If you’re a landlord or a tenant, having a clear rent receipt is a simple but important part of the rental process. A rent receipt template in DOC format ensures that both parties have accurate records of rent payments made. This helps prevent confusion and protects both sides in case of future disputes.

Use a rent receipt template to record key details like the tenant’s name, payment date, the amount paid, and the rental period covered. Including this information in a consistent format is crucial for maintaining clear and easily accessible documentation.

A well-organized template will save you time and effort, keeping all your receipts in one place. Whether you need to create multiple receipts or simply keep a record for tax purposes, a downloadable DOC template can be quickly customized to fit your needs. Make sure to include your contact information and any additional payment details that are relevant to the rental agreement.

For both landlords and tenants, having a rent receipt can make financial tracking smoother and ensure transparency throughout the lease. If you haven’t already, downloading a rent receipt template is an easy first step toward staying organized.

Here are the revised lines with minimized repetition:

To create a clean and concise rent receipt template, it’s important to eliminate redundant phrases. Start by specifying the tenant’s name and rental period clearly, without unnecessary details. For example, instead of “The tenant, John Doe, paid the amount of $500 for the rent for the period of January 1st to January 31st, 2025,” simply state “John Doe paid $500 for rent from January 1st to 31st, 2025.”

Use Direct Statements

Replace lengthy descriptions with direct statements. For instance, instead of saying, “The payment was made on the 5th of January, and this payment corresponds to the rent for the period mentioned above,” opt for “Paid on January 5th, 2025 for January rent.” This cuts down on wordiness without losing clarity.

Avoid Unnecessary Repetitions

Ensure that rental details aren’t repeated. For example, “This is to acknowledge the payment made by the tenant for the current month’s rent,” can be shortened to “Acknowledging payment for January rent.” Keep your focus on clarity, not verbosity.

- Rent Receipt Template DOC: A Practical Guide

When creating a rent receipt template in DOC format, focus on clarity and simplicity. Include key details like the tenant’s name, rental property address, payment amount, and payment date. Ensure each section is well-defined and easy to read. Keep the format consistent to make it easy to update for each new payment.

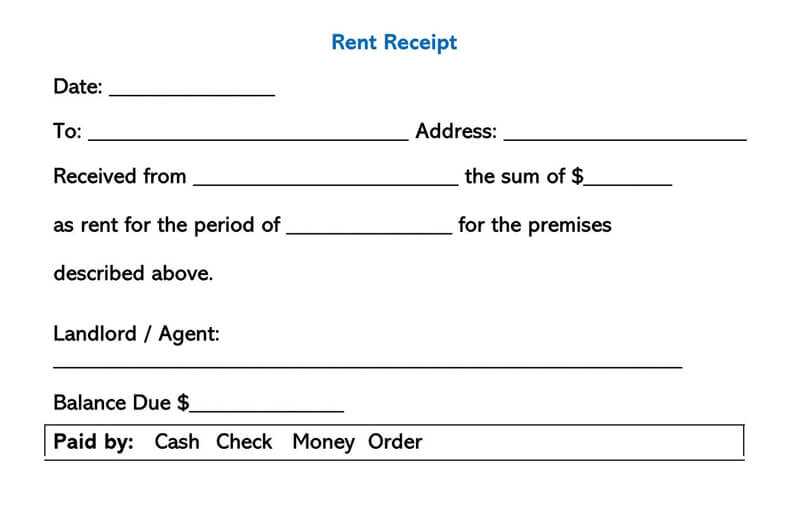

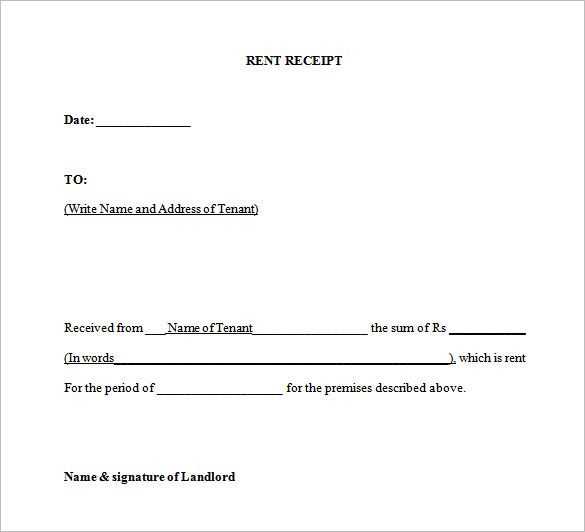

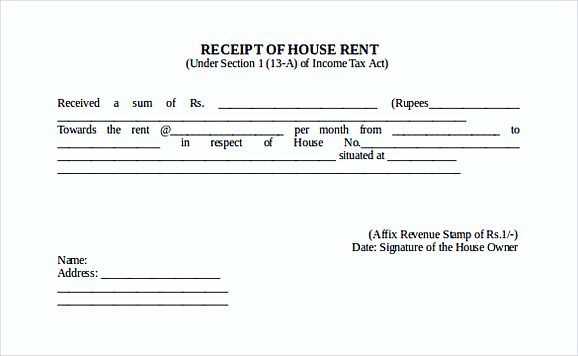

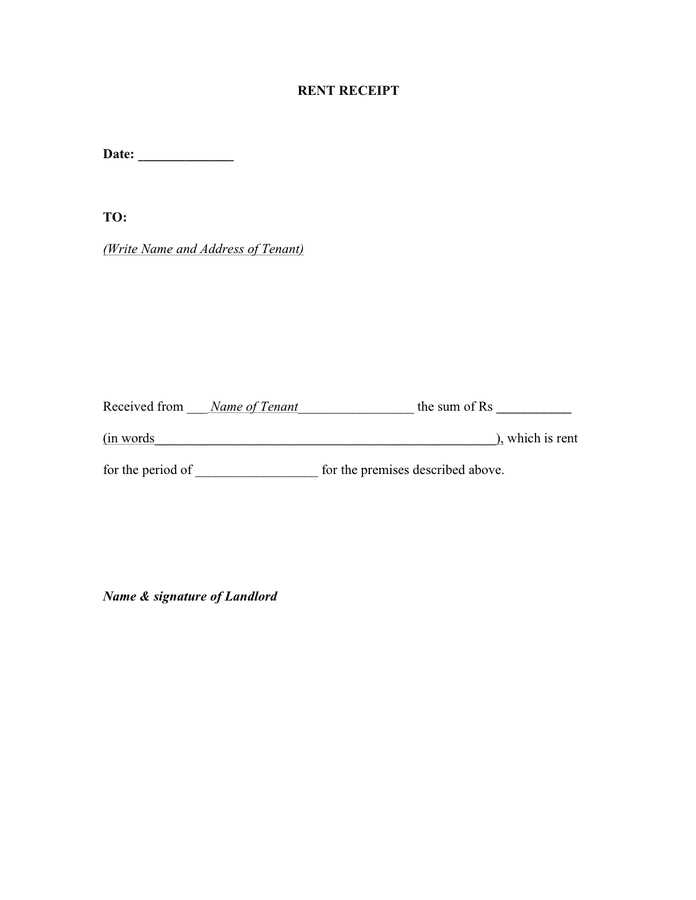

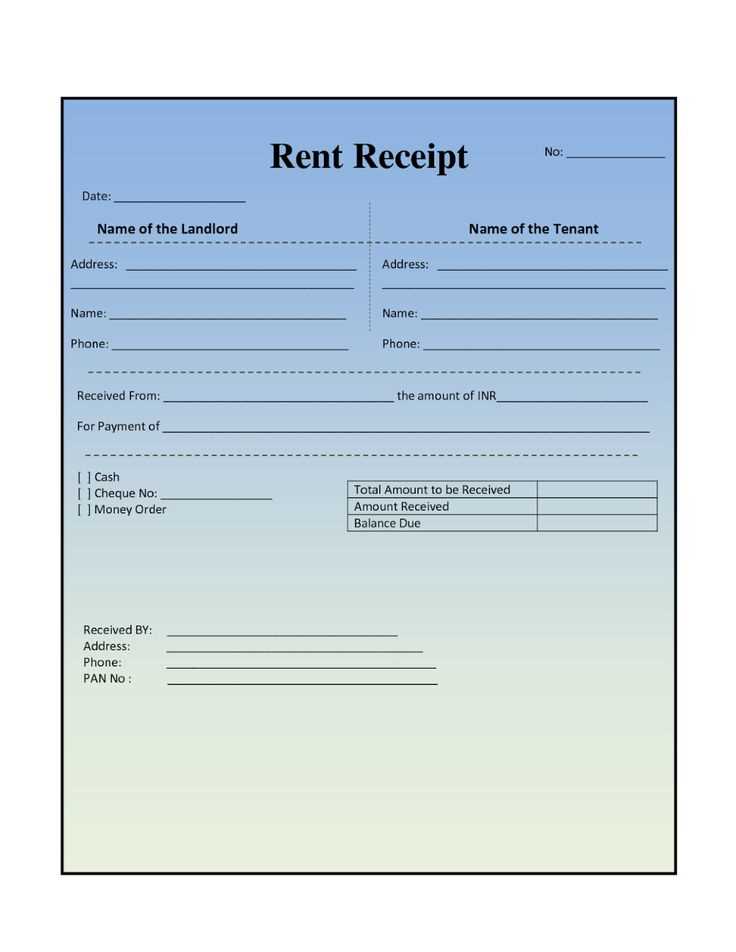

Start with a header that clearly labels the document as a “Rent Receipt.” Directly under it, include the date the payment was received. Below that, list the tenant’s full name and contact details, followed by the address of the rental property. The rental amount should be displayed prominently, along with the payment method (e.g., check, bank transfer, cash) and any relevant transaction IDs or references.

To make the template versatile, consider leaving space for additional notes, such as the payment period (e.g., “Rent for February 2025”). This allows you to use the template for different months and tenants without modifying its structure. Finally, provide space for the landlord’s signature or initials to confirm receipt of the payment.

Using a DOC format ensures the template is easily editable, allowing both tenants and landlords to keep accurate records. By organizing the information logically and maintaining a clean, professional design, the rent receipt will be both functional and legally sound.

First, ensure your rent receipt includes the necessary details: the tenant’s name, rental property address, amount paid, payment method, and date of payment. Customize the format to match your property’s specific needs. For example, if you accept different payment methods, include a section where you specify whether the payment was made via cash, check, bank transfer, or online platform.

In addition, if your lease has special clauses, such as late payment penalties or deposits, include clear references to these terms on the receipt. This can help clarify any outstanding amounts or future obligations for both parties. Add a line for “balance due” if your tenant has any pending payments.

Make sure the receipt has your contact information for any follow-ups or queries. You can also include a section for your property’s legal entity name if it’s managed by a company instead of an individual. Keep the design simple, ensuring that the font is legible and that the information is easy to read and understand.

Lastly, include a unique receipt number for tracking purposes. This is especially useful if you manage multiple properties or tenants. It makes record-keeping easier and helps avoid confusion with previous payments.

Make sure to include the following details when creating a rent receipt:

1. Tenant and Landlord Information

Clearly identify both the tenant and the landlord. Include the full name, address, and contact details of both parties. This helps avoid confusion if questions arise later.

2. Rent Amount and Payment Period

Specify the exact amount paid by the tenant and the period it covers (e.g., January 1 – January 31). This ensures clarity about the timeframe for which the payment applies.

3. Payment Date

Record the exact date the payment was made. This is important for both parties to track payment history and avoid misunderstandings.

4. Payment Method

Note how the payment was made, whether by check, cash, or bank transfer. This adds transparency to the transaction.

5. Receipt Number or Transaction ID

Assign a unique receipt number or include a transaction ID if available. This helps keep records organized and easy to reference in case of disputes.

6. Additional Charges or Deductions

If applicable, mention any extra charges (e.g., late fees, maintenance costs) or deductions that were included in the payment. It provides a clear breakdown of the total amount.

7. Signature

Both parties should sign the receipt. The landlord’s signature confirms that the payment was received, and the tenant’s signature acknowledges the transaction.

8. Rent Due Date

Indicate the next rent due date, helping both parties stay informed about the payment schedule.

| Detail | Description |

|---|---|

| Tenant Information | Full name, address, and contact info of the tenant |

| Landlord Information | Full name, address, and contact info of the landlord |

| Amount Paid | Exact amount paid by the tenant |

| Payment Period | Start and end dates of the rent period |

| Payment Date | The exact date the payment was made |

| Payment Method | Cash, check, bank transfer, etc. |

| Receipt Number | Unique receipt number or transaction ID |

| Additional Charges | Any extra charges like maintenance fees |

| Signatures | Signatures of both tenant and landlord |

| Next Rent Due | Date of the next payment |

Double-check all placeholder fields. Never leave them as they are. Filling in all the necessary information avoids confusion and ensures clarity for both you and the recipient.

- Incorrect Date or Amount: Always verify the accuracy of the rent amount and dates. A simple mistake can lead to disputes or confusion later on.

- Missing or Wrong Tenant Information: Be sure to fill out the tenant’s name, address, and other details correctly. Mistakes can create unnecessary issues during communication.

- Unclear Payment Method: Specify the exact payment method used. If there are multiple options, list them out clearly to avoid misunderstanding.

- Skipping Signatures: Don’t forget to include signatures from both the landlord and tenant. This confirms that both parties are in agreement.

- Not Updating Template Details: Ensure that the template is always up-to-date with any recent changes in rental agreements or local regulations.

Formatting Errors

Incorrect formatting can make the document harder to read or interpret. Make sure the text is organized and legible, using clear headings and bullet points where necessary.

Not Including Important Terms

Some templates may leave out specific clauses or conditions. Include all necessary terms regarding rental agreements, payment schedules, and penalties for late payment to prevent potential conflicts.

Use a well-structured rent receipt template to keep accurate records. The template should clearly state the date, amount, and terms of payment. It should also specify the address of the rented property and include the landlord’s and tenant’s contact details for easy reference. Make sure the document has a section for both the tenant’s and landlord’s signatures to confirm the transaction.

In the “Amount Paid” field, ensure that it matches the exact sum agreed upon in the lease. If there are any additional fees (e.g., late charges), list them separately to maintain transparency. This clarity helps both parties track payments and avoids any potential disputes.

Consider including a unique receipt number for each payment made. This number will be useful for both the tenant and landlord to track multiple payments over time. Storing these receipts in a secure location, such as a digital file system, ensures easy access in case of any questions or future reference.