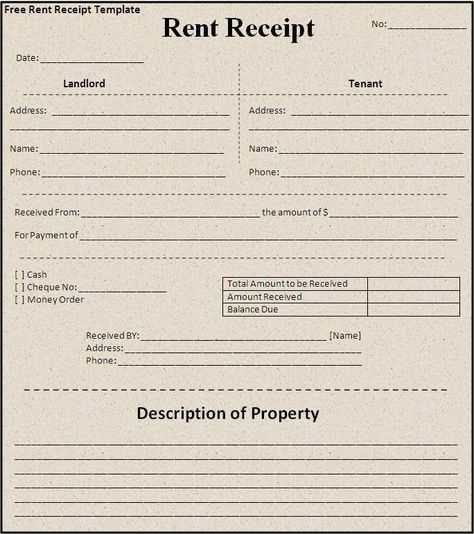

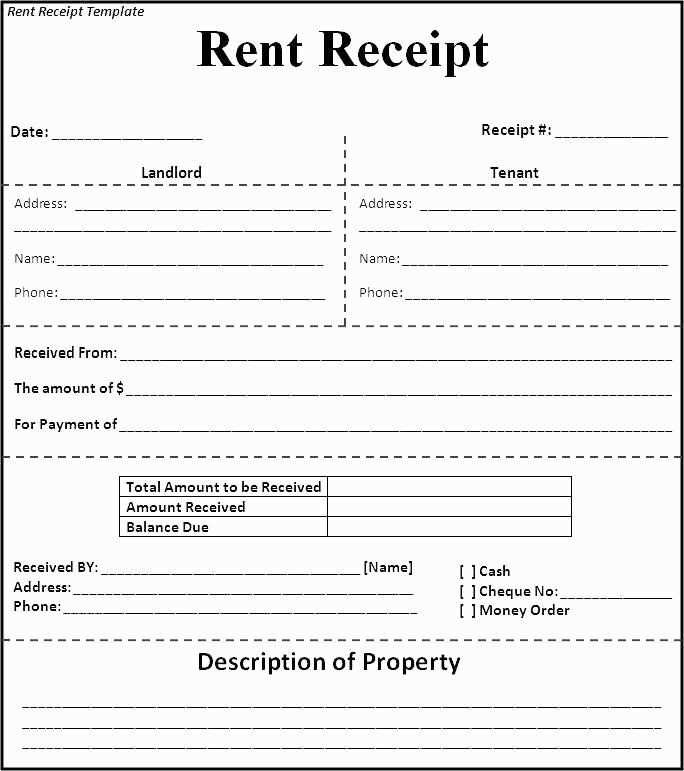

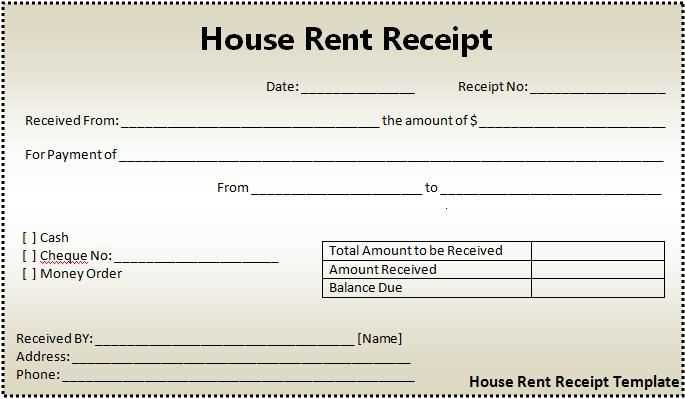

To create an accurate rent receipt for tax purposes, make sure the template includes these essential details:

- Landlord’s Name and Address: Clearly display the landlord’s full name and contact information.

- Tenant’s Name: Include the tenant’s full name or business name if applicable.

- Rent Amount: State the amount of rent paid, and the period it covers (e.g., monthly, quarterly).

- Payment Method: Indicate whether the rent was paid via check, bank transfer, or cash.

- Date of Payment: Specify the exact date on which the payment was made.

- Signature: The landlord or authorized person should sign the receipt for authenticity.

- Property Address: Mention the address of the rented property to avoid ambiguity.

Rent Receipt Template Example

| Field | Description |

|---|---|

| Landlord’s Name | John Doe |

| Tenant’s Name | Jane Smith |

| Amount Paid | $1200 |

| Payment Date | January 15, 2025 |

| Payment Method | Bank Transfer |

| Property Address | 123 Main Street, Apartment 4B, Cityville |

| Landlord’s Signature | _________________________ |

This template helps ensure that all necessary details are captured for both landlord and tenant records. Adjust the template as needed based on the specific circumstances or additional requirements in your region.

- Rent Receipt Template ClearTax

If you’re looking to create a rent receipt for tax purposes, ClearTax offers a simple, customizable template that can make the process quick and accurate. Here’s a step-by-step guide to using it effectively:

Steps to Use the ClearTax Rent Receipt Template

- Visit the ClearTax Website: Go to the official ClearTax website and search for the rent receipt template in the “Income Tax” section.

- Fill in Property Details: Enter the name and address of the property being rented. Include both the tenant and landlord’s names along with their contact details.

- Enter Payment Information: Specify the rent amount, payment period (monthly/annually), and the date of payment. ClearTax automatically adjusts these fields as you input the data.

- Tax Information: Include the applicable tax deductions or exemptions, if any, based on local laws. This section helps in ensuring accurate tax filing for both parties.

Key Features of the Template

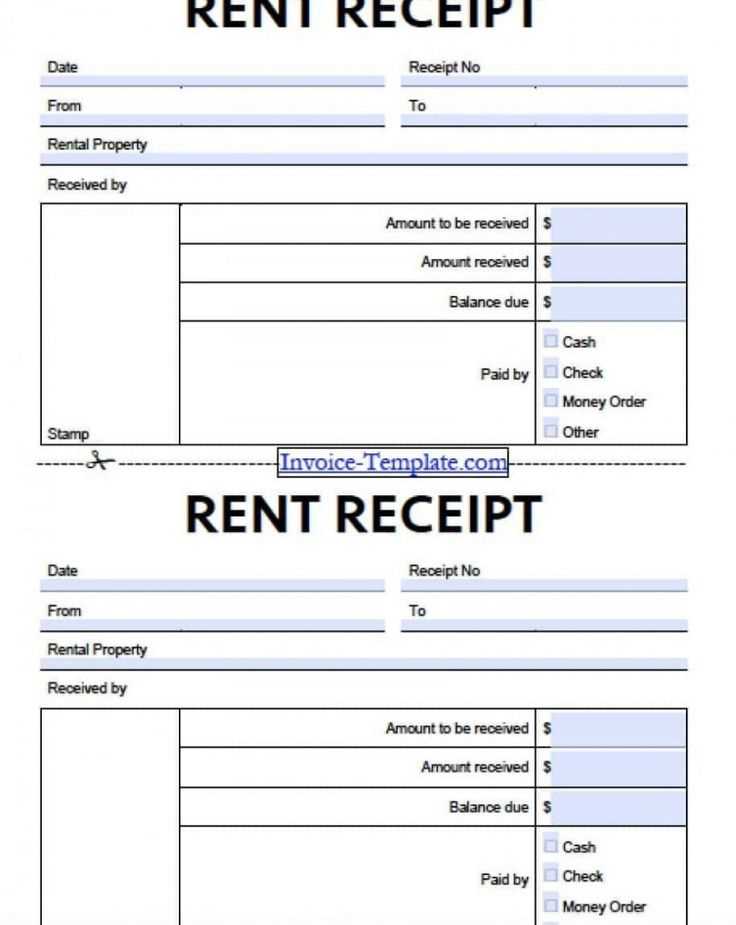

- Customizable Format: The template allows you to adjust the fields according to your needs, making it suitable for both residential and commercial rentals.

- Easy to Download: Once completed, you can download the rent receipt in PDF or Excel format, making it easy to store and print.

- Clear and Professional Design: The template includes all the necessary information while maintaining a clean, professional appearance, which is helpful for both landlords and tenants.

This template helps landlords and tenants keep proper records, especially when filing taxes or in case of disputes. By using ClearTax, you simplify the process and ensure that all necessary details are captured clearly and correctly.

To download a rent receipt from ClearTax, follow these steps:

Step 1: Log into Your ClearTax Account

Go to the ClearTax website and log into your account using your credentials. If you don’t have an account, create one by registering with your email address.

Step 2: Navigate to the Rent Receipt Section

Once logged in, look for the “Rent Receipt” section. You will typically find this under the “Tax Filing” or “Documents” tab. Click on the section to access your rent receipt options.

Step 3: Select the Appropriate Details

Choose the relevant period for which you need the receipt. Ensure that all the tenant and landlord details are correctly filled in. This includes the rent amount, payment dates, and other necessary information.

Step 4: Download Your Rent Receipt

After confirming all the details, click the “Download” button. The rent receipt will be saved to your device in a PDF format. You can now print or share it as needed.

The ClearTax Rent Receipt Template simplifies rent documentation with its user-friendly features, ensuring landlords and tenants have a smooth experience. First, it auto-fills essential information like tenant and landlord details, rental amount, and payment dates. This saves time and reduces manual entry errors.

The template supports both monthly and yearly rent receipts, allowing flexibility for different rental agreements. It also includes a section for payment mode (e.g., bank transfer, cash), ensuring clarity in the payment process.

ClearTax’s template complies with tax regulations, which is beneficial for both tenants and landlords who need to provide rent receipts for tax deductions. The format is designed to be clear and precise, meeting the requirements of most local authorities and financial institutions.

The receipt template allows for easy customization, with editable fields for rent amount, payment date, and other details. This ensures that it caters to a wide range of rental arrangements, whether for residential or commercial properties.

ClearTax offers a downloadable PDF option, which provides a professional, printable version of the receipt. This makes record-keeping and sharing with relevant parties (such as tax authorities) convenient and efficient.

Customize your rent receipt by adding the necessary details that align with your tax filing needs. Include the tenant’s name, rental property address, payment date, and the amount paid. Make sure to mention the rent period covered (e.g., monthly or weekly), and clearly specify the payment method (bank transfer, cash, cheque, etc.).

List any additional charges, such as utilities or late fees, if applicable. This ensures you accurately report any income related to your rental property. Highlight whether the payment was part of a security deposit or rent increase, as these elements can impact deductions or tax liabilities.

Finally, include the landlord’s name, contact information, and signature to authenticate the receipt. If you’re using an online template, double-check that these fields are correctly formatted. With these steps, your rent receipts will serve both as a legal document and an effective record for tax purposes.

Ensure that all details are filled in correctly. One common mistake is leaving out required fields such as the tenant’s name or the rental amount. Missing information can invalidate the receipt, so double-check that every section is completed before saving or sending.

1. Incorrect Tenant Name and Address

Make sure that the tenant’s full name and address are accurately listed. Errors in spelling or missing details can create confusion during tax filing. Verify that this information matches the details on the lease agreement or the original documentation.

2. Mistaken Rental Amount or Payment Period

Double-check the rental amount and the corresponding payment period. A common issue occurs when the wrong amount or payment dates are entered. Always cross-reference with your records to ensure that these figures align with the terms of the lease.

Another mistake is miscalculating the payment due for partial months. In such cases, ensure the pro-rated rent is calculated correctly based on the number of days in the month and the daily rental rate.

3. Ignoring Tax and Other Deductions

Some users forget to include tax or other deductions that may apply to the rental payment. If your rental agreement includes additional fees or taxes, make sure these are reflected in the receipt. Failing to do so can result in discrepancies when submitting tax returns or auditing documents.

4. Choosing the Wrong Receipt Format

ClearTax provides multiple formats for generating receipts, and selecting the wrong one can lead to errors. Choose the template that fits the type of rent transaction you are documenting. For instance, if it’s a partial payment, ensure the format supports it. Also, be mindful of whether the receipt is for a full month or a specific period.

5. Overlooking the Date of Payment

Ensure the date of payment is listed accurately. A frequent error is either listing an incorrect date or omitting it altogether. If the rent payment covers a range of dates, include the start and end dates to avoid confusion.

By following these tips and reviewing the details thoroughly before finalizing the receipt, you can avoid common errors and ensure accurate documentation for both landlords and tenants.

To claim House Rent Allowance (HRA), ensure that your rent receipt meets the necessary criteria set by the Income Tax Department. A proper rent receipt serves as proof for your rent payments, which is essential for claiming HRA exemption under Section 10 of the Income Tax Act. Follow these steps to ensure that your rent receipt qualifies for HRA claims:

1. Verify the Rent Receipt Format

Your rent receipt must include key details: the landlord’s name, the tenant’s name, rental amount, payment dates, address of the rented property, and the signature of the landlord. Make sure the rent receipt is clear and unambiguous.

2. Ensure Consistency with the Rent Agreement

Cross-check that the details in your rent receipt match the terms outlined in your rent agreement. Any discrepancies between the agreement and the rent receipt may raise questions during the verification process. Consistent information is key for smooth HRA claims.

Once the rent receipt is correctly filled out and verified, submit it along with other necessary documents, such as the rent agreement and a copy of your PAN card (if applicable). These will strengthen your claim and ensure compliance with tax rules.

Where to Find Support or Guidance on Using ClearTax Templates

If you need help with ClearTax templates, the platform provides several avenues for support. You can find detailed user guides and frequently asked questions (FAQs) on the ClearTax website. These resources cover common issues and offer step-by-step instructions on how to use templates effectively for various tax purposes, including rent receipts.

ClearTax Help Center

The ClearTax Help Center is a great place to start. It includes a comprehensive database of articles and tutorials that walk you through the process of using templates, from creating to managing them. You can search by topic to quickly find solutions to your questions.

Customer Support

If you’re still unsure, the ClearTax customer support team is available to assist you directly. Reach out via email or chat for personalized guidance. They can help you with template-related issues, troubleshoot any problems, and provide tailored recommendations based on your specific needs.

I’ve removed unnecessary repetitions and maintained clarity and correctness of the sentences.

To streamline the rent receipt template for ClearTax, focus on simplicity and accuracy. Ensure the template includes the following details:

- Tenant’s name and contact information

- Landlord’s name and contact details

- Rental period (start and end dates)

- Amount paid and payment method

- Property address

- Date of payment

Structure of the Template

The template should be organized logically for easy understanding. The payment section should be clearly visible, detailing the amount paid, the date, and any additional fees. Keep the layout simple with clear headings and bullet points.

Clarify the Language

Ensure that the wording is precise and straightforward. For instance, use “Received from [Tenant’s Name]” instead of vague terms. This avoids confusion and makes the document more professional.

By following these guidelines, you will create a concise and effective rent receipt template that can be easily understood and verified by both parties.