If you are a landlord in India, providing a rent receipt to your tenants is not just a good practice, it’s often required for legal and tax purposes. A rent receipt serves as proof of payment and helps maintain transparency between you and your tenants. This document is especially useful when tenants claim deductions or when they need to submit proof of rent payments for other official reasons.

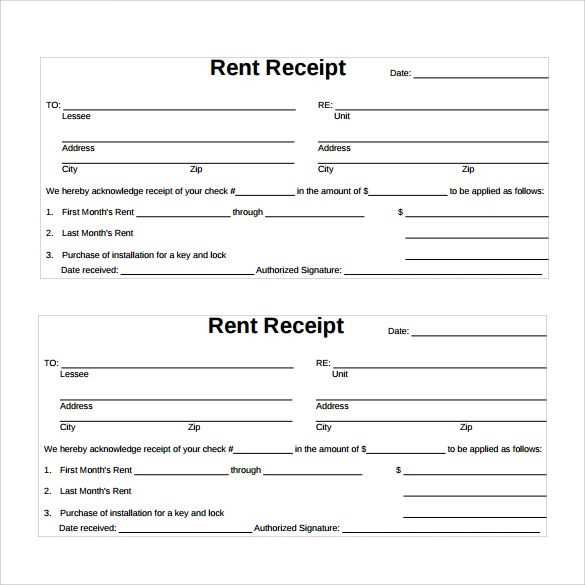

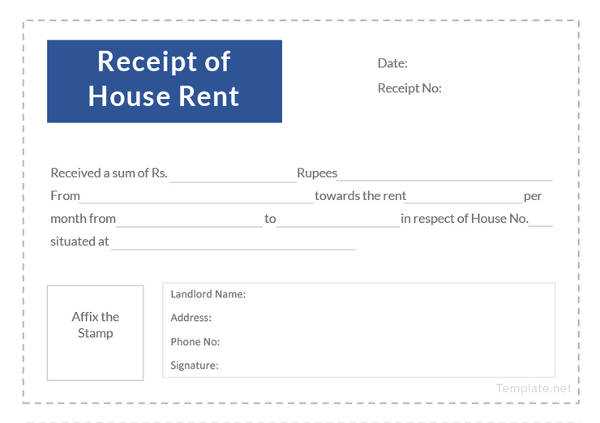

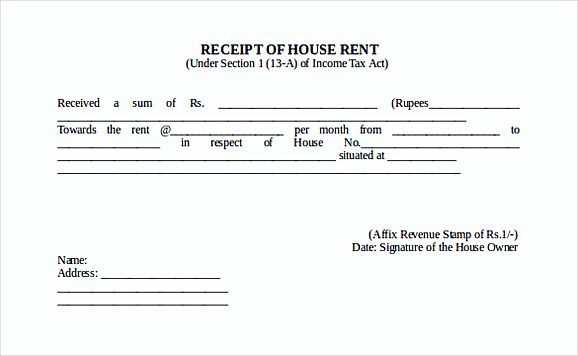

Using a rent receipt template in DOC format is a simple way to ensure that all necessary details are included. A well-structured receipt will contain basic information such as the tenant’s name, the address of the rented property, the payment amount, the date of the transaction, and the payment method. You can easily find downloadable templates online, or you can create one customized for your needs, making sure it adheres to local regulations.

Make sure your template includes clear labels for each section, such as “Rent for the Month,” “Security Deposit,” and “Payment Mode.” Including your contact details and the tenant’s signature line adds a layer of formality and authenticity to the receipt. Regularly updating your receipt template will help you stay organized and meet the legal requirements in India, minimizing disputes and ensuring smooth transactions with your tenants.

Here are the corrected lines with duplicates removed:

To ensure clarity and accuracy in your rent receipt template, focus on removing repetitive information. Below are the key updates that streamline the document:

- Eliminate unnecessary mentions of the landlord’s name and address if listed more than once.

- Standardize the format for rent amount, payment due date, and receipt date. Keep these consistent throughout the document.

- Remove duplicate statements regarding payment terms or late fees. These only need to be mentioned once to avoid redundancy.

- Ensure that both parties’ details (tenant and landlord) are provided only once and clearly defined at the start of the document.

- Do not repeat the payment method if it’s already mentioned once in the document. Use simple references like ‘Paid by cheque’ instead of reiterating multiple times.

By following these guidelines, your rent receipt template will be more concise and professional. Less repetition makes the document clearer and easier to understand for all parties involved.

- Rent Receipt Template Doc India: Practical Guide

To create a rent receipt in India, use a template that includes the following key elements: the date of payment, the tenant’s name, the landlord’s name, the property address, the rental amount, the mode of payment, and the period covered by the rent. A rent receipt acts as proof of payment for both parties, so ensure that all details are accurate.

Start with a header that clearly states “Rent Receipt” at the top. Underneath, include a section for the tenant’s name and the landlord’s details. Specify the payment date, the amount paid, and the payment mode, such as cash, cheque, or bank transfer. Additionally, indicate the rental period for which the payment is made–this can be a month or any other agreed duration.

Incorporate a unique receipt number to help track the payment. The receipt should also specify if GST (Goods and Services Tax) is applicable, as this is mandatory in certain rental agreements. Include a clause that both parties confirm the transaction, signed by both the tenant and the landlord. This ensures clarity and serves as legal proof if needed in the future.

Make sure the document is simple and free of unnecessary jargon. Using a downloadable Word document (.doc) format ensures it can be easily filled out and printed, with space for all necessary information. When drafting the document, keep it in line with local legal requirements to avoid any confusion or issues down the line.

To create a rent receipt template for Indian tenants in DOC format, include the following sections:

Key Information to Include

- Landlord’s Information: Full name, address, and contact number.

- Tenant’s Information: Full name, address (if different from the rental property), and contact number.

- Property Address: Exact address of the rented property.

- Rent Details: Amount of rent, due date, payment period (monthly, quarterly, etc.).

- Payment Date: Date on which the payment was made.

- Payment Mode: Specify whether payment was made by cheque, cash, or online transfer.

- Receipt Number: A unique number assigned to each receipt for record-keeping.

- Signatures: Space for both landlord and tenant signatures to validate the transaction.

How to Format the Document

Open a word processor like Microsoft Word or Google Docs. Start with a title such as “Rent Receipt” at the top. Use a clean layout with headings for each section. You can create a table with two columns–one for labels (e.g., “Tenant’s Name”) and the other for the information (e.g., the tenant’s name). After filling in the details, save the document as a DOC file. This template can be reused each month by just updating the relevant details.

For a rent receipt to be valid and clear, it should include certain key details that both the landlord and tenant can reference easily. Here are the important points to include:

1. Tenant and Landlord Details

Clearly mention the full name and address of both the tenant and the landlord. This helps establish the legal identity of both parties involved in the agreement. You should also include the contact numbers for both parties to facilitate easy communication if needed.

2. Property Address

Always mention the exact address of the rented property. This ensures that there is no confusion about the location of the rental agreement and confirms the property for which the rent is being paid.

3. Rent Amount and Payment Period

Include the total rent amount for the specified period. It should clearly state whether the rent is monthly, quarterly, or another frequency. The receipt should also show the due date and payment date, ensuring the tenant knows when the rent was paid.

4. Mode of Payment

Specify the payment method used, whether it was via cheque, bank transfer, or cash. Including the transaction reference or cheque number adds clarity and proof of payment.

5. Security Deposit Details

If a security deposit was paid, mention the amount, the date it was paid, and whether it is refundable or adjusted against the rent. This can help in avoiding future misunderstandings.

6. Receipt Number

Assign a unique receipt number for each payment. This helps track payments over time and ensures each receipt can be referred to individually in case of disputes or future reference.

7. Signature

Both the landlord and tenant should sign the receipt. The landlord’s signature validates the receipt, while the tenant’s signature ensures both parties agree to the terms. You can also add a space for the tenant’s acknowledgment of the rent payment details.

Rent receipts hold legal value in India when they meet specific criteria. A valid rent receipt must contain details such as the landlord’s name, tenant’s name, rental amount, payment date, property address, and duration of the lease. It must be signed by the landlord or their authorized representative. Additionally, a receipt should be on a printed or formal template, with a clear mention of the rental period for which the payment is made. This is important for tenants to claim tax deductions under section 80GG of the Income Tax Act.

Key Points to Ensure Legal Validity

- The receipt should explicitly mention the property’s address.

- It should specify the rent amount in both figures and words.

- Clearly state the date of payment and the rental period.

- Signature of the landlord must be included for authenticity.

- If applicable, mention GST details (for commercial properties).

Common Mistakes to Avoid

- Omitting the tenant’s or landlord’s details, such as address or contact information.

- Not providing clear proof of the payment amount and rental period.

- Failing to include the date of payment or using incorrect dates.

- Not updating receipts when rent changes or the lease agreement is renewed.

| Common Mistakes | Impact |

|---|---|

| Missing Landlord’s Signature | May lead to disputes over the authenticity of the receipt. |

| Incorrect Rent Amount | Could create confusion in financial record-keeping and tax filing. |

| No Rent Period Mentioned | Can lead to ambiguity regarding the period covered by the rent payment. |

| Failure to Provide Copies | Prevents the tenant from keeping proper records, which could be important for tax claims. |

Use a simple and clear format for your rent receipt. Begin by including the full names of both the landlord and tenant, along with the rental property address. Specify the rental period (e.g., from January 1st to January 31st) and the amount paid. Ensure the payment method (e.g., bank transfer, cheque, cash) is mentioned, along with any applicable GST or tax, if relevant. Include a unique receipt number for easy reference. Lastly, have a signature or digital signature from the landlord to authenticate the document.

To maintain consistency and accuracy, make sure the receipt is easy to read with no ambiguity in any section. Providing this clear and detailed information will ensure both parties are on the same page and protect the interests of both the tenant and landlord.